Elevator pitch

In many countries, ethnic minority groups are over-represented in self-employment compared with the majority community. The kind of work done by minority entrepreneurs can therefore be an important driver of the economic well-being of their ethnic group. Furthermore, growing the self-employment sector is a policy objective for many governments, which see it as a source of innovation, economic growth, and employment. While self-employment might offer economic opportunities to minority groups, it is important to understand the factors that underlie the nature and extent of ethnic entrepreneurship to evaluate whether policy measures should support it.

Key findings

Pros

Self-employment can be a path to prosperity for immigrant and ethnic groups.

Minorities can exploit ethnic-specific cultural resources.

Ethnic enclaves may provide a protected market.

Business growth can provide employment opportunities for others in the same ethnic group.

Cons

Self-employment may be a response to discrimination in paid employment.

Declining self-employment rates may represent economic progress for an ethnic group.

Business outcomes are often worse for ethnic business owners.

Self-employed ethnic minorities may face poor work conditions.

Author's main message

High self-employment rates among ethnic minority groups are often seen as a sign of a healthy entrepreneurial culture and a way to prosper in the labor market and the wider economy. However, while group- or culture-specific factors may attract some ethnic minority individuals to self-employment, on balance the evidence suggests that poor prospects in paid employment push minorities into working for themselves, and that this form of activity may not provide high rewards. Policies targeting higher self-employment rates for minority groups should be aware of the nature, quality, and wider context of ethnic minority self-employment when designing interventions.

Motivation

In many countries, ethnic and racial minorities have higher rates of self-employment (see Defining self-employment) than members of the majority community. Indeed, the ethnic entrepreneur is a frequently referenced stereotype in popular culture—for example, the Asian grocer in the UK and the Chinese restaurateur or the Vietnamese shopkeeper in the US. Ethnic or immigrant groups are often thought to have an advantage in business, whether because of lower risk aversion, enhanced access to informal capital, or the ability to produce ethnic goods and supply ethnic markets more efficiently than members of the majority community. Thus, business ownership may be a path to prosperity and assimilation within the host country.

However, the evidence shows that not all ethnic minority or migrant groups have high self-employment rates and that these rates can change over time with generational transitions and the acquisition of human and social capital. Furthermore, rather than a positive route to a higher standard of living, self-employment may be a rational response to restricted opportunities in paid employment. In these cases, self-employment may trap minority workers in a poorly rewarded form of activity, with little employment protection and few opportunities for advancement.

Discussion of pros and cons

Economists typically think of the choice between paid and self-employment as a comparison of the expected net benefits of each alternative form of activity. Thus, understanding the level and nature of self-employment among ethnic minority and immigrant groups involves considering how the costs and benefits vary across minority groups, and between minority groups and the majority group. It is useful to think of ethnic minority self-employment in terms of the contrast between pull factors and push factors.

Pull factors are the (generally positive) influences that tend to attract ethnic minority individuals to self-employment. Pull factors can include such influences as a reduced level of risk aversion (an entrepreneurial spirit or cultural predisposition to business), access to alternative sources of finance, the ability to serve a protected market within an ethnic enclave, and efficiencies in the production or supply of ethnic-specific goods or services.

Push factors, by contrast, are thought of as a less benign set of influences leading to higher self-employment among minority groups and are usually characterized as reflecting reduced opportunities in paid employment. Thus a lower probability of obtaining paid employment or a lower wage compared to majority workers reduces the expected rewards of paid employment and makes self-employment relatively more attractive. It is well-documented that higher unemployment probabilities and lower wages for minority groups result from discrimination in the labor market. If push factors dominate the pull factors, then higher ethnic self-employment rates come about through a process of marginalization rather than as the realization of the particular talents and abilities of the ethnic groups themselves.

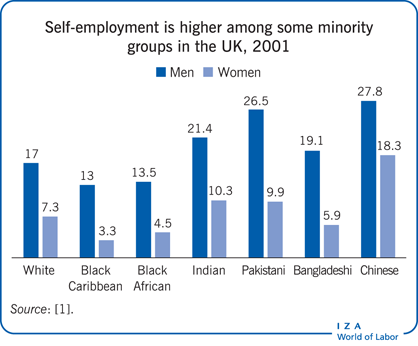

It is crucial to recognize that there is considerable diversity in self-employment rates among ethnic groups and that not all ethnic minority groups will have higher self-employment rates than the majority community. In both the UK and the US, black groups (African and Caribbean in the UK and African Americans in the US) tend to have lower self-employment rates than the white majority, while groups with an Asian heritage tend to have higher rates. Hispanic workers in the US have rates in between those of African Americans and whites. In Germany, immigrant groups from a number of minority backgrounds exhibit a lower propensity to be self-employed than do native Germans. Thus, explanations of ethnic minority self-employment have to take account of this considerable inter-group diversity.

Pull factors driving self-employment

The enclave hypothesis

One of the most influential arguments put forward to explain high ethnic minority and immigrant self-employment rates is the enclave hypothesis. It posits that geographic concentrations of minority groups provide a boost to entrepreneurship in those locales. Such clusters are believed to offer a protected market for the goods and services produced by the minority business that, as part of a self-sustaining ethnic economy, can provide opportunities for employment and economic advancement for group members that are better than in the mainstream (majority-dominated) economy. The mechanisms through which an enclave can boost self-employment are varied and include:

Enhanced access to capital from co-ethnics, possibly through informal channels.

Advantages in the production of ethnic and religious goods.

Sources of labor from people of the same ethnic group.

Less discrimination from consumers.

The enclave hypothesis is typically tested by measuring the association between the probability of an individual being self-employed and the proportion of the population of the local area that is of that person’s ethnic group (co-ethnic). Other factors that are thought to affect self-employment propensity are usually controlled for in a regression framework so that a significantly positive coefficient on the proportion of co-ethnic workers in the locality is interpreted as evidence in favor of the enclave hypothesis. Several studies have estimated such models in a variety of countries with mixed results. While positive effects are sometimes found, particularly for areas with a large Hispanic population in the US, most studies find little effect or even negative effects, which suggests that self-employment is actually lower in enclaves than in less ethnically concentrated areas.

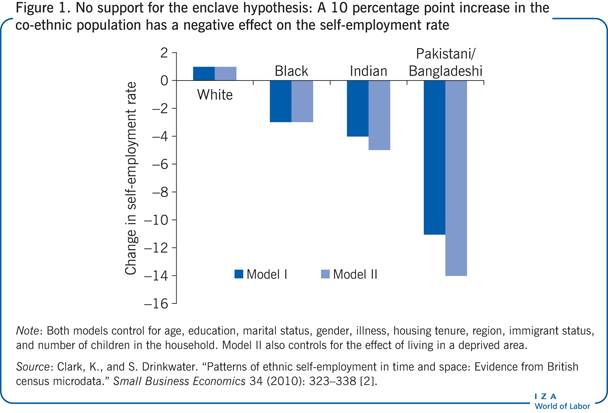

Figure 1 provides an example of some results using individual-level data from the UK census of 1991 for four ethnic groups. These data were matched with characteristics of the local area including the percentage of the population belonging to the same ethnic group as the individual respondent. The figure shows the estimated impact on the self-employment rate of a 10 percentage point increase in the proportion of the local area’s population who are of the same ethnic group as the respondent. The effects were estimated in two statistical models. Both controlled for age, education, marital status, gender, illness, housing tenure, region, immigrant status, and number of children in the household. The model I estimates clearly do not support the enclave hypothesis. For example, a 10 percentage point increase in the local population’s proportion of black residents is associated with a 3 percentage point reduction in the predicted black self-employment rate. Because ethnically concentrated areas in the UK are also relatively deprived areas, model II also includes a measure of local deprivation: the unemployment rate. Controlling for this, however, makes little difference in the estimated enclave effect. Another potential explanation for the negative correlation between self-employment rates and the local proportion of co-ethnics is that co-ethnic business competition is higher in such areas [2].

There is also some doubt about the importance of ethnic-specific goods and services to minority businesses. In the UK, for example, only 20% of entrepreneurs reported that they produced goods that had a particular ethnic significance, and entrepreneurs who lived in areas where there were more co-ethnics were, if anything, less likely to deal in such goods. Bangladeshi and Chinese entrepreneurs were more likely than others to produce ethnic goods, though it seems likely that these goods were not intended exclusively for consumption by co-ethnics. Indeed, 75% of entrepreneurs reported that members of the majority community were their main customers [3].

More recent evidence for New Zealand shows that, rather than the proportion of co-ethnic residents in the local area, what is important for minority business formation is the interdependence of an individual’s self-employment decision with the decisions of other co-ethnic individuals who are located sufficiently close to form a network [4]. This finding operationalizes the idea of “ethnic capital,” whereby membership in an ethnic group provides access to a set of potential advantages in securing outcomes such as education, employment, and in this case entrepreneurial success. This is a more sophisticated approach to modeling geographic interdependencies between co-ethnic self-employment decisions and may reinvigorate the idea of the enclave as a supportive community underwriting minority business success.

Culturally determined propensity toward entrepreneurship

Another example of a pull factor is the idea that minority groups, who are largely immigrants or the descendants of immigrants, have some culturally determined propensity toward entrepreneurship. This broad line of argument has a number of strands, one of which considers whether migrant or minority workers from countries with higher self-employment rates are more likely to start a business in the host country. If this were true, it would mean that entrepreneurial activity could effectively be imported by suitably designed immigration policies. The evidence on this question is mixed. Early studies found a positive link between home and host country economic activity on the part of immigrants, but the most convincing results from the US and Sweden find little influence of home country self-employment rates on individual self-employment propensities in the host country [5], [6]. It is also worth considering that such research may not be addressing the correct question: other US evidence has suggested that an individual’s direct self-employment experience in the home country increases the likelihood of self-employment after migration. In a sample of new immigrants to the US, previous entrepreneurial experience increased the probability of being self-employed by 0.07 compared with a baseline probability of 0.10 [7].

Lower risk aversion

Another aspect of specific immigrant origins concerns risk aversion. The willingness to migrate is often viewed as indicative of a lower degree of risk aversion, something that is often found to be associated with entrepreneurial activity. In a sample of migrants living in Ireland, respondents’ risk attitudes were measured using a combination of self-reported data and responses to a variety of hypothetical risk scenarios. Those reporting higher tolerance of risk were significantly more likely to be self-employed [8]. This provides a potential causal mechanism through which the migration experience can influence self-employment and may constitute another type of pull factor. It is less clear, however, how the risk preferences of second or later generations will be affected by their (parents’ or grandparents’) experiences of migration, and thus the effects may not persist beyond the first generation.

Push factors driving self-employment

The essence of the push factor explanation of high ethnic minority self-employment rates is that a negative shock that reduces the expected net benefits of paid employment reduces the opportunity cost of self-employment and so encourages entrepreneurship. In principle, this shock could come through a variety of channels, but the push factor hypothesis typically focuses on discrimination in the paid labor market. Non-majority ethnic groups face poorer labor market outcomes in many developed countries, and this disadvantage can be only partly explained by lower endowments of human capital such as education, skills, or training. For example, in the UK, non-white men earn at least 10% less than similarly qualified white men, though with substantial variation by ethnic group: 27% less for black African and Bangladeshi men and 15% less for black Caribbean and Indian men. The ethnic pay penalties are somewhat smaller for women, ranging from 1% less than white workers for Chinese women up to 18% less for black African women. Non-white groups also face unemployment rates that are roughly double those of the majority white group [9].

This type of evidence provides a prima facie case for a push factor explanation of ethnic self-employment, with ethnic entrepreneurship viewed as a rational response to restricted opportunities in obtaining (well-paid) work. Studies have also found more direct evidence that constraints in the paid-labor market affect minority self-employment. Research in Germany finds that perceptions of being the victim of discrimination are strongly and significantly associated with the likelihood of being self-employed [10]. In the UK, the expected earnings differential between self- and paid employment has been shown to be an important determinant of the decision of ethnic minority workers to go into business [3]. In Canada, estimates suggest that a 10 percentage point increase in the expected earnings differentials between paid and self-employment increases the immigrant self-employment rate by 1.6–2.5 percentage points, and a 10 percentage point increase in unemployment rates increases the self-employment rate among first-generation immigrants by 6.6 percentage points [11]. Similarly, in the US much of the growth in self-employment during the Great Recession was found to be driven by unemployment, and unemployment rates have risen more for Hispanic and African American workers than for white and Asian workers [12].

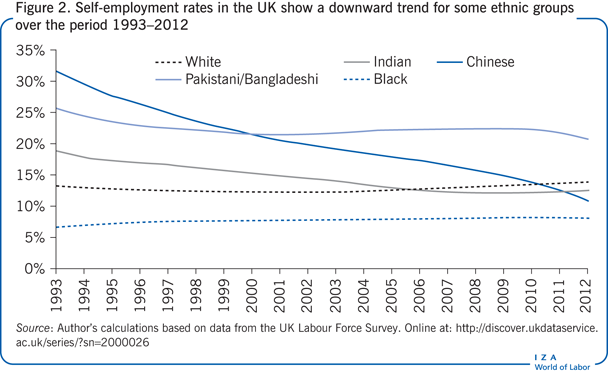

Changes in self-employment rates over time also provide evidence that self-employment among ethnic minority groups should be viewed as a (possibly transitory) response to the difficulties of success in the paid labor market. Self-employment rates for selected ethnic groups in the UK over 1993–2012 show a clear downward trend for Indian and Chinese ethnic groups and a slightly slower decline for Pakistani/Bangladeshi groups (Figure 2). Over this period, Indian and Chinese residents in the UK substantially increased their average levels of educational attainment and achieved employment rates and earnings in the paid labor market that are, on some measures, better than those of the white majority group. Second and higher-generation members of these groups have eschewed entrepreneurship in favor of professional and managerial jobs, which their higher qualifications have opened up to them. These declines in self-employment rates can be interpreted as a positive development for the groups concerned.

Ethnic self-employment is often concentrated in poorly rewarded sectors of the economy. The 1991 UK census shows that 80% of Chinese entrepreneurs were in the restaurant trade; in practice, many of the businesses are small takeaway establishments. More recent UK estimates show that fully half of self-employed Pakistanis are taxi drivers. In the US, black and white entrepreneurs concentrate in different industries, with black people less well represented in construction, manufacturing, and financial services while overrepresented in less well-rewarded sectors such as personal services [13].

Business success, measured in both survival rate and profitability, can thus be expected to vary by ethnicity. The data bear this out. Substantial differences in rewards are found in the UK, where Chinese and Indian entrepreneurs do much better than Pakistani, Bangladeshi, and black groups. Data for Germany support the finding of considerable variation in self-employed earnings between different groups, with some groups earning more on average than native Germans [10].

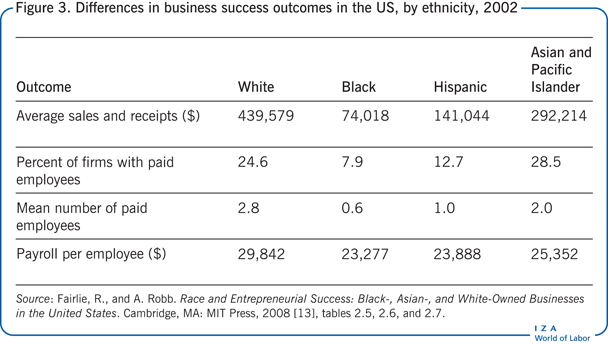

Evidence on business outcomes for the US also supports the notion of differences by ethnicity. Turnover, profits, and payrolls are much lower for black-owned firms than for white-owned firms (Figure 3). Some of these disparities are very large, with white-owned firms having average sales and an average number of paid employees around five times higher than black-owned firms. Asian-owned firms do considerably better than black-owned firms and surpass white-owned firms on some outcomes. Hispanic firms lie somewhere between the black and Asian groups on all reported success measures [13].

Analysis of the determinants of business success suggests that, as in the case of paid employment, human capital in the form of formal education is positively related to higher self-employed earnings and other measures of business success for self-employed individuals. However, other forms of capital are also important for self-employment success. Start-up finance is particularly important due to liquidity constraints that potential entrepreneurs face in capital markets. Differences in start-up capital related to wealth difference have been estimated as the single biggest factor explaining differences in business success between black and white entrepreneurs in the US. Data for several countries show ethnic differences in access to formal bank finance for small enterprises, although it is not clear to what extent this is due to racial discrimination. Other determinants of business success include having prior experience in a similar business; again, black people in the US tend to have less experience, which affects their business success compared with other ethnic groups [13].

Two further aspects of the ethnic minority self-employment experience should be mentioned. First, people who are self-employed tend to work longer hours than people in paid employment. Evidence from a number of countries suggests that this tendency is even more pronounced for ethnic minority self-employed individuals. Measures of business success may therefore need to be interpreted, and adjusted downward, in the light of the additional labor that is being supplied. Second, to the extent that minority groups are over-represented in self-employment, it should be noted that people who work for themselves are less likely than people in paid employment to enjoy the benefits of employment protection, minimum wage laws, or employer-funded pensions.

Limitations and gaps

Given the huge diversity in self-employment rates and forms of activity across ethnic groups and the complex set of potential influences on the decision to become self-employed, no single theory can explain ethnic minority self-employment. Some groups that face considerable discrimination in paid employment have higher than average self-employment rates, while other groups that face similar levels of discrimination have lower than average self-employment rates. In the UK, the contrast between the Pakistani and black Caribbean groups illustrates this point. Teasing out the separate effects of paid employment obstacles and other group- or culture-specific factors can go some way toward explaining these differences. It would also be useful to examine the migration histories of each group to understand why entrepreneurship plays a more or less important role in labor market behavior.

It is also important to consider the heterogeneity of self-employment itself. The term can encompass a wide range of activities, describing those who own large-scale businesses with high turnover and payroll as well as those who, working solely on their own account, provide a service to others that could equally well be provided through a standard paid employment contract but that, for tax or other reasons, is classified as self-employment. Ethnic variations in the nature as well as level of self-employment are likely to influence judgments of the extent to which this form of activity is a route to integration and prosperity or is a more marginal form of activity.

Research into self-employment is also limited by the fact that the data sets available to researchers do not consistently include potentially important variables. An accurate comparison of the rewards in paid and self-employment requires a consistent definition of self-employed earnings, which is typically not the case for the large-scale social surveys used to investigate these issues. Also, researchers may not have much information on sources of start-up capital or how much prior work experience entrepreneurs have in related fields. Data sets that have comprehensive information on paid employment may lack such key information on self-employment and vice versa.

Summary and policy advice

There is considerable diversity in self-employment rates across ethnic groups. Not all ethnic minorities have higher self-employment rates than the majority community. It is useful to think of two sets of influences on ethnic minority self-employment rates: pull factors and push factors. Pull factors describe, mainly positive, group- or culture-specific attributes of the minority that make self-employment more attractive. Push factors depict ethnic minority self-employment as a negative reaction to blocked mobility within the paid labor market. While there is empirical evidence in favor of both views for some groups in specific locations at specific points in time, the overall impression from a wide variety of research in different countries is that the push factors tend to dominate.

The implication for policymakers is that the existence of high self-employment rates among some ethnic groups cannot simply be taken as a sign of economic health and may, rather, be symptomatic of discrimination by the majority community. Policymakers need to understand the heterogeneity of the ethnic experience of self-employment both within and between groups. In some countries, higher self-employment rates are frequently a policy target, based on the view that entrepreneurial activity is inherently desirable and will lead to growth and economic prosperity. The experience of many minority groups suggests that policymakers need also to understand the reasons underlying self-employment, its nature and outcomes, before promoting this form of activity as a socially desirable goal.

The quality, as well as the quantity, of self-employment matters if it is to enhance the welfare of ethnic minority groups. Policies that go beyond simply promoting entrepreneurship may be necessary. For example, addressing discrimination in access to capital through fairer bank lending can level the playing field for potential minority entrepreneurs to establish and grow their businesses. Promoting the uptake of pensions by the self-employed or implementing regulations to reduce working hours and improve conditions may also help. Finally, addressing the persistent disadvantage faced by minority workers in paid employment, while it may reduce the minority self-employment rate, is an important policy goal for government.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Professor Steve Drinkwater for many rewarding years of collaboration and discussion on these issues. The usual disclaimers apply.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Ken Clark