Elevator pitch

All developed economies have unemployment benefit programs to protect workers against major income losses during spells of unemployment. By enabling unemployed workers to meet basic consumption needs, the programs protect workers from having to sell their assets or accept jobs below their qualifications. The programs also help stabilize the economy during recessions. If benefits are too generous, however, the programs can lengthen unemployment and raise the unemployment rate. The policy challenge is to protect workers while minimizing undesirable side effects.

Key findings

Pros

By replacing some lost income, unemployment benefits protect unemployed workers from depleting their assets to maintain consumption.

By augmenting the income of very low-income households, unemployment benefits help keep them out of poverty.

Unemployment benefit programs encourage workers to accept jobs that are important to the economy, despite layoff risks.

Unemployment benefits enable workers to maintain consumption while spending more time searching for a job fitting their skills.

Unemployment benefits provide additional support to workers during recessions, without large negative side effects.

Cons

Unemployment benefit programs can lengthen unemployment spells excessively, especially when maximum benefits continue over long periods.

Unemployment benefit programs modestly raise the national unemployment rate—and by less during recessions.

There is mixed evidence that unemployment benefit programs help people find better paying jobs or jobs better matched to their skills.

Without official monitoring, unemployed workers might exaggerate their job search activity and so may stay unemployed longer.

Unemployment benefit systems financed by payroll taxes may vastly increase layoffs in some industries.

Author's main message

Unemployment benefit programs play an essential role in the economy by protecting workers’ incomes after layoffs, improving their long-run labor market productivity, and stimulating the economy during recessions. Governments need to guard against benefits that are too generous, which can discourage job searching. Governments also need a system for monitoring job search intensity, to reduce negative side effects on the unemployment rate and job creation.

Motivation

All developed economies have unemployment benefit programs that provide income to unemployed workers to enable them to meet their basic consumption needs. However, when unemployment benefit programs are particularly generous, in both benefit level and duration, they are controversial because of potential negative side effects. The debate over generosity often intensifies during recessions and economic downturns, when overly generous programs may slow the decline in the unemployment rate and delay a country’s economic recovery.

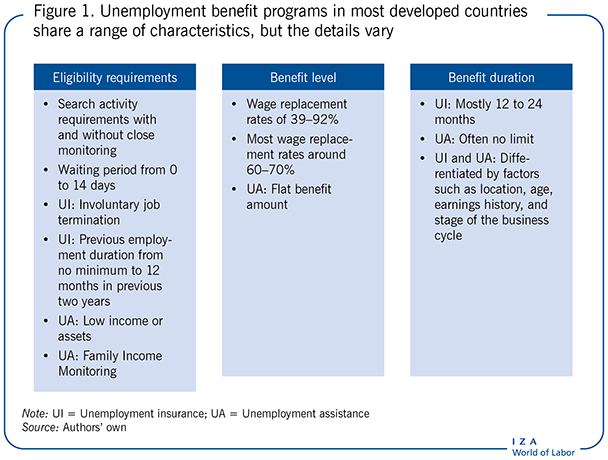

Several dimensions of unemployment benefit programs influence their positive and negative impacts on individuals and the economy (Figure 1). In some areas the evidence on their impacts is clear; in others it remains ambiguous. Governments can take several steps to increase the positive impacts and reduce the negative ones.

Discussion of pros and cons

Unemployment benefit programs in developed economies are similar in structure, but many of the details—eligibility requirements, benefit levels, and benefit duration—vary. These details can have different effects on consumption, job quality, employment, job-seeking, and duration of unemployment. The effects can also vary with the phase of the business cycle.

Structure of unemployment benefit programs in advanced economies

Unemployment benefit programs in advanced industrialized economies share many features, but the details vary in ways that matter for government policy and for the effects of the programs on individuals and the economy. Three of the most important dimensions of a country’s unemployment benefits program are eligibility requirements, benefit level, and maximum duration of benefits (see Figure 1).

Eligibility requirements

Developed countries have one of two types of programs: Unemployment insurance (UI) programs (sometimes called “contributory” programs) where eligibility requires being involuntarily terminated from a job — people who quit their jobs are not eligible (nor are individuals who enter the job market for the first time or after a long absence, and about half of the countries do not cover self-employed workers). About half of developed countries also have Unemployment Assistance (UA) programs, where eligibility only requires having low income or assets. In a few countries, UA is provided only to those who have exhausted UI, in which case UI eligibility must first be established, and in some countries UA is provided only to those ineligible for UI. All countries also require that recipients must register at a government unemployment office, list their job experience and qualifications, and receive information on job openings for workers with their qualifications, and actively search for a job, although how this requirement is enforced varies considerably.

How long a person has to have worked before being eligible for UI after being involuntarily discharged varies as well. Most countries require applicants to have spent some minimum percentage of the previous year or previous two or three years in employment (for example, 6 months out of the past year or 12 months out of the past two years). Some countries also require that applicants have received some minimum level of earnings over those employment periods to qualify.

Some countries also require a waiting period before benefits begin. While about half of Organisation for Economic Co-operation and Development (OECD) countries allow eligible applicants to start to receive benefits immediately after losing a job, the other half have waiting periods of 3–14 days.

Benefit levels

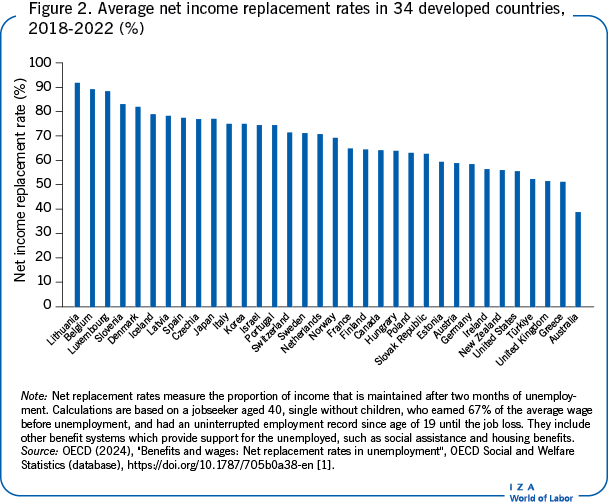

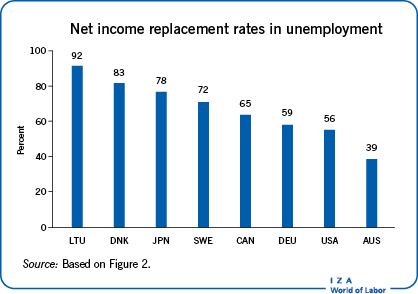

Most countries base benefit levels for UI on the level of past earnings or on a national earnings index, but the levels vary dramatically across countries. UA programs for those not previously receiving UI usually pay, instead, a fixed, flat benefit amount. The most common measure of the benefit level is the replacement rate, which is the ratio of benefits received to the individual’s earnings on the terminated job for which unemployment benefits are being claimed, or else just the ratio of income after becoming unemployed to income before becoming unemployed. The replacement rate in 34 developed economies in 2018-2022 varied from 39% in Australia to 92% in Lithuania, or twice as high (Figure 2). In a majority of countries replacement rates were 60% or higher. The replacement rate is usually somewhat higher, the lower the level of pre-unemployment earnings. Many countries allow some part-time work while receiving benefits.

Benefit duration

The maximum duration of benefits also varies widely. With rare exceptions, UI maximum durations range from 3 months to 30 months, with most in the 12-to-24 months range (but a few, such as the UK and US, with durations of 5 or 6 months). However, maximum durations for UA programs often have no limit (such as Australia and New Zealand) Many countries differentiate the duration of benefits for workers of different types, such as by residential location, earnings history, and age. For example, in Germany limits vary by age, ranging from 6 to 24 months, with older workers eligible for longer periods.

Canada, France, Poland, and the US are unique in changing the maximum duration of benefits over the business cycle. Canada sets a higher maximum length when the regional unemployment rate is higher, while Poland increases the maximum length when the local unemployment rate exceeds the national average. France shortens the maximum duration if the unemployment rate falls below a fixed threshold. The US has both a trigger system that raises the maximum length in a state when the state unemployment rate reaches a certain level, and national legislative authority to raise the maximum length in all states when the national unemployment rate is high.

Effects of unemployment insurance programs

There is a large body of research on the effects of unemployment benefit programs, with studies examining the impact on consumption, employment, job quality after finding a job, job-seeking rates, and on the specific impacts of benefit levels, benefit duration, and method of financing. This literature illustrates the benefits of unemployment insurance programs as well as their costs, and therefore demonstrates the need for policy makers to take a balanced approach when designing their programs. Almost all of the research has been on the effects of UI programs, with very little on UA programs.

Effects on consumption

The aim of all unemployment insurance schemes is to make up some fraction of the lost income for unemployed workers and thereby allow them to maintain their consumption at a reasonable level despite the loss of wages. In this respect, the programs are similar to all insurance programs—they insure the worker against a loss, in this case loss of a job (see The economic functions of insurance). Like many insurance programs, unemployment benefit programs do not seek to fully restore past earnings but only a fraction of it, given the presence of undesirable side effects discussed below.

Although it might seem obvious that unemployment benefits would raise consumption, the amount by which it does so depends on several factors. One is the amount of savings a person has accumulated before becoming unemployed. Most households in developed economies have at least some savings and have built up assets for a “rainy day.” However, the amount of savings is typically small, and very low-income families often have no savings at all, usually because the pressing demands for immediate consumption are so high. But for people who have accumulated savings, consumption levels may remain fairly high even in the absence of unemployment benefits. On the other hand, however, those with substantial rainy-day savings might reduce their savings to some extent if they know that they will receive benefits after a job loss.

Another factor affecting how much consumption rises because of unemployment benefits is whether unemployed individuals can borrow against their expected future earnings. If they can do so, then consumption might not have fallen much even in the absence of benefits. However, most unemployed workers are not able to do such borrowing because banks and other lenders are reluctant to do so (this is called a “liquidity” constraint).

Some people who are unemployed have access to other sources of income. In many countries, means-tested transfer programs provide income support to low-income households, for example. To the extent that these income support programs already allow unemployed workers to maintain their previous consumption levels, the extra effect of unemployment benefits could be small. And in many households when a member loses a job, other working members can help maintain household consumption levels even without unemployment benefit payments.

However, even with all these ways of maintaining some consumption after losing a job, the evidence indicates that unemployment benefit programs increase consumption considerably relative to what it would be in the absence of benefits [2], [3]. There is evidence, for example, that a 10% increase in the unemployment benefit replacement rate reduces the drop in consumption among unemployed workers by 2.65% and that people who do not receive unemployment benefits have to reduce their consumption by more than 22%. Replacement rates at or above 84% — which is the case only in a small fraction of countries — allow households to maintain consumption levels at their pre-unemployment levels while using savings to supplement the unemployment benefit payments. Replacement rates around 60%, which are much more common, enable people to maintain most of their previous consumption. A study found that the positive effects on consumption are much larger among recipients of unemployment benefits who have no assets and no employed spouse [2]. This is consistent with the assumption that whether people are able to maintain consumption even without unemployment benefit payments depends on whether the household has accumulated savings and whether there are other sources of household income.

These positive effects on consumption are particularly helpful to the economy during economic downturns. During times of high unemployment, workers’ incomes fall and so does their spending. That reduction in spending reduces aggregate demand for goods, leading businesses to reduce production, output, and employment, which further depresses spending and then production again. Unemployment benefit programs work against this downward spiral by stabilizing the incomes of the unemployed and reducing any drops in spending. The net effect, therefore, is to reduce the fall in gross domestic product and to mitigate the effects of a downturn. Unemployment benefit programs are called “automatic stabilizers” in an economy: when the economy is doing well, they do not pay many benefits and so do not increase spending, but when the economy is doing poorly, they automatically increase spending, which is precisely what the economy needs at that point in the business cycle.

Effects on job quality

Another goal of UI is to allow unemployed workers to be more selective and search longer to find a better job. As previously noted, a liquidity constraint problem arises because it is generally not possible to borrow against future earnings, so individuals might have to take a low-wage job or one mismatched to their skills instead of waiting to find a more appropriate job. An unemployment benefit program relieves this pressure and allows unemployed workers to maintain consumption without having to accept an inappropriate job.

In the research on this question, there is surprisingly weak evidence that those receiving unemployment benefits find jobs with higher wages. Studies exploring the wage level of the next job sometimes find a positive effect of UI but some also find small or even negative effects [4]. Some studies have further investigated other job characteristics such as tenure at the next job, industry and occupation, wage growth, firm size, commuting distance, and the next job separation probability. Similar to findings on wage levels, the evidence is mixed.

One reason for a weak wage effect is that there are other aspects of job quality, such as job security, work environment, safety, amenities, and so on. Individuals may use unemployment benefits to search for a higher quality job along these dimensions. However, there is relatively little research on this question, mostly because of lack of appropriate data measuring these job attributes.

But another reason for a weak effect on wages is that, as will be discussed more below, individuals may search less intensively during the time spent unemployed, which could offset any potential wage gains. In addition, being unemployed for a longer period may be taken as a negative signal to potential employers, leading them to offer lower wages [5]. Thus, there are countervailing forces affecting how unemployment benefits affect wages on the accepted job, which could contribute to the mixed evidence often found in research on the issue.

Effects on employment

The existence of an unemployment benefit program lowers the risk of taking a job that could later result in a layoff by insuring at least partially against that risk. This is called the “entitlement effect” of unemployment benefit programs (see The economic functions of insurance). Because nearly all countries have qualifying periods of work for unemployment benefit eligibility and most have minimum earnings or contribution levels, anyone who does not meet those qualifications has an incentive to work more, or earn more, in order to meet them.

Evidence for the US demonstrates the existence of the entitlement effect, and it works in the expected direction. People who live in areas with high unemployment benefits are more likely to take jobs that have earnings exceeding the minimum level required for eligibility. People who live in areas with lower unemployment benefits are more likely to take jobs with earnings below the level needed for eligibility [6]. This positive effect of unemployment benefit schemes offsets at least some of the negative effects that might arise from other sources.

Effects on job-seeking and duration of unemployment

With all these benefits of unemployment insurance programs having been documented, the research evidence has also documented a number of side effects. The most studied side-effect is that benefit programs may encourage individuals receiving benefits to search less intensively for a new job than they would have otherwise, for two reasons. The first is that the gain of finding a job is lower for someone receiving benefits, at least during the maximum benefit period. In the absence of unemployment benefits, the gain is simply the wages on the new job. With unemployment benefits that gain is reduced to the difference between the unemployment benefits and the wages paid by a new job because the payments cease when someone becomes employed. In insurance terms this is called “moral hazard”: individuals alter their behavior after becoming eligible for insurance payments because the programs alter their economic incentives.

The second effect is the so-called liquidity effect noted previously, and UI allows individuals to search longer for a better job instead of taking a low-wage job because they need income. The distinction between the two reasons that people receiving unemployment benefits take longer to find a new job than they would without the benefits is critical [7]. The moral hazard reason is an undesirable by-product of the insurance program but the liquidity constraint reason is a desirable consequence.

There is a great deal of evidence on the impact of UI programs on job seeking and on how long individuals take to find a job. The evidence is extensive and points clearly to a negative effect on the time to find a job and a positive effect on how long individuals remain unemployed. The studies typically examine either the effect of the unemployment benefit level, often in the form of a wage replacement rate, or the effect of the maximum duration of benefits received. A recent review summarizes the estimates from the literature conducted on about a dozen OECD countries [8]. For the effect of benefit levels the review finds that a 10% increase in the benefit level leads to about an 8% increase in the time spend unemployed in European countries, with a somewhat lower effect in the US. For the effect of the maximum duration of benefit receipt, the review shows a substantial range of estimates but centered in the range of an additional 4 to 8 days spent unemployed for an extra month of potential benefits. Another review found the effects to be stronger for women and for older individuals [9].

These effects occur, however, only for those among the unemployed who are covered by UI. Unemployed individuals who have newly entered the labor force, who do not have sufficient past earnings or employment to be eligible for unemployment benefit payments, or who have quit their jobs voluntarily, do not experience these effects. The aggregate effect of unemployment benefit programs on unemployment is therefore considerably smaller than the effect on those who receive benefits. In the US, for example, only about a third of unemployed workers typically receive benefits, although the fraction is often higher during economic downturns.

Spillover effects are another reason for a smaller impact on the national unemployment rate than on unemployment of those who receive unemployment benefit payments. Spillover effects occur when a job vacancy that is offered to an unemployed worker who turns it down in order to keep receiving unemployment benefit payments is then filled by an unemployed worker who is not receiving payments. To the extent that this occurs, some of those in the total unemployment pool get jobs they would not have had in the absence of the program. This mitigates any rise in the national unemployment rate.

Another important question is whether the effects of unemployment benefit payments are larger or smaller during economic downturns. On the one hand, during downturns individuals without a job are necessarily unemployed for longer periods because job offers are scarce, and they may be eager to accept the first good job offer they receive rather than extend their time searching just because they are receiving payments. On the other hand, the low number of job offers received may induce individuals to use the unemployment benefit payments to wait even longer to get a good job offer than they would have done in normal economic times.

In Germany, the negative effects of unemployment benefit payments were not lengthened by benefit extensions during economic downturns and were not statistically significantly different than during normal economic times [10]. In the US, the negative effects of unemployment benefits during downturns appear to be smaller than during normal times [11] and benefit extensions during recessions have a statistically insignificant effect on the length of time spent unemployed in many cases [12].

As noted, it is important to determine the relative contribution of moral hazard and liquidity constraints to the effects of unemployment benefit programs on time spent unemployed. Studies find that almost two-thirds of the additional time spent unemployed by people receiving unemployment benefits was a result of liquidity constraints and inability to borrow [7]. A much smaller share of the effect resulted from the socially harmful effects of moral hazard.

Effects of job search requirements

Individuals receiving unemployment benefits are required to search actively for work. Requirements range from simply registering with the governmental unemployment agencies, to periodically visiting the agency to discuss search activities, to providing evidence on employers contacted. A possible negative side effect of benefit programs can occur if these requirements are not enforced and individuals do not meet the requirements. To address this problem, programs often call for sanctions for people who fail to search actively.

There have been a number of studies on the impact of job search requirements, sanctions, and related policies aimed at enforcing those requirements. Most studies have examined the impact on the length of time spent unemployed and on the length of time taken to re-establish employment. While the occasional study finds no impact, most find that these policies shorten the length of time spent unemployment [13], [14]. Two studies, one in Switzerland and one in the Netherlands, find such policies to increase the rate of exit from unemployment and reduce unemployment durations. Some studies in Sweden, Denmark, Finland, and the US find similar effects. However, two studies, one in Switzerland and one in Sweden, find that such policies reduce the wage rates and earnings on the jobs taken after exiting unemployment [15].

Effects of the method of financing

Another policy issue for unemployment benefit programs is how they are financed. Here the greatest contrast is between the US and most European countries. In the US, unemployment benefit programs are financed by a tax on employers that is based on how many workers the firm has laid off in the past, a system known as “experience rating”. While firms that lay off more workers generally have to pay higher unemployment benefit taxes than firms that lay off fewer workers, firms are not assessed a “full” experience rating, under which a firm that lays off workers who receive $1,000 in unemployment benefits, for example, would be taxed $1,000 to pay, indirectly, for those workers’ full benefits. In Europe, on the other hand, unemployment benefit programs are generally financed through general payroll taxes.

The reason the method of financing makes a difference is that different industries typically have different rates of layoff. The construction industry, for example, is highly dependent on the weather and on economic conditions and often has to temporarily lay off large numbers of workers who are later rehired. Most service industries, on the other hand, have much more stable employment. If all industries pay the same payroll tax, then the construction industry is being implicitly subsidized by the service industry, because the construction industry is paying less in taxes than its laid-off workers are receiving in benefits and the service industry is in the opposite situation. This can lead firms in the construction industry to lay off more workers than they would under an experience-rated system.

In Europe, whether any similar effects occur depends on the extent to which payroll taxes affect different industries differently.

Limitations and gaps

The evidence remains inconclusive on several important issues related to unemployment benefit programs. One is whether individuals find higher-paying jobs or jobs that are a better match for their skills than they would without the programs and whether non-monetary aspects of job quality are affected. Studies of this issue have reached very different conclusions, with some suggesting no effect and others a positive effect. Additional studies are needed to resolve this uncertainty or at least to identify when the effects are positive. A second issue is whether the existence of unemployment benefit programs makes it more likely for employers to lay off workers. Also, here more evidence is needed.

Summary and policy advice

Unemployment benefit programs play a major economic role by increasing consumption among unemployed workers and allowing them to avoid depleting their assets during periods of unemployment. Such programs also have a major positive effect on the households of unemployed workers with few or no assets and no access to borrowing to avoid serious temporary reductions in consumption. Unemployment benefit programs also provide much needed support to unemployed workers during economic downturns, without major side effects in lengthening periods of unemployment or raising the unemployment rate. And unemployment benefit programs encourage individuals to take socially beneficial jobs, despite some risk of future layoff, which improves the economy.

On the downside, unemployment benefit programs can encourage the unemployed to reduce their job search intensity and to lengthen the time spent unemployed. Increases in benefit levels and increases in the maximum length of time for which benefits can be received heighten these disincentives.

Policies need to strike a balance between the positive goals and effects of unemployment benefit programs and their negative side effects. This can be achieved by setting benefit levels and duration at adequate but not excessive levels. Another important policy tool is to set clear and firm job-search requirements and to enforce them. Having such a set of requirements reduces the negative side effects of unemployment benefit programs without reducing eligibility, benefit levels, or duration.

Acknowledgments

The authors thank an anonymous referee, Gary Burtless, Till von Wachter, and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of this article updates data and figures, adds new discussions on the effects on job quality. It adds a new Further reading, new Additional and Key references [1], [4], [5], [8], [9], [11], [13], [14] and [15].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Robert A. Moffitt and Wonsik Ko