Elevator pitch

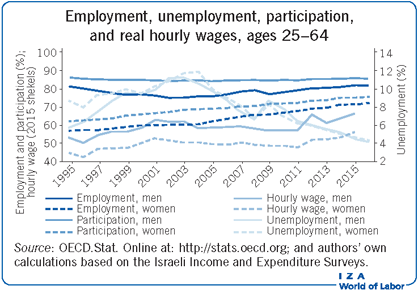

Following a decline in employment and participation rates during the 1980s and 1990s, Israel managed to reverse these trends during the last 15 years. This was accompanied by a substantial decrease in unemployment. New labor force participants are mostly from the low end of the education distribution, and many are relatively old. They entered the labor force in response to cuts in welfare payments and increases in the mandatory retirement age. Net household income for all population groups has increased due to growth in labor income; however, inequality between households has increased.

Key findings

Pros

There have been significant increases in both men and women’s employment and participation rates, and unemployment has decreased to its natural level of around 4%.

Real earnings of the average and median worker have risen.

Net real household income increased for all percentiles and all population groups.

Employment gaps between Arabs and Jews have narrowed.

Employment gaps between ultra-Orthodox and non-Orthodox Jews have narrowed.

Cons

Male participation is still lower than in the OECD average.

Wide gaps in earnings persist between the various population groups.

There is high and growing income inequality between households.

The employment rate for Arabs is still below that of the Jewish population.

The employment rate of ultra-Orthodox Jews is still below that of the non-Orthodox population.

Author's main message

Overall, the Israeli labor market is doing remarkably well. Since 2002, the employment rate has increased by more than ten percentage points, unemployment has fallen to its natural level of 4%, and real hourly wages have increased by eight percentage points. There are, however, serious challenges facing two large minority groups, Arabs and ultra-Orthodox Jews, who lag behind in both employment and earnings. Policymakers can address these challenges by maintaining the current successful policy of promoting employment with a special focus on these two groups, as well as by encouraging investments in their human capital through higher education and training.

Motivation

Following a period of exceptionally rapid increase, the current employment rate in Israel is higher than the US and the OECD averages. This rise can be attributed primarily to a series of successful policy measures that increased the incentives to work, lowered welfare payments and income tax, and increased the mandatory retirement age. Despite the welfare cuts, the increase in employment was accompanied not only by higher wages but also by higher household gross and net incomes. However, these positive outcomes are not equally enjoyed by the entire population. Although individuals who are low-skilled, older, and from large families experienced the fastest growth in employment, significant gaps still exist, with especially low employment among Arab women and ultra-Orthodox Jewish men. Additionally, while labor income inequality went down, net income inequality rose, with Arab and ultra-Orthodox households still having much lower incomes.

Discussion of pros and cons

Employment and participation

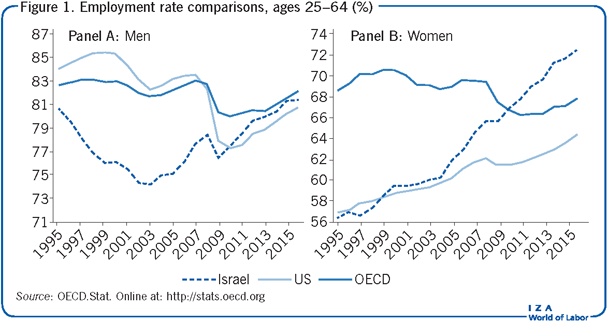

For almost two decades at the end of the last century Israel’s total employment rate fell to exceptionally low levels, especially among men [1]. The growing number of individuals outside the labor force led to a dramatic increase in welfare expenditure. This was followed by a reversal of the trend at the beginning of the 21th century, with the employment rate increasing by ten percentage points during the last 15 years. This reversal was even more surprising when considering trends in the US and other OECD countries, where the employment rate decreased substantially following the 2008 global crisis. In contrast, Israel’s employment rate was hardly affected by the crisis.

By 2002, the employment rate for men in Israel had dropped to 74.3%, as shown in Figure 1, about six percentage points lower than the US and the OECD in general. By 2015, the male employment rate had risen to 81.4%, higher than in the US and slightly below the OECD. The change among women was even more dramatic, with employment increasing throughout the period. Until 2002, the female employment rate and its pace of increase were similar to those in OECD countries, though lower and less stable than the US. Since 2003, the rate of growth in employment has increased, and by 2015, the employment rate among women in Israel reached 72%, 7.8 percentage points higher than the OECD average and 4.5 percentage points higher than in the US. As in many developed countries, the employment rate among women remains lower than among men, but the employment gap in Israel is now only 9.4 percentage points (as compared to 17.9 percentage points in the OECD and 13.3 percentage points in the US).

The data on the participation rate present a similar picture. After having declined for a long period, the participation rate for men began to increase in 2002; it is now slightly below the OECD average and slightly higher than in the US. The participation rate among women, which grew slowly until the end of the previous century, began increasing rapidly in 2004; today it is significantly higher than in the US and the OECD.

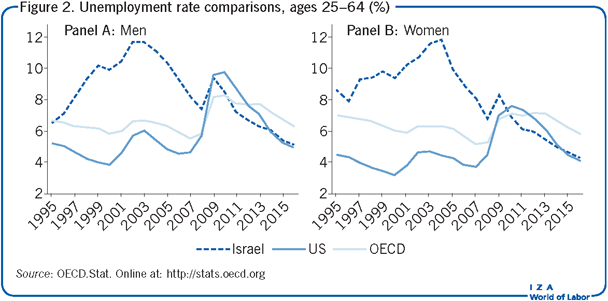

Unemployment

Unemployment has followed a similar reversal in trend as seen for employment rates. In 2000, the unemployment rate in Israel for both men and women was relatively high (around 10%), but it has declined rapidly since 2004, as shown in Figure 2. In 2008, it increased somewhat due to the global crisis, but that was only temporary, and by 2015 it had declined to about 4%, its lowest level in the last 33 years. By all accounts, this seems to be Israel’s natural unemployment level. Since the end of the 1990s there has been virtually no gender gap in the unemployment rate, as also seen in Figure 2.

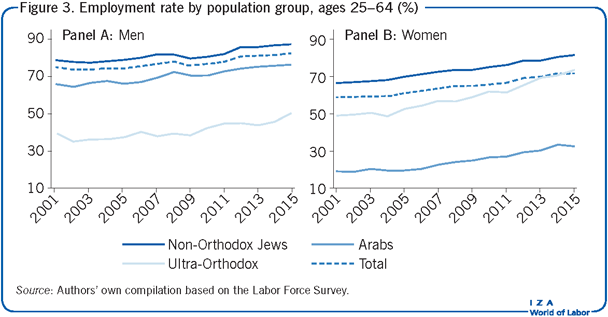

Israel’s unique demographics

Jews account for about 80% of Israel’s population and Arabs for most of the rest. About 10% of the population are ultra-Orthodox Jews. The Arabs and the ultra-Orthodox are characterized by low employment and participation rates, higher poverty rates, a higher level of dependence on the welfare system, and lower education levels. Both groups are characterized by high fertility levels (especially the ultra-Orthodox population), thus making it harder for parents (primarily mothers) to enter the labor force. Since 2002, both of these groups have experienced dramatic changes, though of different magnitudes.

The employment rate of Arab men increased from 64.2% in 2002 to 76.1% in 2015 (Figure 3). Nonetheless, it remains ten percentage points lower than the Jewish employment rate, which increased from 77.6% to 87%. The employment rate of Arab women rose from 18.9% to 32.3%. Meanwhile, the proportion of college graduates among Arab women rose from 7% to 18.6% and their fertility rate decreased substantially (the average number of children per woman dropped from 2.6 to 2). Still, the employment rate of this group is extremely low (32.3% compared to 87% in the Jewish population). If education and fertility trends continue, this gap will narrow, but very slowly.

The employment rate of ultra-Orthodox men is still extremely low, though it has been growing at a relatively high rate, from 35.1% in 2002 to 50.2% in 2015, an increase of more than 40%. The impact of this change on total employment has been amplified by the increase in this group’s proportion within the total working-age population of men, from 4.4% to 7.4%. Nonetheless, the most dramatic and least expected change has occurred among ultra-Orthodox women. Their employment rate has increased from 49.5% to 73.2% within 13 years. Unlike Arab women, the fertility rate of ultra-Orthodox women has remained unchanged during this period (at an extremely high level of 2.9 children per woman). The proportion of college graduates among ultra-Orthodox women rose from 10.4% to 28.3%. It is interesting to note that this is the only group in Israel (and in most developed countries as well) in which women are the main breadwinners of the family and wives work much more than their husbands.

Policy measures—The stick and the carrot

The change in employment is largely due to a series of successful policy measures, some of which have increased the incentive to work, while others have cut unemployment benefits.

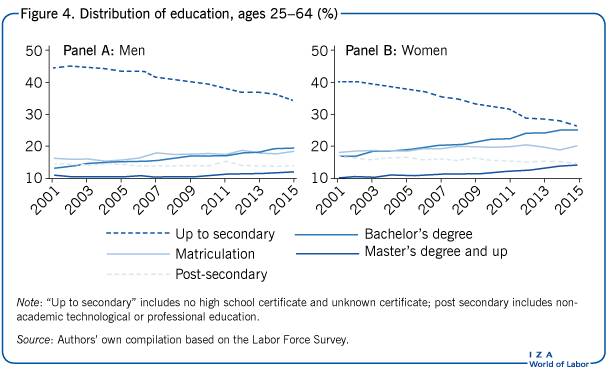

Improving access to higher education

Until the beginning of the 1990s, Israel had only 21 academic institutions that could grant a bachelor’s degree. Five candidates competed for every university slot. In 1990, Israel allowed more academic institutions to open, and by 2000 there were 67 universities and colleges in Israel. As a result, the educational distribution changed dramatically, and a much higher proportion of the population now has college degrees (Figure 4). Skill-biased technological change and increasing returns to college education also contributed to the phenomenon, so the share of college students in a cohort reached 50% in 2013, which is higher than in the OECD as a whole and the US specifically. About 30% of the increase in employment can be attributed to the change in the education distribution [2].

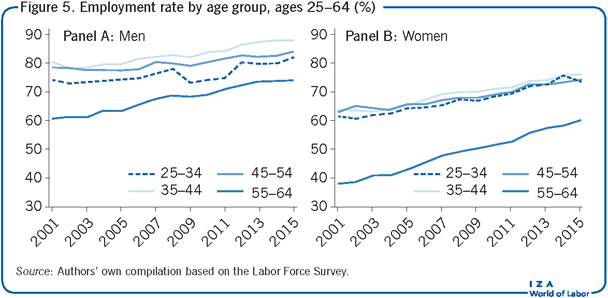

Increasing the mandatory retirement age

Due to increasing life expectancy, in 2004 the mandatory retirement age was raised from 65 to 67 for men, and from 60 to 62 for women. This not only had a direct effect on the employment of men and women in the relevant ages, but also affected the employment rate of individuals close to the retirement age. The 55–64 age group has the lowest employment rate but has experienced the fastest increase in employment (Figure 5). The rate for men aged 55–64 increased from 60.9% to 73.8%, and for women from 38.6% to 60%. The share of this age group in the population has also increased.

Welfare payments, unemployment benefits, and income tax

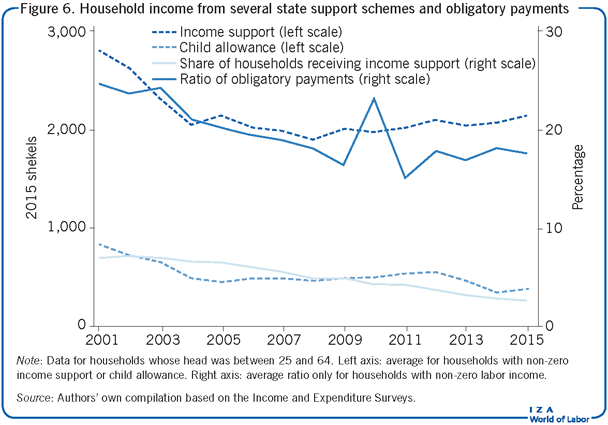

Since 2002, the welfare and benefit system in Israel has undergone a series of reforms aimed at increasing the incentive to work on the one hand, and decreasing the benefits of non-employment on the other. During 2002 and 2003, the level of unemployment benefits and period of entitlement were reduced, and the insurance qualification period was increased from six to twelve months. These changes substantially reduced the number of eligible individuals and total expenditure on unemployment benefits. In 2003, the levels of income support, child allowance, and entitlement were also cut dramatically. Prior to 2003, the child allowance increased with the number of children. Since the fertility level in Israel is high, especially among the Arab and ultra-Orthodox populations, the proportion of the child allowance in total household income reached about 35% for many poor families, thus reducing the incentive to work. The 2003 reform lowered the payment per child and disconnected it from the number of children in the family, which had a positive effect on employment and a negative effect on fertility [3].

During 2002–2004, the income tax system was also reformed. Among other things, the two lower brackets were raised, such that about 300,000 additional individuals were moved below the tax threshold. In 2007, a negative income tax was introduced, the structure of which is similar to that of the earned income tax credit in the US and the working tax credit in the UK. However, the amount of the benefit was relatively small, and eligibility was restricted. As a result, the rate of claims was low. Subsequently, several modifications were made between 2007 and 2012, making it more attractive to claim. Yet, it is still too early to know whether this has had an effect on employment.

As a result of these reforms, income support and child allowance per household declined by 18% and 47% respectively, and the share of obligatory payments (income tax, social security, and health tax) within household labor income declined from 24% to 18%. In addition, the share of households receiving income support decreased also from 7.2% to 2.7% (Figure 6).

Welfare-to-work programs

Since 2005, Israel has implemented several pilot programs to test out mandatory welfare-to-work schemes. In the early pilots, a case manager designed a personal program for each participant, focusing on enhancing their ability to find and keep a job (including job search assistance, community service, and professional retraining). Later pilots were based on the so-called “strive” model, which focuses on “soft” skills by offering counseling, job search assistance, motivation workshops, and personal coaching. In addition, a number of voluntary programs were targeted at specific groups (Arabs, ultra-Orthodox Jews, single parents, and the disabled), and primarily offered job search assistance, basic skills courses, and the completion of education. The evaluation of these pilots has shown an increase in employment and labor income, a reduction in welfare payments, and no effect on hourly and total income. It is important to note that these were only small-scale pilot programs and their effect on total employment was negligible. For further details, see [4], [5], and [6].

Wage developments

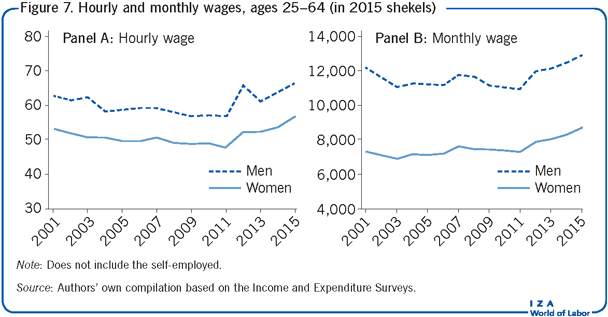

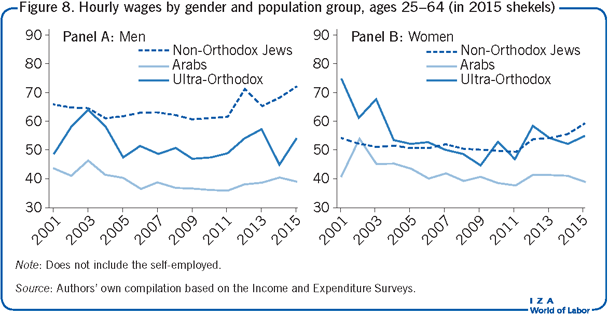

While the employment rate has increased substantially, hourly and monthly wages rose only slightly since the turn of the century (Figure 7). Wages decreased somewhat from 2001 to 2011 and increased slowly afterwards. This late increase was only experienced by non-Orthodox Jews, while the hourly wages of Arabs and ultra-Orthodox Jews have not changed in the last decade (Figure 8). The small decrease at the beginning of the period is due to the fact that many new employees entering the workforce were low-skilled, less educated, and relatively old; moreover, in many cases they were from the Arab or ultra-Orthodox Jewish population, which are characterized by lower wages.

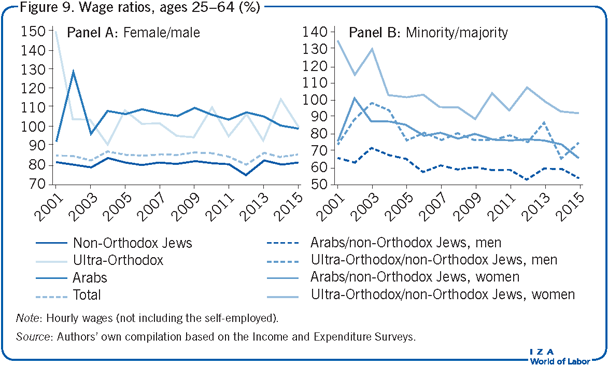

Wage differences by worker characteristics

The overall female/male wage ratio has been relatively high and stable over the period at around 85% (Figure 9, Panel A). It is interesting to note, however, that the gender gap in hourly wages is not observed among either Arabs or ultra-Orthodox Jews. The ratio for Arabs was 90% in 2001, but has since risen to 100%. For the ultra-Orthodox, the ratio was 100% throughout the period (although since employment rates for this group are low, the ratio fluctuated). There are two explanations for the lack of a wage gap within these groups: first, the high positive selection to employment for women, where the women who are working are those with more skills and higher potential wages; second, the high proportion of employees earning the minimum wage. The gender wage gap for non-Orthodox Jews, the majority of the population, is fairly constant at 81%.

In contrast to the relatively small gender wage gap, the minority/majority wage gaps have been quite large, with increases seen in some cases (Figure 9, Panel B). The Arab/Jewish wage ratio among men was 66% in 2001 (as compared to 76% among women) and has since fallen to 54% (as compared to 66% among women). The ultra-Orthodox/non-Orthodox wage ratio for men remained around 75%. The only exception is ultra-Orthodox women, whose hourly wage is similar to that of non-Orthodox Jewish women, and even higher at the beginning of the period.

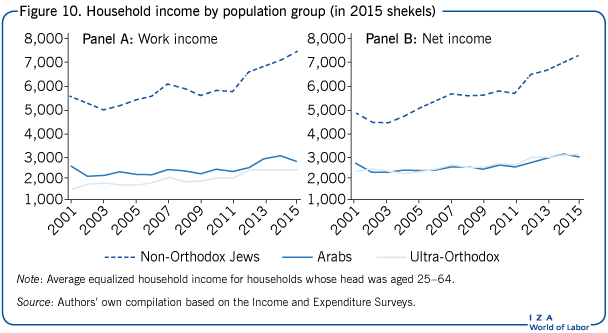

Income trends

The wage trends described above are based on individual data. In order to understand the trends in earnings (and inequality), it is worthwhile focusing on household data. Since ultra-Orthodox households have a significantly larger number of children than the other groups, any discussion of household earnings, poverty, and inequality must control for the number of individuals in the household by using equalized incomes (based on the Israeli Central Bureau of Statistics equivalence scale). The increase in employment rates during the last 15 years has translated into a rise in the proportion of households that earn labor income, as well as the share of labor income within total income, the latter of which increased from 71.6% in 2002 to 78.1% in 2015. This increase in the wage–income ratio was significantly larger for Arabs and ultra-Orthodox Jews.

The equalized labor income of households with earners increased for all groups: by 5% for ultra-Orthodox Jews, 17% for Arabs, and 28% for non-Orthodox Jews. Simultaneously, the proportion of income from social security payments (unemployment benefits, child allowance, disability payments, and income support) within total income decreased.

Although the rise in labor income was offset by the decrease in income from welfare benefits, and many households lost their eligibility for welfare payments due to their increase in labor income, total income per household increased in all population groups, such that the total effect of increased employment rates on household income was positive.

Comparing net and gross total income reveals that the former increased more than the latter, suggesting that the increasing employment rates improved the standard of living for all households (ignoring the decrease in leisure). It is important to note that when looking at all households (including those with no earners), even though the increase in labor income was higher for both Arabs and the ultra-Orthodox Jewish population in comparison to non-Orthodox Jews, their equalized labor income is still much lower than that of the majority population (Figure 10). In addition, equalized net income increased faster for non-Orthodox Jews than for Arabs and ultra-Orthodox Jews, and, therefore, the gap between the groups widened. In 2015, the equalized net income of Arab and ultra-Orthodox Jewish households was only 43% compared to non-Orthodox Jewish households. Lower employment rates and wages combined with higher fertility rates contributed to the size and growth of this gap.

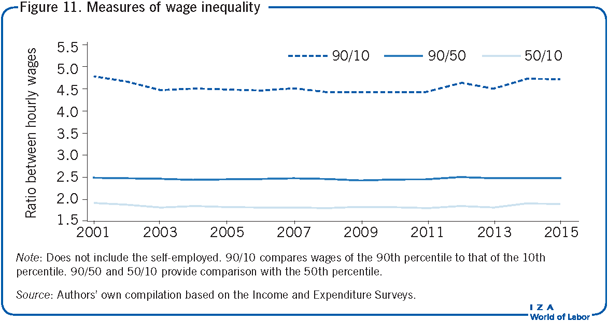

Inequality—Wages and income

The level of net income inequality in Israel has increased noticeably since the mid-1980s, and is currently higher than in most developed countries. The 2014 Gini coefficient (a measure of inequality) and the 90/10 ratio for net household income (showing the gap between the 90th and the 10th percentile of net household incomes) are the third highest among the OECD countries (after Turkey and the US). In contrast, labor income inequality has declined, and is now below US and OECD averages [7], [8].

Here, inequality in the distributions of earnings is measured using the ratios of wages between pairs of individuals at different points of the distribution of hourly wages. In particular, the 90/10 ratio, the 90/50 ratio, and the 50/10 ratio (Figure 11) show that inequality in hourly wages has changed only somewhat, which is consistent with the small changes in the aggregate hourly wage levels described in Figure 8 [9], [10].

Limitations and gaps

While this article focuses on employment and earnings, which are the main and most important labor market outcomes, there are other characteristics that may be of interest: hours of work and the share of part-time and full-time workers; the distribution of workers across occupations and economic sectors; and the dynamic transitions in and out of participation and employment. These can be examined both over time and across groups, but are beyond the scope of this article. The study of transitions requires longitudinal data, which have only been available in Israel since 2012.

Summary and policy advice

Overall, the Israeli labor market is performing remarkably well, with high employment rates, very low unemployment rates, and increasing hourly wages. However, the Arab population (20% of Israel’s total population) and the ultra-Orthodox Jewish population (10% of Israel’s total population) still lag far behind the majority group (non-Orthodox Jews) in terms of employment and earnings. Moreover, according to the Israeli Central Bureau of Statistics, by 2059, the proportion of Arabs in Israel will increase to 23% and the proportion of ultra-Orthodox Jews will increase to 27%, so that together they will account for 50% of the total population. Therefore, an important challenge facing Israeli policymakers is to further increase the low employment rates among those two groups. The good news is that the policy measures described above have had a huge positive impact on employment among these two minority groups. Therefore, the most sensible policy advice when it comes to employment is to maintain the current policy agenda.

In contrast to the increase in employment, hourly wages of Arabs and ultra-Orthodox Jews have not increased, and thus remain much lower than those of non-Orthodox Jews, whose wages did increase during this period. There is an urgent need to encourage investment in the human capital of the minority populations, which can be accomplished by establishing additional institutions of higher education and designated training centers in areas where these groups are concentrated.

Another challenge to address is growing inequality. Past policy measures, together with demographic changes in Israel’s population, have reduced labor income inequality; however, the level of net income inequality is high and has trended upward. This constitutes a threat to the stability of society and should be a top priority for policymakers.

Acknowledgments

The authors thank the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the authors contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [2], [10].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Tali Larom and Osnat Lifshitz