Elevator pitch

Current cohorts of young adults entered adulthood during an international labor and housing market crisis of a severity not experienced since the Great Depression. Concerns have arisen over the impacts on young adults’ employment, income, wealth, and living arrangements, and about whether these young adults constitute a “scarred generation” that will suffer permanent contractions in financial well-being. If true, knowing the mechanisms through which young adults’ finances have been affected has important implications for policy measures that could improve the financial well-being of today’s young adults in the present and future.

Key findings

Pros

In the Great Recession, young adults in most countries experienced disproportionately high unemployment rates.

Entering adulthood during a recession results in persistent declines in earnings.

Young adults experienced large declines in net worth in the Great Recession, attributable to declining assets and rising debt.

Declines in home and stock ownership among young adults may lead to persistent declines in net worth.

Rates of co-residence with parents increased among young adults in the Great Recession, which is partly attributable to borrowing constraints due to elevated debt-holding.

Cons

Entering adulthood during a recession often leads to increased schooling, which could boost earning power in the future.

Young adults experienced smaller declines in net worth than slightly older adults because they were less invested in housing and stock markets.

Depressed rates of home ownership are not permanent, and ownership gaps typically narrow later in life.

At the same age, young adults in the current cohort have higher asset ownership rates and are less likely to experience financial distress than young adults who came of age around 1989.

Author's main message

During the Great Recession, young adults experienced elevated unemployment rates, lower earnings, reduced net worth, lower rates of home ownership, and higher rates of co-residence with parents. The evidence indicates that entering adulthood during a recession can lead to persistent declines in earnings and net worth, although some indicators suggest that young adults may be able to catch up later in life. Understanding the economic experiences of young adults is critical for guiding public policies aimed at improving their financial well-being in the present and future.

Motivation

Concerns have arisen about whether the current cohort of young adults, who entered adulthood during an economic recession of a severity not experienced since the Great Depression, will suffer permanent declines in financial well-being. How has the international labor and housing market crisis affected young adults’ employment, income, wealth, and living arrangements? If young adults are unable to find jobs, or are only able to find jobs inferior to those they might have had in a more favorable market, entering adulthood in a recession might lead to permanent losses in earnings. And recent declines in housing and stock markets have eroded household net worth, which could place this cohort of young adults on a lower trajectory for wealth accumulation. For public policies that aim to improve the financial situation of young adults now and in the future, sorting out whether these young adults will be permanently worse-off or will eventually catch up with cohorts who entered adulthood in more favorable economic conditions is critical. This paper reviews the evidence on the economic experiences of young adults in the Great Recession—including changes in employment, earnings, wealth accumulation, home ownership, and living arrangements—and what they can expect for the future.

Discussion of pros and cons

Labor market outcomes for young adults in the Great Recession and beyond

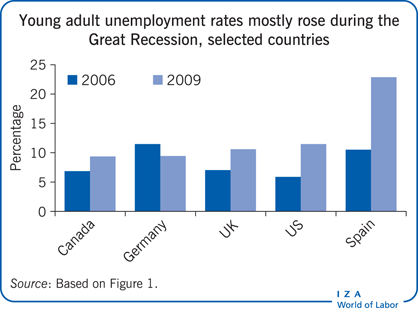

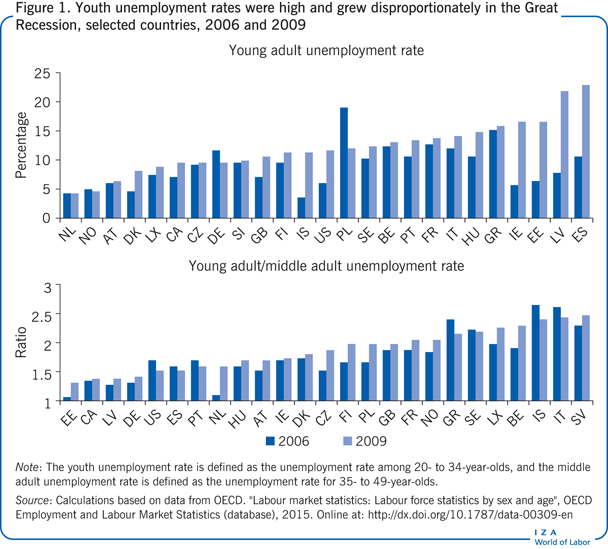

Unemployment rates were high for young adults during the Great Recession. Figure 1 displays unemployment rates for young adults aged 20–34 in selected developed countries in 2006 and 2009, representing the periods before and during the Great Recession. Unemployment rates among young adults varied substantially across countries during the Great Recession, ranging from 4.3% in the Netherlands to 22.9% in Spain in 2009. The median unemployment rate globally was about 11.5%, which is approximately the rate experienced by young adults in the US. In most of the countries displayed in Figure 1, unemployment rates grew about 50% between 2006 and 2009 for young adults.

Unemployment rates among young adults tend to be higher than the overall employment rate even in prosperous economic times. Thus, an important question is not only what the absolute growth in unemployment rates was among young adults, but also whether unemployment rates among young adults grew disproportionately in the Great Recession. The bottom panel of Figure 1 displays ratios of unemployment rates among young adults aged 20–34 to unemployment rates among slightly older adults aged 35–49 (referred to as “middle adults”) in 2006 and 2009. Even in 2006—prior to the Great Recession—young adult unemployment rates were always higher than middle adult unemployment rates in every country shown in the bottom panel of Figure 1. The ratios range from 1.04 in Estonia to 2.65 in Iceland. In the US, young adult unemployment rates were about 70% higher than middle adult unemployment rates in 2006.

Comparing young to middle adult unemployment rate ratios in 2006 to ratios in 2009 shows whether the Great Recession disproportionately affected young adults relative to middle adults. In this case, the results are mixed. In a majority of countries examined, the ratios of unemployment rates among young adults to those among middle adults grew between 2006 and 2009, indicating that young adult unemployment rates were disproportionately elevated in the Great Recession. There are, however, several countries in which the ratio of young adult to middle adult unemployment rates fell, including the US and several southern European countries (Greece, Italy, Portugal, and Spain).

However, these relative improvements in the labor market experiences of some young adults stem from large relative increases in unemployment rates for middle adults, not from declines for young adults. Indeed, in each country where the ratio of young to middle adult unemployment fell, the young adult unemployment rate remained at least 50% larger than the middle adult unemployment rate in absolute terms. Moreover, in most cases, the young adult unemployment rate also grew more than the middle adult unemployment rate in absolute terms (Greece is an exception). Consider, for example, the case of Spain. Between 2006 and 2009, young adult unemployment rose 12.4 percentage points, from 10.5% to 22.9%. At the same time, middle adult unemployment rose from 6.6% to 15.2%, an 8.6 percentage point increase. Thus, although young adults fared slightly better than middle adults in relative terms, they clearly fared worse in absolute terms.

Even for young adults who were able to find a job during the Great Recession, entering the job market during a recession could have negative implications for earnings over time. When the labor market is weak, new entrants may be forced to accept lower wages or jobs that are a poorer match for their qualifications and interests than they might have in better economic circumstances, with both short- and long-term effects on earnings. People who enter the job market during a recession may also be unable to make beneficial job changes that improve their earnings and job match.

Several recent studies tackle the question of whether there are long-term negative earnings effects of entering adulthood in a bad economy. A study for Canada that examines the effects of unemployment rates at the time of entry into the job market on wage growth finds that a five percentage point increase in the unemployment rate (roughly that experienced during the Great Recession in Canada) leads to a 9% reduction in entry-level wages [1]. This wage gap halves in five years and disappears in ten years, but overall there is a 5% cumulative earnings loss. Most of the wage gap is explained by new entrants taking lower-paid jobs initially. A similar study looks at college graduates in the US and finds somewhat larger and more persistent wage effects [2]. Finally, a more recent study that looks at data during the Great Recession finds that the effect of unemployment rates on current earnings was two to three times larger than in previous recessions [3].

Although the evidence suggests that entering the job market in a recession can lead to lower wages, there is growing evidence that it can also lead to increased educational attainment, which may ultimately boost future income. One study that looks at cross-region changes in unemployment rates and post-secondary enrollment in the UK finds large effects of unemployment rates on enrollment, which indicate that the elasticity of enrollment with respect to youth unemployment is approximately 0.2 [4].

The Great Recession and young adult’s balance sheets

In addition to the decline in labor market opportunities, there were historic declines in financial and real estate markets during the Great Recession. If young adults were invested in these markets, they could have experienced large drops in net worth.

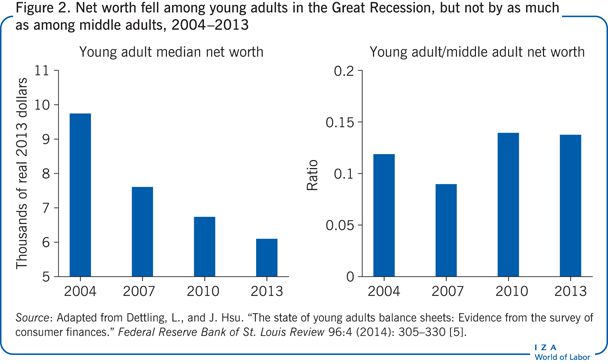

A recent study of young adult’s balance sheets in the US, using data from the Survey of Consumer Finances, finds that median net worth among young adults fell from almost $10,000 in 2004 to about $6,000 in 2013, a decline of nearly 40% (Figure 2, left panel) [5]. This contraction was due to both a decline in assets and an increase in debt.

The study also compares the effects of the Great Recession on the finances of young adults relative to those of slightly older adults [5]. Although young adults sustained a large drop in net worth between 2004 and 2013, middle adults fared slightly worse, with the ratio of young adult to middle adult net worth rising from a low of 0.09 in 2007 to 0.14 in 2013 (see Figure 2, right panel). The net worth of young adults was less affected by the Great Recession than that of middle adults because of the types of assets young adults hold. In particular, home and stock ownership rates are relatively low among young adults. Thus, declines in housing and stock markets, which were severe, had less of an impact on young adults’ net worth.

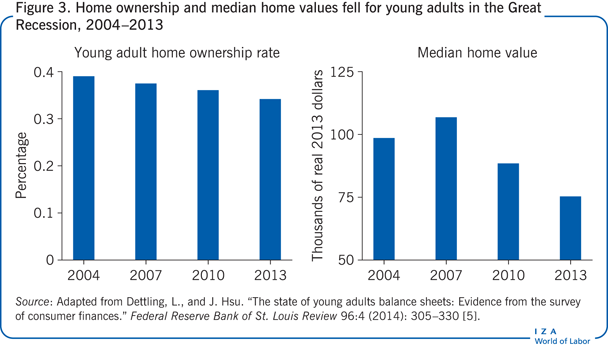

The single largest component of many families’ net worth is their primary residence [6]. Thus, changes in home ownership and housing values can lead to large changes in net worth and overall financial well-being. Between 2004 and 2013, home ownership rates fell among young adults from 39% of young adults owning a home in 2004 to 34% owning a home in 2013 (Figure 3, left panel).

This decline in home ownership could have important long-term implications for this cohort’s ability to accumulate wealth and save for retirement if home ownership is an effective means of building wealth. Indeed, a recent overview of the research on this topic finds that home ownership helps to build wealth by acting as a forced saving mechanism and allowing owners to realize any price gains [7].

There is some evidence, however, that cohorts experiencing low home ownership rates as young adults can catch up later in life. A recent study of economic conditions and cohort-level home ownership rates in the UK finds that cohorts experiencing higher home prices during young adulthood display lower ownership rates at age 30 [8]. However, the study also finds that cohorts with relatively low home ownership rates at age 30 make up almost all of the ownership gap by age 40. Thus, currently depressed home ownership rates may not persist. Moreover, young adults may benefit from the housing price declines during the Great Recession if they are able to enter the housing market while prices are low, potentially allowing them to reap the benefits of future price increases.

Conditional on owning a home, the median value of homes owned by young adults also fell sharply in the Great Recession: between 2007 and 2013, the median value of young adults’ homes fell 30%, from a peak of $107,000 in 2007 to $75,000 in 2013 (see Figure 3, right panel). Declines in home values can be particularly burdensome for the balance sheets of young adults, who tend to be relatively recent entrants into home ownership and, as a result, often have relatively high loan-to-value ratios. For owners with a high loan-to-value ratio, a large decline in home prices—as occurred between 2007 and 2013—can cause the value of the home to fall below the mortgage balance, producing negative equity (often called an “underwater mortgage”). Negative equity is particularly burdensome if the homeowner wants or needs to sell, since an owner needs enough liquid assets to cover the difference between the mortgage balance and the sale price.

When there is negative equity in a home, financial constraints or loss aversion may discourage the owner from selling and moving to a region with better labor market conditions or making a beneficial job change. Indeed, one study finds evidence of these type of “lock-in” effects for owners with negative equity [9]. Having negative equity reduces two-year household mobility by four percentage points, or about a third of baseline mobility. If young adult home owners with negative equity do not make job-related moves, recent declines in housing prices may also have spillover effects on young adults’ labor market outcomes in the present and future.

There was also a large reduction in stockholding among young adults in the Great Recession in the US: the rate of stockholding fell from 13% of young adults in 2004 to 6.5% by 2013 [5]. Instead, young adults are holding money in less risky checking and savings accounts. If this trend persists, it could also lead to long-run declines in wealth accumulation, since stock market returns tend to be high relative to other saving and investment instruments. A study also suggests that this reluctance to hold stocks may be permanent, finding that participation in stock and bond markets is influenced by returns experienced in those markets, with lower experienced stock market returns leading to persistent declines in participation [10]. The study predicts that the stock market declines experienced in the Great Recession should reduce young people’s participation in stock markets by seven percentage points (similar to the decline observed in [5]) and that these effects may take 30 years to fade away.

The US study using Survey of Consumer Finances data also highlights changes in young adults’ credit market experiences [5]. Between 2004 and 2013, median debt to income ratios for debtors (defined as the ratio of total debt to total income) remained similar, but median leverage ratios (the ratio of total debt to total assets) rose. Despite these changes and declines in employment and income, several indicators of young adults’ financial well-being improved. Between 2004 and 2013, young adults were four percentage points (about 10%) less likely to report being credit constrained, seven percentage points (about 20%) less likely to carry revolving debt on a credit card, and two percentage points (about 1%) less likely to be late on payments.

There are several indicators that young adults are not faring worse than previous cohorts [5]. A comparison of the balance sheets of the current cohort of young adults to that of young adults in 1989 shows that the current cohort is more likely to own homes, stocks, and retirement accounts than previous cohorts. Moreover, compared to middle adults, young adults in 2013 had higher relative net worth than did young adults in 1989. And while middle adults in 1989 and 2013 were about equally likely to report facing borrowing constraints or having high debt payment to income ratios, young adults in 2013 were less likely than young adults in 1989 to experience these markers of financial distress. Thus, although the current cohort of young adults has worse balance sheets than those observed before the Great Recession, this cohort may ultimately fare no worse than previous cohorts.

A failure to launch? Trends in household formation during the Great Recession

A persistent media narrative from the Great Recession is the increase in “boomerang” kids, referring to young adults who move back in with their parents. Increased rates of co-residence with parents have important implications for the economy at large. From a household perspective, boomerang kids could be delaying wealth-building and may be a strain on parental resources. From a macroeconomic perspective, young adults who live with parents spend less on rent, furniture, and other items associated with independent living, which can depress aggregate consumer spending and economic growth.

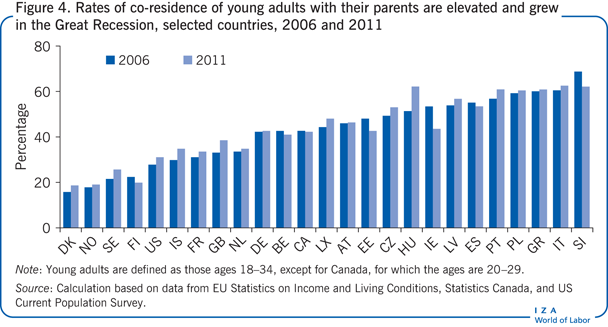

Rates of co-residence of young adults with their parents are currently elevated in many countries compared with rates before the Great Recession. Figure 4 displays the share of young adults residing with a parent in 2006 and 2011 in selected developed countries. Overall, co-residence rates tend to be lowest in the Nordic countries, where co-residence rates are typically below 20%. The highest co-residence rates tend to be in southern European countries, where co-residence rates are above 50%.

Figure 4 indicates that in the majority of the countries examined, co-residence rates of young adults with their parents grew during the Great Recession, in some countries as much as 20%. Countries experiencing the largest rise in co-residence rates include Hungary (21%), Sweden (19%), Denmark (17%), and the UK (16%). In the US, co-residence rates grew 12%. In some countries, however, co-residence rates fell between 2006 and 2011. In Ireland, for example, co-residence rates fell nearly 18%.

An important question is why co-residence rates increased. While anecdotal evidence suggests that elevated unemployment rates and declines in earnings can explain the rise in co-residence, a recent study comparing living arrangements during the Great Recession and other recessions in the US finds a small and statistically non-significant relationship between unemployment rates and the propensity for young adults to live independently [11]. The study also finds no difference between the Great Recession and other recessions in the responsiveness of youth living arrangements to the business cycle.

If the business cycle does not explain the rise in co-residence of young adults with their parents during the Great Recession, what does? A recent US study proposes that the rise in co-residence can be explained by increased borrowing constraints among young adults stemming from higher debt holding [12]. Young adults who are unable to smooth consumption by borrowing may use co-residence with parents as a consumption-smoothing mechanism, since co-residence typically enables young adults to make large cuts in their expenditures.

Using panel data to examine the relationship between debt accumulation, credit risk, and moving into and out of parents’ homes, the study finds that young adults who are likely to face higher costs of borrowing, whether because they are more indebted or are riskier borrowers or both, are more likely to enter into co-residence with their parents [12]. In the aggregate, the explanation for the recent increase in borrowing constraints among young adults in the US is the dramatic rise in student borrowing, which has caused young adults to enter adulthood with far more debt than in previous generations. The study estimates that the rise in debt-holding in the US between 2005 and 2013 can explain 32% of the increase in moves into co-residence with parents and 26% of the increase in median time spent in co-residence [12]. That said, while debt-holding and access to credit can explain much of the change in co-residence patterns in the US, it is not known whether the same mechanisms can explain trends in co-residence in other countries, where credit markets operate differently and student loans are less of a burden on young adults.

Moreover, it is not entirely clear that the rise in co-residence is a setback for the young adults who live with their parents. If co-residence enables young adults to reduce their spending needs below their income, then the rise in co-residence could enable young adults to begin saving and accumulating wealth earlier than they would have otherwise. On the other hand, if these young adults delay saving and entry into home ownership while in co-residence, their long-run wealth accumulation could decline.

Limitations and gaps

Overall, the evidence indicates that young adults experienced declines in financial well-being in the Great Recession and that the future for the current cohort of young adults presents a mixed picture. More research is needed to understand how social welfare and tax policy might mitigate these problems in the short and long run. Most of the evidence discussed in this paper draws on the experiences of young adults in previous recessions, often using cross-sectional variation in unemployment rates across regions and over time to estimate effects. The Great Recession was different from previous recessions on many dimensions, including the magnitude of changes in unemployment rates, the accompanying housing market crisis, and the increase in co-residence with parents. It is not clear whether extrapolations from previous recessions to this environment are valid and whether these differences will have mediating or amplifying effects on young adult’s future financial well-being.

Summary and policy advice

The evidence indicates that young adults have experienced declines in employment and earnings in the Great Recession and may experience persistent declines in future earnings. Depressed home ownership and elevated rates of co-residence with parents are another feature of the Great Recession. This “failure to launch” may keep young adults from beginning to accumulate wealth, which could ultimately affect their preparedness for retirement. To that end, policies aimed at reducing barriers to home ownership among young adults could be effective in encouraging wealth-building. The evidence also indicates this delayed entry to adulthood may be related to difficulties managing debt burdens and an inability to qualify for loans. Thus, policies that aim to reduce barriers to accessing consumer credit, and that aid young adults to manage their debt burdens may be beneficial in both the short and long terms. For young adults who did become homeowners, negative equity may be reducing their mobility and preventing beneficial job-related moves. Thus, policies that aid homeowners with negative equity could have spillover effects on young adults’ labor market outcomes.

Although the Great Recession undoubtedly had a negative impact on young adults’ financial well-being, there are glimmers of hope for the future of this cohort of young adults. Compared with members of the previous generation at the same age, young adults today show some signs of improved financial well-being. Moreover, because the current cohort of young adults was not heavily invested in housing and financial markets before the Great Recession, their net worth was not as affected as that of slightly older adults. Indeed, it could be that today’s young adults are in the unique position of being able to enter adulthood when markets are at their lowest, enabling these young adults to take advantage of future growth in housing prices and the economy. Only time will tell if some of the lessons of previous recessions hold for this cohort.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Joanne Hsu and Kevin Moore for helpful comments. Previous work of the author conducted jointly with Joanne Hsu contains a large number of background references for the material presented here and has been used intensively in all major parts of the article [4], [12]. The analysis and conclusions set forth are those of the author and do not indicate concurrence by other members of the research staff or the Board of Governors.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

Net worth

Source: Bricker, J., L. J. Dettling, A. Henriques, J. W. Hsu, K. B. Moore, J. Sabelhaus, J. Thompson, and R. A. Windle. “Changes in U.S. family finances from 2010 to 2013: Evidence from the Survey of Consumer Finances.” Federal Reserve Bulletin 100: 4 (2014): 1–41.