Elevator pitch

Population aging in many developed countries has motivated some governments to provide wage subsidies to employers for hiring or retaining older workers. The subsidies are intended to compensate for the gap between the pay and productivity of older workers, which may discourage their hiring. A number of empirical studies have investigated how wage subsidies influence employers’ hiring and employment decisions and whether the subsidies are likely to be efficient. To which groups subsidies should be targeted and how the wage subsidy programs interact with incentives for early retirement are open questions.

Key findings

Pros

With populations aging, countries are looking for policy instruments to boost the employment rates of older workers and re-integrate older unemployed workers into the labor market.

Subsidizing work rather than unemployment may be an effective market-based policy.

Wage subsidies compensate for any pay–productivity gap among older workers and may increase their employability.

Wage subsidies appear to be more effective than creating public sector jobs.

Even if rigorous studies find that the policy is mostly ineffective, there are positive effects for some population groups, such as women.

Cons

The effects of the policy on employment are severely reduced by deadweight, displacement, and substitution effects.

Only large and properly targeted subsidies can be expected to have substantial effects, limiting their cost-effectiveness.

If subsidies are given on a case-by-case basis, the policy may induce discrimination and stigma effects.

Abolishing early retirement incentives and increasing older workers’ employability may be more effective than wage subsidies.

Author's main message

Analyses using natural experiments find at best limited overall effectiveness for wage subsidies paid to employers to encourage the hiring and retention of older workers. In general, subsidized work appears simply to displace unsubsidized work, with little net gain in employment of older workers. A closer look shows differences in effectiveness by gender, with some net gains only for women and only in some regions. Where subsidies are meant to counteract incentives for early retirement, the focus should be on removing such incentives and increasing the employability of older workers instead of subsidizing wages.

Motivation

Population aging in many industrialized countries means that workers need to extend their time in the workforce rather than taking early retirement. Working longer is necessary to ease the fiscal burdens of pension insurance systems and, in countries with a shortage of labor market entrants, to maintain a sufficiently large workforce. Employment rates of older workers have increased in many industrialized countries over the last decade, but not by enough, and more older workers who are not employed need to return to work.

Countries have introduced several policies to boost employment among older workers and to re-integrate them into the labor market, such as training and job search assistance. Providing financial incentives to employers is another market-based instrument being tried in many countries. Wage subsidies, whether granted temporarily to induce hiring or permanently to increase employment, could compensate employers for the gap between the pay and productivity of older workers. Surveys and meta-analyses find that wage subsidies are effective in bringing the unemployed back to work [2], [3]. However, these studies often do not consider older workers, and some studies suffer from methodological weaknesses. Contrary to the mainstream literature, more rigorous evidence questions the positive role of wage subsidies.

Discussion of pros and cons

There are two variants of wage subsidies: hiring subsidies, which are granted temporarily, and employment subsidies, which are granted over an extended period or indefinitely. In the case of hiring subsidies, benefits may be combined with a requirement to retain workers for a minimum period of unsubsidized employment after the subsidies expire. Instead of subsidies, governments sometimes provide exemptions from all or part of employers’ payroll taxes. All of these policies potentially increase employment, but they may also result in deadweight effects if employers collect the subsidy but hire the same individuals they would have hired had the subsidy not been available [1]. There may also be displacement and substitution effects among subsidized and unsubsidized groups. In these cases, new hires take the place of incumbent workers, because of either the employer’s hiring and firing decisions or crowding out in the product market, which occurs when companies benefiting from the subsidy can sell their products more cheaply than other companies.

This paper looks at employer-side subsidies only. Not examined here are worker-side subsidies, such as in-work benefits or reductions in workers’ income taxes. These policies would work like employer subsidies where labor markets are competitive and workers can switch jobs freely, but not where labor markets are not competitive. For this reason, they are not considered here. There is, however, a rich literature that addresses these policies [4].

Theoretical arguments for employer wage subsidies

Employer wage subsidies are not a new policy instrument, and their effects have been analyzed since the 1930s [5]. Wage subsidies lower the net wages paid by the employer. In competitive labor markets, the strength of the employment effect depends on the responsiveness of labor demand and supply to wages (wage elasticity). If either is inelastic, the subsidy will not enhance employment. The only effect would then be a financial gain to either the employers or the employees, depending on which side reacts inelastically to the change in wages [1].

In many countries, wage subsidies are targeted to disadvantaged groups, such as younger or older workers, low-skilled workers, and workers with disabilities. The employment effects may turn out to be different for these groups of workers than for workers in general. If wages are fixed because of deferred compensation schemes (in the case of older workers) or collective bargaining agreements, and if employment cannot fall below a certain level because of employment protection legislation, a gap between pay and productivity may arise [6]. A moderate wage subsidy—one that reduces the pay–productivity gap but does not close it—would not lead to additional hiring. Only a large subsidy—one that raises the marginal product of labor plus the amount of the subsidy above the fixed wage level—will induce additional employment.

This discussion does not distinguish between changes in employment because more people work and changes in employment because the same number of people work more. Subsidy programs do make this distinction. Subsidies that are proportional to wages provide incentives to increase both the number of hours worked (working more) and the number of workers, while subsidies paid only for new hires affect the number of people who work.

For older workers, the size of the pay–productivity gap depends on the changes in workers’ productivity over their lifetime (an issue on which there is conflicting empirical evidence) and the trajectory of wages. This suggests that there are interactions between wage subsidies and other labor market institutions, in particular legal employment protection.

More recently, wage subsidies have been analyzed in the framework of the search and matching model [7]. In this framework, age and employment subsidies boost employment, especially among low-skilled workers, while hiring subsidies reduce the duration of unemployment but increase its incidence. However, the larger deadweight effects of employment subsidies make them inferior to hiring subsidies from a welfare point of view [5].

Empirical results: Effectiveness of wage subsidies on hiring

Germany introduced hiring subsidies in 1998 (called the integration supplement, or EGZ) to be paid for a limited time after an unemployed worker was reintegrated in the labor market [1]. Eligibility criteria for target groups have been changed several times. For older workers, the maximum amount was 70% of labor costs (wages set by collective bargaining agreements plus payroll taxes) and the maximum duration of payments was 70 months. In most cases, local employment agencies chose to remain substantially below these limits. If the employment relationship is terminated before a minimum period after expiration of the subsidy, the employer is legally obliged to refund parts of the subsidy. There is no legal entitlement to the integration supplement; decisions on the amount and duration of the subsidy are made by the agency.

An evaluation of the program looked at whether hiring subsidies led to more hiring and, thus, to earlier transitions from unemployment to employment compared with the situation in which no subsidies are available [1]. The observation period was shorter than the maximum duration of benefits, so the study did not consider long-term integration into unsubsidized employment.

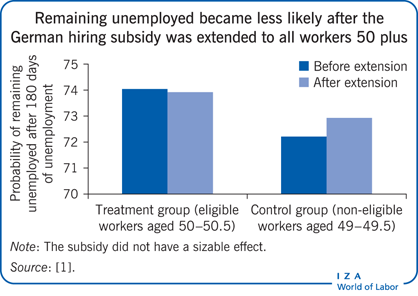

As have other studies of wage subsidies for all workers, the study used a difference-in-differences approach, exploiting changes in eligibility. For instance, a change was introduced in 2002 that extended eligibility from the long-term unemployed to all unemployed workers aged 50 and older. Drawing on a large database of administrative records, the study compared workers aged 50–50.5 years at the time they entered unemployment (eligible workers—the treatment group) and workers aged 49–49.5 years (non-eligible workers—the control group) [1]. Data were collected on both age groups before and after the legal change. Members of the two age groups within the two time periods were followed up to 180 days after the start of their unemployment spell. The outcome measure was whether those who were unemployed were hired during that period (not counting employment in public schemes).

The probability of remaining unemployed after 180 days from the start of the unemployment spell increased between 2001 and 2002 among the control group because of deteriorating labor market conditions but became slightly smaller among the treatment group (a smaller value indicates a more positive outcome) (see Illustration). Thus eligibility reduced the probability of remaining out of work; however, the effect was found to be non-significant. A similar finding was obtained for another change in 2004 which restricted eligibility, but with the effects reversed.

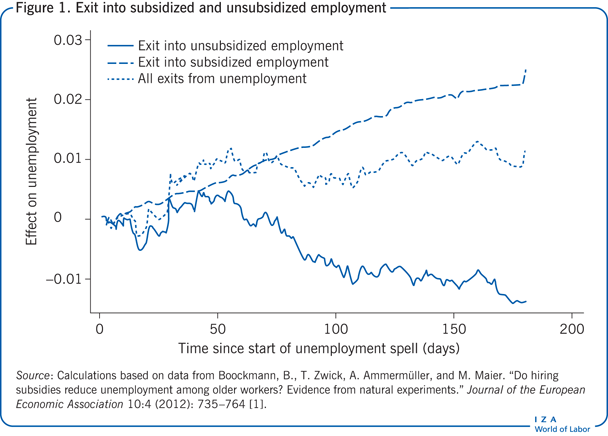

The study also looked at whether unemployed workers who were reintegrated into the labor market transitioned into subsidized or unsubsidized employment, again exploiting the 2002 change that extended eligibility from the long-term unemployed to all unemployed workers aged 50 and older [1]. The change in legal eligibility criteria had relatively large positive effects on subsidized employment (neglecting possible effects on unsubsidized employment) in the treatment group (Figure 1). Measured as a share of all unemployed workers, the results show a two percentage point increase in the probability of exiting unemployment to subsidized employment. This effect is much larger than the effect on total (subsidized plus unsubsidized) employment (shown by the curve labeled “All exits from unemployment” in Figure 1). The difference between the two estimates is explained by the lower number of exits into unsubsidized employment as a result of the subsidy. Hence, deadweight effects dominate employment creation.

Further analyses incorporated workers’ characteristics, possible anticipation effects (such as a reduction in hiring just before the policy change went into effect), and different definitions of age groups or outcome variables [1], but the results were unchanged. In addition, the findings strongly suggest that the ineffectiveness of the policy is due to a deadweight effect and not to displacement or substitution effects, taking into account the narrow definition (in terms of age) of the comparison groups.

Figure 1 is based on the amount of hiring within the same age group; substitution and displacement would affect mainly workers outside this age group. Thus, in most cases, the same workers would have been hired even without the subsidy.

Empirical results: Effectiveness of wage subsidies on overall employment

In Finland, a large-scale wage-subsidy program was temporarily available from 2006 to 2010 for all low-wage workers—whether previously employed or unemployed—who were 54 years old or older. The maximum amount of the subsidy was 16% of gross monthly earnings for workers earning €1,400 a month and was available only to those earning less than €2,000 a month. The subsidies were less generous per period than in the German reintegration program but they could be received for a longer period. In addition, the design of the subsidy created employment incentives not only to hire new workers but also to increase working hours because it covered only full-time workers who were employed at least 140 hours a month. The objective of the subsidy was to increase employment among low-skilled workers and to provide incentives against early retirement.

An evaluation of the program used a 33% sample from the Finnish Longitudinal Employee-Employer Data, an administrative data source covering the entire population of Finland [8]. The data contain tax records and wage information but no direct information on subsidy receipt. The treatment variable was eligibility for the program. The study used a difference-in-differences-in-differences design based on the introduction of the subsidy in 2006, age (taking into account the age limit of 54 and that younger workers may become eligible in the future), and low-wage status (less than €2,000 a month).

The study finds a one percentage point increase in the employment rate for the low-wage group, a half a percentage point increase for the high-wage group (individuals likely to be ineligible for the subsidy), and a half percentage point difference between the two (the treatment effect, as estimated by the difference-in-differences-in-differences estimator [8]). The effect of the subsidy is only marginally significant. And because the subsidy was received by about 60% of all eligible workers and cost about €90 million a year, the effect is also small in magnitude. These results are confirmed by regression analyses that account for worker characteristics. An analysis using the size of the subsidy (or likely size in the case of the treatment group) rather than eligibility as the treatment variable found labor demand elasticities of 0.07–0.13, suggesting that demand for labor is inelastic, e.g. does not respond to these incentives/changes. No significant effects were found for the number of newly hired workers [8].

Thus, the policy appears to be ineffective in bringing the unemployed back to work.

Interactions with early retirement policies

The Finnish subsidy program may have had a variety of effects on the hours worked by employees, depending on how the amount of the subsidy changed with hours worked and total remuneration. Because the subsidy was available only to full-time workers, its most important effect may be that it provided an incentive for employers to offer full-time instead of part-time employment.

This is particularly relevant because Finnish workers are entitled to switch to part-time early retirement arrangements at age 58. The wage subsidy could make this early retirement choice more costly to employers than subsidized full-time employment. Indeed, the share of the age group 58 years and older working part time fell substantially after the subsidy program was introduced, while there was no change in the younger age groups [8]. Thus, the subsidy was effective in counteracting the incentives for early retirement created by other programs.

Belgium introduced a similar policy in 2002, a permanent wage subsidy (a reduction in employers’ social security contributions) targeted to workers aged 58 or older. The program reduces private sector employers’ social security contributions by €400 a quarter for employees in the targeted age group who work at least 80% of a full-time-equivalent job. Calculated at the median wage, the subsidy was 4% of the wage cost—a substantially smaller incentive than in the German reintegration program discussed earlier. The incentive is strongest for workers earning close to the minimum wage. Part-time employees working 33–80% of a full-time-equivalent job also benefit, but the subsidy is reduced proportionately to working time.

The program becomes available to workers at age 58, the age at which early retirement becomes an option for a sizable share of Belgian workers, in particular manufacturing workers. For this subgroup, it serves explicitly as a counteracting force to incentives for early retirement.

A study of the program hypothesized that a wage subsidy might not affect employment decisions for all workers but that it might reduce the attractiveness to employers of dismissing workers through early retirement [9]. The study used a large data set that merges administrative records of different origins and provides information on close to 250,000 workers. The outcome variables examined were the employment rate, working time, and hourly wages. The study used a conditional difference-in-differences approach that compared workers above and below the age limit of 58 and before and after the introduction of the policy to estimate the effects of the policy. If the wage subsidy is effective, the study would be expected to show a smaller drop in employment at age 58 after the policy was introduced.

Despite the large number of observations, the results for all workers are statistically insignificant. This finding is in line with the results obtained for Germany [1] and Finland [8]. However, in manufacturing, where most workers have the option of taking early retirement, the effect of the subsidy is larger and significant for men, though not for women [9]. The effect is also significant for workers in companies where a large share of workers had taken the early retirement option before the subsidy was introduced. In that group, a labor cost decline of 10% increases the probability of being employed by 9%, implying that labor demand reacts relatively elastically to changes in labor costs. The study also finds a significantly positive but small effect on number of hours worked.

The results for Finland [8] and Belgium [9] suggest that wage subsidies to older workers may be effective in preventing early retirement. However, wage subsidies do not boost employment in the workforce as a whole, and they are not appropriate instruments for increasing the hiring of older workers.

Differences across subgroups of the target population

It is plausible that the effects of wage subsidies differ across population groups, such as between low-wage and high-wage workers or between the long-term and short-term unemployed. And deadweight effects could be lower in groups in which there would be little hiring in the absence of the subsidy. Unfortunately, there is little systematic evidence to support or refute these differences. In particular, it is difficult to compare the effects of the subsidies between low-wage and high-wage workers if the amount of the subsidy (relative to wages) depends, as in Belgium and Finland, on the wage before subsidies.

The German study considered the effect on four population groups: men and women in eastern and western Germany [1]. Of these groups, significant employment effects are found only for women in eastern Germany. One reason for the stronger effect for eastern Germany may be that the hiring subsidies are more generous than in western Germany: the duration of subsidies is, on average, considerably longer in eastern Germany than in western Germany. In western Germany, only one-third of the subsidies last between two and three years, while in eastern Germany more than two-thirds do. Thus, the incentives for hiring are stronger in eastern Germany. This, however, does not explain the differences between men and women in eastern Germany.

In addition, women in eastern Germany may be a special case because of the high rate of unemployment in this group: 19.3% in 2000–2004 compared with 8.1% in western Germany [1]. High unemployment results in a high elasticity of labor supply, so wages are unlikely to rise in response to the subsidy. At the same time, the level of education and work experience of women in eastern Germany is high, so the initial pay−productivity gap may be low relative to the subsidy. Further analysis shows that the positive effect of the subsidies on hiring is confined to skilled and semi-skilled workers.

The studies of the subsidy programs in Belgium and Finland also looked at the gender effects. The Belgian study finds statistically significant effects for men but not for women, which can be attributed to the lower employment rate among women [9]. In addition, fewer women work in manufacturing, where the results are most significant. In Finland, the subsidy is equally ineffective among women and men [8].

Other factors influencing the effects of wage subsidies

Evidence shows that the effects of wage subsidies for older workers are affected by the existence of early retirement schemes and are likely affected by other policies, such as employment protection and wage-setting institutions. Furthermore, the effects could differ with macroeconomic conditions. A recent study of a temporary tax credit scheme in France (the “zéro charges” program enacted in 2008) finds a positive effect on employment during the recent recession [10]. It is not clear, however, to what extent this finding applies specifically to older workers.

Wage subsidies, if targeted to particular groups or paid on a case-by-case basis, may create stigma effects by signaling to employers that productivity is lower among these workers. To examine this issue, the effectiveness of hiring subsidies for people with disabilities, offered through Swiss Disability Insurance, was analyzed in a small-scale social field experiment [11]. The results show that for clients of job coaching services, callback rates for job openings increased if employers were made aware of the subsidy. In another group (vocational training graduates), however, the subsidy was counterproductive. The issue of stigma effects of targeted wage subsidies needs additional investigation.

Limitations and gaps

The evidence on the effectiveness of wage subsidies for older workers is still patchy. The major studies differ in eligibility age (50 in the German subsidy program, 54 in the Finnish program, and 58 in the Belgian program), institutions (employment protection and early retirement), types of workers (low-wage workers or all workers), size of the incentives, and other characteristics. To date, these studies provide case study evidence for particular subsidy schemes, but it is not straightforward how results can be generalized.

There is also little systematic information on what drives different effects across population groups. This information would be necessary for targeting wage subsidies to particular population groups, such as men or women, low-wage workers, or the long-term unemployed. In addition, more research must be done on the interaction of wage subsidies with employment practices such as deferred compensation schemes, employment protection, and early retirement rules.

Summary and policy advice

Deadweight costs for wage subsidies for older workers are huge. Thus, these programs are unlikely to be cost-effective. Deadweight effects are largest in the case of subsidies given to current employees. However, the German experience shows that deadweight costs also matter when subsidies are paid only for newly hired workers. In all cases, the financial cost of these programs has been high, while the effects on employment have been small.

Finding a way to reduce deadweight effects is thus important if these programs are to be retained. One possibility would be to target the subsidies more closely to particular population groups. However, there is too little systematic evidence so far on differences in effects across population groups. Another possibility is to make subsidies conditional on net job creation, by paying subsidies only if total employment in the firm has actually increased [10].

To achieve the policy goal of increasing employment among older workers, policymakers need to consider other options. Where subsidies are meant to counteract incentives for early retirement, the focus should be on removing such incentives and increasing the employability of older workers instead of subsidizing wages. Limiting the incentives for early retirement is particularly important, as is shown by the analyses of subsidies in Belgium and Finland: these programs were effective only in preventing transitions into early retirement, a possibility that was created by policy incentives for early retirement in the first place [8], [9].

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author (together with Thomas Zwick, Andreas Ammermüller, and Michael Maier) contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [1].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Bernhard Boockmann