Elevator pitch

The cost of children is a critical parameter used in determining many economic policies. For instance, correctly setting the tax deduction for families with children requires assessing the true household cost of children. Evaluating child poverty at the individual level requires making a clear distinction between the share of family resources received by children and that received by parents. The standard ad hoc measures (equivalence scales) used in official publications to measure the cost of children are arbitrary and are not informed by any economic theory. However, economists have developed methods that are grounded in economic theory and can replace ad hoc measures.

Key findings

Pros

The ad hoc equivalence scales used in official publications have no basis in economic theory, are unadjusted for child or family characteristics, and imply a cost of children that is always proportionate to family income.

Scales that are more solidly based in economic theory, such as Engel and Rothbarth, are easy to estimate from survey data and can replace ad hoc scales.

Modern approaches based on economic analysis more precisely identify what parents spend for children and take account of economies of scale.

Modern approaches are consistent with the possible conflicting interests of parents.

Cons

Official publications use simple, standard ad hoc equivalence scales to take into account the cost of children.

Engel scales are based on some arbitrary assumption and may overestimate the cost of children.

Rothbarth scales are inconsistent with the possibility of economies due to family scale.

Engel and Rothbarth scales assume comparablele welfare levels for different families, which is not testable, and introduce arbitrariness to the measurement of the cost of children.

Modern approaches necessitate more sophisticated estimation methods.

Author's main message

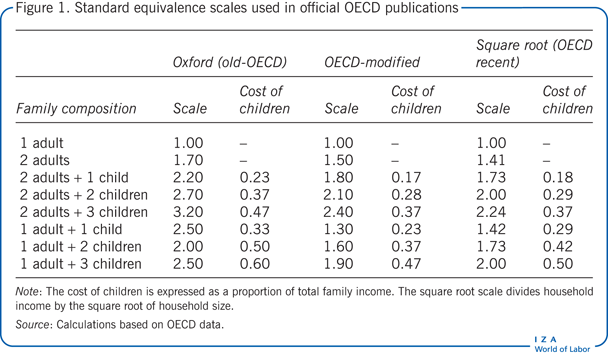

Recent empirical estimates of the cost of children for an average family are generally close in size to the results of traditional ad hoc equivalence scales used in official publications of the Organisation for Economic Co-operation and Development (OECD). However, the empirical estimates are potentially much richer and may take into account the wide diversity of families. The cost of children may depend on a large set of explanatory variables including children’s characteristics as well as those of parents and is not necessarily proportionate to family income, as the ad hoc scales assume. Thus the empirical methods are more relevant for studying poverty and inequality.

Motivation

Many government transfer policies are based on the costs of child rearing. For example, most tax systems include tax deductions, sometimes quite large, for families with children. Family policies also include targeted transfers that are intended to assist with specific child-related expenses, such as tuition fees. The role of these policies is not always clear: they may be intended to encourage childbearing, to ensure the well-being of children, or to treat couples with and without children equitably. In all cases, however, such policies require some kind of measure, even if imprecise, of what children really cost their parents. Measures of the cost of children are also indispensable in calculating changes in poverty and inequality when the average number of children is not stable over time and for comparing poverty and inequality across countries.

One frequently used class of measure is equivalence scales, which take into account the fact that household needs and expenses rise with each additional member, but not proportionally because of economies of scale in consumption. Equivalence scales assign households with different compositions a value in proportion to their needs and expenses. The factors generally considered in assigning equivalence values are household size and whether household members are adults or children. While traditional equivalence scales contain a large element of arbitrariness, the methods used by economists are grounded in economic theory. The cost of children is derived from consumption data.

Discussion of pros and cons

Equivalence scales in official publications

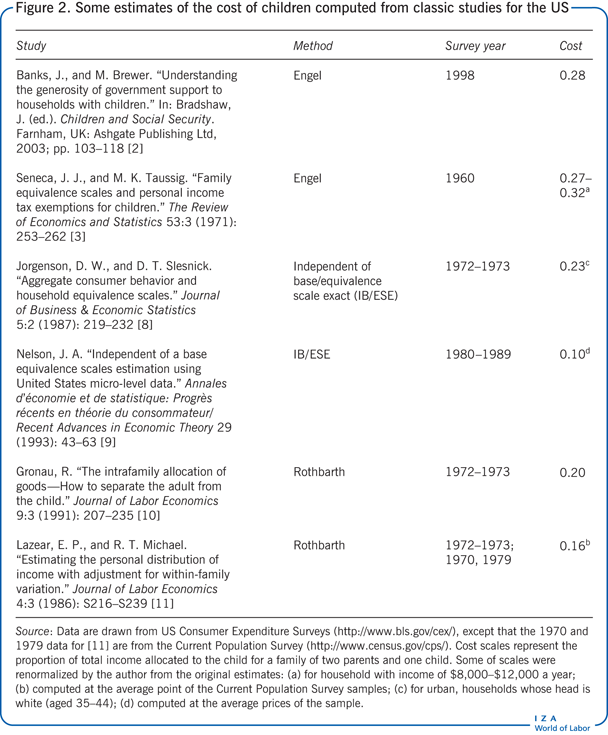

Equivalence scales implicitly take into account the cost of children. The simplest—and roughest—measure of the cost of children relies on fixed equivalence scales to calculate how much a household’s economic needs change with its size. OECD publications have used several equivalence scales over time, though they caution that there is no accepted or universally recommended method for taking household size into account. For instance, the Oxford (or old-OECD) scale assigns different weights to adults and children in total family expenditure. If the first adult has a weight of 1.0, the second adult would have a weight of 0.7, and each additional child a weight of 0.5 (Figure 1).

To see how this works, consider a monthly household income for a couple without children of €3,400. For a person living alone, the “equivalent” monthly income is reduced to €2,000, using an equivalence scale of 1.7. For a couple with one child, the equivalent monthly income would rise to €4,400, using an equivalence scale of 2.2. Thus, the implicit cost of a child in this case is defined as €4,400 minus €3,400, or €1,000, an assessment that is quite arbitrary as it takes no individual characteristics of family members into account. Figure 1 summarizes the most commonly used scales and the associated cost of children.

In all these commonly used equivalence scales, the measure of the cost of children has two important characteristics. First, the cost of children increases less than proportionately with the number of children. This is due to the existence of public and semi-public goods, which generate scale economies of consumption for multi-person families. In a family context, a public good is one whose consumption by one family member does not reduce its availability to other family members. A semi-public good is one whose consumption by one member may slightly reduce its availability to other members. Housing has a strong public good component since, for example, the use of a bedroom by one child only slightly reduces its availability for another child. Similarly, clothing purchased for the oldest child can be worn by the younger children, and toys purchased for one child can be used by all the children.

Second, these measures of the cost of children are proportionate to family income and are independent of individual characteristics of the children and the parents. To take an example using the square-root scale, the annual cost in 2013 of one child would range from $2,232 for a US family with income equal to the 10th percentile of the US income distribution (in 2013), to $9,349 for a US family with median income, to $27,000 for a US family with income equal to the 90th percentile. Therefore, it may be conjectured that, even if such ad hoc equivalence scales give a good approximation of the cost of children in the average family, they may provide biased values for families at the high and low ends of the income distribution. These are serious drawbacks and need to be addressed.

What is the “cost of children”?

The equivalence scales shown in Figure 1, though convenient, are not based on any clear economic theory and may therefore be misleading. Just what do they mean? The answer depends on what question you are trying to answer. Reaching for an equivalence scale in response to any of the following questions is tempting, and yet they should not be confused as each question may require a different means of measuring the cost of children [1]:

The needs question: How much income does a family with children need compared with a family without children?

The welfare question: How much income does a family with children need to be as well-off as a family without children?

The expenditure question: How much does a family spend on its children?

The needs question requires evaluating the price of a bundle of goods and services considered necessary for children. This will always be a subjective exercise—even if experts convey an impression of validity—and the answer will be normative rather than descriptive. Nevertheless, the approach is transparent and simple and was regularly adopted in early studies. In 1963, for instance, a set of equivalence scales were constructed from an evaluation of daily nutritional needs and used as the official measure of poverty by the US government. These scales are still used now. Despite this exception, the needs question is rarely studied today. Economists tend to reject the notion of needs in favor of assessing the cost of children directly from observed behavior. This approach is accordingly left out of the remaining discussion.

Answering the welfare question is important, for instance, for implementing transfer policies (taxes and subsidies) that seek to equalize welfare across families. Trying to do so raises complex conceptual issues. To start with a simple example, consider a couple with a certain number of children whose well-being is measured using a numerical representation of family well-being (utility index). The higher the level of utility, the better off is the family. The level of utility depends on various factors, among them family income and number of children. The cost of children can thus be defined as the amount of money that needs to be transferred to a family with children so that its utility would be the same as it would be without children. In other words, it is a money transfer that makes the family indifferent between having children or not having them.

An obvious objection is that, in general, children are desired by their parents. Therefore, parents decide to have children only if the happiness they (expect to) get from having children is larger than the money cost of having children. For a couple that wants children, the money transfer needed to compensate them for children should thus be negative, while for a couple that does not want children, the transfer needs to be positive. This may go too far, however. It can reasonably be argued that the personal satisfaction (or dissatisfaction) that parents get from children should not enter the sphere of government action and that economic policies should be independent of the way parents create their happiness. Setting aside technical considerations, the methods discussed below thus rely on the notion that a sub-utility index that depends solely on the consumption of goods and services by family members can be disentangled from the full family utility index. This requires some specific assumptions on the form of the family utility index. Moreover, if economists focus solely on consumption, the welfare question is no longer clearly distinguishable from the expenditure question.

The expenditure question is the most straightforward. While one can imagine answering it directly by investigating “who gets what” in the family, doing that would ignore two potential problems. One problem is related to the presence of public and semi-public goods that need to be taken into account when measuring the cost of children. The public nature of the goods can be more or less pronounced, and it may be difficult to disentangle what is public and what is private in family consumption. Moreover, even for a purely public good (such as energy use in the home), the value assigned to the good by each individual may differ. A family member may even negatively value the public good (for example, finding the temperature to be too high). It is thus necessary to have a theoretical model to determine how to incorporate consumption of the public good in the measure of the cost of children.

The second problem concerns data availability. Surveys report data on the level of family expenditures for each broad category of goods and services (food, clothing, housing, transport, recreation, and so on), and the cost of children has to be inferred from these data. What is actually consumed, and by whom, is generally not reported. This limitation of the data has long been recognized. To address it, a few recent surveys, such as the Danish Household Expenditure Survey and the Dutch Longitudinal Internet Studies for the Social Sciences, include some information on individual consumption. Because such consumption data are still rare, economists have turned to indirect methods to infer the cost of children. These are examined below.

The most common indirect methods of calculating the cost of children

The traditional indirect methods of calculating the cost of children fall into two categories: the Engel-type methods and the Rothbarth-type methods, which differ by the key assumption on which they are based.

The Engel method and its generalizations

The Engel method is based on the observation made by German statistician Ernst Engel in the 19th century that the proportion of family income spent on food declines when, all other things equal, family income rises and family size rises. Engel concluded that the share of total income devoted to food (or possibly any other good whose budget share systematically varies with family income) is a good indicator of family well-being. The resulting Engel equivalence scale is defined as the ratio of the income of a family with children to that of a family without children that both have the same share of the budget devoted to food. The cost of children can then be derived from these equivalence scales.

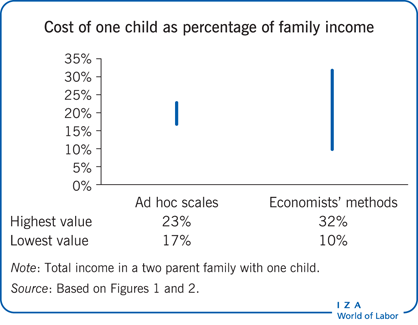

The Engel scales can be estimated using simple statistical methods applied to traditional survey data. The simplicity of the method explains its popularity, even today. Illustrative estimations are given in Figure 2, where the cost of a single child is about 30% of the income of an average two-parent family [2], [3]. Despite the method’s popularity, its theoretical underpinnings are fragile. Engel’s empirical observations are indisputable and are still regularly confirmed today. This does not mean, however, that families with the same budget share for some particular good (food or anything else) necessarily receive the same utility. It can even be argued that using the share of the budget devoted to food as an indicator of well-being tends to overestimate the true cost of children [4].

Suppose that the parents are fully compensated financially for expenses they incur for a newborn child so that they are exactly as well off as before the arrival of the child. One might then believe that the pattern of goods they consume does not change much. However, spending on children is biased toward food, so the share of family income spent on food would be greater than it was before the birth of the child. The Engel method would therefore predict a level of compensation greater than what is needed to equalize utilities. Consequently, it is generally acknowledged that the Engel method “is unsound and should not be used” [5].

The criticism can be answered, however, thanks to more general approaches. The addition of a child to the family not only diverts a share of the family resources from parents to the child, but also changes the implicit (or internal) prices parents face—the price that represents the true costs of goods for parents. For instance, goods that are heavily consumed by children are relatively more expensive in a family with many children, and parents will tend to substitute other goods for them. Everything else being equal, the relative share of family income spent on food will thus tend to increase. This idea was formalized by the Dutch economist Anton P. Barten, who suggested a way to estimate implicit prices that led to an important generalization of Engel scales. However, the method is quite complicated.

Alternatively, a new concept of scales, based on a technical property called independence of base/equivalence scale exactness (IB/ESE), has been developed that is consistent, though in a very restrictive way, with a possible modification of implicit prices induced by changes in family size [6], [7]. Generally considered an acceptable compromise between flexibility and parsimony, IB/ESE scales are believed to neither overestimate nor underestimate the true cost of children and are thus in common use. Examples of IB/ESE estimations are given in Figure 2. The cost of a single child varies considerably in these estimations, from 10% to 23% of an average two-parent family income [8], [9]. This variability may be explained by the choices of different consumption goods in the estimations.

The popularity of generalizations of the Engel method should not obscure the inherent weaknesses of the approach. It is generally recognized that the use of equivalence scales requires two hypotheses: one testable, the other not. In the traditional Engel method, for example, a change in family composition with the arrival of a child will affect the budget share devoted to food by a simple shift in family resources. This is a restriction that can be checked out using traditional consumption data. Under the second hypothesis, and following the Engel’s initial intuition, the family is perfectly compensated for the arrival of a child provided that the budget share devoted to food remains constant after the change in family composition. This conjecture about the comparability of the welfare level of different families is not testable and introduces arbitrariness to the measurement of the cost of children.

The Rothbarth method

In 1943, Erwin Rothbarth suggested another method for calculating the cost of children based on the intuition that family spending on goods typically consumed by adults might be an indicator of the overall well-being of adults in the family. Thus, if the arrival of a child induces a reduction in the consumption of adult-specific goods, one might conclude that the well-being of the parents declines. The cost of children is then defined as the fraction of total family income that a family without children would have to waive so that its level of expenditure on adult goods is the same as it would be for a similar family with children. This definition would be easy to apply with survey data except for the difficulty of defining what makes families “similar.” It is generally taken that similar families have the same observable adult characteristics, such as level of education and age. Figure 2 shows that, using this method, the cost of a single child is equal to about 16–20% of the income of an average two-adult family [10], [11].

The choice of adult-specific goods can be tricky. Many studies choose clothing because it is fairly well defined in consumer surveys on the basis of age. Alcohol and tobacco are also adult-specific goods, but their consumption may be modified for reasons unrelated to family income. Young parents may simply decide to stop smoking or drinking alcohol after the arrival of a child. It is hard to find adult-specific goods whose consumption is not affected by children. To take another example, “Babies may not go to the movies, nor eat meals in restaurants, but their presence may alter their parents’ consumption of movies and restaurant meals” [5].

The criticisms of the Engels method in the previous section also apply to the Rothbarth method, but with nuances. As already mentioned, the Rothbarth method ignores the non-income effects of adding a child to the family. It is sometimes also claimed that the method requires an assumption of the comparability of the welfare levels of different families, but this assertion seems excessive. It is actually sufficient to compare the utility of similar adults in two different situations, with and without children. While this is a much more acceptable interpretation, it implies having to make a distinction between the adults’ utility index and the child’s. And that distinction is at the center of modern approaches used to measure the cost of children, as explained below.

Intrafamily bargaining and indifference scales

In the traditional equivalence scale literature, family behavior is almost always analyzed using a single family utility index. Well-being is assessed at the family level (even if it is sometimes admitted that family utility coincides with the parents’ utility).

Initially, the concept of utility was developed to characterize individuals, not groups such as families. What is a family’s utility? There is no clear answer. Therefore, the modern approach has adopted a “collective” description of family decision-making, with each family member characterized by a specific utility index. Well-being is thus explicitly envisaged at the individual level. The decision process within the family is described by a general rule that allocates utility among each parent and child. The allocation of utility may change along with changes in a large set of variables, including the children’s and parents’ characteristics, the parents’ relative income, and the family environment. In particular, many empirical studies have shown that “who earns what” in the family is relevant to expenditure patterns. It also appears that, everything else being equal, an increase in the mother’s relative income in total family income—because of a policy reform like that in the UK at the end of the 1970s, for instance, which made mothers the recipients of child benefits—generally leads to an increase in the share of total income devoted to children [12].

Empirical applications of this individualistic approach to the measurement of the cost of children are still rare because the literature is recent and estimations are complicated. One approach (ignoring here the more technical details) enables separating the share of total income devoted to each parent and each child and calculating a numerical measure of the scale economies the family benefits from [13]. Parents transfer some resources to their children, but parents may also benefit, as explained above, from the consumption of public and semi-public goods purchased for the children. The various components of the cost of children (income shares and the measures of scale economies) can thus be estimated from survey data. This suggests a new concept. The number by which family income is multiplied so that adults living as a couple (with or without children) attain the same level of welfare as adults living alone is called an indifference scale.

This measure has a more solid theoretical foundation than traditional equivalence scales because it is based on a direct measure of individual well-being and not on a fictitious index of family utility. Preliminary empirical evidence using this framework suggests that economies of scale are large, implying that the true cost of children is fairly small. Individual representations of well-being can also be used to estimate the share of the cost of children born by each parent. However, no clear conclusions have yet emerged from the research, which is ongoing.

Limitations and gaps

The development of the collective approach to family decision-making, with each family member characterized by a specific utility index, has provided a sound foundation for measuring the cost of children. The main limitation is that generally available data do not contain information on individual consumption. Recently, however, new data sets from more complete consumption surveys have become available and can be used to estimate economies of scale and the technology of consumption.

Two other weaknesses of the current literature should be noted. First, the exclusion of non-economic costs and benefits associated with children makes sense only if some restrictive hypotheses are postulated concerning the form of the family or individual utility indexes. These restrictive hypotheses have never been empirically tested, and if they were to be refuted, the consequences for evaluating the cost of children are unclear. In the same vein, the representation of scale economies due to the presence of children in the household is generally arbitrary.

Second, almost all estimations of the cost of children use consumption data and ignore the time costs associated with children. Thus, if the parents provide child care themselves, the time they dedicate to children, which has opportunity costs, is not included in these estimations. In particular, the long-term costs associated with a parent’s withdrawal from the labor market are certainly important and, in large part, borne by women. The size of the costs includes both the direct loss of earnings and the effects of career interruptions on lifetime earnings, which is more difficult to evaluate. Without doubt, incorporating time costs into estimates of the cost of children would seriously challenge current perceptions.

Summary and policy advice

Economists have long used methods to measure the cost of children using survey data. Traditionally, these methods have required an untestable assumption about the comparability of the utility levels of families of different compositions. More recent approaches start from a more realistic representation of family behavior that characterizes the preferences of individual family members. These approaches rely on comparisons of individuals with similar characteristics but in different situations: in a couple or not, with children or not.

Examining empirical estimations of the costs of children (see Figure 2) shows that they are not markedly different from traditional ad hoc measures (see Figure 1). In particular, the costs of children implied by traditional equivalence scales can be seen as satisfactory representations of the average cost of children. Nevertheless, poverty and inequality measures may be seriously biased if the real cost of children is not a constant proportion of income. More sophisticated methods are essential if what parents spend on children is not proportionate to family income and depends on characteristics of the parents or children. Such methods are also essential to distinguish the share of the cost of children that is borne by mothers from that borne by fathers. The development of expenditure surveys with information on consumption by individuals, along the lines initiated by the Danish and Dutch surveys, is also important to better understand the intra-household mechanisms of consumption allocation.

The producers of official statistics could be inspired by economists’ estimates of the cost of children and suggest standardized, but richer, equivalence scales that take into account parents’ and children’s characteristics. Such equivalence scales could be used to guide transfer and family policies.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Support of the labex MME-DII (ANR11-LBX-0023-01) is also gratefully acknowledged.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Olivier Donni

Equivalence scale

Utility

A numerical representation of individual well-being, generally expressed as a function of consumption and leisure time. May also depend on other variables, such as the number of children. By extension, may also be used to represent the well-being of groups of individuals.