Elevator pitch

Migration policies need to consider how immigration affects investment behavior and productivity, and how these effects vary with the type of migration. College-educated immigrants may do more to stimulate foreign direct investment and research and development than low-skilled immigrants, and productivity effects would be expected to be highest for immigrants in scientific and engineering fields. By raising the demand for housing, immigration also spurs residential investment. However, residential investment is unlikely to expand enough to prevent housing costs from rising, which has implications for income distribution in society.

Key findings

Pros

High-skilled immigration attracts foreign direct investment.

Immigrants can help multinational firms find investment opportunities abroad.

Increasing the share of high-skilled immigrants has sizable income effects that can be attributed to productivity gains.

Foreign-born scientists and engineers, in particular, contribute to innovation and productivity growth.

Immigration spurs investment in residential housing by increasing housing demand.

Cons

Immigration is less likely to promote productivity growth when immigrants are low-skilled.

The income effects of attracting high-skilled immigrants in scientific and engineering fields on low-skilled native-born workers are fairly small.

Residential investment triggered by higher immigration is insufficient to prevent housing costs from rising.

Temporary migrants put most of their savings into remittances, which do not boost investment in the host country.

Author's main message

Immigration by high-skilled workers attracts foreign direct investment, helps firms find investment opportunities abroad, and raises per capita income by boosting productivity. However, despite triggering residential investment in the host country, immigration also raises housing costs, with undesirable income distribution effects. Policymakers should thus consider selective immigration policies that attract high-skilled workers, accompanied by redistributive measures that benefit low-income households in the host country and by compensating measures for the home countries that lose high-skilled migrants.

Motivation

Modern economic growth theory suggests that the interaction of technological progress and capital accumulation is the ultimate source of long-term economic growth. Whether immigration flows cause changes in labor productivity through investments in capital and research and development (R&D) is an important issue for policymakers. Examining how immigration affects capital formation requires a dynamic perspective that includes the effects on the accumulation of intangible assets (knowledge capital) as well as physical assets. For instance, technological improvements could arise as a result of the immigration of high-skilled workers with science and engineering skills. Moreover, immigrants may help foreign firms find investment opportunities in the host country and foster foreign direct investment (FDI).

Also relevant to migration policy are the potentially differential impacts of temporary and permanent immigration. The income distribution effects through the impact on housing costs also need to be considered. If immigration raises the demand for housing faster than supply is able to expand, owners of land and housing property will gain while tenants will be hurt.

Discussion of pros and cons

The interaction between international migration and investment has been studied much less than, for example, the labor market effects of immigration on native-born populations and foreign-born workers already living in host countries. In the studies surveyed here, immigrants are typically defined as foreign-born individuals aged 25 or older. Although the shorter-term effects of immigration on employment and wages that have typically been found in the empirical literature are small, migration may lead to large increases in wage income by enhancing FDI in the home and the host countries and productivity in the host country.

Migration and physical capital investment

Measures of FDI flows capture international movements of physical (productive) capital rather than other financial assets. FDI is one potential channel through which migration could affect labor productivity in both home and host regions. That is because immigrants may reduce information frictions that typically lead to a bias by firms against investing in business ventures in foreign countries, about which firms know much less than they do about their home country. Increasing FDI may not only raise the physical capital stock, but also improve technology and thus result in productivity gains.

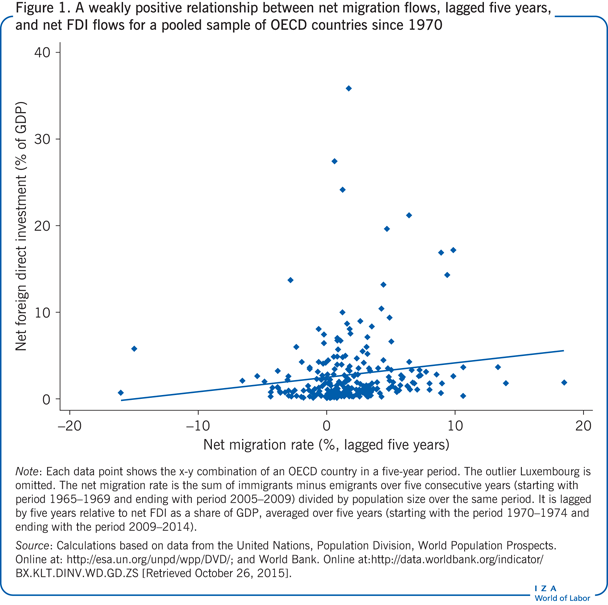

For a pooled sample of OECD countries, Figure 1 shows only a weakly positive (although statistically significant) relationship between net migration flows (defined as total migration inflow minus migration outflow over a five-year period as a share of the average population over the same period) and the sum of net FDI flows over five years as the share of total gross domestic product over the same five years. The net migration rate is lagged by five years (migration data cover the period 1965–2009 and FDI data the period 1970–2014) in order to capture the notion that migration (for example, in the period 1965–1969) affects FDI five years later (in the period 1970–1974).

Inward foreign direct investment

According to theoretical models, under conditions of international or interregional capital mobility, labor market integration that leads to immigration of workers attracts capital inflows because of the complementarity between capital and labor in producing goods and services. Analogously, emigration slows capital formation.

It is important to distinguish the causal effect of migration on capital movements, which is strongly positive, from the correlation between them, which may be weak. Even when the causal effect is positive, labor and capital may move in opposite directions across countries and regions. For that reason, little correlation may be observed between capital accumulation and labor flows, even though the causal effect from net migration to the change in the capital stock is unambiguously positive. A prime example is the opposite movement of labor and capital following reunification of Germany in 1990. Large labor flows moved from East to West Germany, while capital accumulated faster in the East [5]. Neoclassical growth theory suggests that if the integration of labor markets leads to labor outflows from a less developed region with a capital stock per capita that is below its long-term level, capital will also move into the region but at a slower rate than without emigration. If labor market integration occurs when the regions involved are sufficiently developed, labor and capital may flow in the same direction [6].

The challenge for empirical research is to identify causal effects between immigration and FDI. One study looks at the two-way relationship of stocks of immigrants and stocks of inward FDI from foreign countries into the 16 German states over the period 1991–2002 [7]. It finds that inward FDI is significantly increased by a higher stock of immigrants, if it comes from high-income countries. One possible explanation for this effect is that immigrants assist in interactions with foreign companies in their home country, thus helping overcome information problems. It is interesting to note that, unlike a higher stock of immigrants, a larger domestic labor force does not promote inward FDI, so it is not just the larger population size that attracts inward FDI.

Outward foreign direct investment

There is also evidence that a higher stock of immigrants has a positive impact on the stock of international bank loans from the host country to the immigrants’ home country [8]. The effect is particularly large when the immigrants are high-skilled and the two countries do not share a common language, legal heritage, or colonial past. This suggests that immigrants are particularly important for facilitating cross-border financial flows when informational problems are severe.

As is the case for bank loans, there may also be a positive effect from immigration on outward FDI from the host country to the immigrants’ home country. One study suggests that a larger immigration stock of both low- and high-skilled workers in the US in 1990 led to higher subsequent growth of outward FDI financed by US firms over 1990–2000 [9]. The channels through which immigration affects outward FDI may differ for low- and high-skilled migrants, however. One hypothesis is that investors in developed countries with little advance information about the quality of the labor force in developing countries may observe a rather high productivity of immigrants despite their few formal qualifications, take it as signal of the quality of the labor force in the home country of the immigrants, and thus may be more positively inclined to invest there than they would be without that signal. High-skilled immigrants, by contrast, may actively contribute to the creation of international business networks.

Demonstrating causality despite the weak correlation shown in Figure 1 is usually tackled by predicting migration using variables that affect migration but have no direct effect on investment or productivity gains. Using predicted rather than actual migration avoids that the estimated migration effects actually come from omitted determinants of investment and productivity that are correlated with migration and would therefore bias estimation results. The most common approach to avoiding such omitted-variable bias is to use historically rooted migration stocks of different immigration groups as a predictor of migration. The approach is based on the notion that potential migrants determine where to migrate based on the number of prior migrants from their country, who can ease their migration by providing a social network based on family or cultural ties.

This method is used, for instance, in a study that accounts for the possibility that outward US FDI induces migration of workers in foreign subsidiaries to the US headquarters of multinational companies [10]. The study predicts the total stock of migrants from a home country using the share of the stock of migrants in that country’s population 30 years earlier. The results suggest that a 1% increase in the stock of college-educated immigrants in the US raises the stock of outward FDI from the US to the home country of the immigrants by about 0.5%. The effect is slightly lower for an increase in the stock of all immigrants.

Savings and remittance behavior of immigrants

It is also interesting to examine the savings behavior of migrants, to see whether they invest their savings in the host country or remit them to their family members who have not migrated. The literature suggests that both the savings rate and the amount of remittances depend on whether migrants are temporary or permanent. For example, immigrants in Germany seem to have lower saving rates, on average, than native-born residents with similar characteristics. Immigrants who plan to stay only temporarily, however, tend to save more and not less than natives; they remit more than immigrants who plan to stay permanently [11]. Thus, remittances are a major motive for savings, particularly for temporary migrants who plan to return home some time in the future. Those savings are not invested in the host country but may help to accumulate productive capital in the home country. Particularly in home countries where credit markets for financing productive investments are underdeveloped, remittances may be able to boost school enrolment, reduce child labor, and promote entrepreneurship.

Migration and knowledge capital formation

Immigration may also be important for the accumulation of intangible assets. High-skilled immigrants with science, engineering, and other professional skills may contribute to technological improvements in the host countries. While it is common to use formal intellectual property, such as number of patents, to measure innovation, informal innovations in tacit knowledge and organizational improvements can also lead to productivity gains. Thus, to gauge the joint impact of immigration on intangible assets through observable and unobservable R&D, one needs to look not only at the number of patents but also at total factor productivity (the share of output that is not explained by the amount of inputs used in production).

Patent activity, innovation, and productivity

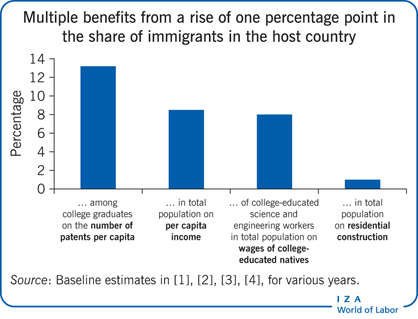

A survey of US college graduates offers evidence on the patenting behavior of immigrants and native-born residents [1]. Immigrant graduates are one percentage point more likely (probability of 1.9%) than native graduates (0.9% probability) to be granted a patent. That difference can be attributed entirely to the fact that the share of immigrants with a science or engineering degree is higher than the share of the native-born population. These results suggest that increasing college-graduate immigrants’ share of the population by one percentage point raises the number of patents per capita by 6%.

On the other hand, it has been argued that there could be other reasons for this finding and that a country does not gain from increased patenting through the immigration of scientists and engineers. There may be fears that immigrants’ patents will crowd out the patenting activity of native-born workers. It is also possible in this case that if the students had not immigrated to the US, they would have applied for their patents elsewhere and the US might still have benefited from these patents through cross-country knowledge spillovers.

However, the evidence does not support these suggested theoretical possibilities challenging the effect of immigration on patenting. For instance, a study using 1940–2000 US state data points to positive creativity spillovers within the US from a higher share of college-graduate immigrants on the patenting activity of the native-born population [1]. To address the possibility that this finding simply reflects that immigrants choose host countries with high patenting activity, the study looked at changes in patents over time. It predicted the share of immigrants in the workforce (ages 18–65) using the stock of immigrants in 1940 from various home countries. The results suggest that a one percentage point increase in the workforce share of immigrants with a college degree (3.5% in 2000) boosts patents per capita by 13.2% within 10 years. The results are similar over 30-year and 50-year periods. The effects of analogous increases in the college-educated native population over 10, 30, and 50 years are just 2–6%. Moreover, a one percentage point increase in the share of immigrant scientists and engineers in the workforce boosts the number of patents per capita by an astonishing 52%—more than twice as much as for a similar increase in the share of scientists and engineers in the native-born population. Thus, there is a clear boost in patents associated with the immigration of college graduates, particularly the immigration of scientists and engineers.

Overall productivity effects

Other studies examine the overall productivity effects of immigration, not just through patenting. Again, the US offers a good opportunity to examine the importance of foreign-born college-educated STEM (science, technology, engineering, and mathematics) workers. The US H-1B visas allow foreign workers to migrate temporarily to the US to work in “specialty” occupations such as those requiring these skills. One study estimates the increase in science and engineering workers attributable to changes in the number of H-1B visas issued in 219 US cities over 1990–2010 [2]. The results suggest that a one percentage point increase in the share of foreign-born scientists and engineers in the working population boosts the average weekly wages of native-born college-educated workers by 8–11% and those of native-born non-college-educated workers by almost 4%. These results suggest positive productivity effects. However, the increase in the share of foreign-born scientists and engineers in the working population over the period of the study was just 0.53 percentage points (two-thirds of the total increase in the employment share of such workers in US cities). It is unclear, though, whether the large effects found in this study would hold with heavier inflows of foreign-born science and engineering workers, possibly of lower average quality.

Long-term effects could also come from attracting foreign-born PhD students to scientific and engineering fields. There is evidence that these students increase academic output (as measured by number of scientific articles). This kind of basic research may have positive productivity effects, although the effects may take longer to arise than for the immigration of science and engineering workers (rather than PhD students).

Rather than focusing on only one country, other studies use international data on bilateral migration stocks across countries [3], [12]. Bilateral migration data are available for 1990 and 2000 for up to 194 countries. The data set includes information on migrants’ education level (e.g. on how many college-educated, working-age immigrants from Greece live in France). One study uses the past emigration stock to predict high-skilled migration rates into OECD countries. The evidence suggests a small, positive effect on the ratio of total factor productivity in the host country to that in the home country. For example, a five percentage point increase (a doubling) in the ratio of college-educated migrants from a migrant-sending country to the college-educated population living in an OECD country raises the ratio of total factor productivity in the home country relative to in the host country by one to two percentage points [12].

Another approach is to predict a country’s share of foreign-born population using bilateral migration flows that are determined by geographic and cultural distance between countries and to use this prediction to estimate the effect of a larger immigration share on per capita income and productivity [3]. The results suggest that a one percentage point increase in the immigration share (which averages 4% for the sample of 181 countries for which the required data were available) raises per capita income by about 6–10%. The effect is driven almost entirely by the increase in total factor productivity; the per capita stock of physical capital is basically unaffected. The productivity effect is attributed to immigration’s contribution to innovation activity and the diversity of productive skills. By contrast, openness to trade (the sum of exports and imports as a share of GDP) has no effect on per capita income once the migration share is accounted for. This comparison between migration effects and trade effects illuminates possible biases in studies that estimate the effects of trade expansion on per capita income and do not control for the contribution of immigrants.

Population diversity

Immigration contributes to the diversity of the population in many ways, and it is important to distinguish among them. The literature has focused largely on the change in the composition of education levels in response to immigration. Diversity can also refer to genetic or cultural diversity. The different forms of diversity may not be strongly correlated, and they may have different effects on economic prosperity in the host country. The literature suggests that the optimal degree of diversity balances the positive complementarities in production between immigrant and native-born workers that arise from the different skills associated with different cultural backgrounds and the increasing costs of communicating in a culturally diverse work environment.

When cultural diversity leads to ethnic fragmentation, the effects of diversity may be predominately negative, especially in developing countries. Meanwhile, birthplace diversity (the probability that two individuals drawn randomly from the population were born in different countries) has been shown to have predominantly positive effects. It is viewed as a good measure of skill complementarities between the immigrant and native-born populations [13]. A country’s birthplace diversity is composed of the share of immigrants in the population and the birthplace diversity among those immigrants. Both variables are individually found to have a positive effect on per capita income. The effects are larger for skilled immigrants than for unskilled immigrants. Again, this confirms the expectation that positive productivity effects come from skilled immigrants. The positive effects are particularly strong for patent applications per capita and total factor productivity, two potential drivers of higher per capita income. The results still hold after controlling for measures of ethnic, linguistic, and genetic diversity.

Economic development consideration: Brain drain or brain gain?

But what about brain drain and the ethics of depriving other countries of their most productive workers? For migration between developed countries, the effects appear to be moderate. The free movement of labor within the EU may aggravate income differences across member countries, while at the same time generating efficiency gains by letting workers move to the location where they are most productive [12]. Equity concerns call for redistributing the efficiency gains in the host countries through compensating public transfers across EU member states.

The impacts may be more severe for immigration from developing to developed countries. There is evidence that lowering immigration barriers in order to increase the likelihood that skilled workers will be able to emigrate from poor countries with low levels of human capital could stimulate human capital investment in home countries that results in a net brain gain rather than a drain. However, the effects differ across countries, and more countries may lose than gain. Thus, skill-selective immigration policies, while most effective in terms of enabling productivity increases in the host country, are clearly at odds with development goals for some poorer countries. This possibility should be taken into account by developed country policymakers. If skill selection of migrants is preferred over broader liberalization of migration policies that includes non-economic reasons for migration, developed country policymakers should consider possible ways of compensating developing countries. Options include offering study visas for potential immigrant students and fostering technology transfers.

Migration and residential investment

Numerous studies suggest that immigration also affects housing costs. At the local level, housing prices may fall if low-income-earning immigrants move into a neighborhood and drive out higher-income earners, who relocate to richer neighborhoods. As this then raises housing prices in those neighborhoods, at a less disaggregated level immigration leads to higher housing prices through an increase in overall demand for housing services. Higher demand for housing also leads to higher investment in residential housing. The important question thus is whether the supply response is large enough to offset the price increases from rising demand, at least in the longer term.

The effect of immigration on housing supply through investment in housing is not nearly as well studied as its effect on housing prices. One exception is an investigation of the effect of regional immigration on residential construction in Spain [4]. By using past immigration to predict current immigration at the regional level, the study accounts for the possibility that immigrants locate in economically booming regions. As Spain’s total population grew by 1.5% a year over 2001–2010, with an average annual increase in the immigrant share in the population of about 1.3 percentage points, the number of new housing units grew 1.2−1.5% a year. In other words, a one percentage point increase in the immigrant share in the population led to a roughly 1% increase in residential construction. Half the residential construction boom in Spain can thus be attributed to immigration.

Despite the increase in residential construction, however, housing prices increased by about 2% per year. The explanation for this is straightforward. The combined effect of higher demand and higher supply of housing associated with higher population density determines land prices. The land area available for residential construction can be extended only within naturally determined limits. Consequently, land prices are likely to grow in line with housing demand, thus raising housing costs [6]. Land prices are important from an income distribution point of view because land ownership is often highly concentrated among wealthier individuals and historically determined. An immigration-induced increase in housing demand thus provides windfall gains for landowners, with long-term effects on wealth concentration through familial bequests.

Limitations and gaps

Though consistent, the evidence that immigration is positively related to capital investment, productivity, and innovation is still rather limited and confined largely to the US. More evidence at the regional level within other countries is also needed on the effects of immigration on FDI and the housing market.

No empirical studies have been conducted so far on the two-way interaction between immigration and residential investment. Intuitively, while immigration triggers housing demand and residential investment, inadequate residential investment because of zoning restrictions can lead to high housing prices that discourage immigration. The wage gains of immigrants in the host country compared with the home country could be nullified by rising housing costs in the host country, thereby further discouraging immigration. It would thus be interesting to know more about the interaction of immigration and zoning and housing construction regulations for residential construction.

The evidence strongly suggests that high-skilled immigrants stimulate capital investment and raise productivity in the host country, but much less is known about the potential effects of migration, particularly of low-skilled migrants, on capital formation in home countries. A potential avenue for such impacts is through remittances, which can, among others, support entrepreneurship among migrants’ family members who remain behind in the home country.

Summary and policy advice

Empirical evidence suggests that immigration of educated workers attracts FDI, helps firms find investment opportunities abroad, and raises per capita income by enhancing labor productivity. The immigration of scientists and engineers, in particular, stimulates innovation in the host country through new patents. The migration of low-skilled workers seems to have less impact on capital formation in host countries. The evidence supports the design of selective immigration policies to attract high-skilled workers, particularly those with science and engineering skills. Greater birthplace diversity in a population through immigration is also found to foster economic prosperity, particularly if immigrants are well-educated.

However, there is the issue of potential brain drain in developing countries that lose their skilled workforce in response to skill-selective immigration policies in host countries. Such emigration may conflict with development goals and may lead to a net skill loss in home countries. Admitting more students from developing countries on student visas in developed countries may be a way to compensate for brain drain.

From a development policy perspective, the main benefit of emigration for the home country may come from remittances, from both high- and low-skilled migrants. Because remittances tend to be higher from temporary migrants than from permanent migrants, providing opportunities for temporary work in developed countries may be conducive to economic development in home countries. However, temporary migrants have less incentive to learn the host country language, which is an obstacle for improving their earnings prospects over time. This point may be particularly relevant for refugees, who should quickly be moved onto the track of permanent residence in the host country after their refugee status is approved.

Despite the many potentially positive effects of immigration, policymakers have to be aware that high levels of immigration can provoke a backlash against liberal immigration policies in host countries, especially if housing prices rise as a consequence. Clearly, not everyone in the host country benefits from the efficiency gains from immigration. Possible measures to redress the imbalance include transfers to low-income households (who typically rent rather than own housing property), possibly financed by increases in taxation of housing property, wealth, and bequests. Thus any undesirable income distribution effects associated with higher housing prices could be addressed by the tax-transfer system instead of by limiting immigration and forgoing the related positive impacts.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. He also thanks Aderonke Osikominu for comments and Fabienne Helfer for excellent research assistance. Previous work of the author (together with various co-authors) contains a larger number of background references for the material presented here and has been used intensively in major parts of this article [6], [12], and Felbermayr, G., V. Grossmann, and W. Kohler. “Migration, international trade and capital formation: Cause or effect?” In: Chiswick, B. R., and P. W. Miller (eds). The Handbook on the Economics of International Migration, Vol. 1B. Amsterdam: Elsevier, 2015; pp. 913–1015.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Volker Grossmann