Elevator pitch

Because entrepreneurial activity can stimulate job creation and long-term economic growth, promoting entrepreneurship is an important goal. However, many financial, bureaucratic, and social barriers can short-circuit the process of actually starting a business, especially in transition economies that lack established institutional systems and markets. The main obstacles are underdeveloped financial markets, perceptions of administrative complexity, political and economic instability, and lack of trust in institutions. Gender disparities in the labor market are also reflected in less entrepreneurial activity among women than men.

Key findings

Pros

Increasing access to finance and loans helps latent entrepreneurs move to the next stage of trying to start a business.

Reducing the number of procedures required to start a business can make it easier for latent entrepreneurs to become active entrepreneurs.

While there are fewer women than men at each stage of entrepreneurship, women are as likely as men to successfully start a business once they attempt it.

Social capital is especially helpful for women’s entrepreneurship, indicating that it can compensate for the connections and resources they are less likely to gain in the labor market.

Cons

Many people who would like to be entrepreneurs never progress beyond latent entrepreneurship, especially in transition economies.

Underdeveloped financial markets and inadequate financial capital remain serious obstacles to the expansion of entrepreneurship.

Perceptions of administrative complexity, political and economic instability, and lack of trust in institutions are key impediments to starting a business.

Less entrepreneurial activity among women than men mirrors gender disparities in the labor market.

Author's main message

Increasing the number of people who want to be entrepreneurs and making it easier to start a business can create jobs and stimulate economic growth, especially critical in low-growth transition economies. But there are many obstacles in the way of achieving such gains. Easing access to financing, simplifying start-up procedures, and building trust in the financial and judicial systems are among the key policies for boosting the rate of business start-ups. By removing barriers and encouraging more people to become entrepreneurs, such policies can deepen the pool of potential entrepreneurs and free entrepreneurs to develop their ideas and fuel growth.

Motivation

Promoting entrepreneurship has been a key goal and strategy for development in countries around the world. The underlying belief behind these strategies is that entrepreneurial activities, especially small- to medium-size enterprises, contribute to job creation, stimulate innovation, boost productivity, and thus lead to economic growth. Entrepreneurship has played an important role in facilitating economic development and needed structural change in several transition economies, and it can be a key factor in recovering from the weak labor markets in many of these countries [1].

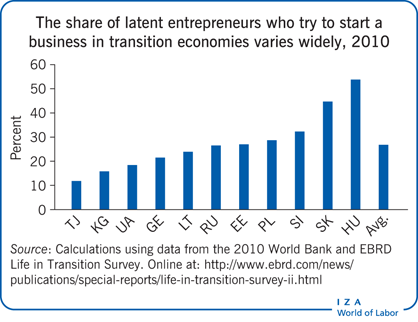

Understanding what drives each stage of entrepreneurial activity is important for identifying policies that can promote entrepreneurship at each of its three main stages. The first stage is latent entrepreneurship, which includes people who would prefer self-employment but who are still engaged in wage employment. The second stage is attempted entrepreneurship, when people first try to start up a business. The third stage is active entrepreneurship, when people have succeeded in their attempt to set up a business (Figure 1).

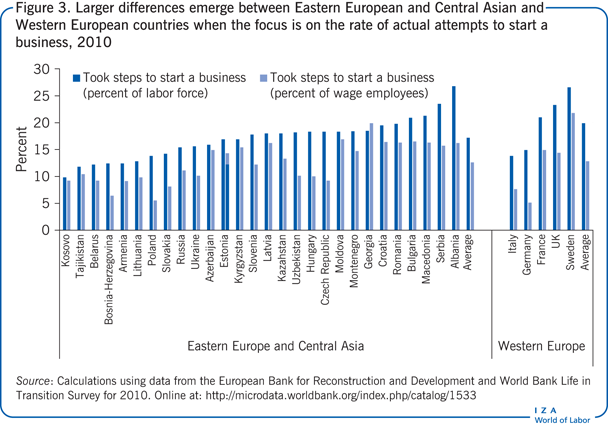

The transitions between these three stages are not seamless. Latent entrepreneurship is a necessary but clearly not sufficient stage, since not all latent entrepreneurs try to start a business. For example, only 27% of latent entrepreneurs actually attempted to open a business in transition economies in Eastern Europe and Central Asia in 2010. And among people who attempt to start a business in transition economies, as many as 40% fail [1]. The discrepancies between the number of people who would like to be entrepreneurs, those who try to start a business, and those who succeed imply that there are imperfections in the business environment that create friction in moving across the three stages of entrepreneurship.

A fourth stage of entrepreneurship, business failures or exit from entrepreneurship, is also an important part of the entrepreneurship life cycle. The right policies and environments are needed to enable failing firms to declare bankruptcy and shutter their business. This paper reviews the literature to identify the key policy measures that can boost the number of latent entrepreneurs and the successful conversion of latent entrepreneurs into active entrepreneurs.

Discussion of pros and cons

Most of the literature on entrepreneurship focuses on the factors that influence the active entrepreneurship stage, which includes only the successful start-ups. However, getting to the stage at which people can successfully operate a business requires transitioning through the earlier stages. Studies suggest that people can become discouraged in these earlier stages and never get as far as starting a business, especially in transition economies that lack the necessary financial, institutional, and private sector development to foster the emergence of new businesses. Policies to support these hidden latent entrepreneurs can yield several long-term benefits for economic growth. To promote a higher level of entrepreneurial activity and contribute to long-term economic growth, policymakers need to consider both how to foster higher rates of latent entrepreneurship and how to convert latent entrepreneurs into active entrepreneurs.

Latent entrepreneurship remains dormant in transition economies

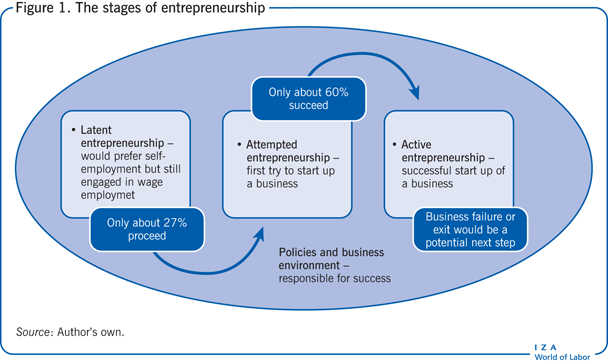

While the rate of latent entrepreneurship in transition economies is comparable to that in developed countries, the rates are considerably lower for converting latent entrepreneurs into would-be entrepreneurs who attempt to start a business and then into active entrepreneurs. Figure 2 (which draws on data from the European Bank for Reconstruction and Development and World Bank Life in Transition Survey for 2010) compares latent entrepreneurship rates as a percentage of the labor force and as a percentage of the wage employees in transition economies in Eastern Europe and Central Asia (many of which are transition economies) and some Western European countries. There is wide variation in latent entrepreneurship among the transition economies in the region. For example, rates of latent entrepreneurship are as low as 10% of the labor force in Azerbaijan and as high as 38% in Kyrgyzstan. On average, however, the percentage of the labor force that prefers self-employment is similar across transition economies in the region and more developed Western European countries, as well. On average, around 26% of the labor force and 22% of wage employees would prefer to be self-employed in the Eastern Europe and Central Asia region; respective averages for the Western European countries are around 27% and 21%.

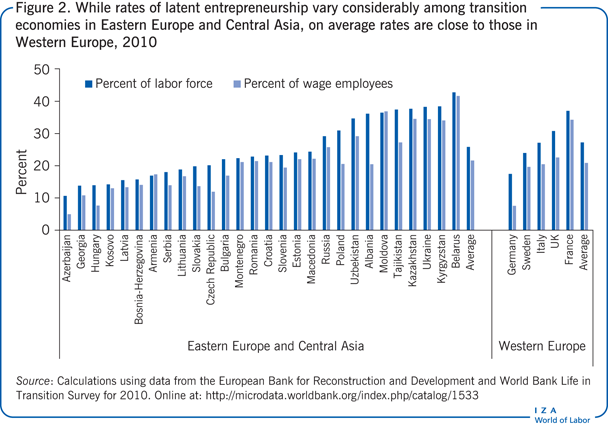

Some differences begin to emerge between the two groups of countries, however, when the focus shifts from latent entrepreneurship to the average rate of actual attempts to start a business (Figure 3). On average, 18% of the labor force in the transition economies of Eastern Europe and Central Asia has taken steps to start a business, compared with 20% among the Western European countries. As a share of wage employees, however, the two regions are very close in rates of attempts to start a business: 12.6% in Eastern Europe and Central Asia and 12.8% in the Western European countries.

The gap widens considerably, however, when attempts to start a business are examined as a percentage of latent entrepreneurship rather than as a percentage of the labor force or of wage employees. Striking differences are evident between transition economies and developed economies in the percentage of latent entrepreneurs who attempted to start a business. In the transition economies of Eastern Europe and Central Asia, 26% of the people who would prefer to be self-employed took steps to start a business at some point, well below the 43% average for the Western European countries in the sample. These discrepancies suggest that an important share of the average difference in attempts to start a business between transition and developed economies is due to a greater hesitation among latent entrepreneurs in transition economies to take the steps necessary to become a business owner.

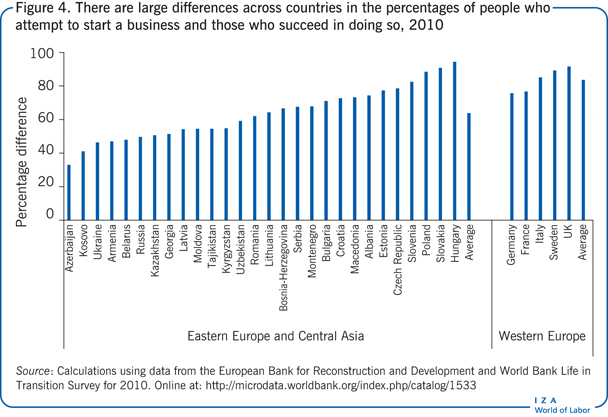

Similarly, there are large differences in the percentages of those who attempt to start a business who succeed in doing so (Figure 4). The success rates are around 35–50% in Azerbaijan, Kosovo, Ukraine, Armenia, Belarus, and Russia but more than 90% in Slovakia and Hungary. Looking at averages for the two regions shows that about 64% of people who attempt to start a business succeed in doing so in Eastern Europe and Central Asia compared with around 84% in the Western European countries.

This analysis reveals two major gaps. The first is between latent entrepreneurs and those who attempt to start a business, suggesting that people can get discouraged from pursuing entrepreneurial initiatives before really starting. There are people who want to be entrepreneurs but never take a step toward starting a business, and their share is larger in transition economies than in developed economies. The second gap is between attempting to start a business and successfully starting a business. Again, the success rate is lower in transition economies than in Western European economies.

These imbalances signal the existence of greater barriers to entrepreneurship in transition economies than in Western Europe, as research has confirmed. Entrepreneurial activities are shown to be more difficult in transition economies, especially in the Eastern Europe and Central Asia region [2]. Research has also identified financial, bureaucratic, and social barriers to the expansion of small- and medium-size businesses in transition and developing economies. However, there is little evidence for why latent entrepreneurs have more difficulty moving to active entrepreneurship in these countries than in developed countries and on what role policies play in impeding active entrepreneurship [1].

Access to finance and development of the financial sector

Lack of access to finance and underdeveloped financial markets are among the most important barriers to entrepreneurship in transition economies [3], [4]. Deterrents such as loan size, payment conditions, and complicated documentation requirements may prevent many latent and attempted entrepreneurs from funding their planned start-up ventures.

Because starting a business requires considerable seed capital and financial risk, access to financing is an essential determinant of entrepreneurial activity. There are usually two stages in financing start-up ventures. Initially, most entrepreneurs use their own savings and funds from family and friends to start their business, as reflected in the significant positive relationship between wealth and entrepreneurship [5]. In the next step, entrepreneurs seek external financing to expand their business. In transition economies, this step can be a chokepoint. Difficulties in accessing external financing mean that a person’s individual and household income level will be far more important for starting a business in transition economies than in developed economies. Lack of external financing affects latent entrepreneurship and attempted start-ups as well as successful attempts [1].

Bureaucratic complexity and ease of doing business

Business development is closely related to how easy and efficient it is to do business in a country. People’s perceptions about the bureaucratic complexity involved in starting a business and the lack of information on start-up procedures have been shown to discourage entrepreneurship [6]. Ease of doing business has been measured using a variety of indicators, such as number of required procedures to start a business, investor protection, and resolved bankruptcy cases. Active entrepreneurship levels are higher in countries that have less complicated business start-up procedures and stronger investor protection.

Active entrepreneurship levels are also higher in countries that make it easier to wind down a failing business. Entrepreneurs are more willing to take risks than the average person [7], [8], and entrepreneurial ventures, by their nature, involve high risk. For that reason, latent entrepreneurs also take into account what will happen if their firm fails when they are considering starting a businesses. Strong investor protection, simple procedures for closing down a firm, and higher rates of resolved insolvency cases allow entrepreneurs to feel more confident about taking on the risks of starting a business.

Ease of doing business is associated with higher rates of latent entrepreneurship as well as higher rates of active entrepreneurship. This suggests that when people are considering even the possibility of starting a business, they take into account the entire business cycle from firm birth to firm death, the costs of opening a business, and the costs of closing it down should the endeavor fail [1].

Social capital

Social capital, defined as “the sum of the actual and potential resources embedded within, available through, and derived from the network of relationships” in which an individual is engaged, is also relevant to entrepreneurship [9]. Two categories of social capital are especially important for entrepreneurship: individuals’ trust in the system and the social networks they are a part of. Overall, individuals in transition economies are found to have less social capital, due to a lack of strong institutional development, yet another impediment to entrepreneurial activities [3], [10], [11].

Trust

Trust in the system includes trust in institutions, trust in government, trust in the economy, trust in financial markets, and trust in courts. All these forms of trust are related to people’s perceptions about a country’s institutions, including its markets. Political and economic instability are among the key obstacles to developing trust in a country’s institutions and thus are also obstacles to entrepreneurial activity. Trust in financial markets is related to the issues of financial capital and access to finance opportunities. Similarly, having greater trust in government makes an individual more likely to become an entrepreneur. Trust in the judicial system and the courts can be especially important in transition economies, where legal enforcement procedures remain especially complex. All these trust measures are also positively correlated with latent entrepreneurship and with the transition from latent entrepreneurship to attempted and active entrepreneurship [1].

Social networks and clusters of entrepreneurial activity

Networks and relationships have been shown to be more important for entrepreneurial activity in transition economies than in developed economies. In an environment of high instability and weak institutional and market structures, social networks and informal ties can help entrepreneurs gain access to resources and cope with the inevitable bureaucratic inefficiencies [12]. Social networks can include personal relationships and ties, as well as membership in religious, art, educational, labor, and charity organizations, among others. People who are more active in social networks have a higher likelihood of being entrepreneurs [1]. Previous experience of working in the private sector has a positive relationship with entrepreneurship, which suggests that people can gain the social ties and skills necessary to start a business through their job experiences in private firms.

Entrepreneurial activity tends to be clustered. This suggests that some regions might already have better financial and institutional development which makes them attractive areas for business start-up ventures. Having clusters of entrepreneurs in a region can strengthen relationships, improve skills, and provide access to the capital needed to start a business. People who live in areas with large numbers of active entrepreneurs and have better access to such entrepreneurial networks and resources may feel a stronger urge to become entrepreneurs themselves [1]. Thus stimulating latent and active entrepreneurship may be easier in areas with high entrepreneurial resources than it is in areas with low levels of entrepreneurial activity.

Gender differences

Studies consistently find that women are less likely than men to become active entrepreneurs, and this pattern applies especially to transition economies. Women are also less likely to be latent entrepreneurs and less likely to attempt to start a business. These findings reflect women’s lower rate of labor force participation and thus lower access to the financial and social capital needed for entrepreneurial activities. However, among women who attempt to start a business, the rate of becoming active entrepreneurs is as high as that among men [1]. This finding suggests that the low level of active entrepreneurship among the female labor force is due to lower levels of latent and attempted entrepreneurship. Once women attempt to start a business, they are as successful at doing so as men are.

Limitations and gaps

Several data limitations make it harder to analyze the factors that influence latent entrepreneurship. First, identifying the policy factors that affect each level of entrepreneurship within and across countries requires large-scale data collections, which are still rare. Second, to identify latent entrepreneurs, most surveys ask whether the respondent would prefer to be self-employed, but not all forms of self-employment represent true entrepreneurship. For some people in transition economies, self-employment is a survival strategy in a hostile labor market that makes it difficult to find gainful employment. Nonetheless, most entrepreneurial activity is driven by the desire to be self-employed. It would be reasonable to assume that actual entrepreneurs are drawn from the pool of the latent entrepreneur population, even if a portion of self-described latent entrepreneurs considers entrepreneurship only because of sparse job market opportunities.

Another limitation is that much of the data are cross-sectional. Most surveys collect data from respondents at one point in time but are unable to track the same individuals over time. There can be unobserved characteristics of individuals that affect their decision to become an entrepreneur. If respondents could be followed over time as they move from one stage of entrepreneurship to another, factors associated with each stage could be more readily identified. Having such data could lead to better estimates of the determinants of latent, attempted, and active entrepreneurship, holding all permanent individual characteristics constant.

Summary and policy advice

Evidence on the rates of latent, attempted, and active entrepreneurship in the transition economies of Eastern Europe and Central Asia suggests that transition economies lack the essential financial and institutional development, trust in institutions, and social capital needed when trying to start a new business. In addition, women may need special support to become entrepreneurs. Women are less likely than men to be latent entrepreneurs and less likely to attempt to start a business. However, once women attempt to start a business, they are as successful at doing so as men.

Because access to finance is a major impediment to starting a business in transition economies, public policies could promote all three stages of entrepreneurship by making it easier to get loans for business start-ups and by easing loan conditions such as repayment terms and interest rates. Lower taxes on business start-up loans could help to expand external financing. De-regulation and privatization of the banking sector can advance entrepreneurship by promoting competition in the financial sector, increasing access to finance, and reducing inefficiencies [3]. However, de-regulation comes with risks, especially when the institutional and judicial structures are not well adapted to dealing with increased competition in the financial sector. Under-regulated financial institutions may take too many risks in financing shaky ventures. They may seek short-term profits to please shareholders while shying away from long-term investments. When a bank fails, depositors’ funds can be lost, and there can be negative spillover effects on other banks and financial institutions, threatening the sustainability of the financial sector. The failure of financial institutions can be more damaging to the economy than the failure of other business ventures [13]. Therefore, it is important for governments to make sure that the necessary institutional and judicial structures are in place, including appropriate supervisory institutions, when they promote greater competition in the financial sector.

Also important for encouraging all stages of entrepreneurship are measures to simplify business start-up procedures, increase investor protection, promote trust in the financial and judicial systems, simplify administrative procedures, and root out corruption [1], [3], [6]. Policymakers can foster the expansion of social capital through policies to increase confidence in institutions, financial markets, and the legal system, such as removing inefficiencies and cumbersome regulations, fighting corruption, and tightening enforcement. All these measures can inspire entrepreneurial activity.

Finally, women are a great untapped entrepreneurial resource. Women, especially in transition economies, have significantly lower rates of entrepreneurship than men at all levels of entrepreneurship, stemming in part from lower participation in the labor market and lower incomes [1]. The lower participation in the labor market can prevent women from acquiring the connections and skills necessary for successful entrepreneurship. Other social settings and engagements may need to compensate temporarily for women’s isolation from professional networks and resources in the labor market. Policies to promote entrepreneurship among women include encouraging participation in social networks, such as memberships in community organizations (sports, art, religious, and charity organizations, for example) [1]. Promoting access to finance can be more critical for female entrepreneurship, because women have fewer personal financial resources, on average, and less access to financing through social networks [3].

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a large number of background references for the material presented here and has been used intensively in all major parts of this article. The author is grateful to her co-authors on that paper, E. Tiongson, P. Van der Zwan, and C. Sanchez [1]. The author acknowledges financial support from the World Bank for consulting services related to entrepreneurship projects.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Hilal Atasoy