Elevator pitch

Globalization brings both good and bad job news. The bad news is that jobs will be outsourced from high-cost developed countries into lower-cost locations as soon as the associated economic activity becomes mechanized and predictable. The good news is that globalization creates opportunities that can be realized by people bold enough to transform new ideas and knowledge into innovations. In that way, entrepreneurs will play a vital role in creating the jobs of the future by transforming ideas and knowledge into new products and services, which will be the competitive advantage of the advanced economies.

Key findings

Pros

Innovative activity is the result of investments in new knowledge, such as human capital, research and development (R&D), and creativity.

There are positive correlations between R&D investment and innovation performance and between R&D investment and productivity.

Knowledge investments exploit the opportunities of globalization through their spillover potential, creating innovations geographically close to the source of the new ideas.

Innovation bestows competitive advantage in the globalized economy and has the potential to become an engine of future growth.

Cons

Investments in new knowledge do not automatically generate innovative activity and new jobs, but require conduits for the spillover of knowledge to innovative activities.

The spillover propensity for investments in knowledge is strongly influenced by contextual factors, such as institutions specific to an industry, region, or country.

Knowledge investments in human capital, creativity, and R&D can be appropriated only to the extent that knowledge spillovers can be exploited to generate innovations, employment, and growth.

Author's main message

Globalization has challenged the standard of living, competitiveness, and economic performance of developed countries, but it has created opportunities for them as well. Two policy strategies can harness the opportunities. One is to invest in generating ideas and knowledge through R&D, academic research, education, and creativity. The second is to facilitate the spillover of knowledge created through those investments from academia to enterprise, focusing on incentives to promote entrepreneurial startups, technology transfer from universities, and public–private partnerships linking university research to the private sector.

Motivation

Jobs and growth have stalled in developed countries for more than a decade. Globalization has undermined the competitiveness of firms, industries, and entire regions that had been thriving for decades. Confronted with competition from lower-cost locations, economic activity in traditional industrial sectors, particularly in manufacturing, is simply no longer sustainable. The loss of competitiveness has resulted in stagnant growth and nagging rates of unemployment. Both academics and policymakers declared the advent of globalization as the beginning of an inevitable decline in the standard of living, economic growth, and job opportunities in developed economies.

Jobs and growth in the post-Second World War economy were fueled by physical capital. Today, thanks to outsourcing and offshoring, physical capital is relocating to lower-cost areas, putting downward pressure on job creation in developed countries [1]. However, there is one source of economic activity that does not easily lend itself to outsourcing and offshoring: knowledge and ideas. The growth models introduced by Paul Romer in the 1980s made clear that the driving force behind economic growth and jobs had shifted from physical capital to knowledge and ideas. Thus, economic activity based on human capital, creativity, and research and development (R&D) is becoming more important.

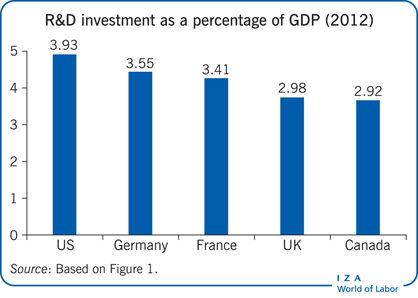

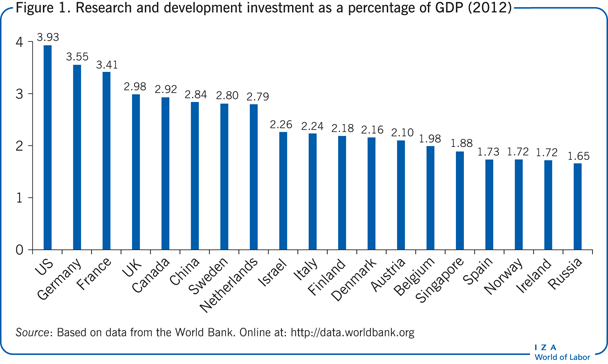

In line with this, some of the strongest economies in the world allocate large sums of money to R&D, expecting this to lead to innovation and economic growth. Figure 1 shows which countries allocate the highest percentages of GDP to R&D. And it is not a coincidence that arguably the most developed economies in the world rank in the highest positions.

Discussion of pros and cons

The knowledge filter and knowledge spillovers

Governments responded to the emergence of the knowledge economy as the basis for jobs, growth, and competitiveness by prioritizing investments in human capital, R&D, and creativity [2]. The 2000 European Council of Lisbon, recognizing the importance of knowledge as a source of jobs and growth in the globalized economy, declared that the EU would become the knowledge and innovation leader of the world. To achieve that goal, each EU member country was encouraged to invest 3% of its GDP in R&D. The European Commission, in its Innovation Union Competitiveness Report 2011, noted a positive correlation between R&D investment and innovation performance, and between a country’s level of R&D investment and its total factor productivity (Figure 2). It also observed that countries with higher levels of R&D intensity are also leaders in innovation performance and achieve higher levels of productivity.

In the US, President Obama has acknowledged the role of innovation in creating future jobs in the White House strategy document A Strategy for American Innovation: Securing Our Economic Growth and Prosperity and in his 2011 State of the Union Address to Congress, when he announced that “America’s economic growth and competitiveness depend on its people’s capacity to innovate. We can create the jobs and industries of the future by doing what America does best—investing in the creativity and imagination of our people. To win the future, the US must out-innovate, out-educate, and out-build the rest of the world. We have to make America the best place on earth to do business” [1].

Moreover, since 2008, international students who receive a US degree in science, technology, engineering, or math (STEM) have been permitted to extend their optional practical training (OPT) program by up to 17 months beyond the initial one-year period. The OPT program allows students with an F-1 student visa to work in the US to gain practical experience related to their field of study. In the case of STEM graduates, this practical experience is likely to be closely related to the highly innovative technological sector and may lead to innovative discoveries.

However, investments in new knowledge do not automatically generate innovative activity and new jobs. In what became known as the Swedish Paradox and subsequently the European Paradox, analysts characterized the simultaneous existence of high levels of knowledge investments in human capital, creativity, and R&D with high rates of unemployment [3]. Mechanisms and channels are required as a conduit for the spillover of knowledge from the organization creating the knowledge to the firm using the knowledge to generate innovative activity [1].

There are three key characteristics of knowledge-based economic activity that influence future jobs. The first is that new ideas and knowledge created and generated by a firm or organization, such as a university or research institute, are often exploited by other firms and organizations through what are referred to as “knowledge spillovers,” whether or not the firm creating the knowledge commercializes it through its own innovative activity.

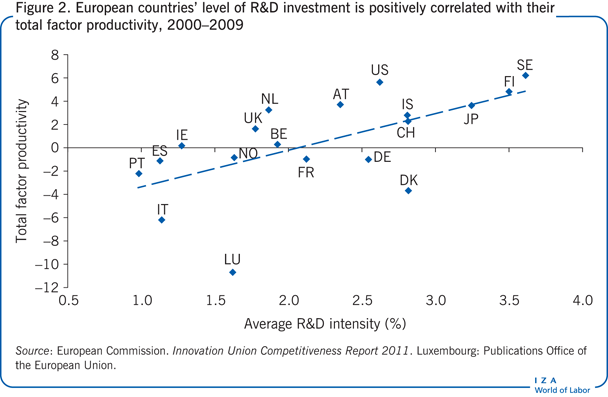

These knowledge spillovers are meant to play an important role in the near future. Figure 3 shows that between 2007 and 2010, a larger percentage of executives believed increased market share was the main growth engine for their companies. In 2010, about 40% of CEOs said that increased market share was the main opportunity for their business to grow. On the other hand, only 20% of CEOs saw new product development as the main growth opportunity. In 2011, the percentage of CEOs for both categories converged at about 30%, while other variables remained constant. About 25% of those who answered increased market share in 2010 changed their answer to new product development in 2011. This statistic is significant because it demonstrates that executives are progressively understanding the power of R&D and product/service development as an economic growth driver.

The second characteristic is that knowledge and ideas tend to stop spilling over as they move across geographic space. The reason is that ideas and insights may require face-to-face communication to facilitate their transmission, while information may be costlessly transmitted over the internet. This means that knowledge spillovers tend to be spatially localized within close proximity to the source creating the knowledge. Globalization was originally viewed as rendering location irrelevant [4]. As The Economist famously proclaimed in a widely heralded headline in 1995, globalization had ushered in “the death of distance.” However, the localization of knowledge spillovers actually makes location more important in an economy where the competitive advantage is based on knowledge and ideas.

The paradox of globalization is that location has become more, not less, important because of the increased influence of knowledge and its potential to spill over. This means that future jobs will be driven by the ability of a place—whether a city, region, state, or country—to both invest in the creation of new knowledge and ideas and to be receptive to knowledge spillover entrepreneurship that can generate localized innovative activity and ultimately economic growth. Examples of successful and sustained clusters of knowledge spillover entrepreneurship that drive economic growth include Silicon Valley in California, the Research Triangle in North Carolina, and Cambridge in the UK.

The third characteristic of knowledge-based economic activity is that new ideas and knowledge, because of uncertainty and asymmetries, are not typically pursued in the company investing in their creation through R&D and human capital. Because it is impossible to know beforehand whether a product or idea will be successful, companies that are more risk-averse often hold back on projects that, if implemented, would be hugely successful. Older but still successful technology companies, such as IBM, seem to struggle to keep up with the level of innovation in younger technology firms. By contrast, some of the most forward-thinking and innovative companies in the world are also the most successful. For example, Amazon and Facebook have experienced astonishing growth in recent years, both surpassing the $300 billion mark in market capitalization. Leadership from risk-taking entrepreneurs like Jeff Bezos and Mark Zuckerberg keep Amazon and Facebook pursuing projects they think will allow their firms to maintain a competitive advantage over the competition.

Thus, it often takes a bold entrepreneur, who values the new ideas more highly than do incumbent companies, to start a new company that acts as a conduit facilitating the spillover of knowledge. This process is referred to as “knowledge spillover entrepreneurship” [5]. For example, five engineers working for IBM near Mannheim in the German state of Baden-Württemberg developed an enterprise-wide system based on Scientific Data Systems (SDS)/SAPE software. When IBM executives decided that this business software could not be made into a commercially viable product, the five engineers (Dietmar Hopp, Klaus Tschira, Hans-Werner Hector, Hasso Plattner, and Claus Wellenreuther) decided that the only way they could continue to develop their new idea and product was by launching their own company. In June 1972, they founded Systemanalyse und Programmentwicklung nearby, in Walldorf, Baden-Württemberg. The idea and knowledge were created in the organizational context of IBM, but it took the start-up of the new firm, known today as SAP, to facilitate the knowledge spillover by creating a new product. The knowledge spillover was spatially localized: the start-up used the knowledge created in another organization (IBM) located nearby [6]. The knowledge spillover benefited not only the entrepreneurial start-up but also the region where SAP was located. As of 2014, SAP had grown to 75,000 employees. While much of the employment is located elsewhere, Baden-Württemberg has benefited considerably from the knowledge spillover through job creation and a higher standard of living [1].

Of course, not all research that comes out of universities and research institutions is relevant. Academics and researchers around the world produce large numbers of ideas but that does not mean that those new ideas will lead to innovation or will materialize into significant outputs. The concept of the “knowledge filter” refers to research and knowledge that comes out of universities but in the end does not lead to a concrete positive output or does not allow a specific company to take advantage of it.

Small firms access and use ideas and knowledge developed elsewhere

The Nobel Prize-winning economist Milton Friedman famously observed, “There’s no such thing as a free lunch.” Inputs are required to generate output. Economists have formalized Friedman’s observation through the model of the production function, which links inputs to outputs. As the importance of innovation for driving growth and jobs became clear, economists used the same approach to analyze the knowledge production function linking knowledge inputs, such as human capital and R&D, to innovative output. Numerous empirical studies tested the validity of the knowledge production function, which has been found to hold at the country level [7], [8]. Countries exhibiting the highest levels of innovative output, such as patents, tend to have the highest levels of knowledge inputs, such as R&D intensity and human capital. The knowledge production function also holds at the industry level. Industries generating the most innovative output tend to have the highest level of knowledge inputs. However, the empirical evidence is considerably more ambiguous at the firm level. In particular, small firms, which do not account for a large share of knowledge inputs in the form of R&D and human capital, generate a large share of innovative output [9].

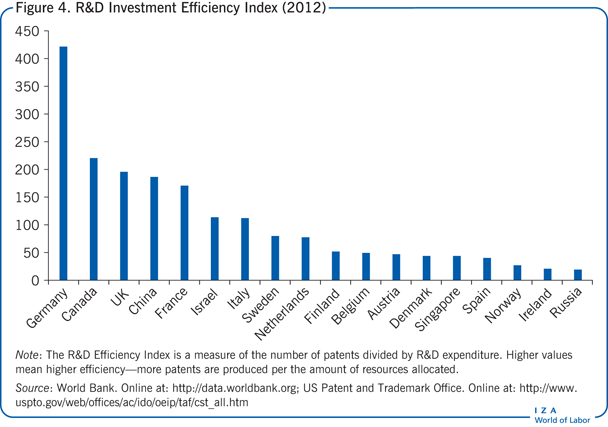

Figure 4 takes into account the percentage of GDP spent in R&D and the number of patents issued in that country in 2012. The R&D Investment Efficiency Index is meant to measure whether a country’s R&D expenditure turns into patents or not. As Figure 4 shows, countries such as Germany, Canada, and the UK are very efficient and their R&D expenditures often turn into patents. The US, which is not included in the graph due to the significant differences in patent laws with respect to other nations, is by far the most efficient country. The US’ R&D Investment Efficiency Index in 2012 was 7,050 points. The relative easiness of obtaining patents in the US compared to other countries implies that an easier patenting process often leads to higher R&D investment efficiency. On the other hand, the number of patents by itself does not represent a good measure of innovation, as many of those patents may not be used to produce innovative products or services.

The high level of innovative activity coming from small firms, even with their paucity of R&D and human capital, is referred to as the Schumpeterian Paradox [10]. The Schumpeterian Paradox is resolved through knowledge spillovers, as small firms access and use knowledge created in other organizations (firms or research institutions, such as universities) to generate their own innovative activity [11]. This important empirical finding explains the source of the knowledge fueling small-firm innovation.

Knowledge spillover entrepreneurship

The actual mechanism facilitating the spillover of knowledge remained unclear, however. Was the new knowledge simply “in the air,” as the famous economist Alfred Marshall once posited? This would imply that a firm merely had to locate near a firm that was generating knowledge and ideas in order to access and use them. But as the example of SAP cited above and of countless others suggest, the ideas and knowledge did not simply spill over in a way that any small firm could access. Rather, the ideas and knowledge were used as the base from which to launch a new enterprise, in the process described as knowledge spillover entrepreneurship. A large body of studies spanning many different countries provides compelling empirical evidence supporting the knowledge spillover theory of entrepreneurship [5], [12].

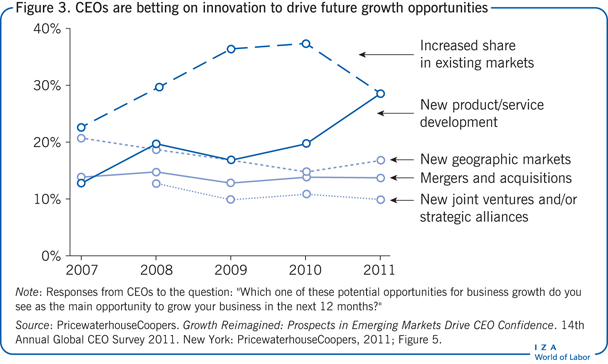

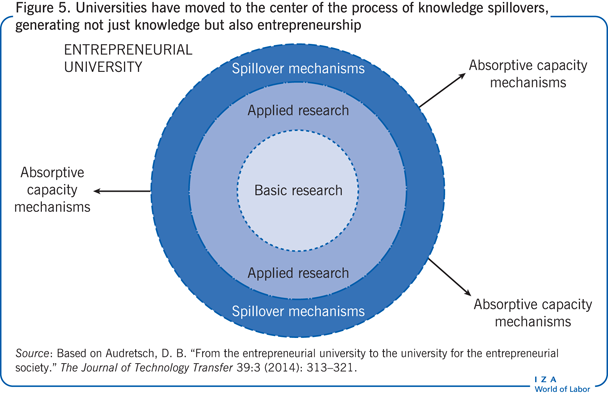

Universities, once extraneous to economic performance, have moved to the center of the process of knowledge spillovers, generating not just knowledge but also entrepreneurship in the new entrepreneurial economy (Figure 5). Because public universities cannot legally commercialize the intellectual property resulting from their research, the only way that innovative activity can result is through knowledge spillovers. However, as for private firms, knowledge does not automatically spill over from universities to companies. Indeed, the US Congress, frustrated by a paucity of innovative activity resulting from university research, enacted the Bayh–Dole Act in 1980, with the goal of facilitating knowledge spillovers from universities [13].

There is compelling empirical evidence that certain types of infrastructure promote knowledge spillovers [6]. Figure 5 represents the concept of the entrepreneurial university. The structure of the entrepreneurial university flows from the inside out, starting with basic research and moving out to applied research, spillover mechanisms, and finally to absorptive capacity mechanisms. Absorptive capacity mechanisms include start-ups and other innovative companies that acquire patents or other types of innovation based on ideas and new knowledge developed in the university. Basic research comprises traditional areas of study, including mathematics and philosophy, among many others. These are the classic disciplines that have been taught for hundreds of years. The second layer includes applied research and focuses on the types of study that draw from a combination of basic research disciplines to create a new and relevant area of study. This group includes such disciplines as business management, public affairs, and chemistry. The entrepreneurial university also has spillover mechanisms. These include business incubators and research institutes that give applied research students a place to go to propose and test new ideas. Some of these ideas are eventually protected by patents. At that stage, entrepreneurial companies come in and absorb the knowledge, by buying the patents or hiring the people who came up with an innovative idea. Spillover mechanisms are basically a platform for showcasing innovation and attracting companies or investors.

Limitations and gaps

There are several limitations and gaps in the literature on knowledge spillovers, related mainly to four aspects of knowledge spillovers. The first relates to what precisely constitutes an investment to create new knowledge. The value of elementary education, secondary education, occupational skills training, and university education, with its multiple disciplines and degree levels, can differ widely, influenced in part by the context. Similarly, most studies treat expenditures on R&D as homogeneous, without differentiation by field or type of research. Yet, as for human capital, investments in research are anything but homogeneous.

A second type of limitation involves the spillover mechanisms. Research has made some progress in identifying the role of entrepreneurship as a conduit for knowledge spillovers. Similarly, for knowledge spillovers from universities there is a substantial literature identifying the role of patents and licensing of intellectual property as conduits of technology transfer. However, there has been little research on what may be the most prevalent mode of knowledge spillover—face-to-face interactions and networking.

A third limitation of the research involves the barriers to knowledge commercialization and spillovers. There are two aspects to this limitation. One is the barriers within firms that impede the transformation of the knowledge they produce into innovation. While it may seem counterintuitive that firms would undertake expensive investments only to ignore the potential returns from those investments, the discussion above explains how the uncertainty inherent in knowledge and ideas can lead to the rejection of ideas that ultimately prove to be valuable. Still, what firms can do to reap the returns from their own knowledge investments is not fully understood. Also not well understood is why some contexts—technology, industry, region, and country—seem to be more conducive to knowledge spillovers than others.

The fourth limitation involves the spatial dimension of knowledge spillovers. While studies consistently find that knowledge spillovers are spatially localized, meaning that geographic proximity to the knowledge source is required to access spillovers, there is little recognition that knowledge is not homogeneous or that the spillover process is not likely to be homogeneous either. This means that the spatial dimension of knowledge spillovers and their geographic localization may be sensitive to many different contexts, such as the technology, industry, location, and country. Thus, the consistent finding in the research literature that the spillovers of knowledge tend to be spatially localized does not mean that all types of knowledge spillovers are spatially localized or localized in the same geographic dimension. This is clearly implicit in the crucial distinction between information, which is not spatially localized, and knowledge, which is. Little is known about the life cycle of ideas and knowledge as they evolve from being highly tacit, and therefore spatially localized, toward becoming codified information, and therefore spatially unbounded.

Summary and policy advice

Among the world’s leading economies, globalization has triggered a decision point on the road to economic development. The prospects for future job growth are likely to be diminished in countries that stubbornly stick with the traditional industries and sectors. By contrast, countries that shift to knowledge-based economic activity that focuses on innovation have the potential to generate sustainable, high-quality jobs.

New insights from research about the importance of knowledge spillovers in the global economy point to two key focal points for policy. The first is that investments in creating new knowledge are crucial for creating future jobs, spurring economic growth, and enhancing competitiveness. Those investments can take the form of education or training and skill accumulation to enhance human capital, expenditures on R&D, or activities that foster creativity. However, while it is necessary for policy to prioritize knowledge investments in R&D, creativity, and human capital, it is also not sufficient.

Thus, the second focal point for policy is to enhance and facilitate the spillovers from those knowledge investments, so that the city, region, state, or country undertaking those costly investments can reap the benefits in terms of greater competitiveness, faster growth, and sustainable job creation. If knowledge does not spill over but remains uncommercialized, the return on public investments in knowledge creation remains low. Society demands a higher rate of return on knowledge to justify costly investments in education, university research, and cultural activities. Therefore, policy instruments designed to facilitate and enhance knowledge spillovers are particularly important. Examples include financial incentives to promote entrepreneurship; offices of technology transfer; science parks and incubators to facilitate spillovers from university research; and conferences, workshops, and networking events to spur the exchange of ideas across individuals and firms.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The analysis and conclusions in the article are those of the author and not necessarily those of Indiana University.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© David B. Audretsch