Elevator pitch

The rural non-farm sector plays an important role in diversifying income for rural households in developing countries and has the potential to emerge as a major source of employment. In some cases it has outgrown the agricultural sector, in part due to the expansion of credit through microfinance institutions that are supported by governments, donor agencies, and businesses. However, future expansion of the rural non-farm sector requires increased flexibility in credit contracts, as well as decreasing the cost of credit and the delivery of complementary inputs, e.g. skills training.

Key findings

Pros

Rural non-farm enterprises can help absorb growing labor forces in many developing countries.

Rural non-farm enterprises can be very profitable; injections of new capital often result in high returns.

Evidence suggests a strong association between rising rural non-farm employment and a decline in poverty.

Expansion of microfinance alternatives that do not require collateral for loans and target poorer households may help the poor to engage in rural non-farm employment.

Cons

In the absence of credit and other complementary services, rural non-farm employment is often of low productivity.

Owners of rural non-farm enterprises, especially female owners, frequently use unpaid family labor, which may lead to overstated profits.

The non-farm sector is heterogeneous in terms of productivity and quality of employment; its expansion may increase inequality.

Microfinance can be inflexible, requiring frequent (e.g. weekly) and almost immediate loan repayment.

Microfinance institutions typically charge high interest rates and may not offer credit to men.

Author's main message

Public policy should support expansion of the rural non-farm sector as a means of combating poverty. This sector—often neglected by policymakers—helps absorb growing rural labor forces in developing countries by providing employment to the rural poor. A policy option for stimulating the rural non-farm sector is the provision of credit through microfinance institutions and commercial banks at reasonable interest rates to the rural poor. Complementary services, such as targeted training programs and linkages to urban markets can further enhance efforts to expand the sector.

Motivation

In 2015, three developing regions—Africa, Asia, and Latin America and the Caribbean—were home to 1.7 billion children and another 1.1 billion young people [2]. Despite high internal migration and rapid urbanization in many countries within these regions, the majority of the population still lives in rural areas and relies on agriculture for income and employment. Moreover, the gap between the number of new rural workers and the number of new jobs in agriculture is growing. While new urban jobs help to reduce this gap, the rural non-farm (RNF) sector can play an important complementary role in absorbing this growing rural labor force.

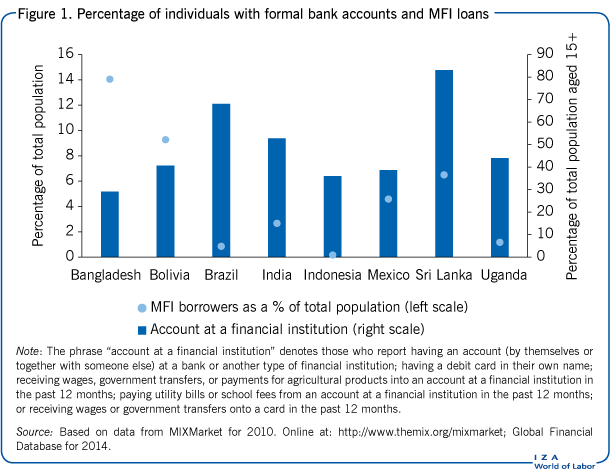

There is general consensus among policymakers and development economists that access to credit at reasonable interest rates can help expand the RNF sector by promoting entrepreneurship, firm growth, and non-farm employment in rural areas [3]. However, more than 2.5 billion people, nearly half of the world's population, do not hold an account with a formal financial institution [4]. Therefore, it is unlikely that the traditional banking sector will be able to offer financial services to many of these individuals in the immediate future.

Microfinance institutions (MFIs) have emerged as a strong complement to the traditional banking and finance sector. In sub-Saharan Africa, for example, there are 480 MFIs for every 1,000 commercial banks [4]. By the end of 2013, more than 3,000 MFIs reached more than 211 million borrowers. Given their rapid expansion, MFIs will play an increasingly important role in reaching those individuals without formal financial ties, offering credit and other financial services that are crucial for facilitating economic growth. As the vast majority of MFI customers reside in rural areas, it is thus important to examine how MFI-led credit expansion affects RNF sector growth and employment.

Discussion of pros and cons

Rural non-farm sector and microfinance

Rural households in developing countries often engage in multiple occupations alongside farming and agricultural labor. RNF employment encompasses wage and self-employment in a wide range of non-agricultural activities such as commerce, manufacturing, and services. In many cases, rural households’ dependence on RNF employment as a source of income is significant. Based on the World Bank's Living Standards Measurement Surveys, almost half of all households in developing countries have members engaged in non-farm enterprises [5]. By the mid-2000s, RNF employment contributed about 35% of rural household income in Africa, and 50% in Asia and Latin America [1].

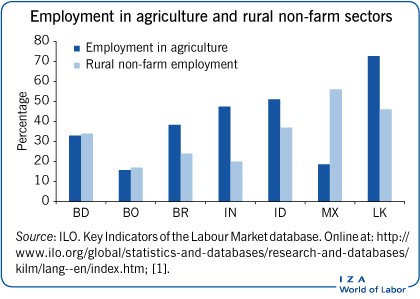

While RNF employment is substantial and rising in many developing countries, the contribution of agriculture in rural employment is declining. The illustration on page 1 shows the contribution of agricultural employment and RNF employment for selected developing countries. Employment is defined as persons of working age who were engaged in any activity to produce goods or provide services for pay or profit, whether at work during the reference period or not at work due to temporary absence from a job, or to working-time arrangements.

As seen in the illustration on page 1, RNF employment contributes approximately one-fifth to more than half of total rural employment in the selected countries. In Mexico, for example, RNF employment contributes 56% of total rural employment. In addition, because many agricultural workers also undertake non-farm activities, particularly during lean seasons, and because they do not all list non-farm as their primary occupation, it is likely that the reported contribution of RNF employment is a lower bound of the actual quantity of labor supplied to it. For example, in Africa, 15–65% of farmers have secondary employment in the non-farm sector and 15–40% of total household labor is allocated to non-farm activities [1]. Hence, it is possible that RNF activities constitute the major contributor to total rural employment in many developing countries.

RNF enterprises are diverse; they range from rural households rendering occasional services such as preparing snacks and selling them in a weekly market place to manufacturing agricultural tools such as ploughs and harvesters for local farmers. The importance of RNF enterprises in employment and the significance of credit as a major constraint to enterprises’ growth are well recognized by policymakers and academics. Evidence of causal links between access to finance and firm growth are also well recognized in development literature [6]. In the absence of credit, rural entrepreneurs need to rely on their own savings, borrow from family and friends, or from professional moneylenders at exorbitantly high interest rates. Not unsurprisingly, the scope for such borrowing is often limited, especially for poorer households and such loans are typically not suitable for activities that require long-term capital. For example, upgrading a tool manufacturing RNF enterprise from making traditional tools to modern tools requires significant investment amounts that usually cannot be financed from one's own savings or from high interest bearing informal loans from moneylenders.

Further contributing to the lack of finance options for RNF enterprises is the fact that formal sector lending to the poor suffers from several chronic problems, including inadequate coverage, low repayment, and high interest rates. The evidence suggests that state-sponsored credit programs have not been overly successful at reaching the poor, with the benefits of such programs often going disproportionately to the rural elite [7].

Microfinance is usually understood as offering small loans to poor individuals or groups without requiring any collateral. Unlike previous government-led efforts, the success of non-government sector-led microfinance in reaching the poor has been impressive. Several features have made this strategy more successful. First, the “group” nature of this lending approach, where poor borrowers are organized into groups whose members are made jointly liable for one another's loans, creates a situation in which members monitor each other to ensure that credit is utilized in the “right” activities, such as investing in productive capital. Second, MFIs often promise future loans conditional on full payment of current loans, which works as a dynamic incentive for borrowers to repay. Third, the loans are often repaid in frequent and small installments, which keeps the borrower's incentives to default low. For example, in the case of Grameen Bank (a Nobel Peace Prize-winning microfinance organization and community development bank founded in Bangladesh), loans were offered in self-formed groups where group members were jointly liable and required to repay in 50 equal weekly installments [3].

Attracted by this success, government initiatives in countries such as India and Bangladesh have since followed the group-lending schemes pioneered by MFIs, and the private sector has also joined in. Recent innovations in microfinance include offering complementary services, such as saving facilities, insurance schemes, and skill training. Available evidence shows that the RNF sector's success may hinge on such complementary services, which offer assistance to borrowers that extends beyond the realm of finance.

Figure 1 shows the percentage of people who hold an account at a financial institution versus those who borrow from MFIs for selected developing countries. Accordingly, MFI borrowing is negatively associated with the existence of formal financial services. Countries with lower levels of financial development have higher dependence on MFI lending. For example, Bangladesh offers the extreme case, where a very low level of financial development is associated with a very high level of MFI borrowing. This implies a stronger role of MFIs in RNF financing at the early stage of economic development.

Expected benefits

Non-farm enterprises in rural areas in developing countries often enjoy high returns to investment but remain small. Removing credit constraints through injections of new capital can result in high returns on investment. For example, in Sri Lanka it is found that an influx of capital stock into small firms is associated with returns as high as 5% per month [8]. Similarly, in Mexico, small firms with capital stocks of less than US$200 earn about 10–15% return on investment per month. Similar or higher returns on investment for small business are reported for other developing countries such as Ghana [9]. There are a number of possibilities that may explain the high return to capital in RNF enterprises observed in these countries. It is likely that many RNF enterprises have high family labor endowment and low capital endowment; as such, any addition to their capital stock increases their return without increasing any associated labor cost. However, by the same token, family labor employed in such enterprises is often unpaid and unaccounted for in their profit calculations. It should be noted that given the high unemployment rates in these countries, the opportunity cost of family labor is also low, and accounting for the full cost of family labor may not be justifiable.

Existing evidence suggests a strong relationship between rising RNF employment and a decline in poverty [10]. It is certainly plausible that RNF employment helps poor households diversify their income sources, thereby smoothing income and consumption fluctuations. More importantly, it typically provides employment opportunities during lean seasons, when demand for agricultural labor is low or limited. In addition, RNF employment often helps women earn extra income in situations where female labor market participation is low or job opportunities are non-existent.

Historically, one of the largest constraints to the RNF sector has been limited access to credit at reasonable interest rates. Offering credit that does not require collateral and targeting poorer households for loans has the potential to increase RNF employment for the poor. However, despite decades-long state-run efforts via the formal banking sector, rural households, especially poor ones, have not been able to access formal credit. The expansion of MFI-provided credit opportunities to households who might otherwise have had no recourse, or who would have had to secure credit through alternative sources, such as moneylenders, who charge exorbitant interest rates, e.g. from 4% per month up to 5% per day [3]! Available evidence suggests that interest rates charged by MFIs are about 30% per annum or lower, though there are substantial variations [11]. While that rate seems high at first glance, it needs to be considered in contexts where loan sizes are small and transaction costs are high. Given the high rate of returns to investment in RNF enterprises reported in several countries [8], [9], additional access to credit through MFIs may facilitate further expansion of the RNF sector.

Expected costs

The heterogeneity of the non-farm sector in terms of productivity and quality of employment is well recognized. Available evidence suggests that poor households are often unable to harness the full potential of RNF investment opportunities due partly to limited access to capital and lack of complementary skills [1]. While it is likely that high-return, high-productivity RNF employment opportunities that are often undertaken by richer households in rural areas may require complementary inputs such as business management skills, it is also likely that access to capital at a reasonable cost also favors richer households, both of which contribute to significant inequality in the RNF sector.

In Ecuador, it is found that, overall, non-agricultural income reduces inequality [1]. However, in rural areas alone, the effect is to raise inequality slightly. A similar increase in inequality in rural areas is reported in India and China. This can be explained by the fact that poor rural households are often credit constrained, lack collateral, and borrow at very high interest rates from moneylenders. As such, these households may be unable to take advantage of new RNF employment opportunities, leaving them further behind in terms of income compared to wealthier households that do not face the same set of challenges. Hence, the observed inequality potentially trigged by RNF employment opportunities could be a result of additional constraints faced by poorer households attempting to access the RNF sector.

A potential issue among MFIs may be the existence of gender bias against men. Most MFIs target women as their clients, often because of goals that include female empowerment, financial independence, and participation in economic opportunities and employment. The most cited example is the Grammen Bank in Bangladesh, 95% of whose clients are women. However, limited evidence from Sri Lanka [8] and Ghana [9] suggests that women are not necessarily better than men in generating more profit when capital is given freely to them. In some cases, women may not even want to expand their businesses, the reasons for which have not been fully understood. In such a case, restricting loans to women or excluding men places further constraints on RNF activities.

There is substantial variation in interest rates charged by MFIs, and they are often higher than the interest rates charged by commercial banks on similar loans. In some cases, interest rates charged by MFIs have exceeded 100% per annum (e.g. in Mexico [11]). However, such high interest rates are still generally lower than the prevailing interest rates in the informal lending markets available to many RNF enterprises; in Mexico, for example, the informal market interest rate is 145% per annum. Note that RNF enterprises often do not have access to the formal banking sector. Nonetheless, interest rates charged by MFIs are typically rather high and may limit investment opportunities. Similarly, microfinance contracts are frequently inflexible with respect to repayment conditions. Under the classic microfinance contract made popular by Grameen Bank, regular weekly repayment starts within two weeks of loan disbursements. Evidence based on field experiments conducted in the West Bengal state of India suggests that such inflexibility discourages risky investment that is not readily convertible to cash, thereby limiting microenterprise growth [11].

Lastly, despite their poverty alleviation role, RNF activities do not always correspond to escaping poverty. Given the apparently high return to capital in small non-farm enterprises observed in a number of developing countries, it is relevant to ask why micro-entrepreneurs do not save their way out of poverty? It is possible that such enterprises are characterized by critical scale constraints; they might be profitable on a small scale, but would require substantial expansion to make them profitable at a larger scale. This may also justify why many owners, especially female owners, may not want to expand their non-farm activities. Another possibility is that RNF enterprises frequently make use of unpaid family labor. This unpaid labor is not accounted for in their profit calculation, meaning that their actual profit margins may be much lower than they appear. Either way, the high returns to investment in RNF enterprises accompanied by the prevalence of persistent high poverty remains a puzzle that requires further study.

Does microfinance help rural non-farm activities?

Studies that examine the impact of microfinance on non-farm employment are limited. The earliest evidence (based on data collected in the early 1990s) shows positive impacts of microfinance on labor supply (i.e. employment) [12]. Credit given by Grameen Bank and other MFIs to female borrowers in rural areas of Bangladesh had large positive effects, especially on female labor supply, most likely due to women's increased participation in non-farm activities. However, since its publication, the study has come under intense scrutiny. It relied on the borrower's eligibility rule that was supposedly employed by Grameen Bank (borrowers should own 0.5 acres of land or less); however, in the data, the rule does not appear to have been followed by Grameen Bank [6].

A recent report summarizes evidence drawn from six studies conducted in six different countries (Bosnia and Herzegovina, Ethiopia, India, Mexico, Mongolia, and Morocco) that vary in terms of market and non-market environments [11]. The examined studies all tested the effects of microfinance on micro-entrepreneurial activities, considering business start-ups as well as business expansions. The effects of microfinance on new business start-ups are modest: Three countries (Bosnia and Herzegovina, India, and Mongolia) showed some positive effects on business start-ups, while the others showed no effects. The effects observed on business size and profits are more encouraging; each study finds some evidence showing that the expansion of microfinance has resulted in increased business activity.

Turning to employment, the effect seems to be context specific. In Mexico, access to credit from MFIs raised business investment and business size; however, no effect is found on labor supply. In Morocco, access to microfinance increased self-employment activities. However, this increase has been accompanied by a reduction in outside employment, leaving the total labor supply unaffected. In Ethiopia, access to microfinance has no impact on non-farm business for a large majority of outcomes such as business revenue and employment. While the impact on labor supply in Ethiopia was positive, it was not significant. In India, access to microfinance led to more overall business creation, had some impact on business profit, and had a positive and significant impact on overall business expansion. Furthermore, in India, it led to an increase in household labor supply to own businesses. There is also evidence of substitution between microfinance and informal finance in India. Such substitution can be positive, to the extent that it reduces informality and brings RNF enterprises into at least a semi-formal financial arrangement.

Where does microfinance flourish?

Given the limited and mixed evidence on the effects of microfinance on rural non-farm growth and employment, one obvious issue is to look at the country-level contexts that may determine success. Limited evidence finds strong complementarity between the performance of MFIs and the health of the broader economy in a macroeconomic context [13]. While it is plausible to think that MFIs may perform better in poorer economies that have fragmented financial, goods, and labor markets, the evidence finds stronger MFI performance in countries that have higher economic growth and greater financial depth. It seems that higher workforce participation and vibrant labor markets create demand and lead to better growth opportunities for RNF enterprises funded by MFIs. Evidence also supports complementarity between large agricultural sectors and stronger MFIs’ performance [13].

Limitations and gaps

One of the main gaps in the literature is the lack of any direct evidence about the impact of microfinance on RNF employment. While a number of well-designed impact evaluation studies have recently examined whether offering microfinance helped to improve borrowers’ well-being, they do not necessarily focus on the impacts on RNF employment, despite the fact that some of these studies did examine the impacts on business growth and profitability. Furthermore, with the exception of one study [11], evidence on how a less rigid repayment structure may help non-farm growth is non-existent.

A further limitation involves a lack of understanding on the relationship between profitability and capital constraint. Despite the fact that non-farm businesses typically enjoy very high returns on investment, often much higher than interest rates charged by MFIs, the take-up rate of credit among prospective non-farm owners is low, which is puzzling [11]. Future studies may want to address why such an apparent contradiction exists between high returns to capital and the persistent low demand for credit in rural areas in developing countries.

Summary and policy advice

The RNF sector in developing countries has played an important role in providing employment to the rural poor (especially to women), supporting income diversification and alleviating poverty. Looking ahead, this sector has the potential to absorb the growing rural labor forces in developing countries by creating new non-farm enterprises and thus providing gainful employment, especially to young people. While the recent expansion of microfinance may help the RNF sector by reducing credit constraints, the effect of microfinance on RNF growth seems to be mixed. Microfinance can have positive effects on existing businesses; at the same time, it may have a limited effect on business start-ups and new employment creation.

Previous attempts by governments to increase access to formal credit for the rural poor through state-owned banks has frequently resulted in high rates of credit default and an unsustainable level of public subsidy, without achieving the stated goal. By contrast, the expansion of innovative credit products offered by MFIs to rural areas in many developing countries has helped poor households that otherwise lacked access to the formal banking and finance sector. However, despite this success, it is unlikely that microfinance will replace the need for a formal banking sector, especially for firms that need to grow beyond a certain size or when they require long-term credit. Appropriate public policies need to be devised to address the needs of these businesses in order to facilitate further growth in the RNF sector.

Despite its success, microfinance is not a panacea. The rigidity of microfinance repayment structures should be considered a constraint that may limit investment opportunities. The size of microloans should also be looked at since they may limit firm growth. Despite the progress made by MFIs in recent years, extending a full range of financial services to rural areas in developing countries and, importantly, offering them to all households, irrespective of income levels, remains a major policy challenge.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Shyamal Chowdhury