Elevator pitch

Minimum wage increases are not an effective mechanism for reducing poverty. And there is little causal evidence that they do so. Most workers who gain from minimum wage increases do not live in poor (or near-poor) families, while some who do live in poor families lose their job as a result of such increases. The earned income tax credit is an effective way to reduce poverty. It raises only the after-tax wage rates of workers in low- and moderate-income families, the tax credit increases with the number of dependent children, and evidence shows that it increases labor force participation and employment in these families.

Key findings

Pros

There is little causal evidence that minimum wage increases will reduce poverty rates overall or for workers.

Minimum wage increases go primarily to workers in non-poor families.

Some workers lose their jobs when minimum wages rise, pushing their families into poverty.

Most working-age poor people do not work, work part-time, or have wages above proposed increases in the minimum wage.

Earned income tax credits more efficiently provide benefits to workers in poor families and increase employment in them.

Cons

Modest minimum wage increases at most only have a small negative effect on employment.

Minimum wage increases circumvent the budget process: they are funded neither by government expenditures nor by tax liabilities.

The macroeconomic effects of a higher propensity to spend by those whose wages rise because of a minimum wage hike reduce its direct negative microeconomic effects on employment, at least in the short term.

Minimum wage increases during the expansion phase of a business cycle, when labor demand is growing, can reduce poverty if the employment effects are small.

Author's main message

Introducing or increasing a minimum wage is a common policy measure aimed at reducing poverty. But doing so is unlikely to achieve this goal. While a minimum wage hike will increase the wage earnings of some poor families and lift them out of poverty, some workers will lose their jobs, pushing their families into poverty. In contrast, improving the earned income tax credit can provide the same income transfers to the working poor at far lower cost. Earned income tax credits effectively raise the hourly wages only of workers in low- and moderate-income families, while increasing labor force participation and employment in those families.

Motivation

Societies struggle to remedy the economic plight of their working poor. Politicians and other public leaders make the ethical argument that jobs should pay enough to prevent poverty. These are long-standing social concerns. In 1908, the US Supreme Court ruled in Muller v. Oregon that maximum-hour laws are not unconstitutional interferences by a state legislature with an individual's right to contract. In 1909, the Trade Boards Act in the UK empowered trade boards to set minimum wage conditions that were legally enforceable. But it was not until 1938 that US President Franklin Roosevelt signed the Fair Labor Standards Act, achieving the goal of a single federal minimum wage and ending all debate about the power of the legislature to establish such labor laws. In his 2021 State of the Union speech, US President Joseph Biden urged Congress to do so again: “[L]et's raise the minimum wage to $15.00. No one—no one working 40 hours a week—no one working 40 hours a week should live below the poverty line.”

But for those concerned about the working poor, is more than doubling the current federal minimum wage the most effective method of bringing them out of poverty? In the 21st century, efforts to redistribute income are achieved primarily by government tax and transfer policies rather than by direct intervention in the marketplace. The earned income tax credit is a more efficient alternative to reduce the number of people living in poverty. The earned income tax credit is a refundable tax credit available only to workers who live in low- to moderate-income families. As a result, the share of workers receiving this credit who live in poor families will be considerably greater than the share who gain from a general minimum wage hike. In the US, it first entered the tax code in 1975 at a cost of $5.9 billion (in 2019 US dollars) and expanded rapidly, according to Internal Revenue Service data. The US Treasury estimated that the cost of the earned income tax credit in tax expenditures for 2019 was $66 billion. The US Congressional Budget Office (CBO) estimates that 51% of the credit goes to families in the bottom fifth of the income distribution and 80% goes to families in the bottom two-fifths [1]. Evidence on the impact of the earned income tax credit is most complete in the US. Thus, this article primarily focuses on findings for the US for this program.

Discussion of pros and cons

The article weighs the relative merits of an increase in the federal minimum wage and enhancements to the earned income tax credit as poverty reduction policies in two core respects: whether and how government should intervene to reduce the number of people living in poverty, and how increases in the federal minimum wage and the earned income tax credit compare as policy alternatives.

Raising the minimum wage

In a seminal article in 1946, future Nobel Prize laureate George Stigler argued against further increases in the nominal minimum wage, writing, “The minimum wage provisions of the Fair Labor Standards Act of 1938 had been repealed by inflation … and … the elimination of extreme poverty is not seriously debatable” [2], p. 358. But he went on to say that the important questions are whether minimum wage legislation diminishes poverty, and whether there are efficient alternatives. This article draws on international empirical evidence to explore these two issues.

Empirical evidence on the effects on employment varies

In the US

In 2019, the CBO estimated the effects of an increase in the federal minimum wage. It found that a federal minimum wage increase from $7.25 to $15.00—a 107% increase when fully implemented in 2025—would reduce total employment by about 1.3 million workers, or about 0.8%, with a two-thirds chance that the employment loss would be between close to zero and 3.7 million workers. An increase in the minimum wage would directly boost the wages of 17 million workers who remained employed. But it would reduce the number of people (not workers) in poverty by only 1.3 million, or less than half of a percentage point [3].

So, for people who are concerned about the working poor, this minimum wage increase is not a very effective mechanism for reducing poverty. That was Stigler's conclusion in 1946 for exactly the same microeconomic reasons given by the CBO in 2019. That is why Stigler argued for a negative income tax instead [2]. Artificially increasing the wages of low-skilled workers above the wage rate established in the competitive marketplace by the forces of supply and demand would reduce the number of workers employed at this higher wage.

The CBO's central employment elasticity estimate in 2019 for all teenagers was –0.128. That is, a 10% increase in the minimum wage would reduce overall teen employment by 1.28%. The CBO reported a central estimate of –0.004 for all adults. These elasticities support the CBO's prediction that fewer workers would be employed because of a 107% increase in the federal minimum wage rate [3].

In addition to microeconomic effects, the CBO analysis considered macroeconomic effects that take into account the aggregate demand increases that occur because of the more general distributional effects of minimum wage increases. The CBO argued that aggregate demand would initially increase because the families of the workers receiving the higher wages have a greater propensity to consume than do the owners of the firms who pay them and the families who purchase the products whose prices have risen because of the higher minimum wage. However, these effects would dissipate over time as inflation rose and as output approached its maximum achievable level in 2025 according to CBO projections [3].

The CBO's employment elasticity range is based most heavily on natural experiments in which employment changes in a state affected by a minimum wage increase are compared to employment changes in another state unaffected by a minimum wage increase. The use of these types of natural experimental designs to study the effects of minimum wage increases was pioneered in a 1995 work that shattered a decades-old consensus that minimum wage increases would come at the cost of modest but significant reductions in the employment of low-skill adults and teenagers given assumed competitive labor markets [4]. In fact, the authors found no evidence of a negative effect on employment—but some evidence of a positive effect.

However, this surprising result of zero or positive employment effects has proven to be far from universal in a now voluminous literature using natural experiments to study minimum wage hikes. A 2021 review of the literature finds that 79% of the new wave of minimum wage studies estimate a negative employment elasticity, leading the authors of the review to conclude that: “In its totality this body of evidence and its conclusions point strongly toward negative effects of minimum wages on employment of less-skilled workers” [5], p. 4. One reason for the change in findings since 1995 is that the federal minimum wage remained relatively low after 1995. As more states increased their minimum wage above the federal minimum, the greater variation in the data made it possible to more accurately identify the effects of the minimum wage policy.

The intense debate on the appropriate identification strategy continues, especially on how to define relevant control groups along the borders of states or other areas with different levels of the minimum wage. Results are sensitive to the definition of treatment and control groups as well as how pre-existing trends in employment are addressed. The large range of employment elasticities that results from different modeling choices and different data sources imposes a large degree of uncertainty on their magnitude, even if the majority of studies find that they are negative.

In Europe

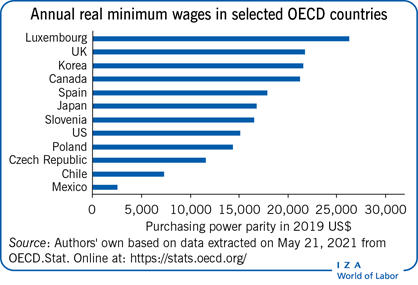

Though most evidence is US-based, minimum wages have also been widely introduced in other countries. Minimum wages have been effectively introduced (either as a statutory minimum or through collective bargaining) in all European countries and are generally higher relative to the average wage than in the US, according to Eurostat data. However, empirical evidence on the economic effects in Europe is less convincing than for the US, in large part because of a lack of plausible geographical controls.

A recent review of the impacts of different minimum wage regimes in Europe concludes that minimum wage hikes have typically had muted negative effects on employment. In the absence of a lack of geographic variation in minimum wage policies within European countries, these studies generally exploit the fact that minimum wage hikes have greater bite in certain regions or among certain types of workers. For instance, one review of a series of studies that focus on the national minimum wage introduced in the UK in 1999 for the most part finds little or no employment effects, although one of the studies finds substantial employment loss for part-time female workers [6]. The review then turns to evaluations of the more recently enacted National Living Wage in the UK that increased the minimum wage for workers over 23 years of age, and similarly finds small negative overall effects but larger negative effects for part-time female workers. The author notes that estimates from studies on the introduction of a minimum wage in Germany in 2015 range from modestly negative to sometimes positive effects on employment, and studies of minimum wage increases in Hungary suggest modest negative effects [6].

Empirical evidence on the effects on poverty is more uniform

In contrast to the effects on employment, the evidence that minimum wage increases are not very effective in reducing poverty is much less contentious. Minimum wage increases are not related to decreases in poverty rates because most people living in poverty do not work, and many of the working poor do not work full-time; or they work at hourly wage rates above the new minimum [4], [7]. In fact, one study finds that after a rise in the US minimum wage, the movement out of poverty of families whose wage earnings increase is more than offset by the movement of low-income families onto the poverty rolls because their earnings fall [7]. The authors further find no relationship between minimum wage increases and poverty rates for the working poor [7], echoing previous results [4]. A more recent study explicitly considers the effect of minimum wage increases on prices of goods produced by low-wage workers—which must rise if effects on employment and profits are negligible—finding that minimum wage increases are akin to a consumption tax that hits lower-income consumers harder and funds higher wages for low-wage workers who often are not members of low-income families [8]. Most recently, another study finds that under certain conditions—when labor demand is growing during the expansion phase of the business cycle and minimum-wage-induced employment effects are small—minimum wage increases can reduce poverty [9]. No credible empirical evidence was found outside the US on the effects of minimum wage increases on poverty.

Expanding the earned income tax credit

But what about Stigler's second question: Are there efficient alternatives to minimum wage increases? On this issue there is very little disagreement. The earned income tax credit is a far superior way to provide additional income to workers who live in poor families. A 2007 CBO report compares the cost to employers of a change in the minimum wage that raised the income of poor families by a given amount with the cost to the federal government of an enhancement in the earned income tax credit that raised the income of poor families by roughly the same amount. The cost of a higher minimum wage to employers (and to consumers who purchase their products) was much larger than the cost to the government (and the taxpayers who provide these revenues) of an enhancement in the earned income tax credit [1].

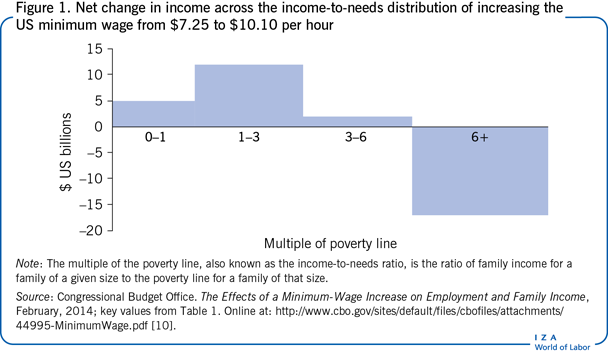

A 2014 CBO report shows how much better an earned income tax credit enhancement rather than an increase in the minimum wage would be for raising the wage earnings of the working poor [10]. Figure 1 reproduces the key values from Table 1 in the 2014 CBO report. It shows that raising the current minimum wage from $7.25 an hour to $10.10 an hour would result in a $17 billion net loss for families whose incomes are six or more times the poverty line (the poverty line for a family of four was approximately $23,500 per year in 2013) through reduced business profits and dividends and the higher cost of goods and services. It also shows that this $17 billion plus the additional $2 billion coming from the minimum wage increase's macroeconomic effects on growth will go to those below six times the poverty line. But of this $19 billion, only $5 billion will go to people in poverty (zero to one times the poverty line) [10].

The reason for this outcome as shown in another study is that most minimum wage workers who gain from an increase in the minimum wage are not in poor or even in near-poor families. And some workers who do live in poor families have wage rates that are already above the proposed minimum. They just do not work full-time. But it is also the case that some of the working poor will lose their jobs or work fewer hours [11].

The lives of the working poor could be dramatically improved if the real economic costs of the minimum wage were instead devoted to financing an earned income tax credit expansion. The earned income tax credit is a much more targeted and effective policy for helping poor families because it raises only the earnings of workers in low- or moderate-income families, and the size of the effect depends on the number of dependent children in those families. Thus, people living in lower-income families receive the vast majority of benefits. In addition, the negative microeconomic effects on employment would be reduced since the earned income tax credit is paid for through the federal income tax rather than directly by the employer. Furthermore, the positive macroeconomic effects would be greater because, presumably, the working poor have the greatest propensity to consume.

Consequently, the earned income tax credit outperforms the minimum wage in reducing poverty. One US study compares the effectiveness of the minimum wage and the earned income tax credit in helping families escape poverty, and concludes that the earned income tax credit is far more beneficial for poor households than the minimum wage, because it increases both the labor force participation and employment of family members [7].

Again, empirical evidence has been focused largely on the US. But many European countries have implemented credits that increase the reward to work for lower-income workers as well, with studies generally finding positive employment effects. In the UK, the working families tax credit was introduced in October 1999. An econometric simulation discussed in a 2005 lecture estimates a modest increase in labor force participation as a result of the new tax credit of about 30,000 individuals, primarily single mothers. A later empirical study based on labor force surveys confirms this result, finding an increase in single parents’ employment of around 3.6 percentage points [12].

Limitations and gaps

Despite more than 80 years of research since the passage of the US Fair Labor Standards Act of 1938, the debate over the size of the employment effect of a minimum hourly wage rate increase rages on. But even relatively small elasticities like the ones used in the 2019 CBO report find important reductions in employment when large minimum wage hikes are considered [3]. This contrasts with the effect of increases in the earned income tax credit, which unambiguously increases labor force participation and employment as concluded in a comprehensive review of the literature on this topic [13]. These findings suggest that subsidizing the employment of workers in low- and moderate-income households via the tax system is more likely to increase their employment than raising the minimum wage. But by how much more is still controversial. Furthermore, there is still some question about how much an increase in the earned income tax credit reduces the number of hours worked by those who are already employed. This occurs because, after a short disregard period during which a worker's additional income does not affect the amount of the earned income tax credit benefits, the phase-out period begins and a worker's benefits start to decline, lowering the effective wage rate [13].

A further limitation of the existing evidence on the minimum wage and the earned income tax credit is its primary focus on the US economy. To what extent the insights of this research can be applied to other economies is less known. It would be advisable to expand the empirical research (behavioral and distributional effects) of minimum wage systems as well as earned income tax credit systems in Europe. It would also be of interest to gather more evidence on smaller, targeted tax credit instruments in other countries (one example being the wage top-up for low-income workers in Germany).

Summary and policy advice

At the turn of the 20th century, people in the US who were concerned about the distributional consequence of a market-driven economy turned to government to improve minimum living standards and reduce poverty by intervening directly in labor markets through minimum-wage and maximum-hour legislation. In the absence of government tax and transfer programs, such direct interventions were seen as the only means of achieving those goals. But it was not until 1938 that the Fair Labor Standards Act established these standards at the federal level and ended the debate about the power of government to establish such labor laws. Since then, the empirical debate from an economics perspective has not been over the social goal of eliminating poverty but rather has focused on the two questions first posed by Stigler [2], p. 358: “(1) Does such [minimum wage] legislation diminish poverty? (2) Are there more efficient alternatives?” The evidence examined here suggests that the answers are “not much” and “yes.”

Currently, federal minimum wage legislation plays a minor role in US labor markets. The overwhelming majority of American workers earn hourly wage rates that are either determined by market forces or by state minimum wage rates. These wage rates are often high enough to not be affected by more modest increases in the federal minimum wage, but would be substantially affected by an increase to $15.00. This is especially the case in states without state minimum wages that exceed the current federal minimum of $7.25 per hour. As reported by the National Conference of State Legislatures, 29 states and the District of Columbia have a minimum wage in 2021 that exceeds the federal minimum. This varies from $15.00 in the District of Columbia to $8.65 in Florida. However, 21 states have an effective state minimum wage matching the $7.25 federal standard.

Minimum wage increases affect the lowest-skilled workers at the bottom of the wage rate distribution. Most empirical research has examined how these minimum wage increases have affected their employment. In 2019, the CBO estimated that an increase in the minimum wage to $15.00 an hour would reduce employment by some 1.3 million jobs, with a band of 0 to 3.7 million around these estimates [3]. While these estimates remain contentious, they are plausible. The evidence on the employment effects of minimum wages in Europe is mixed.

The reduction in employment in part explains why past minimum hourly wage increases have not been found to reduce poverty. But a more important reason is that there never was a one-to-one relationship between a worker's wage rate and the income of that worker's family. And this fuzzy relationship, which Stigler also talked about in 1946 [2], has become even fuzzier as the number of workers per family has increased and the share of minimum wage workers who are their family's primary earner has decreased. These changes help explain why the earned income tax credit has increasingly become a more target-effective way of providing employment-based subsidies to the working poor. The earned income tax credit is now the most important cash transfer program in the US for providing income to low-income families who work and one that the CBO found in 2007 to be a more cost-effective way of doing so than increasing the federal minimum wage. And that is why policymakers interested in reducing poverty in the US should increase the earned income tax credit rather than the minimum wage.

The argument that the distributional effects of minimum wage policies are too dispersed to be effective in reducing poverty applies to European countries as well. Introducing and fostering tax credit systems similar to the US earned income tax credit could be attractive to these countries as a more focused instrument than a minimum wage increase in fighting poverty. Direct individual subsidies can be designed and targeted much more specifically, making them more appropriate for particular target groups.

Rather than increase the rewards of work for all minimum wage workers, the earned income tax credit increases the hourly wage rate only of workers in low- or moderate-income families. The preponderance of the empirical evidence is that earned income tax credit enhancements lead to substantially reduced poverty rates and increased employment. Nonetheless, the earned income tax credit is not a panacea. In its phase-out period, the credit may to some degree result in fewer hours of work above this income level. In addition, the increase in low-skilled workers drawn into the labor market because of the earned income tax credit will lower wages to some degree, thus allowing employers to capture part of the subsidy. Finally, because it is a tax credit, expansion of the earned income tax credit is part of the budgetary process and may be harder to achieve than an increase in the minimum wage whose costs to the public are less visible.

Acknowledgments

The authors thank an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of the article updates the text following President Joseph Biden's 2021 call for a $15.00 minimum wage, updates the “Illustration,” and adds to the discussion of research via new “Key” [3], [5], [6], [8], [11], [12], [13] and “Additional” references.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The authors declare to have observed the principles outlined in the code.

© Richard V. Burkhauser and Kevin Corinth

Earned income tax credit

The earned income tax credit is the largest source of government-provided cash transfers to low-income families in the US. In 2021, for each dollar of wage earned by a worker in an income-eligible family, earned income tax credit benefits increase by $0.08 for workers with no children (to a maximum of $543), $0.34 for workers with one child (maximum of $3,618), $0.40 for workers with two children (maximum of $5,980), and $0.45 for workers with three or more children (maximum of $6,728) per year. Thus, during the benefit phase-in period, the earned income tax credit effectively raises the hourly wage earnings of all low-income workers. After a short “disregard” period, during which additional income does not affect earned income tax credit benefits, the phase-out period begins and earned income tax credit benefits are reduced by $0.08 (no children), $0.16 (one child), $0.21 (two children), and $0.21 (three or more children) per dollar of income. All benefits are lost at $15,820, $42,158, $47,915, and $51,464 per year. Phase-in and phase-out benefit periods are indexed for inflation. Twenty-four states and the District of Columbia supplement the federal earned income tax credit, further increasing the effective hourly wage rate for their low-income workers. A review of the behavioral and distributional consequences of the earned income tax credit concludes that unlike other safety-net programs, the earned income tax credit has unambiguously positive labor market participation incentives because it subsidizes only the income of people who work. And because it phases out benefits at higher incomes, its benefits are targeted to low- and moderate-income families.

Source: Tax Policy Center. Tax Policy Briefing Book. Urban Institute and Brookings Institution, 2021. Online at: https://www.taxpolicycenter.org/briefing-book/what-earned-income-tax-credit; Nichols, A., and J. Rothstein. “The earned income tax credit.” In: Moffitt, R. A. (ed.). Economics of Means-Tested Transfer Programs in the United States, Volume 1. Chicago, IL: University of Chicago Press, 2016; pp. 137–218.

Natural experimental designs

Natural experimental designs or difference-in-differences methods are increasingly used to evaluate the consequences of policy changes when a randomized controlled trial cannot be set up. These designs—also used in the natural sciences—depend on establishing a control group, such as workers within a geographic boundary that is not affected by the policy change, and a treatment group of similar workers within another geographical boundary that is affected by the policy change. The causal effect of the treatment is determined by comparing before and after outcomes (e.g. in employment) in the treatment group with those in the control group. In the analyses of effects of the US minimum wage, treatment and control groups are defined along state borders between states that introduced minimum wages at different times. The identification then stems from comparing employment and poverty before and after introduction of the minimum wage, using states not affected by the introduction as the control group.