Elevator pitch

Aside from employment protection laws, which have been converging, other labor market institutions in new and old EU member states, such as wage bargaining coordination and labor union density, still differ considerably. These labor market institutions also differ among the new EU member states, with the Baltic countries being much more liberal than the others. Research that pools data on old and new EU member states shows that wage coordination mechanisms can improve a country’s macroeconomic performance. Stronger wage coordination and higher union density reduce the response of inflation to the business cycle.

Key findings

Pros

Labor markets are generally perceived to be more flexible in the new EU member states than in the old.

More centralized wage bargaining coordination and higher union density are often associated with lower unemployment.

Wage coordination may result in less sensitivity of inflation to domestic output, thus stabilizing inflation when unemployment is very low.

The benefits of wage coordination may be realized when the lead sectors in wage negotiations are subject to competition through active engagement in international trade.

Cons

Labor markets in the new EU member states offer much less protection to displaced workers than those in old EU member states.

More centralized wage coordination is associated with higher inflation, especially in the traded sector.

Wage coordination may reduce the inflation-dampening effects of higher unemployment during economic downturns.

When the non-traded sectors (which include many service sectors and the public sector) are the de facto leaders in wage negotiations, a country’s competitiveness may suffer.

Author's main message

Both formal and informal wage coordination mechanisms can contribute to macroeconomic stability. The traded goods sector rather than the public sector or non-traded services sectors should take the lead in wage coordination so that negotiated wages do not exceed productivity gains. However, in both old and new EU member states, the public sector or the non-traded services sectors are sometimes the de facto leaders—potentially compromising a country’s external competitiveness. Policymakers should encourage across-the-board wage settlements that follow productivity gains in traded sectors.

Motivation

Labor market institutions in the new EU member states (those that have transitioned from centrally planned to market economies) differ from those in older member states for two main reasons. First, the institutional mechanisms set up during the socialist era to protect labor did not survive the transition to capitalism; most transition economies thus entered the 1990s with few vestiges of labor protection. Second, because the economic systems of these new EU member states were relatively under-developed, these countries could not afford to establish costly labor market institutions such as unemployment benefits and active labor market policies (like training and employment search support). As a result, these institutions are often undersized in the new EU member states. The same conditions did not affect some other labor market institutions, such as hiring and firing restrictions and other employment protection regulatory instruments that affect wage bargaining and labor unions. This paper looks at some of the differences in labor market institutions between (and within) new and old EU member states and the impact they have on each country’s macroeconomic outcomes. It focuses in particular on wage coordination mechanisms and labor union density (the proportion of workers who are union members).

Discussion of pros and cons

Labor market institutions in the new and old EU member states

Differences in labor market institutions between new and old EU member states follow a clear pattern. Wage coordination and union density are generally much lower in the new member states, as are all measures of expenditures on labor programs. Only employment protection measures, at least on paper, are at an equivalent level. Overall, there is much less institutional or policy interference with the functioning of the labor market in new member states, which also implies that displaced workers receive much less protection. Most contracts are bargained in a decentralized setting, and the role and powers of labor unions are more limited.

Do different institutions produce different macroeconomic outcomes?

Labor market institutions affect the labor market through multiple channels. They may influence the aggregate process of wage determination; the pricing of different types of labor; the hiring and firing decisions of firms, and thus the size and duration of unemployment; the search behavior of workers (and again the duration of unemployment); and the sectoral allocation of workers.

In addition, through these effects and through interactions with other structural characteristics of the economic systems, labor market institutions may influence the evolution of such macro- and microeconomic variables as the aggregate and sectoral investment decisions of firms, especially the flow of foreign direct investments; the duration and amplitude of business cycles; the determination of prices and the overall inflation rate; and finally the competitiveness of firms and thus the balance of net exports.

Detecting the size and direction of these effects may be difficult, however, both in theory and in applied research. In theoretical modeling, it is sometimes impossible to predict what effect should follow from a specific labor market institution. For instance, it has been suggested that the optimal strategy for firms in the presence of hiring costs is to reduce both hiring and firing, with an ambiguous effect on employment [1]. It has also been suggested that stricter employment protection laws imply slower adjustment of employment toward equilibrium [2].

Empirical evidence on these effects is also hard to find. A recent survey on 150 mostly developing countries confirms earlier findings that although the distributional effects of labor market institutions are clearly identifiable, their effects on efficiency are much harder to uncover [3]. It nevertheless concludes that too much interference with the functioning of the labor market can harm employment and output. Some supporting evidence is provided in [4]. Another study for a sample of 20 OECD countries finds that mandatory dismissal regulations depress the growth of total factor productivity in industries with a higher than average layoff rate. The recent Great Recession has swung the opinions of former supporters of outright economic liberalization toward a more nuanced approach. In this vein, a recent OECD survey finds that restrictions on layoffs cushioned unemployment during the economic crisis [5].

The macroeconomic outcomes of wage coordination and union density

There are two competing theories on the macroeconomic consequences of alternative bargaining arrangements [6]. The corporatist hypothesis posits that centralization and coordination of wage bargaining improve economic outcomes, by inducing wage restraint and thereby boosting employment and lowering inflation. A counter-argument, known as the “hump-shaped hypothesis”, claims that the same moderating influence on wages can be achieved through competitive pressures on the labor supply side in a highly decentralized labor market [7]. (According to this hypothesis, negotiated real wages are low in a decentralized setting, which is subject to strong competitive pressures from other firms; somewhat higher when negotiations take place at the industry level, supported by industry-based unions; and low when negotiations are coordinated by national unions, as these internalize the inflationary and unemployment implications of excessive wage demands.)

According to the latter view, the intermediate level of centralized bargaining with industry-based unions produces the worst outcome because firms can more easily accommodate higher wages at low employment cost by raising prices. Also, industry-based unions may often successfully lobby the government to favor their industry at the expense of other sectors or social groups [6]. However, two objections weaken this conclusion. First, industry-based unions cannot set higher wages in industries that are open to international trade. Second, wage coordination is not limited to wage bargaining at a national or sectoral level. Indeed, much coordination is achieved through informal practices among firms and between firm- and industry-level unions. Informal coordination (although quite difficult to measure), may take place both among firms and between firm- and industry-level unions, and may produce the same restraining effects as formal coordination mechanisms. Japan is a case in point: if informal coordination is not taken into account, Japan appears to be among the least coordinated countries in the OECD, whereas if informal mechanisms are taken into account, it is one of the most coordinated [6]. Informal coordination can happen in a variety of ways, e.g., through casual consultations at the industry, regional, or national level between unions and firms or, in the case of a dominant sector, through consultations with other sectors that follow the same agreements adopted in the dominant sector. Alternatively, formal coordination may fail, as happens for instance if sectoral organizations within the same union pursue different objectives.

The survey conclusions can be summarized in two main arguments [6]. First, once bargaining coverage and coordination are taken into account, union density in itself has little or no impact on the comparative performance of labor markets, except that union density is associated with a compression of the wage distribution and thus a reduction in earnings inequality. Second, when both formal and informal mechanisms are taken into account, bargaining coordination can affect comparative economic performance during periods when the economy is adapting to changing conditions, by helping eliminate the adverse effect of shocks.

Have labor market institutions in new and old EU member states converged?

In recent years, countries have been moving toward greater labor market flexibility. Employment protection laws (especially dismissal regulations) have eased in the last decade in more than one-third of OECD countries, especially those with the strictest regulations. This has particularly been the case since the onset of the Great Recession [8]. Union density has also been declining rapidly in many countries. Overall, however, different institutions have been evolving differently in the two groups of countries, as discussed below.

Employment protection

On a scale of zero (no protection) to five (high protection), old EU member states have eased employment protection (in the case of individual and collective dismissals, for regular contracts) from an average of 2.58 in 1994 to 2.26 in 2013. In the last year, the most stringent regulations were in Portugal (3.18), the Netherlands (2.82), Germany, and Italy (both 2.68); the least stringent were in Ireland (1.40) and the UK (1.14). Also, all new member states for which data are available fall close to the average for old EU member states: for the four Visegrad states (the Czech Republic, Hungary, Poland, and Slovakia), average protection in 2013 was 2.15; for the three Baltic states (Estonia, Latvia, and Lithuania), it was 2.31; while for Slovenia, it reached 2.14 in 2014.

However, the effect of employment protection laws across countries is not obvious. For instance, in the Baltic states, actual labor force coverage of the new regulations is low, and there is clear evidence of violations at the firm level [9].

Labor market policies

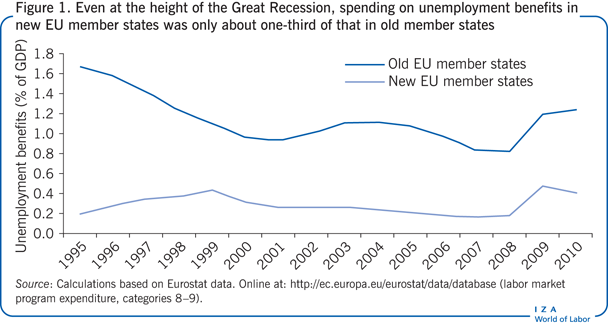

Both active and passive labor market policies are costly to implement and thus more developed in the wealthier EU member states (in terms of GDP per capita). Consider expenditures on unemployment benefits as a percentage of GDP. Until the Great Recession, these expenditures had been declining in the old EU member states while remaining fairly stable in the new member states. And even at the height of the crisis, their expenditures never exceeded one-third of the spending in the old member states (Figure 1).

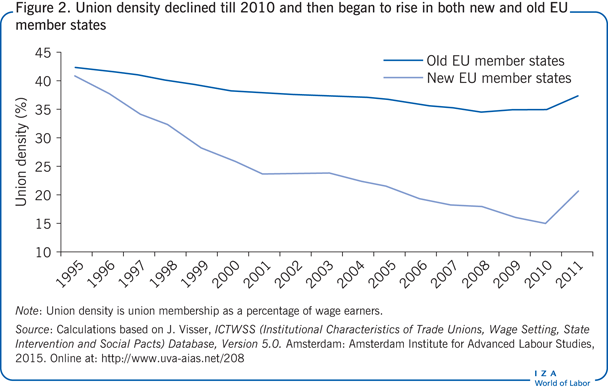

Wage coordination and union density

Other labor market institutions have evolved differently between the two groups. Wage coordination has increased only slightly in the old EU member states since 1994, averaging 3.6 in 2013 (on a scale from one, low, to five, high), except in the UK, where it has long been at one. Over the same period, wage coordination has decreased slightly in the new member states, reaching 1.7 in 2013. Differences have been even greater for changes in union density. While union density was generally declining in all member states until 2010, the decline was significantly greater in the new member states. Union density rebounded sharply in both new and old member states beginning in 2011 (Figure 2).

Labor market institutions differ among new EU member states

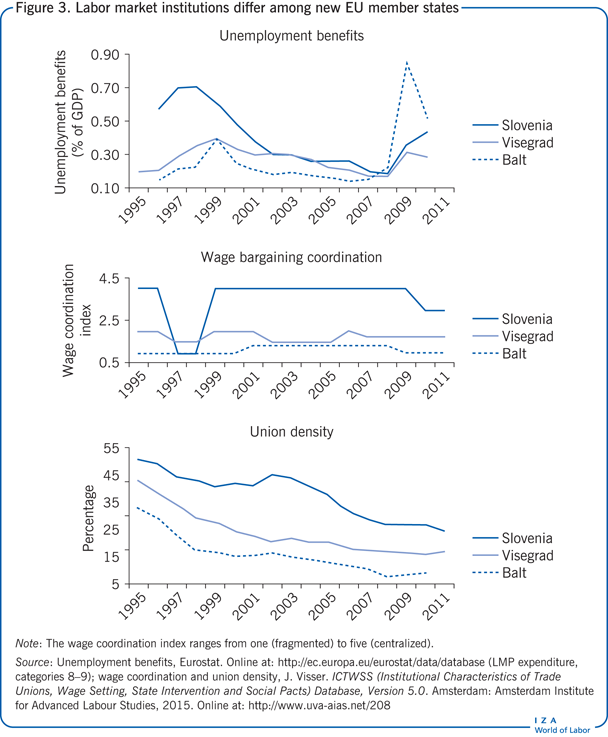

So far, the comparison of labor market institutions between old and new EU member states has assumed that labor market institutions are the same in all the new EU member states, which is not always the case. To examine the differences, three groups of new member states are considered: Slovenia, the four Visegrad countries (Czech Republic, Hungary, Poland, and Slovakia), and the three Baltic countries (Estonia, Latvia, and Lithuania). The literature suggests that there are broad institutional differences across these groups. Slovenia is a neo-corporatist state, with frequent government interventions, including the coordination of wage bargaining; the Visegrad countries exemplify “embedded liberalism,” which incorporates a degree of social protection but which is subordinated to maintaining competitiveness; and the Baltic states follow a neoliberal model, with very little social protection [10].

There are considerable differences across these three groups in unemployment benefits, wage coordination, and union density (Figure 3). Unemployment benefits were considerably higher in Slovenia over 1995–2001, after which benefits fell and converged with the other two groups until the Great Recession, reaching a low of around 0.2% of GDP around 2008. During the recession, paid benefits rose in all three groups, especially in the Baltic states. For wage coordination and union density, the ranking of the three groups matched their institutional characterization: both indicators are much higher in Slovenia and much lower in the Baltic states. Union density has been declining in all three groups, and even in Slovenia, union density has fallen below the level in the old EU member states since 2006.

Searching for evidence: What are the macro outcomes of these institutional differences?

Because data were lacking, earlier research focused on OECD member countries and did not include the new EU member states in formal econometric analyses. Newer research has begun to include those countries, either by themselves or together with the old EU member states. This is important because identifying the most appropriate way to establish well-functioning and socially inclusive market economies requires taking into account the differences in labor market institutions among new EU member states and between them and old member states. Having data on these cross-country variations allows researchers to formulate better hypotheses and to test their implications on wider sets of data, which should improve the reliability of estimated outcomes for both new and old EU member states. However, only a few research projects have dealt explicitly with the macroeconomic consequences for the new EU member states of labor market institutions in general and of wage coordination and union density in particular. Three studies are considered here.

One study focuses on the impact of labor market institutions on unemployment [11]. While the aim was to show the inherent weaknesses of previous claims about the negative employment effects of labor market institutions, the study also finds a strong negative relation between the unemployment rate and wage bargaining coordination. This result holds for new and old EU member states alike. The model employed in this work accounts only for the possibility of a linear relationship between wage coordination and unemployment, and thus can provide validation only for the corporatist hypothesis and only weak indirect evidence against the alternative hump-shaped hypothesis [7].

A related study offers some clear implications for the debate on the effects of wage coordination. Focusing only on the ten new EU member states over 2000–2011, the study shows that even without formal mechanisms of wage bargaining coordination, de facto coordination may emerge in some instances [12]. This informal coordination is modelled in terms of wage leadership between industry (which stands for the traded sector) and services and the public sector (the non-traded sectors). With full and efficient wage bargaining coordination, services and the public sector would be expected to follow wage settlements in the open (traded) sector. But the study shows that only Slovakia follows this prediction, whereas the other new member states seem to follow a different pattern of long-term relationships. Slovakia has a relatively low degree of wage coordination, implying that industry’s leadership is not formally institutionalized. Thus, this finding indirectly confirms the existence and relevance of informal coordination practices across sectors.

While these first two studies focus on the impacts of different institutional arrangements on the pattern of wage settlements and aggregate employment, a more recent work focuses on the impact of different labor market institutions on inflation [13]. Based on a sample of 26 EU countries for 1994−2012 (which includes the ten new, post-socialist EU member states), the study finds that stronger wage coordination or higher union density explain a significantly higher rate of price inflation in both the traded and the non-traded sectors, with a much stronger effect in the traded sector. The response of sectoral inflation to macroeconomic shocks (deviations of unemployment from its trend and changes in the real exchange rate) is always significantly negative, but much larger in the non-traded sector.

However, both wage coordination and union density modify these responses: stronger wage coordination and higher union density reduce the response of inflation to the business cycle, while they amplify the response of inflation to changes in the real exchange rate (they increase the exchange rate pass-through), in both the traded and non-traded sectors.

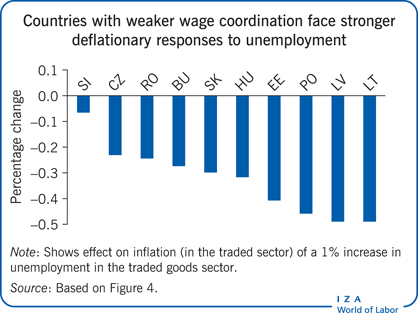

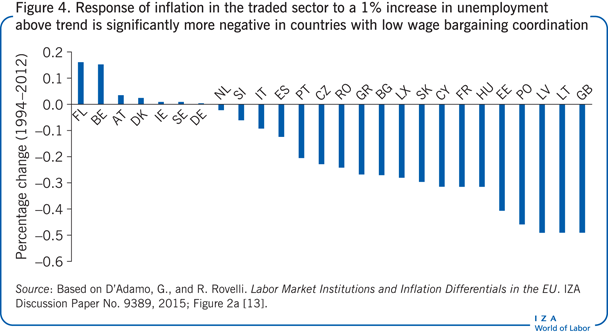

Another way to look at these results is to ask how they affect the patterns of inflation adjustment to a macroeconomic shock in each country. In this study’s model, different country responses to a macroeconomic shock arise through an interaction between the shock and a time- and country-specific index measuring labor market institutions. Consider how wage coordination affects the response of inflation in case of a 1% increase in unemployment above its trend rate (Figure 4). Under the standard model (Phillips curve), inflation would be expected to decline when unemployment rises. By how much depends on each country’s labor market institutions. The largest responses (a 0.4–0.5% decline in inflation in the traded sector) are observed in the Baltics, Poland, and the UK—all countries with very low wage coordination. Among new EU member states, the least responsive is Slovenia, while Bulgaria, the Czech Republic, Hungary, Romania, and Slovakia are in an intermediate position. Note, however, that with the exception of Slovenia, the deflationary response is stronger among new EU member states than among old EU member states, with the exception of France and the UK.

While Figure 4 shows that the same increase in unemployment generates a stronger estimated deflationary response in the traded goods sector in countries with weaker wage coordination, a more stable inflation rate does not necessarily imply a worse overall outlook for unemployment. For EU member states where wage bargaining coordination is strong, average unemployment since 2004 has been lower, and it increased less between 2004–2008 and 2009–2011 than in EU member states where wage coordination has been low. Thus, wage coordination seems to be associated with better overall macroeconomic performance in most EU member countries, especially the new member states.

Limitations and gaps

While there have been considerable improvements in measuring labor market institutions in both old and new EU member states, some constraints remain. First, enforcement of formal labor market institutions, especially employment protection laws, may differ across countries and over time. It would be useful to have measures that take actual enforcement into account. Second, measures of wage bargaining coordination must reflect informal institutions and practices as well as formal ones. While both types of institutions evolve over time, it is particularly difficult to account for informal practices, which may also depend on the extent to which unions share macroeconomic objectives. Third, labor union power is not necessarily a reflection of labor union density. Union power is also affected by the coverage of collective bargaining agreements. For some countries, such as France and Spain, density and coverage differ considerably, which raises the question of how to balance them to obtain a more comprehensive measure. Fourth, it would be useful to understand how the effectiveness of labor market institutions is influenced by broader institutional characteristics in each country, as suggested by the literature on varieties of capitalism. Fifth, new and old EU member states should be examined together in research studies. Continuing to split them into separate research and policy agendas diminishes our understanding of the interaction of labor market institutions and macroeconomic outcomes.

Summary and policy advice

Studies that pool the new EU member states together with older member states have shown that stronger wage coordination and higher union density are associated with lower unemployment and higher inflation, especially in the traded sector. Such studies have also shown that these labor market institutions reduce the response of inflation to deviations of the unemployment rate from its trend rate (“flattening” the Phillips curve) almost equally in the traded and non-traded sectors, while amplifying the real exchange rate pass-through (the extent to which a real exchange rate appreciation has a dampening effect on inflation).

Recent research thus documents some desirable effects of wage coordination, including the setting of wages at levels compatible with preserving external competitiveness in the traded sector (most manufacturing sectors). If this is indeed the case, then more coordination should have favorable employment implications, which has also been documented in practice. However, it is important that wage settlements follow productivity gains in the traded sectors and that cross-sectoral wage spillovers move from traded to non-traded sectors rather than the other way around. This pattern is especially important within a monetary union such as the eurozone.

Policymakers should thus encourage the establishment of this pattern of wage settlements, by favoring opportunities for labor market participants to share information and to coordinate their objectives and negotiation goals.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for helpful comments and suggestions on earlier drafts. He also thanks Gaetano D’Adamo and Riccardo Rinaldi for comments and Rinaldi for assistance with data collection and analysis. Previous work of the author with D’Adamo contains a larger number of background references for the material presented here and has been used intensively in parts of this article [13].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Riccardo Rovelli