Elevator pitch

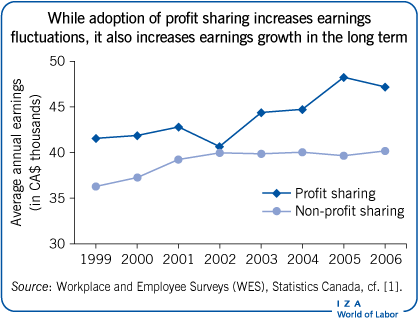

Profit sharing can lead to higher productivity and thus to higher firm profitability and employee wages. It may also enhance employment stability by enabling firms to adjust wages during downturns rather than lay off workers. While adoption of profit sharing increases earnings fluctuations, it also increases earnings growth in the longer term. As with any group incentive plan, profit sharing may result in some workers benefiting from the effort of others without themselves exerting greater effort (“free-rider problem”). However, there is evidence that in team-based production workplaces, profit sharing may reduce shirking and thus contribute to productivity growth.

Key findings

Pros

Profit sharing can lead to higher productivity and thus to higher firm profitability and employee wages.

By reducing shirking behavior, profit sharing may reduce supervision costs.

Profit sharing can lessen compensation risks for employers by allowing greater flexibility in wages.

Profit sharing may enhance employment stability by enabling firms to adjust wages during downturns rather than lay off workers.

The use of team-based production is important to the positive productivity growth effect of employee profit sharing.

Cons

As with any group incentive plan, profit sharing may result in some workers gaining from the effort of others with no greater effort on their part (“free rider problem”).

Workers cannot see strong links between their effort and their organization’s performance (profits).

Profit sharing may increase compensation risks for employees by making earnings more variable.

Profit sharing may incur high administrative costs.

There is a negative link between unionization and profit sharing as most unions oppose such organizational incentive programs.