Elevator pitch

The earned income tax credit provides important benefits to low-income families with children in the US. At an annual cost of about $60 billion, it increases the incomes of such families while encouraging parents to work more by subsidizing their incomes. But low-income adults without children and non-custodial parents receive only very low payments under the program, providing them with little income benefits or work incentives. Many of these adults are low-income young men whose wages and employment rates have been declining for years and who might benefit substantially from expanded eligibility for the earned income tax credit.

Key findings

Pros

The earned income tax credit boosts income and work effort among low-income parents and contributed to the steep rise in employment among single mothers in the 1990s.

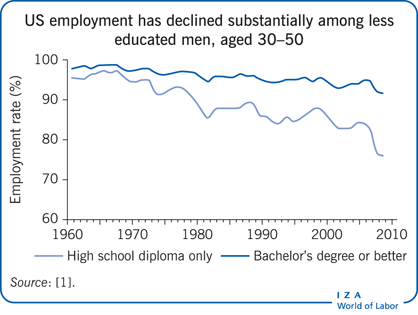

Expanding the tax credit to low-income childless adults would raise income and work effort among a group whose earnings and employment have fallen substantially in recent decades and who now get little assistance from the program.

The statistical evidence shows that work effort among low-income adults is sensitive to their net wages, and an earned income tax credit for childless adults would raise their net wages.

Cons

The earned income tax credit costs about $60 billion a year, and extending it to childless adults would add to those costs.

Strong evidence is lacking on how effective such a program would be at raising income and employment among childless adults.

Expanding the tax credit to childless low-income adults might discourage marriage and reduce work effort among childless adults whose credits are phasing out.

Low-income men with child support orders or criminal records face additional barriers and disincentives in finding work and might need help to find and keep employment.