Elevator pitch

Developing countries are often seen as unquestionable beneficiaries in the phenomenal rise of global value chains in international trade. Offshoring—the cross-border trade in intermediate goods and services which facilitate country-level specialization in subsets of production tasks—enables an early start in global trade integration even when the requisite technology and knowhow for cost-effective production from scratch to finish are not yet acquired. A growing economics literature suggests a more nuanced view, however. Policymakers should be mindful of issues related to inequality across firms and wages, labor standards, and effects of trade policy.

Key findings

Pros

Global input realignment leads to mutually beneficial efficiency gains for participating countries.

Offshoring can lead to employment and wage gains due to rising labor demand and productivity effects.

Countries participating in offshoring experience growth in high-quality jobs that can incentivize skill upgrades.

Suppliers of intermediate goods are typically subject to lower tariffs than those providing final goods.

Cons

Offshoring can induce unequal distributional consequences with adverse impact on small- and medium-sized firms.

Wage inequality between skilled and unskilled workers may grow in countries providing offshoring activities.

Workers in offshoring firms often perform monotonous jobs under poor conditions, and do not gain durable or marketable skills.

Countries become more susceptible to trade policy and trade cost uncertainty, and incentives to launch import barriers can be altered due to participation in global value chains.

Author's main message

Developing countries’ position along the global value chain has gradually transitioned from low-skill producers of intermediate goods, to hubs of business service providers, and more recently to manufacturing bases of high-skilled tasks including computer programming and medical professional services. Given this backdrop, what are the labor market consequences and policy implications of offshoring for developing countries? Research suggests the need for a nuanced view, highlighting a need for policymakers to consider tradeoffs along four dimensions: tradeoffs in economic efficiency, employment and productivity growth versus wage inequality, labor standards, and impacts from trade policy.

Motivation

Offshoring has become an indispensable feature of global production. The lowering of trade costs, improvements in communication technologies, and the routinization of tasks have contributed to the fragmentation of global production across countries over long distances. It is by now widely acknowledged that low wages, policies supporting growth via exports, and proximity to other economies with upstream or downstream linkages are all potential drivers of the strong growth in offshoring in developing countries.

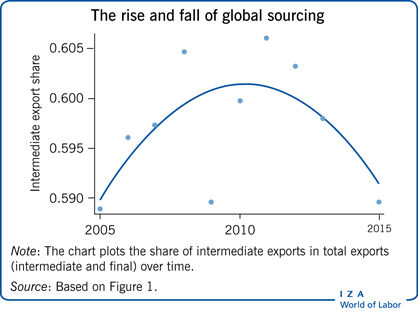

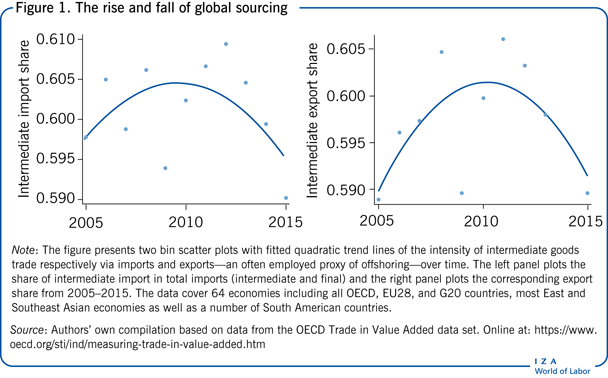

Over 50% of the value of imports and exports in OECD countries are intermediate inputs (see Figure 1). Trade in intermediate goods has made up as high as two-thirds of global trade, although this share has diminished somewhat in recent years. In this global network of manufacturing and business service offshoring, developing countries are featured prominently both as upstream producers of parts and intermediates, as well as prime locations for business service outsourcing. For example, China and India are among the world's largest importers, as well as exporters, of intermediate goods in overall value terms. In intensity terms, developing country labor markets in Vietnam, Indonesia, Malaysia, Peru, Kazakhstan, and Colombia feature some of the highest shares of intermediate goods trade in total intermediate and final goods trade. Taking advantage of rapid improvements in communication technologies in recent years, developing countries play key roles in offshored services as well, for example in business, information technology, and medical services.

What are the implications of offshoring in developing country labor markets? What lessons have been learned and what knowledge gaps remain?

Discussion of pros and cons

Offshoring research has traditionally tended to address developed country labor market issues, partly in response to highly publicized predictions of the potential for significant job losses. For example, one study estimates that even in conservative terms, over 22% of all jobs in the US are potentially offshorable [1]. Another prominent study postulates that jobs that are offshorable tend to be geographically concentrated [2] and furthermore finds that the share of such jobs in the US can be as high as 38%. The nature of the types of jobs that are offshorable has also changed over time, from tasks that are readily routinizable to jobs and tasks that involve high communication/technical skills made possible by advents in telecommunication, such as medical technician and computer programmer [3].

This article focuses on developing country consequences of offshoring, and addresses the question of whether developing country labor markets, typically host countries of jobs offshored, benefit from offshoring. This question is pursued from four perspectives: (i) macro-level efficiency and distributive impacts, (ii) firm-level productivity, wage, and employment, (iii) job quality and the routinization of tasks, and (iv) new policy considerations brought on by global trade in intermediate goods.

Efficiency and distributional effects of offshoring as a global division of labor

Research on international trade has long emphasized that the efficiency gains from international trade in intermediate goods and services are distinct from, and complementary to, canonical gains from trade in final products [4]. A key difference that sets gains from offshoring apart from standard arguments of gains from trade is that the home and host countries of offshoring engage respectively in backward and forward participation in global value chains. Specifically, along the global value chain, a country's exports can embody the value of another country's exports. Trading in intermediate goods and services, therefore, involves more than consumer-to-producer relationships, it includes producer-to-producer relationships as well. The determinants of the efficiency gains from offshoring thus include traditional determinants of trade gains (e.g. factor endowments and trade costs) in addition to institutions that govern firm-to-firm relationships, and a country's position along the value chain.

A common starting point in theoretical models of global value chains is the multi-staged nature of production. The resulting international trade in tasks and parts can have key implications for productivity, and for the revealed comparative advantage of nations [3]. Earlier models are based on factor abundance as rationale for trade, as well as the welfare and income distribution impacts of new technologies that enable the production process to be fragmented across countries. These studies importantly note that the effect of fragmentation is tantamount to a productivity improvement in favor of the sector involved in the global value chain. Thus, while taking advantage of the possibility of offshoring clearly creates efficiency gains via cost savings, these models also predict distributional tradeoffs. The relative impact of offshoring on capital and labor, and between skilled and unskilled workers, depends critically on: the capital or skill intensity of the offshoring sector relative to the rest of the economy, and the number of sectors that may be simultaneously engaged in offshoring.

Next generation models do away with the implicit assumption that the set of tasks that can be offshored is exogenous to the firm. Counterfactual analyses using this class of models have generated predictions that vary quite widely depending on the type of the counterfactual scenarios studied. For example, there have been modest predictions of changes in real income due to trade liberalization, to the tune of around 1% for Mexico due to NAFTA, for example [5]. These results contrast sharply with estimates of real income gains from trade that are considerably larger when intermediate goods trade is included.

Complementing these model-based counterfactual predictions, the empirical literature on the gains from participating in global value chains likewise suggests substantial gains from participation through mechanisms that are particularly relevant for developing countries. In particular, participation in global value chains is strongly associated with reduced poverty, skill and knowledge spillovers, as well as improvements in female labor force participation. Whether these relationships are causal is a key question awaiting future research. One exception is a cross-country study from 1995 to 2008 that employs a novel instrumental variable approach based on the presence of deep water ports, with the rationale being that such geographical advantage facilitates trade [6]. The study decomposes total exports into their domestic and foreign components using input-output tables, and scrutinizes the size of the growth effect of total exports depending on a country's degree of upstreamness—that is, the number of productive steps between each industry and the final consumer—in the value chain. The authors find that the growth impact of trade is stronger in more upstream export industries.

Employment, productivity, and wage inequality effects of offshoring

Participation in global value chains confers multiple potential sources of productivity benefits to developing country producers. Workers benefit as well through improvements in employment and wage prospects, in addition to labor productivity as firms gain access to foreign inputs and markets. Inflows of foreign investments, specialization in specific production processes and the establishment of relationships with a network of foreign firms can additionally result in knowledge spillovers and experience sharing. Using GDP per capita as a proxy for per capita productivity, a 10% increase in the level of participation in global value chains is associated with an 11–14% increase in GDP per capita [7]. In the handful of dedicated country studies to date, covering issues such as service offshoring in India, intermediate goods in China and Costa Rica, for example, the production of offshored tasks is shown to increase employment within the offshoring sector.

Disentangling the sources and the causality of these apparent gains from offshoring is an important task that, again, warrants additional research. Research has made progress particularly with respect to gains from vertical foreign direct investments and production by foreign affiliates. Three types of effects have been demonstrated to date: (i) direct effects on foreign affiliates, (ii) employment transition effects between formal and informal sectors, and (iii) indirect/spillover effects across sectors.

Direct effects of foreign investment on the productivity of foreign affiliates have typically been shown to result in positive firm-level impacts. Indeed, offshoring presents a way for developing countries to integrate into the global economy even when they are not able to complete the production of a final good in its entirety.

Country-specific labor market investigations offer additional insights. Foreign direct investment has contributed to large-scale employment transition from informal to formal manufacturing employment in Turkey, for example, where manufacturing foreign direct investment has added tens of thousands of high-paying formal jobs.

There are indirect/spillover effects associated with foreign direct investment as well, and these may be adverse or beneficial. To start, foreign investment can crowd out domestic investments as demand for and thus the cost of local factor input rises. Such crowding-out effects can have adverse consequences, particularly in small- and medium-sized firms. One study finds that foreign direct investment in Venezuela raises productivity within plants but lowers that of domestically owned plants [8]. In an in-depth analysis of the Costa Rican experience, high-tech offshoring, proxied by export processing zones employment, grew at an annual rate of 25% between 1991 and 2005 [9]. The growth rate of employment and wages in the rest of the economy during the same period was lower, however, at around 3.8% in all of manufacturing. Research has confirmed a positive productivity effect on foreign-owned firms, but a negative indirect/spillover productivity effect of foreign direct investment on locally owned firms in China. Higher foreign direct investment has also been shown to be associated with a slightly lower household living standard if the household does not have a member who is employed by a foreign entity in Vietnam. Positive spillover effects of foreign direct investment have also been demonstrated among upstream local suppliers that have connections with foreign affiliates in Lithuania, and particularly in projects with shared foreign and domestic ownership.

In addition to employment and productivity, offshoring is associated with skill-biased technical change, resulting in changes in wage inequality between workers as well. Since offshored tasks in developing countries are typically more skill/capital intensive than the average task in developing countries, participation in the global value chain can change the relative demand for skills, and worsen the distribution of income between the skilled and the unskilled. Analogous wage inequality effects have been demonstrated in Costa Rica, Poland, Brazil, and China.

Job quality and routinization of tasks

A key feature of offshoring singled out by recent studies is that only a select class of production processes and tasks are offshored [3], [10]. Offshorable jobs accomplish tasks that are readily codified, with cost-effective quality control that can be implemented effectively despite remote production [1]. Can wholesale migration of jobs across countries affect the task characteristic and skill requirement of the typical job in developing countries? While economists have not yet produced causal findings on this topic, there is nonetheless ample evidence showing that routine task intensity is higher in developing countries, and furthermore, the shift from routine to non-routine tasks is slower in developing countries. One Chinese study employs the China Employer-Employee Survey to show that consistent with the rise in global value chains, firms that are foreign owned and export oriented employ workers that specialize in less abstract and more routine tasks. This is in sharp contrast to the hollowing-out of middle-skill jobs in the US. The evidence also points to a reduction in relative labor demand for abstract tasks in China, and consequently a rise in middle-wage jobs in the labor market.

Relatedly, labor standards in factories completing offshored tasks have been a major source of concern for developed country consumers, where reports of factory accidents and sweatshop like conditions have given rise to calls for better work conditions and consumer boycotts. One study canvasses the experiences of Argentina, Brazil, India, and the Philippines in the business process outsourcing industry. While the study finds that these jobs are reasonably high quality compared to the typical local job in terms of wages, hours, and non-wage benefits, the study also uncovers multiple areas of concerns related to labor standards. These include heavy workloads, rigid performance targets, along with monotonous and undesirable tasks that have culminated in especially high turnover rates among workers employed in the sector.

Naturally, the conditions of offshored jobs across industries are not uniform. Advancement in telecommunications has paved the way for rising skill requirements in offshored tasks. A notable example is India, a key exporter of information technology and related services. Similar changes have been reported in the health service sector, where offshored tasks have slowly graduated from routine work such as medical transcription or accounts and billing, to tele-imaging and telepathology. There is evidence within European multinational firms of an increase in the hiring of foreign inventors (36% between 1991 and 2005) relative to domestic inventors (15%), including from emerging markets and Eastern European countries. Another example is Costa Rica, where offshoring employment was synonymous with employment in high-tech sectors commanding higher wages compared to the rest of the economy.

Offshoring and policies targeting intermediate goods trade

As participating partners in the global value chain, developing countries engaged in offshoring confront policies set both by upstream and downstream trading partners. This is important for several reasons. First, countries routinely impose lower import tariffs on imported intermediate goods than on imported final goods. The resulting tariff escalation means that developing countries engaged in exporting intermediate goods can end up facing an entirely different tariff schedule at a lower average rate compared to others that export primarily final products. For workers engaged in producing foreign offshored tasks, any such trade policy changes are significant, as firms have been shown to be highly input and output price sensitive; accordingly, they readily substitute away from inputs that are of higher cost in sectors that face trade barriers. For example, studies have uncovered sizable trade diversion impact on intermediate goods imports in Mexico subsequent to the implementation of rules of origin of the NAFTA agreement, and substitution away from imported inputs relative to other inputs by Indian firms as a consequence of the imposition of antidumping duties in India.

By contrast, participation in global value chains also subjects each participating country to multiple sources of possible trade policy shocks, originating from any one of the many countries engaged in the value chain. This results in a high degree of uncertainty facing developing labor markets arising from shocks to trade policies or offshoring costs [11]. The impact of these shocks on developing country firms engaged in the global value chain is an emerging area of research. One novel study in this regard shows that foreign direct investment into Mexico declines with trade policy uncertainty; the authors demonstrate this by leveraging data from Google trends to form a trade policy uncertainty index [12].

Cross-country offshoring ties also give rise to novel forms of policy interdependence between offshoring partners. A recent study highlights one such form of interdependence, wherein developing countries export offshored labor services to developed countries, only to import final products from the same developed countries that contain their own countries’ labor content [11]. In such a scenario, a tax on developed country imports intended to defend local wages is now simultaneously an indirect tax on local labor, because imported final goods embody domestic labor content. A recent study provides evidence that corroborates these concerns in the context of the Chinese boycott of Japanese automobiles in 2012. The study shows that the boycott had negative wage and employment consequences for workers employed in Chinese auto-part firms located near major Japanese auto factories in China. International offshoring linkages can thus fundamentally alter the incentives for developing countries to erect import barriers, whether to support local wage/employment, or to use as threats in trade dispute settlement cases. These studies suggest the need to revisit the rules of the World Trade Organization in the presence of offshoring to clarify the definitions of the principle of reciprocity, as well as the rules of dispute settlement.

Limitations and gaps

Significant data availability gaps exist in the literature. For example, firm-level data on the intensity of employment that completes offshored tasks, or, alternatively, data on firms that both import and export, are particularly difficult to come by. Meanwhile, using country-level input-output tables to shed light on local outcomes is often problematic because of the need to invoke a so-called proportionality assumption on the share of economic impact and employment across location and sectors. Indeed, many studies referenced in this article use foreign direct investment as a coarse proxy of offshoring. Such investment embodies both the manufacturing of intermediate as well as final goods, and does not include offshoring through buyer-seller contracting in more arm's length organization connections. Research on the consequences of offshoring in developing countries is admittedly nascent. Employment, productivity, and wage impacts are but a very small subset of a potentially large set of both short- and long-term outcomes. If developed country experiences can serve as a glimpse of the menu of potential outcomes, skill-biased changes in labor demand associated with trade liberalization can potentially lead to long-term shifts in youth outcomes, including college enrollment and completion, marriage, fertility, and crime.

Summary and policy advice

Offshoring has become an indispensable element of global trade. Workers in developing countries stand to gain from better access to world markets, foreign inputs, new technologies, and skills. The result is an improvement in overall efficiency through global division of labor, higher employment, and growth in productivity, in addition to improvements in job remuneration and better job quality in some cases. These desirable benefits should be evaluated against a list of possible pitfalls. For example, both theory and empirical evidence have pointed to the possibility of unequal distribution of gains from offshoring, adversely affecting less productive, and typically small- and medium-sized firms. Changes in the skill requirement of offshoring may also give rise to rising wage inequality. To the extent that cost minimization is the business model, there have been concerns and some evidence that workers toil for long hours under poor conditions, performing monotonous tasks with little possibility of skill upgrading.

Developing countries also confront novel challenges in setting trade policies in the face of global trade linkages through offshoring; for example, erecting import barriers may be self-defeating because imported final goods may embody domestic labor content.

Taken together, policymakers should pay particular attention to the adverse income distribution consequences of offshoring among workers as well as between establishments, depending on competency and scale. These considerations notwithstanding, important knowledge gaps remain. Specifically, since the current world trade infrastructure is based on rules written with trade in final products in mind, a key knowledge gap involves the design and enforcement of trade policies that take into account the spillover effects associated with offshoring, while maintaining the stability of world trade. As such, a revision of trade rules to account for the new challenges facing countries along the global value chain is both pressing, and potentially enabling for developing country members.

Acknowledgments

The authors thank an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The authors declare to have observed the principles outlined in the code.

© Arnab K. Basu and Nancy H. Chau