Elevator pitch

Long-term unemployment can lead to skill attrition and have detrimental effects on future employment prospects, particularly following periods of economic crises when employment growth is slow and cannot accommodate high levels of unemployment. Addressing this problem requires the use of active labor market policies targeted at the unemployed. In this context, hiring subsidies can provide temporary incentives for firms to hire unemployed workers and, when sensibly targeted, are a very cost-effective and efficient means of reducing unemployment, during both periods of economic stability and recovery.

Key findings

Pros

Hiring subsidies have lower deadweight costs and other negative indirect effects than wage subsidies.

Hiring subsidies enable employers to screen workers and help the unemployed to regain their human capital.

Sensible targeting of the unemployed, especially the long-term unemployed, strengthens positive effects and their position in the labor market.

Targeted hiring subsidies can be cost-effective measures that yield higher employment probabilities in the future.

Cons

The impact of hiring subsidy programs varies depending on their targeting and design.

Targeting that is too loose may create high potential deadweight and displacement costs.

Targeting that is too tight may create stigmatization of workers and administrative and monitoring costs for the employer, and may therefore result in low employer take-up.

Evidence is still limited, especially on the longer-term effects on careers.

Author's main message

Hiring subsidies provide financial incentives to employers by temporarily reducing their labor costs. They can increase employment and are an effective means of supporting unemployed workers. Sensible targeting and design have to balance direct impacts and indirect effects. Targeting the long-term unemployed redistributes employment incentives to the disadvantaged and strengthens their labor market attachment. Hiring subsidies can thereby increase labor market flows, reduce labor market persistence, and enable a more equitable distribution of employment. They can act as a significant countercyclical policy tool to stabilize the labor market and are an important device for supporting economic recovery. Policies should ensure that targeting is tightened once the recovery accelerates to reduce costly negative effects.

Motivation

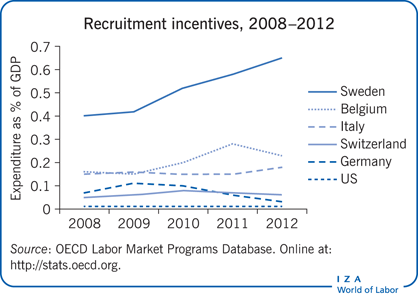

Active labor market policies (ALMPs) have been heavily advocated by the OECD and are gaining interest and relevance in many countries, particularly in the wake of economic crises when unemployment is often increasing and persistent. Jobless recoveries can lead to more prolonged unemployment spells, leading to attrition of skills that can reduce future employment prospects. At the same time, tighter budget constraints and deficits highlight the need to invest in cost-effective ALMPs.

When assessing the suitability and effectiveness of ALMPs it is important to ask whether, from a microeconomic perspective, they benefit the targeted workers, and whether, from a macroeconomic perspective, they are cost-effective and socially desirable [1].

However, to answer these questions it is not enough to evaluate the direct effects of such policies on employment, unemployment and earnings. There are also indirect and macroeconomic effects, reinforcing or countervailing, such as on wage bargaining and incentives for targeted employers and workers, which contribute to the overall net employment effect. In addition, there are implications for government budgets, as well as changes in the composition and dynamics of the labor market.

Although such negative indirect effects might outweigh the direct employment effects, policies that generate marginal net employment effects might still be desirable if they reduce long-term unemployment. Furthermore, beyond mere impact effects, longer-term effects of policies on workers’ career paths must be taken into account [1].

Discussion of pros and cons

Are hiring subsidies effective for bringing targeted workers into employment?

Hiring subsidies provide financial incentives to private employers by temporarily reducing their labor costs (e.g. salary and social contribution costs). The resulting higher demand for labor can lead to higher wages and higher employment. At the same time, the increased demand for labor can encourage inactive workers to join the labor force, due to better employment prospects. This, in turn, can increase the supply of labor, which partly offsets the wage increase [1].

Various reviews of studies focused on OECD countries (and especially evaluations for Sweden) highlight that private-sector hiring subsidies can generally be more effective than public education, training measures, or public works programs in bringing the targeted workers into employment [2], [3]. Evidence for the success of hiring subsidies has been found for many countries, including Austria, Australia, France, Germany, Poland, Slovakia, Sweden, and the UK. However, success strongly depends on the design features of the hiring subsidy program.

Evidence also highlights that hiring subsidies outperform other ALMPs in terms of post-program employability. US evidence shows that—in the worst case—hiring subsidies are at least twice as effective in improving post-program employability as public job creation programs [4].

However, while the evidence shows that hiring subsidies can bring unemployed workers into employment and that these workers are retained (direct effects), these evaluations often do not take the indirect effects into account.

Sensible targeting is crucial

The effectiveness of hiring subsidies in increasing employment of unemployed workers and their overall cost-effectiveness depend on various indirect effects. Compared with wage subsidies, which are targeted at specific groups of workers, irrespectively whether they are new hires or already employed workers, hiring subsidies tend to be more successful and more cost-effective. This is because, first, hiring subsidies are only paid for a limited period of time and, second, they only cover new hires, which means that significantly fewer workers are covered by hiring subsidies than by, e.g., low-skill wage subsidies.

However, the effectiveness of hiring subsidies depends crucially on how they are targeted, as this affects the positive and negative indirect effects. For example, hiring subsidies have lower “deadweight costs” (that is the share of the subsidy going to workers who would have been employed regardless of the subsidy), than low-wage subsidies. Additionally, targeting unemployed workers may lead to a “displacement” effect, in that employment generated by ALMPs may displace or “crowd out” regular employment [1].

Therefore, focused targeting of hiring subsidies is needed to reduce negative indirect effects and strengthen positive ones, but also needs to avoid the risk of stigmatizing workers and creating cost-intensive monitoring or bureaucracy, which would make the subsidies less attractive to firms. For example, subsidizing only additional or net created jobs (the principle of “additionality” imposed in so-called “marginal” subsidies) can lead to higher effectiveness [5]. However, this may significantly marginalize or reduce employer take-up rates, due to higher administrative costs resulting from additional documentation and reporting requirements [4], [6]. In line with this, early evidence from the US shows that employer reporting requirements increase administrative costs and thereby significantly reduce take-up [6].

Stigmatization results from targeting very disadvantaged workers too tightly, so that workers participating in the program may be perceived as being those with low productivity. Thus, as widely demonstrated, targeting too tightly may effectively reduce targeted workers’ future employment prospects [6], [7].

Can hiring subsidies be cost-effective from a macroeconomic perspective?

Deadweight costs, substitution, and displacement effects

Targeting can address “deadweight” and “substitution” effects, which lower the cost-effectiveness of subsidies. Subsidies can induce firms to substitute a certain skill-class of worker for another to do the same work because of the resulting change in the relative labor costs between different skill classes. For example, subsidies for low-wage workers may create an incentive for employers to substitute medium-ability workers with low-ability workers [1].

Since wage subsidies not only target new employees but all workers with certain qualifications and from certain industries or geographic locations, they can cause huge indirect effects, which offset between 42% and 100% of the direct employment impacts of the subsidies [2], [4], [8].

However, indirect costs tend to be smaller in the case of hiring subsidies. Evidence from France on hiring subsidies for low-wage workers shows that 84% of hires would have materialized regardless of the subsidies [5]—this implies major deadweight costs. By restricting subsidies to the hiring of unemployed workers—and thereby excluding subsidizing job-to-job transitions—the deadweight costs can be decreased though. Evidence from Germany estimates the costs at 20−30% lower [9]. Deadweight costs can be further minimized by tightly targeting workers with low exit rates out of unemployment, such as the long-term unemployed. However, such costs cannot be avoided completely.

The limited period covered by hiring subsidies is another reason for lower potential substitution effects, namely the subsidy-induced employment of low-skilled workers to do higher-skilled work. However, this effect lacks empirical support in the literature, which suggests that substitutability between different skill groups is minimal.

Finally, hiring subsidies can result in significant “displacement” costs. Hiring subsidies may incentivize firms to hire subsidized workers instead of unsubsidized workers, to lay off existing workers to hire subsidized workers, or to lay off subsidized workers once the subsidy expires. These indirect effects significantly lower the cost-effectiveness of programs, since they clearly influence the net employment effect [8]. Accordingly, Swedish studies find sizeable displacement effects for hiring subsidies of around 65−70%; while studies for Ireland and the UK show 20%; for Belgium, 36%; and for the Netherlands, 50% [8]. Evidence from France, however, shows no displacement effects at all [5]. Tighter targeting (as well as monitoring) can minimize displacement effects and increase net employment impacts by 20−30% [2].

However, displacement effects, however sizeable, may not be that significant. First, aggregate employment is only fixed in the short term and will adjust as a result of induced investment to effective labor supply. Furthermore, in the medium term, capital will adjust. Thus, the displacement effect is only relevant in the short term [2]. Second, besides reducing displacement effects through sensible targeting, displacement could also be tolerated if positive indirect effects, such as “screening” and “transition” effects (see below), are sufficiently large [3].

Screening and transition effects

Hiring subsidies enable employers to use subsidized hirings to screen workers as a substitute for work experience—the “screening effect”. This indirectly improves matching in the labor market. For example, due to a lack of alternative information, an individual’s long-term unemployment may signal (correctly or incorrectly) low productivity to firms. Subsidized hiring now enables employers to obtain direct information on the productivity of that individual. As a result, they may be more willing to retain this worker after the subsidy program ends than they would have been to hire that worker without the subsidy. Reviews of international evaluations, especially evidence from Sweden and Switzerland, show that employers effectively use subsidized hirings to screen unemployed workers [3], [7].

The “transition effect” (also known as the “learning-by-doing” effect) can also potentially offset displacement effects. By enabling unemployed workers to re-enter employment they can sustain or regain their human capital by re-establishing a work routine and recovering on-the-job skills. In this way, labor supply is effectively enhanced [2], [7]. Such work-specific human capital is clearly valued by firms, as evidence from Switzerland and Sweden indicates. This effect is also highlighted in recent evidence from Germany, which reveals the same employment rate after several years for workers who were hired into a subsidized job as for workers who received formal work-specific training and were employed immediately [10]. In addition, this notion is supported by the broad evidence that the closer subsidized employment is to regular employment, the more valuable it is [11].

The transition effect, like the screening effect, rationalizes targeting unemployed workers and is strongest for the long-term unemployed, who suffer from skill attrition and loss of a work routine. If hiring subsidies enable these long-term unemployed workers to transition back into employment, their human capital appreciates; they gain work motivation, habits, and routine, and, as a result, become more valuable to firms. In the end, hiring subsidies help to exchange previously low employment probability with a higher retention probability. This holds even if subsidized workers are laid off once the subsidy expires, because their human capital has increased and as short-term unemployed they are more likely to be reemployed than they would have been as long-term unemployed workers [1].

In support of this, evidence on hiring subsidies targeted at the long-term unemployed in Sweden reveals that subsidy duration positively affects the probability of retention [1]. Further evidence from the UK on the “New Deal,” as well as recent evaluations of different German labor market programs, supports the existence and relevance of the transition effect [9], [12]. Evidence from Sweden finds that those hiring subsidies that especially target long-term unemployed workers perform best and have been most cost-effective [3]. Evidence from Switzerland also highlights strong effects for the long-term unemployed [11].

The long-term effects

The cost-effectiveness of hiring subsidies also depends on whether, via the transition and screening effects, they have a longer-term impact on workers’ employment prospects. Generally, empirical evaluations of ALMPs focus on exit rates from unemployment or labor market employment status shortly after the start or end of the respective program. Empirical research has only recently begun to look at longer-term effects, like the relationship between ALMPs and job duration. Such longer-term evaluations clearly indicate the cost-effectiveness of hiring subsidies and show that short-term rankings of an instrument’s effectiveness can be overturned. These findings highlight the importance of evaluating the long-term implications [3].

Evidence from Sweden, for example, confirms a higher employment probability for workers who have been involved in a subsidized hiring of 40 percentage points after the program and 10 percentage points after five years, averaging to 19 percentage points over the five years [3]. Again, these effects will be stronger for the long-term unemployed, suggesting that these are the workers who should be targeted [11].

Wage, competition, and other indirect effects

Hiring subsidies entail much lower wage effects than wage subsidies. Wage subsidies reduce a firm’s labor costs and increase the bargaining surplus of a labor market match. This means that workers will bargain accordingly to capture their share of the higher surplus, which will result in lower net employment effects. Hiring subsidies, on the other hand, target only “outsiders” (i.e. unemployed workers). They are less protected than “insiders” (i.e. employed workers) by high labor turnover costs (e.g. firing costs) and thus, have a weaker bargaining position. Evidence from Germany shows that wages are unaffected by hiring subsidies, suggesting that they do not reduce direct employment effects [1]. Similarly, French hiring subsidies targeted at low-wage workers also show no wage effects, although this is more a result of the institutional setting of a high minimum wage and broad coverage of collective wage agreements [5].

Another feature of hiring subsidies targeted at unemployed workers is the “competition effect,” which has a converse effect to the wage effect. Accordingly, employment incentives are redistributed to outsiders, strengthening their position in the labor market. This increases competition and exerts downward pressure on wages, indirectly increasing employment [12].

Furthermore, “locking-in” effects are also lower with hiring subsidies. These effects can reduce workers’ employment probabilities, due to the reduced need to search for regular employment as a result of workers participating in subsidized employment. In contrast to wage subsidies, which can prove difficult to phase out and are subject to strong locking-in effects, subsidized hirings are restricted to a limited period, whereby locking-in effects are reduced [1].

Finally, negative effects on workers’ longer-term employment prospects may be due to disincentives to acquire skills, which are common with wage subsidies (and to a lesser degree with hiring subsidies) that are targeted at low-skilled workers. A low-wage subsidy reduces the wage differential between skilled and unskilled work and consequently reduces the incentive to invest in skills. The implications of such an effect will only materialize in the medium term and can outweigh positive short-term employment effects. Again, these disincentive effects are minimized with hiring subsidies that target unemployed workers, so that hiring subsidies are more effective in encouraging workers to adapt their skills, activities, and interests to changing labor market conditions [1].

Budget effects

To evaluate the cost-effectiveness of hiring subsidies, indirect budget effects also have to be taken into account. For example, on the one hand, hiring subsidies financed via higher taxes will decrease the payoff from employment and, as a result, reduce incentives to search and work for all workers. Alternatively, they may encourage inactive workers to re-enter the labor market and raise the number of recipients of unemployment support. On the other hand, hiring subsidies may generate additional tax revenue from increasing the number of employed workers and through savings in unemployment benefits and social assistance [4]. Such revenue and savings can, in turn, be used to finance the subsidies and make them very cost-effective. They could even be self-financing, as evidenced, for example, in an impact projection study for Germany and an evaluation study for France [5], [13].

Design, implementation, and institutional settings

In addition to sensible targeting, the cost-effectiveness of hiring subsidies crucially depends on their design, implementation, and the policy environment. In this respect, hiring subsidies evaluated in Germany provide some useful insights [13]. These involved “lump-sum” hiring subsidies that led to positive employment effects mainly through transition effects. Yet they generated sizeable deadweight costs. Albeit at the cost of increased administration, deadweight costs could be further reduced by linking the size of the subsidy to the employment probability of the unemployed, e.g., by increasing the subsidy payment with unemployment duration and by reducing it with the qualification level of the worker. In addition, since transition and screening effects materialize with progressing employment, the size of the subsidy could be reduced accordingly.

Furthermore, the evaluations show that different programs were targeted at different groups of disadvantaged workers and not applied “across-the-board.” Consequently, on the one hand they generated a higher risk of stigmatization, and on the other hand they may have been confusing, overlapping with respect to target groups, and also more administratively cost-intensive [13].

The effectiveness of hiring subsidies can also be undermined by the “cream-skimming” effect, by which only workers with high employment probabilities are selected into the program. This is especially significant with weak targeting and if caseworkers who have an incentive to ensure high re-employment rates of participants assign workers to ALMPs. To avoid cream-skimming effects subsidies should be paid for any new hiring of a clearly-targeted group of unemployed workers that qualifies for the subsidy. This way, the allocation of subsidies is not left to caseworkers [1].

In light of US evidence, hiring subsidies should not be targeted at specific groups of employers, e.g., small employers. While small businesses may contribute over-proportionally to net job growth, this contribution is often restricted to new firms; and, generally, the take-up of subsidies by small firms may be relatively lower than by larger firms due to administrative costs [4].

In order to ensure a holistic, or comprehensive, approach, ALMPs should take into account the interactions, complementarities, and repercussions with other active and passive labor market policies. For example, in combination with strong wage rigidities resulting from a high minimum-wage, hiring subsidies targeted at low-wage workers have proved to be particularly successful and cost-effective in increasing employment [5].

Regarding the interaction of hiring subsidies with unemployment benefits however, the literature provides mixed recommendations. A combination of a “stick” and “carrot” approach is often recommended in this context. This provides incentives to search for, and accept, jobs by making participation mandatory, with the additional threat of benefit sanctions. Some evidence points at a higher effectiveness if participation in the hiring subsidy program is a condition of qualifying for the continued receipt of benefits.

In contrast, other studies show that using participation as an incentive instrument to (re-)qualify for the receipt of unemployment benefits can give rise to costly “churning” effects. Workers who have little interest in regular employment would participate only in order to gain entitlements for another round of unemployment benefits. This effect is especially strong near benefit exhaustion. It boosts program size and costs, creates locking-in effects, and has no impact beyond the program itself [2], [7]. Such churning can be reduced by implementing a follow-up period in which workers cannot be dismissed. But while this may strengthen the transition effect, it may also create administrative costs and reduce employer take-up [4], [9].

A further argument for adopting participation as an incentive instrument is the “threat effect.” This can increase incentives for unemployed workers to search for a job. However, threat effects are more common with public works programs or job-search assistance and are less relevant with hiring subsidies [1].

Limitations and gaps

It should be noted that the development of optimal evaluation methods is continuously evolving to avoid potential biases in the results. Most studies either look at whether the measures benefit the targeted workers, or whether they are cost-effective from a macroeconomic perspective. Most studies also do not perform a rigorous cost−benefit analysis.

Hiring subsidies are not a panacea. They will have limited effects and can have substantial deadweight and displacement costs. Impacts vary and depend on design, institutional settings, and on the resulting actual demand and supply elasticities.

The details of design and targeting play crucial roles in balancing the various effects and avoiding disincentives in the implementation. In any case, any program should be piloted and always continuously scientifically evaluated.

Furthermore, the existing evidence is still limited and more evidence is needed. Little direct and concise evidence on the impact of transition and screening effects also does not allow the determination of the optimal duration of hiring subsidies.

Nonetheless, with well-focused objectives and sensible targeting, hiring subsidies can clearly be cost-effective. This is something that will be significantly increased if, as recent longer-term evaluation studies indicate, they impact on workers’ employment probabilities for a longer period of time (i.e. three to ten years).

However, while the evidence is still limited, these results clearly call for a shift toward following workers’ employment trajectories and careers in order to better evaluate the role of screening and transition effects, and to ascertain the impact of individual ALMPs on the development of longer-term employment [1].

While there is some evidence for OECD countries, there is hardly any evidence for developing countries. Open questions remain in terms of the applicability of hiring subsidies to developing countries due to the necessary budgetary outlays involved and to the limitations of the formal sector. However, hiring subsidies could also serve to increase incentives for formal employment, which may be the actual objective [1].

Finally, there is a lack of evidence on the effectiveness of hiring subsidies as a countercyclical policy tool having stabilizing effects [4].

Summary and policy advice

Clearly limited-period hiring subsidies to private employers are preferable to general wage subsidies. They can be cost-effective and have modest macroeconomic employment effects.

Sensible targeting and design need to balance direct impacts and indirect positive and negative effects, e.g. deadweight, substitution, and displacement costs, as well as stigmatization, take-up, and monitoring costs.

To maximize positive competition, transition, and screening effects, hiring subsidies should be targeted at outsiders in the labor market, especially the long-term unemployed [11], [13]. Targeting the long-term unemployed also reduces costly deadweight and may avoid targeting too tightly and stigmatizing workers.

To further reduce deadweight costs and increase cost-effectiveness, the size of subsidy payments could negatively depend on workers’ qualifications so that subsidy payments could be increased for those with fewer qualifications. Payments could also continuously increase with unemployment duration and decrease with the subsequent employment duration [13]. However, these specific adjustments may lead to increased monitoring, administration, or take-up costs, which will reduce cost-effectiveness.

Hiring subsidies for the long-term unemployed may be socially desirable, even without any net employment impact, i.e. when positive employment effects balance out significant deadweight costs and displacement effects. Hiring subsidies redistribute employment incentives and thereby strengthen outsiders’ position in, and attachment to, the labor market. As a consequence, long-term unemployment is reduced (at the cost of increasing short-term unemployment). The flow of workers out of unemployment is also increased and labor market persistence is reduced. As a result, hiring subsidies enable a more equitable distribution of unemployment [2].

Hiring subsidies do not reduce the incentive to increase skills, but rather, to the contrary, can also implicitly act as an automatic stabilizer, which incentivizes unemployed workers to search for jobs and to adapt and develop their skills.

Finally, hiring subsidies can be significant automatic countercyclical stabilizers that provide direct incentives for job creation rather than income protection. In order to support recoveries, policies should be directed toward tightening the targeting of hiring subsidies so as to adapt to potentially increasing and costly indirect effects [4].

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. This article benefited from previous work and discussions with Christian Merkl and Dennis Snower. Previous work of the author and Johannes Koettl contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [1].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Alessio J. G. Brown