Elevator pitch

High risk of poverty and low employment rates are widespread among low-skilled groups, especially in the case of some household compositions (e.g. single mothers). “Making-work-pay” policies have been advocated for and implemented to address these issues. They alleviate the above-mentioned problems without providing a disincentive to work. However, do they deliver on their promises? If they do reduce poverty and enhance employment, is it possible to determine their effects on indicators of well-being, such as mental health and life satisfaction, or on the acquisition of human capital?

Key findings

Pros

Permanent in-work benefits generally increase the transition from welfare to employment of single mothers.

Offering permanent in-work benefits reduces the incidence of in-work poverty.

Permanent in-work benefits have a positive effect on mental health and life satisfaction of (single) mothers.

Children of beneficiaries can also benefit from permanent in-work benefits.

If society values the well-being of low-paid workers, permanent in-work benefits can improve the redistribution of income.

Cons

In-work benefits based on total family income decrease the employment level of secondary earners.

By increasing overall labor supply, in-work benefits eventually reduce pre-tax wages, in the absence of downward wage rigidity.

In-work benefits are often complex and interact with other schemes; they can thus be poorly understood, particularly by their target beneficiary group.

Relating very closely the access to income to the holding of a job, in-work benefits could become out of date in the coming decades.

Author's main message

Permanent in-work benefits often enhance the socio-economic position of low-skilled workers with low financial incentives to work. Some evidence suggests that the mental health and the overall life satisfaction of beneficiaries are also improved, with, for some subgroups, additional favorable effects seen in their children. The complexity of the tax and transfer system, however, should not be overlooked. This calls for clearly understandable policies that offer permanent in-work benefits alongside supporting mechanisms that assist with childcare, health care, and housing.

Motivation

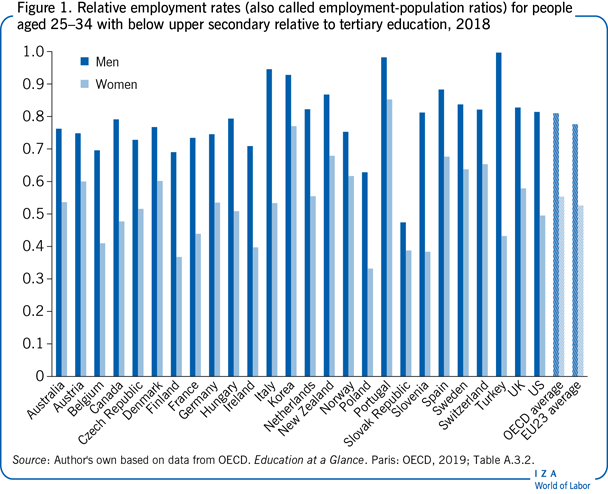

Some low-skill groups or specific household compositions (e.g. single mothers) have low employment rates and/or suffer more from poverty than other subpopulations. The relative employment rate of the less educated in the EU is below 0.5 and this is particularly true for women (Figure 1). In the EU, the employment rate among women declines with the number of children in their household that are under the age of six (with some exceptions, e.g. Denmark). Among single mothers, the employment rate is lower (compared to similar childless women) in countries such as Germany, the UK, the US, and the Netherlands, but the reverse is true in a number of other countries.

Leaving welfare (or unemployment insurance) to enter employment does not necessarily raise net income. This lack of monetary incentive is particularly true for specific groups with low pay potential who benefit from a non-negligible out-of-work benefit that is taxed away at a very high rate when entering employment. During the last 25 years, a number of countries have reformed their tax and transfer system so as to redistribute income toward low-paid workers.

Discussion of pros and cons

In-work benefits: Purpose and standard features

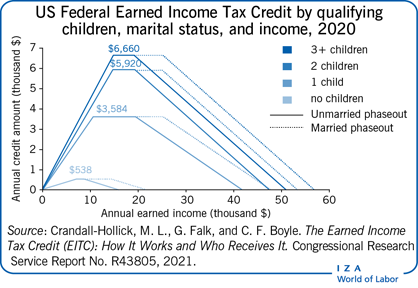

In-work benefits (IWB) intend to provide income support to (some) low-income families in a way that provides incentives to remain attached to the labor market and avoids loss in human capital due to joblessness. So, IWB are provided to low-income families with at least one member employed in the formal sector, whether salaried or self-employed. IWB take the form of direct earnings subsidies or tax credits. The latter are typically refundable, meaning that if the credit is higher than the tax liability, the difference is paid to the taxpayer. Eligibility to a non-negligible IWB can require the presence of “qualifying” children in the household (i.e. a child that meets criteria in terms of e.g. age, residency, and relationship with the claimant of the IWB). Higher out-of-work welfare benefits for families with children and higher costs of working provide a rationale for this restriction. The Illustration shows a common eligibility and compensation profile for IWB. There is a phase-in region, followed by a plateau and a phase-out region. In the UK, the Working Tax Credit has no phase-in region, with IWB jumping in from zero at a minimal number of hours worked (16 hours a week for a single parent). Some IWB are paid for relatively short periods of time (e.g. the Self–Sufficiency Project in Canada where the earnings supplement is received for up to three years); however, most IWB have in principle no time limit. This is true for the Working Tax Credit and the in-work support available under a new scheme called Universal Credit in the UK and for the Earned Income Tax Credit (EITC) and Child Tax Credit in the US. Permanent IWB are also present in continental Europe: for example, the “Prime d’Activité” in France, the “Arbeidskorting” in the Netherlands, the “Social and Fiscal Work Bonuses” in Belgium, or the “Jobbskatteavdraget” in Sweden. When IWB require the presence of “qualifying” children, they expire, for example, when children reach a certain age.

The common feature of IWB schemes is that the “participation tax” (i.e. the difference in net tax liabilities due when employed versus when out of work) is negative at the bottom of the income distribution. So, if net taxes are negative for those out of work, say as a result of untaxed means-tested welfare benefits, an IWB scheme means that for a range of low income levels, net taxes are even more negative when working. Now, in practice, in the presence of local taxes and of other benefits, like housing benefits or child and dependent care benefits, it is not unusual that IWB schemes only reduce the positive “global participation tax,” where “global” means that all benefits potentially lost when taking a job are included.

When would in-work benefits be the right approach?

IWB, when in place, are a component of the tax and transfer system, which affects the distribution of income in society. When only consumption and leisure time ultimately matter and rational decisions are taken, a tax and transfer system that optimally redistributes income should include IWB under two major conditions [1]. First, the decision to participate or not in the labor market (the so-called “extensive margin”) is the main behavioral response to incentives among low-income groups (responses related to in-work effort and hours worked—the so-called “intensive margin”—are less important). Second, the government values an additional unit of income for the working poor more than an extra unit uniformly distributed across all income groups. The first condition is widely accepted, having been confirmed by many studies, though it has been challenged [2]. The second condition is not uncontroversial. On the one hand, some might argue against any form of income redistribution. At the other extreme, others might argue that redistribution aims at improving the position of the least well-off people only. In the latter case, since the least well-off are typically jobless people, a relatively generous out-of-work benefit would be taxed away at a high marginal tax rate. Put differently, a negative income tax (or, alternatively, a basic income) would be optimal. Under less extreme views, the second condition is easily met. Then IWB should be one of the public instruments used to redistribute income among citizens.

Considered as a labor market policy, the justification for IWB relies on the following arguments: the low employment rate of low-skill groups and specific household compositions is due to a lack of monetary incentives to take vacant jobs because means-tested out-of-work benefits create an “inactivity trap” (the argument can be generalized to unemployment insurance benefits). So, the main problem is on the supply side. Given the profile of the target groups, it is also assumed that the best answer to non-employment is to insert them directly into formal jobs. Neither a handicap nor lack of (cognitive or non-cognitive) skills prevents these people from being hired by firms with standard productivity requirements (i.e. no “productivity trap” exists). If this was not true, then training programs or the direct creation of well-designed temporary public employment programs (i.e. “relief jobs”) could be a more appropriate initial step.

There is strong evidence that means-tested benefits act like an inactivity trap. However, there can be an overall lack of vacant jobs during economic downturns or in stagnant economies; in some countries, this problem is structural for some groups (in particular, the low-skilled). In these cases, the difficulty is not only, or not primarily, on the supply side. Policies that increase labor supply, as IWB do, can then only increase labor demand if wages are flexible downwards (i.e. can be reduced). In the presence of binding minimum wages, this assumption can be far-fetched at the bottom of the wage distribution. So, depending on the context, hiring subsidies can be more effective at creating jobs than IWB.

IWB reduce poverty and can provide partial insurance against some shocks

When not accompanied by a reduction in out-of-work benefits, the introduction or the extension of an IWB can have non-negligible effects on standard indicators of poverty (such as total net income being below either a certain amount of money, or a proportion of the median income). It has a direct, mechanical effect on poverty if the behavior of economic agents remains unchanged and this effect can be amplified by taking into account labor supply responses. The magnitude of the reduction of poverty obviously depends on the generosity of the IWB and the specific definition of the poverty rate. In the US, “the fraction of EITC-eligible wage earners below the [federal] poverty line falls from 31.3 percent without the EITC to 21.4 percent by mechanically including EITC payments (holding earnings and reported incomes fixed). The fraction below the poverty line falls further to 21.0 percent once earnings responses to the EITC are taken into account” [2], p. 2685.

Given that insurance and credit markets are incomplete, IWB should also be seen as a (partial) public insurance program against random shocks to the labor market or to the family structure (e.g. a break-up). This can be expected as long as these shocks do not push people out of work. To the extent that IWB lead to a net rise in income, they also stimulate savings and, hence, self-insurance [3].

Effects on labor supply, job entry, and employment retention

Contrasting the experiences of eligible (low-educated) single mothers and non-eligible (low-educated) women without children, the literature finds that single mothers increase their labor market participation in the US as a result of IWB [4]. Similar conclusions were reached in the UK [5]. The evidence in continental Europe is, however, sometimes less clear-cut [6]. Among single mothers who are already employed, the impact of in-work support on hours worked is rather mixed. The effect, if any, has typically been found to be small, or at least not strong enough to outweigh the positive effect on labor market participation [7]. As single mothers are likely to be part-time workers, the minimum hours eligibility condition to receive IWB with the former British Working Tax Credit (16 hours a week for a single mother) has lowered the number of jobs with very short hours [8].

At the moment that women transit into single parenthood, a reduction in job exits is observed as a result of IWB [8]. Single mothers have traditionally shown a higher probability of exiting employment compared to single childless women or to mothers that are part of a couple. The 1999 policy reforms in the UK reduced this penalty [8].

When eligibility is conditional upon a household's total income, the employment rate or the number of hours worked among partnered women with children, who are typically the secondary earner, somewhat declines [3], [7]. There is little evidence of any effects on men in the US, but some positive effects have been detected on men in the UK [5].

Beyond the differences between single and partnered mothers, IWB turn out to have diverse effects on the participants. There is some evidence that the effect of IWB on the employment rate of single mothers is stronger when they have school-aged children under the age of ten [8], [9]. Furthermore, the effect of the EITC on participation in the labor market is 6.1% among single mothers with less than a high school education while it equals 2.6% for high school participants [4].

Some IWB are payable for relatively short periods of time (between one and three years). They are therefore cheaper than the above-mentioned IWB. A number of social experiments have shown that the provision of such time-limited IWB helps single parents to find jobs and leave welfare. The main question is whether this effect is temporary and disappears close to the end of entitlement. A prominent case is the Canadian Self-Sufficiency Project. The main message of the evaluation literature has for a long time been that, when targeted at long-term welfare recipients, this earnings supplement had no lasting impact on full-time work. Recent evidence has convincingly questioned this conclusion [10]. A lack of agreement about the effects of time-limited IWB on employment retention is also present in the UK. In sum, additional evaluations are needed about the long-term effects of time-limited IWB.

In-work benefits and human capital acquisition

In the long term, IWB have potentially numerous effects. By raising the level of income in low-paid jobs, IWB reduce the return from education. Hence, formal education choices can be influenced because the (uncertain) returns of alternative choices are modified by IWB. On the other hand, by reducing the time spent receiving welfare (or in unemployment), IWB should dampen skill depreciation. Thus, if learning-by-doing or labor market experience is central to skill development, then stimulating job entry and job retention enhances post-education human capital. However, in the case of on-the-job training and out-of-employment training, the time devoted to learning can arguably be seen as competing with potential time spent in work. In the UK, there is evidence that IWB have led to a decline in post-compulsory education of women [3].

In-work benefits affect a range of indicators of well-being of single parents

The effect from IWB on single mothers’ mental health is not obvious. The adverse consequences of a break-up can be mitigated, for instance, if they keep their job. However, when they take (or hold onto) a job, single mothers have to juggle work while raising their children. Since the 1999 reform in the UK, there is evidence that both mental health (as reflected by the General Health Questionnaire score) and overall life satisfaction have improved [8]. The evidence on mental health and self-reported health is similar in the US after the 1993 expansion of the EITC [11]. It is difficult, however, to judge whether these improvements should be attributed to the increase in income, the change in hours worked, or the non-monetary job characteristics.

Effects on children

Children may benefit if the earnings supplements raise parental income or mental health, but they may suffer from the reduced time availability of parents who take jobs. The evidence available in the US indicates that the first effect dominates the second one [11], [12]. The reduction in the time spent with children is non-negligible but the type of interactions between children and parents when they are together would also be affected [13].

Effect of in-work benefits on wages

If IWB boost labor supply, then unless wages are downward rigid (i.e. there is no possibility for wages to decline from their current levels), wages should decline; this should eventually raise the quantity of labor demanded by firms. An analysis for the US concludes that “employers capture about $0.36 of each dollar spent on the program through reduced wages. Workers’ after-tax incomes rise by only $0.73−$1 in EITC payments, plus $0.09 from increased labor supply, less $0.36 in reduced wages per hour worked” [11], p. 201. The net effect, however, varies considerably within the working population. The after-tax incomes of those eligible for the EITC rise by $1.07 per dollar in EITC payments while “ineligible workers loose $0.18 through reduced wages and $0.16 through the induced reductions in labor supply” [11], p. 201.

To what extent can this evidence be informative for countries with labor market institutions and rules that are very different from those in the US? There is no clear answer to this question. However, analyses of European individual data suggest that total real wages have been downward flexible during the last decade and in particular in the aftermath of the Great Recession. This is also true at the bottom of the wage distribution, where the base wage is more downward rigid in the presence of legal minimum wages. So, it is possible to conjecture that a negative effect of IWB on wages might be expected in European countries as well. This effect would obviously reduce the redistribution effect of IWB.

Complexity of in-work benefits

Assessing the net gain accruing to a household when one of its members enters employment or changes their working time is a complex task. Lack of knowledge about the structure of the tax and transfer system is widespread. The complexity of IWB schemes is increased if they interact with other components of the tax and transfer system. For instance, if the IWB is based on the net-of-tax family income (in contrast to being based on the pre-tax family income), then the interaction with all other benefits is particularly important. In the UK, the working families tax credit was “counted as income when calculating entitlements to other benefits, such as Housing Benefit and Council Tax Benefit” [9], p. 485. While in the US, “most federal means-tested benefit programs do not count EITC refunds as income” [11], p. 152. These interactions should be carefully taken into account when designing IWB schemes.

Furthermore, the behavioral responses to IWB are much different than initially presumed, as recipients do not operate with a perfect understanding about the structure of the tax and transfer system [2]. For the US, a study argues that hours worked vary more than expected among subgroups who are better informed about the details of the EITC [2]. As such, the weak average effect on hours worked reported above would be due to a widespread lack of knowledge of the tax code, as well as to other adjustment frictions. In the UK, the spike in the distribution of hours worked at the minimum hours eligibility level suggests that this informational problem is not as much of an issue.

The recognition of the importance of imperfect information leads to a major recommendation: to induce the expected behavioral adjustments, highly readable (i.e. understandable) IWB policies are needed, and any reform to an existing program should be salient and accompanied by well-designed information for the targeted population.

In-work benefits, marriage, cohabitation, fertility, and some design issues

When eligibility to IWB and subsidy amounts are based on family composition and income, there are incentives to cohabit or marry. When eligibility requires the presence of children, fertility can also be affected. In the US, the evidence is inconclusive and the effects are at best small [11]. Some more clear-cut effects have been detected in the UK [8]. However, it is not easy to disentangle whether these effects should be attributed to the IWB per se or to their effects on labor supply decisions and income effects.

Moreover, the idiosyncrasies of each IWB system are highly influential in practice: the precise definition of income used, the definition of qualifying children, the frequency at which the benefit is paid, to whom (in the family) it is paid, and the precise claiming process are among the key features. In particular, the latter affects the take-up rate of IWB [11]. In addition, IWB rarely exist in isolation. They interact sometimes in a complex way with the other components of the tax and transfer system. While discussing all these features is beyond the scope of this article, some other dimensions regarding the design of IWB are worth mentioning.

Should the target of IWB be the family or the individual? The choice of the family can be understood since poverty is typically defined at the level of the household. However, this choice can generate complex incentives on various decisions (labor supply, education, fertility, marriage, or cohabitation). In particular, there is some evidence of negative labor supply incentives for secondary earners. Conversely, IWB programs based on individual earnings are prima facie more costly but provide better work incentives to secondary earners. Taking several induced effects into account (among others on savings and taxation), an IWB assessed on individual instead of family income has favorable short-term but negative long-term effects on female employment in the context of the 2002 tax and benefit system in the UK [3].

Should there be a minimum number of hours eligibility (adapted to family composition)? If people freely choose their number of working hours and the latter is observable with no errors, then there is a case for such a criterion, as taking hours into account allows more resources to be redistributed without increasing efficiency losses [9]. However, hours worked are often only partly observable by public authorities and can be manipulated by self-employed workers. Furthermore, the labor demand side can impose restrictions on working time (e.g. only recruit part-time workers during peak hours). So, before introducing a minimum number of hours eligibility, the decision maker should see, sector by sector, how such a requirement actually affects low-paid workers who must often juggle work with family duties.

Finally, should eligibility to IWB depend on the presence of children? As said earlier, the relative employment rate of (single) parents with (young) children is not a matter of concern in all countries. It depends on many factors, such as the supply of public and private childcare facilities, the existence and the design of family allowances and of child(care) tax credits. What actually matter are the net total benefits of participating in the labor market and of changing the number of working hours. Still, labor supply responses vary with the age of children [9]. Exploiting this information should allow a better design of the tax and transfer system.

In-work benefits need to be integrated in a broader package of policies

Last but not least, the impediments to work resumption are often multidimensional. IWB should be seen as part of a comprehensive answer to the difficulties encountered by the low-skilled population. In addition to the already mentioned issues such as lack of human capital and limited access to childcare, policymakers should be aware that the encountered impediments can also relate to housing and health conditions, limitations to geographical mobility, or indebtedness. The latter matters since a return to work accompanied by income gains can imply a significant increase in repayment obligations.

Limitations and gaps

Evaluating the impacts of IWB requires the building of a counterfactual situation. The counterfactual measures what would have happened to the participants in the absence of the earnings supplement. If conducting a randomized experiment is out of scope, this is a daunting task. If it is possible, there remain some pitfalls [10].

In the absence of randomized experiments, many evaluations exploit an existing reform and choose a comparison (or control) group that is, or is supposed to be, not affected by the reform, but which is likely to share a similar environment. The composition of the target and comparison groups should not vary with time. Moreover, all other possible changes in the environment (except for the reform) should affect both groups in an identical way. The latter requirement is often quite difficult to achieve in reality, because other changes in taxes and benefits affecting families occur simultaneously. Some evaluation studies failed to check these assumptions carefully. It is nevertheless fair to conclude that those studies that did follow rigorous procedures generally confirm that IWB do have a significant impact on the outcomes considered above. One aspect is still blurring the picture though, namely the possible effects of IWB on overall wage rates, since the comparison group would then be affected. The same concern emerges if large-scale IWB improve the employment prospects of their beneficiaries at the expense of other, yet similar, groups who compete in the same labor market. These problems are less acute in the case of (randomized) pilot studies. However, only time-limited schemes have been evaluated in such conditions and the message delivered by these evaluations leads to uncertain conclusions. More studies are clearly needed about the impacts of temporary earnings supplements.

It would also be very useful to more accurately know how conditions on the demand side of the labor market affect the impacts of IWB. This is particularly needed in the current context of accelerated and disruptive technological and climate changes and in a new era that could be periodically characterized by pandemics. In such a context, one may wonder whether the very close connection between income and the holding of a job, that IWB have reinforced, will still be sensible in the coming decades.

Furthermore, current knowledge on the role of IWB on human capital acquisition is also still very limited. Finally, there is still an imperfect understanding of the reasons why evaluations of IWB in continental Europe can substantially differ from those in the US or the UK.

Summary and policy advice

Permanent in-work benefits (IWB) often increase labor force participation by single mothers and reduce in-work poverty. In the UK and the US, these effects appear to be accompanied by improved indicators of health and life satisfaction for the beneficiaries, as well as some positive effects detected on their children. There is also a broad consensus that IWB can improve the redistribution of income. Still, IWB have a negative impact on low wages in the absence of downward wage rigidities, which reduces their redistribution effects.

IWB should not be implemented in isolation. They should be seen as part of a broader package of support to low-income families, including, in particular, access to subsidized childcare facilities, health care, training, and housing. Furthermore, plausible constraints on the labor demand side should not be forgotten. Finally, some groups can be so disadvantaged that other approaches will be needed for them.

As far as the design of IWB is concerned, a lack of knowledge regarding the structure of the tax and transfer system is widespread among the target population. The complexity of some IWB schemes, or of their interactions with the broader tax and transfer system, is a pervasive difficulty. All this affects the take-up rate of IWB negatively. Therefore, tax reforms need to be easily understood by their intended beneficiaries. One potential solution worth considering is whether the IWB should be excluded from taxable income (a feature which is standard in the US). Finally, in a context of disruptive trends that could lower labor demand, the close connection between IWB and the holding of a job could become misplaced.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 offers more clear-cut evidence on the impacts of IWB on education and on beneficiaries’ children; challenges the common wisdom on the shortcomings of time-limited IWB; and questions the appropriateness of connecting IWB to the holding of a job.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Bruno Van der Linden

Benefits terminology

Among the able-bodied working-age population, means-tested welfare benefits, if any exist, provide a guaranteed minimum income level to jobless people. These benefits should be distinguished from unemployment insurance benefits, which are not means-tested.

Hiring subsidies (also called “hiring credits”) intend to lower (typically, temporarily) the cost of labor of workers recruited from specific groups (sometimes, they target specific employers instead of specific workers).

Wage subsidies is an all-encompassing denomination. For some, they are designed to raise the effective wage earned (“worker subsidies” being then a better name); for others, to lower the cost of labor (“employer-side wage subsidy”). They are not limited to newly recruited workers.

In-work benefits (IWB) (also called “work allowance,” “earnings supplements,” or “employment-conditional benefits”) are work-contingent transfers or tax credits, typically subject to a family income based means-test.

Low-income support is a broader notion. In addition to the minimum income guarantee and to IWB, low-income support can, for instance, include housing benefits, additional childcare benefits for the needy, or transfers in kind.

A basic income is an income paid to an individual member of society whether they are willing to work or not, whether they are poor or not. If it is financed through the income tax, it is taxed away at a relatively high marginal tax rate. Such a scheme is similar to a negative income tax.