Elevator pitch

Aggregate labor productivity is a central indicator of an economy’s economic development and a wellspring of living standards. Somewhat controversially, many macroeconomists see productivity as a primary driver of fluctuations in economic activity along the business cycle. In some countries, the cyclical behavior of labor productivity seems to have changed. In the past 20–30 years, the US has become markedly less procyclical, while the rest of the OECD has not changed or productivity has become even more procyclical. Finding a cogent and coherent explanation of these developments is challenging.

Key findings

Pros

Labor productivity growth is recognized both by growth theory and developmental practice to be associated with high rates of economic growth.

In most OECD economies, aggregate labor productivity also typically moves procyclically.

One explanation of procyclical labor productivity is that business cycles are driven primarily by systematic economy-wide shifts to total factor productivity.

Procyclical productivity can also reflect labor hoarding, and reduction of labor hoarding can lead to more efficiency, lower prices, and better resource allocation.

One contributor to changing cyclical behavior of labor productivity may be the demise of collective bargaining and rising flexibility of labor markets.

Cons

Short-term labor productivity growth is volatile, depends on a host of factors, and is susceptible to significant measurement error.

Notable exceptions to labor productivity moving procyclically include the US and Spain.

Fundamental difficulties involving measurement of total factor productivity growth may lead to incorrect conclusions about its cyclical behavior.

Procyclical labor productivity can also arise from the need to preserve firms’ human capital in temporary economic downturns.

Increased labor productivity may come at a cost of increased unemployment and loss of worker representation at the workplace.

Author's main message

Labor productivity is the ultimate source of economic well-being in a market-based economy. For most industrial countries and for most of the post-World War II period, labor productivity has been procyclical—moving along with overall economic activity. Remarkably, the most prominent exception appears to be the US since the mid-1980s, with a further anomaly being Spain since the death of General Franco in 1975. The common feature of these two countries is a declining influence of collective bargaining institutions and increased flexibility in the labor market.

Motivation

Labor productivity—generally measured as market output (GDP) per hour worked in the market and corrected for changes in purchasing power and possibly for measures of effort—is a necessary, but not sufficient condition for high living standards. Its growth is recognized both by theory and developmental practice to be associated with high rates of economic growth. Some countries may achieve high GDP per capita (such as South Korea) via large sacrifices of leisure time. Labor productivity depends on a host of factors that make it susceptible to significant measurement error. A correct assessment of these factors is crucial for our understanding of how labor markets operate in both the long and short term.

Discussion of pros and cons

Labor productivity and long-term prosperity: Theory and evidence

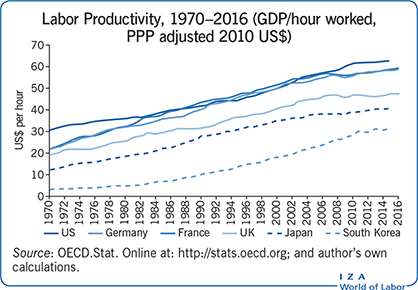

In a market-based economy, labor productivity is the ultimate source of economic well-being. The Illustration displays the evolution of GDP per hour worked since 1970 for different countries, measured in US dollars of constant purchasing power as reported by the OECD. As an aggregate measure, hourly productivity summarizes the market value of labor’s employment to an economy. It measures the average contribution of labor to the generation of goods and services in a society, and is a major factor behind GDP per capita. It is worth stressing that GDP represents not only consumption of private goods per se, but also, more generally, the resources available for better provision of health services, care of the aged and disabled, education, public safety and security, as well as pollution abatement and research and development. Naturally, as an average, aggregate labor productivity masks enormous variation across workers in different workplaces, sectors, and occupations. Yet, as a macroeconomic indicator it is a remarkably reliable sign of a nation’s prosperity as well as its international competitiveness.

Labor productivity is obviously influenced by a given region’s workers or residents, but is also the outcome of conscious decisions on the part of a whole host of other economic actors. For that reason, economists consider labor productivity to be an endogenous variable—it is determined jointly with many other economic outcomes. At the most basic level, the willingness of workers to work for a wage will influence labor productivity. In countries or regions where workers are in desperate need of economic resources, labor input per person will tend to be higher; as a result, marginal (and average) productivity will tend to be lower. At the same time, holding workers’ willingness to work constant, complementary factors of production such as physical capital, acquired skills, and intellectual property are known to increase labor productivity. Workers outfitted with more or better equipment are more productive than those without. Employees who have experienced some higher education or have participated in vocational training will tend to be more effective in the workplace than those without. Employees working with or for companies with proprietary brands will generate more value added than those producing standardized or intermediate input goods. Just as important, policy decisions taken in the past regarding the provision of productivity-enhancing public goods such as transport infrastructure, educational facilities and standards, communication networks, and health systems also matter for labor productivity. These factors can enhance the effectiveness of labor—and of capital—by increasing total factor productivity. Total factor productivity—sometimes called multi-factor productivity—is defined as the common effectiveness of all inputs in production, when their levels are held constant.

Growth theory and empirical research have shown convincingly that labor productivity is a necessary condition for economic well-being. Yet, a range of factors influences how this relationship plays out. For one, countries with low hourly average productivity might have higher GDP per capita by simply working longer hours per day, week, or year (the so-called intensive margin of labor supply), thereby increasing the effective labor input per person. More hours worked by the population will indeed increase total GDP and GDP per capita, but more hours worked means fewer hours to enjoy the fruits of labor. Additional hours per worker are likely to raise the level of work-related stress and discomfort—including workplace accidents and psychological burnout. While this increased pain and disutility is real, it is not captured by conventional market-based measures of GDP, and it weakens the link between GDP and well-being or overall “life satisfaction.” At the same time, a higher employment rate (the ratio of employed people to the population of working age) will also raise GDP per capita, holding productivity constant. Because the life satisfaction of an employed person is likely to be higher than one who is unemployed, a higher employment ratio is also likely to generate more happiness and well-being—even if people generally do not like to work. These two forms of labor utilization are important to consider when linking hourly productivity to national income and welfare.

There are more subtle and difficult-to-measure sources of slippage between productivity and economic standards that involve the measurement of effective work effort delivered. Hours worked are difficult to measure for a number of reasons. Measurement error may cause hours paid or reported at work to deviate in systematic ways from hours actually spent at work. Sometimes the source of the data—firms or households—can be decisive [1]. Moreover, effort is more important than hours reported or hours paid. Econometric evidence shows that those who work longer reported hours tend to spend more time on the job in activities which do not qualify as work [2]. Whether this “non-work” represents shirking, loafing, legitimate breaks, downtime, or rejuvenation is difficult to know. But it demonstrates that economies in which workers spend a lot of time at the workplace (such as South Korea or the US) may wind up with lower productivity measures and higher GDP per capita than those in which workers are stingier (or more efficient) with their effort.

Hourly productivity is tightly associated with earnings, both at the individual level as well as across sectors, occupations, and countries. This is because workers with higher average productivity are more profitable to their employers, and employers tend to share this increased profitability with their employees. It is thus not surprising that workers in countries with high productivity levels also report higher earnings in the sense of total labor income, including fringe benefits such as health and social insurance contributions, which can often represent as much as half of an employee’s total cost to employers.

In summary, the linkage between labor productivity and a nation’s economic well-being may be affected by hours per employee, employment ratios (the extent to which those of working age are employed), and effort exerted by workers in the workplace. Yet that positive relationship is undisputed and understanding the sources of labor productivity is central to understanding prosperity in both the long and the short term.

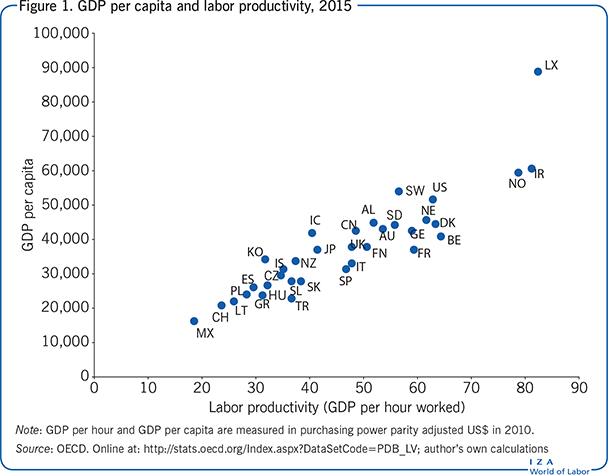

At the national level, evidence shows that labor productivity measures and GDP per capita are highly correlated across countries, but not perfectly so. Figure 1 shows this relationship for 35 OECD countries in 2015.

This shows that even among the world’s richest nations there is considerable dispersion in labor productivity. Theoretically, it should be relatively straightforward to isolate reasons why some OECD countries have not yet reached the frontier level of hourly labor productivity (the theoretical maximum production level per unit of time that can be achieved with all else being equal). More and better machines, better education, and more innovative products in the “right” industries would seem to represent the logical secrets to success. Unfortunately, this task is not that easy. While some of the variation in labor productivity can be explained in this way, research shows that “soft” or intangible elements of the economic environment also influence labor productivity. These soft factors include the rule of law, the reliability of the legal system, and the overall level of trust among market participants. While decisively important, these factors are notoriously difficult to measure and cannot be changed overnight. A noteworthy piece of research shows that even if Niger and the US had the same endowment of physical and human capital, US workers would still be seven times more productive [3].

Another complication is that average productivity is just an average of a great range of outcomes at the sector, enterprise, or even individual level [4], [5]. The structure of production within a nation consists of many sectors or firms of different productivity. As long as firms with low productivity survive, they can “trap” factors of production that presumably could be more effective in other uses, thereby pulling down the average [6].

Labor productivity and the business cycle: Theory and evidence

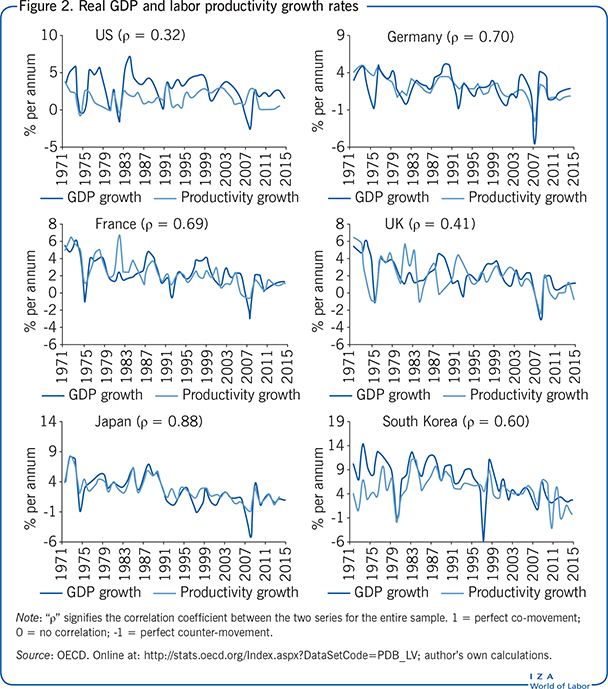

If higher labor productivity is associated with higher GDP and long-term prosperity, would it not also be logical to associate it with business cycles—the ups and downs of general economic conditions? Indeed, business cycle analysts have long sought to connect sudden shifts in labor productivity to the business cycle. In most industrialized countries and for most of the post-World War II period, labor productivity has been procyclical. Figure 2 plots the temporal evolution of growth rates of GDP and the same productivity measure presented in the Illustration and Figure 1 for six major OECD economies. For these countries (and for the OECD as a whole, with few exceptions) average labor productivity generally rises when the pace of economic activity is expanding.

Historically, economists have long understood that booms are generally associated with periods of rising labor productivity, however they often saw this as a contradiction or an intellectual conundrum [7]. Early analysts expected marginal and average products of labor to decline with increasing input, but early studies did not bear this out. In the 1930s, Keynes was aware of the puzzle, noting that the procyclical behavior of wages was difficult to reconcile with stable labor demand. Wages tend to track the marginal product of labor, and average labor productivity should fall as lower-productivity labor is added to employment—and this implies counter-cyclical wages. In contrast, procyclical productivity implies that the potential for wage increases across the board is greater in upswings, since marginal productivity and average productivity move together.

However, as always in economics, the world is more complicated. Measured labor productivity is highly volatile in the short term and depends on a number of factors, some already mentioned above, and some to be discussed below. In addition, it is susceptible to significant measurement error.

A common objection to the comparison of growth rates of GDP and labor productivity is that the underlying determinants of the two series may be subject to differing trends that are not detected properly by growth rate comparisons. An alternative procedure was employed to examine deviations from separate trends estimated individually for hourly productivity and GDP. This analysis, which is not reported, leads to very similar conclusions: with few exceptions, productivity rises when GDP is rising, both absolutely and relative to trend.

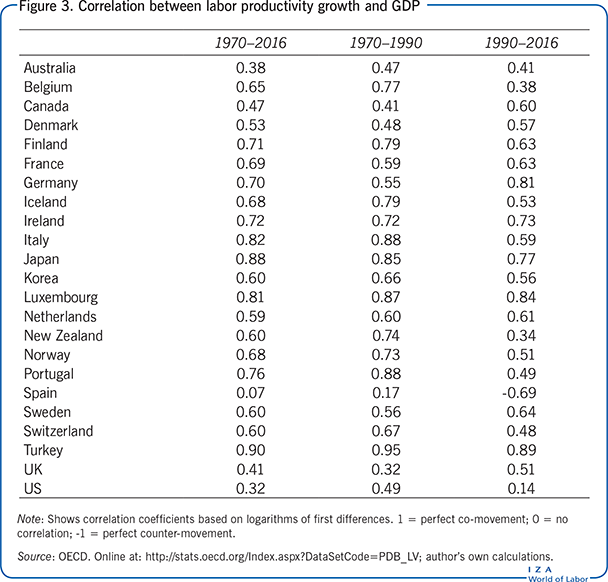

A priori, there is no economic reason to believe that the average productivity of labor should move in the same direction as GDP. From inspection of the charts in Figure 2, it is evident that positive productivity–output correlations are only a general tendency in the data, and not at all an iron law. Individual cycles and larger swaths of time exist in which positive co-movement breaks down, or even turns negative, for example, in France in the late 1970s, or in the UK in the late 1980s. The most prominent case is the deterioration of the positive productivity–output link in the US after the mid-1980s (stressed in [8] and [9]) which is confirmed in studies with better quality labor data [10]. Figure 3 displays simple correlations for OECD countries in the period 1970–2016. For most countries and most sub-periods, the relationship seems stable enough, yet the US is not the only interesting exception. While most of OECD Europe and Asia seem to confirm the general tendency, Australia, New Zealand, and Portugal represent important deviations. Most significant is Spain, where the correlation has also been negative since the 1990s; unreported results using other de-trending procedures show a negative correlation since as far back as the mid-1970s.

What is the best explanation of the positive productivity–output linkage, sometimes punctuated by periods of zero or negative co-movement? To explain “normal” business cycles, macroeconomists employ several narratives. One involves the arrival of a technical innovation, or news thereof, that increases the productivity of labor or capital goods, thereby stimulating investment in capital equipment, software, and other productive goods. Both the innovation itself and the subsequent investment raise the productivity of labor, while employment and output follow. Another explanation claims that improvements in the terms of trade can stimulate investment, labor productivity, and employment. Yet another states that a surge in aggregate demand—from private or public sources—could temporarily lift firms’ investment activity as they reach capacity constraints, which would in turn increase labor productivity. In all cases, the story is enhanced by the practical observation that employers hoard labor if they perceive downturns as temporary and want to preserve “human capital”—skills embodied in their workers that would be lost were they to leave.

This interpretation of “normal correlations” also hints at explanations for less unambiguous patterns of co-movement in addition to the well-established declining cyclicality of US labor productivity. First, the prevalence of aggregate demand shocks can overturn the normal case. For example, if an economic upturn were driven solely by expansionary monetary policy, productivity and real wages might instead be more likely to decline in booms—or at least until new investment comes online and lifts the productivity of labor hours. Yet if labor hoarding is prevalent, its positive effect on labor productivity is likely to dominate even in the short term. Second, the disappearance of procyclical productivity in the US seems durable enough to note. It could be due to permanent structural change in recessions, during which inefficient firms are culled and the economy increases its overall efficiency. This Darwinist perspective is plausible as globalization has intensified in recent years. Research from the US points to large within-sector variance of productivity across firms; increased international competition makes recessions increasingly difficult to survive merely by hoarding labor [6]. The net macroeconomic outcome is an enhanced effectiveness of labor employed by firms, lower prices, and a more efficient allocation of resources.

A common feature of countries with vanishing procyclical productivity is an erosion of labor market institutions, especially those associated with collective bargaining and job protection. Membership has declined not only in labor unions but also in employers’ associations, taking with it the power of institutionalized collective bargaining and job protection. Increased labor market flexibility means that firms can hire and fire workers more easily, attenuating the most commonly cited incentives for labor hoarding. One possible counterargument is that excessive layoffs of workers and closure of loss-making firms may not always be the appropriate response to a generalized downturn. At the same time, poorly performing firms may be forced to face the music and stop “gambling for resurrection.” The deterioration of the positive correlation may signal that recessions increasingly represent harbingers of permanent structural change.

Limitations and gaps

The long-term nexus between labor productivity and prosperity is compelling. It is therefore imperative for economists to understand the exogenous determinants of labor productivity’s slowdown in recent decades. Due to limits on the number of hours a worker can feasibly work and the natural bounds on the unemployment rate, it seems almost tautological that countries with higher labor productivity will have a higher GDP per capita. Yet significant and persistent deviations from this relationship are possible. The most interesting developments show that countries that have undertaken major labor market reforms over the past four decades—e.g. the UK, the Netherlands, Denmark, and Germany—were able to mobilize more workers and increase output per capita, sometimes even in the face of stagnating hourly productivity. These reforms range from deregulating part-time work, restricting the scope and power of labor unions, limiting the replacement income provided to the unemployed, increasing pressure on them to take up jobs, and increasing the options for them to do so.

More puzzling and variable is the behavior of labor productivity over the business cycle. Why do most OECD countries continue to exhibit procyclical productivity, often increasing in strength over time (Germany, France, the UK, South Korea, and Japan), while others seem to be heading in the opposite direction (the US, Australia, New Zealand, Portugal, and Spain)? Could developments in the latter group be due to the waning power of unions? Or increasing ruthlessness of firms with respect to layoffs and lost human capital? Or greater labor market flexibility, related among other things to the proliferation of temporary contracts and agency employment? It is noteworthy that labor productivity remains largely procyclical in the UK and France, where union membership has declined but coverage remains high. The unusual case of Spain, which has displayed counter-cyclical labor productivity continuously and without exception since the death of General Franco in 1975, has already captured the attention of researchers [11], [12].

Summary and policy advice

Policymakers consider labor productivity a prerequisite for prosperity, and analysts place great weight on it, particularly its rate of growth. Output per hour is an excellent predictor of long-term standards of living. As an endogenous variable subject to many influences, however, it is not directly susceptible to short-term policy management or manipulation and masks heterogeneity across industries, occupations, firms, and individuals. Yet, in the long term, aggregate labor productivity can be affected by private accumulation of complementary factors such as physical capital, education, and training. Public promotion of competition can take new methods, products, and technologies to market and help economies reach their production potential more rapidly. Governments can help markets supply the appropriate amounts of goods and services when positive externalities are present, as is likely the case with primary education, public health, or transport infrastructure. At the same time, the elimination of market overregulation, high and persistent unemployment, and low rates of labor force participation among youth and older persons can also contribute to higher overall standards of living.

The behavior of labor productivity over the business cycle, on the other hand, seems to be conditional on the circumstances. There is no a priori reason to believe that labor productivity should move pro- or counter-cyclically. While the data suggest that labor productivity is procyclical on average, there have been countries and periods where it is not. Reconciling the short and long term is clearly a challenge. Booms may simply contain a larger persistent component of labor productivity that survives the subsequent downturn, possibly because cutting-edge, high-productivity firms introducing new methods and products tend to enter and expand in good times. Counter-cyclical productivity over the long term, in contrast, could reflect the fact that weak firms tend to enter in economic expansions and do not survive subsequent downturns. The presence of collective bargaining institutions and job protection are associated with procyclical labor productivity and are likely to influence these processes. Trends and cyclical evolution of the market power of firms, the state of competition in product and labor markets, and institutional factors can also affect the cyclical behavior of labor productivity.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts as well as Tobias Bergmann and Jacob Meyer for research assistance and Samuel Bentolila for informative discussions.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Michael C. Burda