Elevator pitch

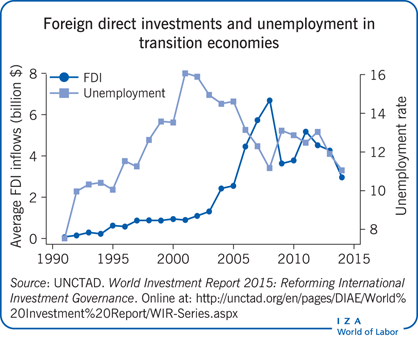

Foreign direct investment (FDI) has been argued to improve company performance and stimulate growth and employment. Transition economies of Central and Eastern Europe (CEE) faced a desperate need to join the global economy, to improve their competitiveness and to create jobs through FDI. So, did the FDI come, and did it deliver what was expected? FDI levels were high for CEE, and for some resource-rich transition countries (e.g. Russia and some of Central Asia), but primarily delivered significant benefits (e.g. employment) for the former. FDI arrived much later to other transition countries (e.g. the former Soviet republics and the Balkans) and had much less impact.

Key findings

Pros

FDI was a significant investment source in transition economies, though with marked variation across regions and time periods.

FDI arrived earlier in countries that joined the EU.

Transition economies experienced positive effects on growth and the labor market due to FDI inflows.

FDI inflows were associated with higher levels of GDP and lower unemployment for some periods.

EU member states exhibit distinct effects of FDI on firm restructuring, productivity, and employment.

Cons

FDI arrived later in Russia, the Central Asian region, the former Soviet Union, and the Balkans than in EU member countries.

FDI was driven largely by resource-seeking in Russia and some of the Central Asian republics, where the effects on employment were less pronounced.

Positive spillover effects from FDI were much less apparent in Russia, the former Soviet Union, and the Balkans, likely due to institutional challenges and insufficient human capital.

Author's main message

FDI inflows to the transition economies have been substantial, though variable across countries. These differences are most likely explained by EU membership and domestic policies, especially concerning institutions. Considerable evidence suggests that FDI benefited recipient countries in terms of growth, employment, productivity, and trade. However, these benefits are not automatic and many factors that deter FDI also hinder its spillovers. Transition governments should thus consider policies that simultaneously enhance FDI’s scale and maximize its external benefits, particularly by improving institutional quality and human capital.

Motivation

Economic transition from a planned to a market system began in 1989. There were many reasons for the demise of the Soviet bloc, but stagnation in economic growth was clearly important. Especially for economies without natural resources, foreign direct investment (FDI) was seen as a mechanism for restructuring and growth, and was facilitated by widespread privatization [1].

Under the auspices of central planning, Central and Eastern European (CEE) economies operated largely in isolation from the global economy and FDI inflows, cutting them off from many technological developments. Transition involved the restructuring of trade patterns, as well as upgrading products and implementing new technologies. However, domestic savings were scarce and there were serious deficiencies in managerial experience and capabilities, as well as relevant labor skills. Inward FDI assumes special significance in this context; providing sorely needed capital, technology, and know-how [2], [3]. Foreign firms, structured for the global economy and with their long experience of internationalization, also lead to deeper integration into the global economic system. So, how have FDI flows to transition economies actually developed since 1989, and have they produced the expected effects, particularly with respect to the labor market?

Discussion of pros and cons

The economies of CEE have indeed received considerable inflows of FDI since 1989 [4]. However, the pattern has not been even across the whole region or time periods [5], [6], [7]. To understand the pattern, it is helpful to categorize transition economies, as defined by the European Bank for Reconstruction and Development (EBRD), into four groups according to their level of development, geography, and institutions:

EU members. Countries admitted to the European Union as of 2015. These are among the most economically developed economies and institutionally sophisticated as well as the most westward. This group contains all current EU members: Czech Republic, Slovakia, Hungary, Poland, Estonia, Latvia, Lithuania, Slovenia, Romania, Bulgaria, and Croatia.

Russia. The size of the Russian economy leads us to treat it as its own category.

Other former Soviet and Balkan economies. These are the new European countries that were previously part of the former Soviet Union (FSU) (Armenia, Azerbaijan, Belarus, Georgia, Moldova, and Ukraine) and the countries formed from the former Yugoslavia (Bosnia and Herzegovina, Macedonia, Kosovo, Montenegro, and Serbia) plus Albania. These countries, all new apart from Albania, have been struggling to assert national identity and address problems of institutional weakness and economic isolation. Aside from Azerbaijan, they are not rich in natural resources and mostly small in population.

Central Asian economies. Five of the six countries included in this group (Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan), were also spun out of the FSU; the sixth country is Mongolia. They are mostly also institutionally underdeveloped and geographically isolated, but in several cases, are rich in natural resources.

The pattern of FDI inflows

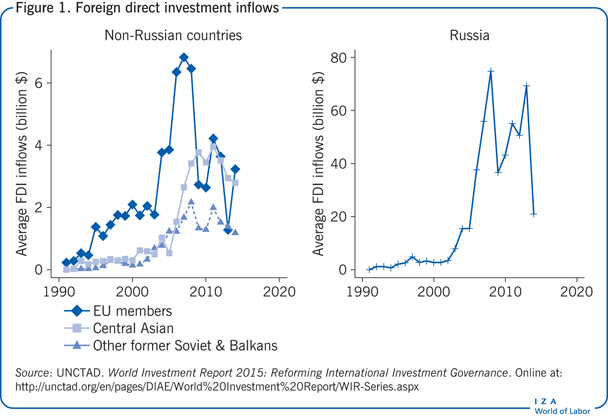

FDI inflows to the entire transition region relative to unemployment are shown in the Illustration. FDI responded very slowly to the transition process before experiencing a very sharp increase from around 2003; despite setbacks following the recession in 2008, relatively high FDI continued to flow into the region as a whole. Unemployment rose steadily to 2001 and has since been falling. However, as seen in Figure 1, in 1990–2014, there were sharp differences in FDI inflows between the four regions. FDI increased earlier in the EU membership group and rose to higher levels.

These inflows were significant for growth, representing a large proportion of total domestic investment or gross fixed capital formation (GFCF). For example, among EU members, Slovakia received more than one-third of GFCF via FDI between 2000 and 2007; Bulgaria received more than 50% of GFCF via FDI between 2003 and 2008, with a maximum of 99%! In contrast, FDI to Russia has been modest, given the scale of the host. Even so, FDI represented more than 10% GFCF after 2003, reaching more than 20% in peak years.

The other two regions, FSU and Central Asia, showed a similar pattern to Russia, but at lower rates of FDI, though even these inflows were often large as a share of GFCF, exceeding 50% in many years in Kazakhstan, Uzbekistan, and Azerbaijan.

Direct effects of FDI on output and the labor market

FDI and GDP

Increased FDI inflows provide the host economies with supplies of investment that do not have to be matched by domestic savings. As such, one might expect that it would increase GDP and have positive effects on employment, reducing the rate of unemployment.

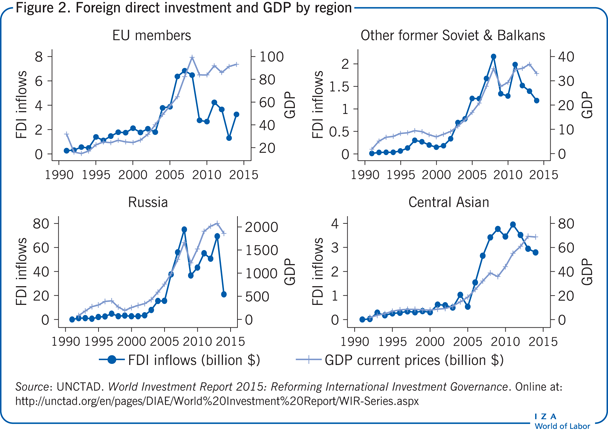

Figure 2 describes the relationship between FDI and output, plotting FDI inflows against GDP overall for each of the four regional groupings. In aggregate, FDI and GDP for the transition region are quite closely correlated, at least until 2008. This close correlation weakens after 2008, when both FDI and GDP decline, though with the former doing so more sharply than the latter. This evidence is consistent with the view that FDI was a significant driver of economic growth across the region [8].

Interestingly, while the specific FDI patterns vary across the four regions, one can draw largely the same conclusion about the relationship between FDI and GDP (i.e. that FDI was a driver of GDP) in three of the four. The outlier is Central Asia; GDP growth after 2005 is not closely related to FDI inflows.

Regression analysis on the entire range of countries and sample period allows for a deeper understanding of the situation, including consideration of the direction of causality. Theory would suggest that investment, of which FDI is a major element, should lead to economic growth. This implies a time sequence in which FDI occurs first and GDP grows at a later date. Estimations confirm that previous FDI inflows do significantly increase GDP. The same holds when considering GDP per capita, which is also found to be driven by previous levels of FDI. Thus, evidence indicates that FDI has had a positive influence on levels of output and development in transition economies [9].

FDI and unemployment

If FDI to the transition economies increases output, one might also expect to see it lead to a reduction in unemployment. However, the theoretical predictions are less clear-cut in this case because FDI is usually associated with enterprise restructuring, which, because firms under socialism were state-owned and had substantial overemployment, is likely to involve substantial reductions in employment [9], [10]. This is especially true if the bulk of FDI came into the transition countries via acquisitions of inefficient former state-owned firms through privatization.

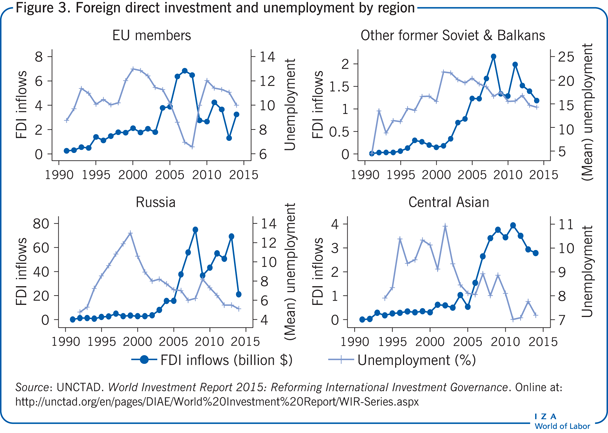

As noted in the Illustration, unemployment rose in the 1990s, presumably due to the impact of enterprise restructuring on labor markets. Figure 3 reports FDI inflows against (average) unemployment for each of the four regional groupings where the picture is rather more uneven. The pattern of inverse correlations between FDI and unemployment seen among the region as a whole broadly holds for the group of EU members; the decline in unemployment starts at the end of a long gradual period of rising FDI, perhaps when the most important employment effects from restructuring are complete. Unemployment is at its lowest levels when FDI reaches its peak, and the rise in unemployment after 2008 closely follows the pattern of decline in FDI. A similar pattern of inverse correlation is seen in Central Asia, where a period of low FDI and high unemployment is followed by one of higher FDI and much reduced unemployment levels.

However, the trend seen in the other former Soviet and Balkan countries, suggests that the process of restructuring takes much longer and is less reliant on FDI than for the EU members [10]. It is difficult to discern any relationship between FDI and unemployment rates in Russia, perhaps because FDI is driven more by the resource cycle. Regression analysis on these data reveals that FDI in one year significantly reduces subsequent levels of unemployment. Thus, it can be concluded that FDI does act to reduce unemployment in the transition economies.

FDI and institutional change

It is often argued that FDI inflows and institutional change will be closely related, though the causality is not necessarily straightforward. The evidence suggests that foreign investors will enter economies with stronger institutional arrangements because their investments will likely be better protected from expropriation or corrupt practices and their ability to earn profits will be enhanced [5]. However, the logic may also run the other way; foreign engagement in the economy may lead to domestic political and economic pressures to improve institutional arrangements. Stronger institutions will also likely be associated with better functioning labor markets [9].

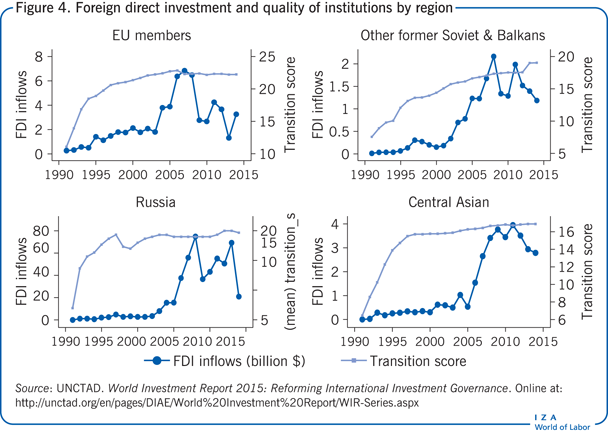

The EBRD has developed a series of indicators of institutional quality for transition economies and data have been collected for the entire transition period. Figure 4 displays the average score for each of the four regional categories from 1991–2014 against FDI inflows.

In aggregate, improvements in transition scores predate the upswing in FDI; institutional improvements in the 1990s laid the foundation for FDI from around 2000. The relationships shown in Figure 3 offer some evidence for this. FDI into EU countries rises sharply some seven years after the transition index stabilized at quite a high level, and FDI into Central Asia and Russia rises steeply some ten years after the increase in transition scores. However, in the FSU, FDI begins to rise quite early, already in 2001, while transition scores remain rather low. It is notable that institutional quality and policy environments are not always tightly related, especially in resource-rich economies like Russia and Central Asian countries.

Regression analysis confirms the above interpretation, showing that FDI responds positively, but with a lag to the transition scores. This suggests that policies to improve the institutional environment covered in the EBRD transition indicators, namely governance—liberalization, privatization, trade and exchange rates regime, and competition policies—had positive effects on FDI, and through that on growth and employment.

Indirect effects of FDI on the labor market

One major survey summarizes the empirical literature on the indirect effects of FDI on the labor market [10]. It finds that privatization to outside owners resulted in 50% more restructuring than privatization to insiders (current managers or workers). Foreign ownership was found to produce significantly more restructuring than privatization to domestic owners, especially for EU members. In the FSU, privatization to foreign owners typically yielded a positive effect, while privatization to domestic owners typically generated a negative one. Turning to employment, the authors identified 17 studies that examined the effect of ownership on employment; they found a marked tendency for privatized firms with foreign owners to increase employment relative to firms with state ownership. As such, FDI via privatizations can be seen as a leading factor generating enterprise restructuring in transition countries, especially amongst the EU members. While FDI via privatization to foreign owners may also have contributed to unemployment in the transition economies initially (as seen in Figure 3), it also enhanced competitiveness in the longer term, probably driving the later rises in output and declines in unemployment.

During the socialist era, the transition economies had become isolated, falling behind the Western world when it came to key technologies, skills, and capabilities. FDI served as an important mechanism for catching up. In particular, recipient economies could be stimulated through spillover effects from FDI, which diffuse more productive methods throughout an economy via access to advanced technology, systems, skills, training, and management, all of which can act to raise firms’ total factor productivity [2], [3]. Furthermore, rising productivity levels may contribute to improved international competitiveness, allowing the host economy to increase exports and improve their balance of payments, potentially alleviating international finance constraints to economic growth and increasing demand for labor [9].

It is usually argued that positive spillover effects from FDI derive from the diffusion of technology and knowledge between foreign entrants and domestic incumbents [2]. Demonstration effects represent an important channel for knowledge diffusion; they occur, for example, when local firms upgrade their technologies or adopt similar organizational practices to mirror more productive foreign companies [3], [8]. Furthermore, domestic entrepreneurs may also recognize the market potential of innovations introduced by foreign firms.

Labor mobility is another important mechanism that enables the diffusion of superior technology, skills, and know-how from foreign to local firms [3]. A local workforce that was previously trained and employed by foreign-owned firms might possess better skills when they accept jobs in local enterprises, or they may choose to exploit these skills through entrepreneurship. Finally, foreign investors can help domestic firms compete better in the global economy. Thus, exposure to FDI can positively influence the export decisions of existing domestic firms or help local entrepreneurs to identify export market opportunities.

However, while there is positive evidence about spillovers for particular countries, notably some EU member states such as the Czech Republic, the overall findings from FDI in transition economies are ambiguous. Of five studies specifically covering the transition region, three reveal positive spillovers, while two others find negative effects [9]. This variation is probably explained by differences in two main factors: integration to the global economy, e.g. EU membership, and the quality of institutions.

The benefits that host economies can gain from spillover effects depend on their ability to absorb the knowledge and skills being generated by foreign investors. The previous studies indicate that the scale and direction of FDI’s impact on the host economy are conditional on factors such as the quality of institutions and the levels of human capital and financial market development [9]. Thus, while the expectation is for positive effects, the host economy and domestic firms may not have the “absorptive capacity” necessary to raise their productivity to the levels attained by their new foreign competitors; the technological gaps may be too large, the incentives too weak, and the availability of human capital too limited for competitive processes to raise domestic performance [3], [8], [11]. The latter problems are characterized by shortages of key skills, including managerial ones, and deficiencies in technical education and training [8]. Thus, for FDI to produce the greatest benefits for national economic performance, institutions must be strong—especially with regard to the rule of law and freedom from corruption—and the level of human capital must be high enough to facilitate the transfer of knowledge.

Limitations and gaps

There are some serious data limitations concerning FDI and its impact on transition countries’ labor markets, especially for the early years. For example, data for some of the former Yugoslav states did not become available until after 2003, and the data for the immediate post-transition period are probably unreliable because collection systems were not fully operational. FDI data are also frequently revised and the information for recent years may yet change. There is also variation across countries in the quality of the data about employment.

Descriptive and regression analysis have been used in an attempt to address the issue of causality between FDI and labor market outcomes, but the methods used were very simple, and restricted by the size of the sample and the heterogeneity of countries within it. Attempts to address this included the analysis of countries by groups categorized by geography and institutional quality, but the sample sizes within each group were too small for regression analysis.

Summary and policy advice

Flows of FDI into transition economies were a significant source of investment capital, though with marked variations between different regions and time periods. FDI arrived earlier in EU member countries, but later in Russia, the Central Asian region, the FSU, and the Balkans. FDI inflows appear to have been associated with higher levels of GDP and lower levels of unemployment in aggregate, and for some specific time periods in most regions. The effects were most pronounced and occurred earlier in the EU members and were least so in the former Soviet Republics and Russia. FDI was influenced by natural resource considerations in Russia and some of the Central Asian republics, and the effects on employment were less pronounced.

The indirect effects of FDI on company restructuring, productivity, and employment were very distinct in the EU member countries; indeed, some studies suggest that much of the shift toward improved competitiveness and integration into the global economy derived from FDI. However, these positive spillover effects were less apparent in Russia, the FSU, and the Balkans. This was probably because institutions were less developed, the gap between the investing firm and domestic capabilities was larger, and the absorptive capacity of the host economies was smaller, making it more difficult to take advantage of the potential opened up by FDI.

These results have a number of important policy implications. FDI can clearly play a significant role in company restructuring and raising productivity, improving labor skills and managerial capabilities, and the diffusion of new products and technologies. This might lead countries to adopt policies incentivizing FDI. However, the benefits are not automatic; rather, they depend on the policies and structure of the host economy. For example, the differences observed between the EU members and the other transition economies highlight the benefits of EU membership. It seems likely that the institutional improvements required for EU membership played a major role in improving the EU member group’s absorptive capacity, allowing them to benefit relatively more from FDI, as well as enhancing the amount of FDI they received.

Even in the absence of EU membership, host economies obtain more benefits from FDI if they are better able to absorb the new processes, systems, and methods being brought over by foreign firms. To a significant extent, this is a matter of human capital, and the central policy to consider is one of education. However, infrastructure is also important. Better transport systems, superior ports and airports and faster information technology highways facilitate the diffusion of new products and technologies. Infrastructure acts both to encourage more FDI and to ensure that the FDI that is received has a greater benefit to the economy as a whole.

Finally, institutional quality plays an enormous role in the impact of FDI on labor markets. It is well known that foreign investors are strongly deterred by corruption, weak rule of law, and the risks of expropriation [5]. At the same time, weak institutions hinder the diffusion of new ideas that drive the positive spillovers from FDI to domestic firms. Stronger and fairer institutions are therefore critical to obtaining the benefits of FDI for labor markets.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Meng Tian.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Saul Estrin

Foreign direct investment inflows

Source: World Bank. “What is the difference between Foreign Direct Investment (FDI) net inflows and net outflows?” Online at: https://datahelpdesk.worldbank.org/knowledgebase/articles/114954-what-is-the-difference-