Elevator pitch

Poor people in developing countries can benefit from saving to take advantage of profitable investment opportunities, to smooth consumption when income is uneven and unpredictable, and to insure against emergencies. Despite the benefits of saving, only 41% of adults in developing countries have formal bank accounts, and many who do rarely use their accounts. Improving the design and marketing of financial products has the potential to increase savings among this population.

Key findings

Pros

Demand for savings seems to be high.

Access to low-cost savings accounts increases savings and improves measures of individual well-being.

Marketing campaigns and account features that try to overcome psychological obstacles to saving show promise in increasing take-up and use of savings accounts.

Technological innovations, including mobile banking and direct deposit options, have the potential to expand access to and use of savings accounts.

Cons

Simply increasing the interest rates on savings accounts does not seem to raise savings.

Most financial-literacy interventions have had little or no effect on savings but may be an important complement to other interventions.

Interventions that encourage people to open savings accounts do not guarantee that they will make deposits into those accounts.

Poor service and lack of trust in banks can reduce the effect of savings accounts.

Many poor people hold expensive debt, and reducing that debt might be a higher priority than accumulating savings.

Author's main message

By increasing the availability of low-cost savings products and matching their design to the needs and constraints of poor people, financial institutions and policymakers can provide tools that increase investment and improve welfare. Strategies that address behavioral factors related to savings show particular promise. Inexpensive account features or interventions such as labeled accounts and text message reminders have raised savings in several countries.

Motivation

Poor households may not be able to afford not to save. They often have opportunities to make investments with high returns, and because farmers and the self-employed have irregular incomes, they need to be able to smooth their consumption across high- and low-earnings periods. Despite the importance of savings for poor households, only 41% of adults in developing countries have savings accounts, and, in many settings, fewer than half of the people who open accounts ever use them for deposits or withdrawals. Access to low-cost savings accounts can profoundly affect the amounts households save, invest, and consume. Products that address the specific needs and constraints of poor households in developing countries can make financial access more powerful in mobilizing deposits and improving economic well-being.

Discussion of pros and cons

Policies shown to increase savings

Demand for savings appears to be high, and access to low-cost accounts has substantial effects on savings and measures of individual well-being. Several randomized controlled trials have evaluated the effect of offering individuals access to savings accounts. In these experiments, participants are typically offered assistance in opening bank accounts, such as help in filling out forms, meeting identification requirements, and overcoming other informational barriers that might discourage them from opening an account. The experiments also usually waive account-opening fees and cover the minimum balance required to open an account, thus easing credit constraints that might prevent account take-up. Some experiments also temporarily waive transaction fees on withdrawals. All the experiments evaluate savings products that are either already locally available or very similar to an existing product available from local microfinance institutions or commercial banks. Data to assess outcomes (savings balances, assets, transfers, profits, consumption, health, and other welfare measures) come from administrative data on savings and from surveys that measure investments in businesses or other entrepreneurial activities.

High take-up rates for existing financial services

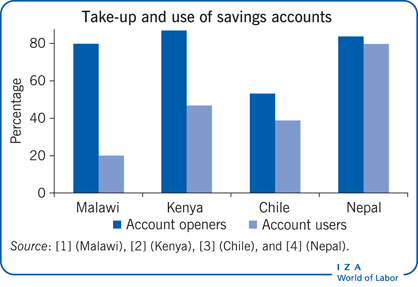

A key measure of the utilization of formal financial services is account opening, often called “take-up.” Take-up of savings accounts is often very high. In one study, 87% of market vendors and bicycle taxi drivers working from a trading center in rural Kenya who were offered accounts chose to open them [2]. In another, 84% of female heads of household in Nepali slums opened accounts with a local non-governmental organization. However, other studies have found somewhat lower take-up: 53% of members of a Chilean microfinance organization who were offered savings accounts chose to open them. In Malawi, tobacco farmers were offered a bundle of financial products that included direct deposit into individual savings accounts; just before harvest, more than 80% opened accounts and enrolled in direct deposit [1]. All of the experiments reduced the information barriers and financial costs of opening accounts, demonstrating that even small costs can be big obstacles. Simplifying account-opening processes and removing fees for no-frills accounts can sharply increase account ownership, especially for customers who are often illiterate, lack formal identification documents, and may be uncomfortable interacting with bank officials.

Large effects on financial assets despite low use

Despite high willingness to open savings accounts, use of those accounts lags behind take-up. The Kenya study found that less than half of those who opened accounts ever made a deposit or withdrew funds. In Chile, while 73% of participants who opened accounts either deposited more than the minimum amount initially or made a subsequent deposit, the remaining quarter of customers never used their accounts [3]. About 20% of the Malawian farmers deposited at least some money into their accounts. Use of the accounts was highest in Nepal, where 80% of participants made at least two deposits within the first year of opening the account—and many made far more, with an average of 44 deposits in a one-year period.

Despite incomplete utilization of the accounts, all three studies found big effects of access to savings accounts on the amount saved and on other outcome measures. Monetary assets—concentrated on savings in the bank—increased, an almost mechanical effect of the savings accounts. Non-monetary assets did not decline, suggesting that money in the accounts represents an increase in savings, not just a change in assets.

Positive welfare implications, particularly through investment

The studies consider welfare measures appropriate to their populations—recognizing that increased savings do not automatically imply increased well-being—by looking at whether profits, consumption, or other indicators improve. The population studied in Kenya are business people, so investments, which have the potential to improve profits, are an important outcome. For account holders, investments in businesses increased an average of 60%. In Kenya, the benefits were concentrated among active account-users. For those who use their accounts actively, investments doubled. As a result, account users can spend more on food and other items, although the results are somewhat imprecise. Similarly, the farmers in Malawi increased their investments in fertilizer and had higher earnings the next season. In Nepal, those offered accounts increased spending on education, some food items, and on festivals, and they reported improvements in their subjective assessments of their financial situations [4]. In Chile, those with savings accounts borrowed less, were better able to smooth consumption following an emergency, and were much less anxious about their financial situation [3].

Overall, there is considerable evidence that reducing barriers to formal savings accounts increases:

savings;

asset accumulation;

investments; and

consumption.

The benefits to those with business opportunities—the market vendors in Kenya and the cash crop farmers in Malawi—are especially notable, because they lead to investments with apparently high returns.

Overcoming psychological barriers through commitment savings accounts and direct deposits

There are clear advantages to designing products that match the behavioral as well as the economic factors that influence decisions about saving and consuming.

While simply reducing the informational and financial barriers to opening basic savings accounts has big effects, several studies have gone further, accounting for psychological and social obstacles to savings. People sometimes have trouble adhering to their own plans for saving money. Economists have tested products like commitment savings accounts that may mitigate the constraints imposed by social norms and help overcome time-inconsistent preferences. Accounts with commitment features can boost savings and investment when time-inconsistency is an obstacle. Simple interventions such as labeling accounts or reminding people of their savings goals are also effective strategies designed to address other psychological phenomena that may reduce savings.

Unlike ordinary or “liquid” savings accounts that allow money to be freely withdrawn, commitment savings accounts have features that allow users to voluntarily restrict their access to funds until they reach a specific target date or amount saved. Commitment accounts operate much like the fixed-deposit accounts available in many developed countries, but they allow users more flexibility regarding the maturation period. These accounts are useful for saving money for future use by guarding against the temptation to spend the money before reaching the goal. For example, farmers, who receive most of their annual income right after harvest, can use commitment savings accounts to save for next year’s agricultural investments. The self-employed and others who earn irregular incomes can use the accounts to save money from high-income periods to support consumption in low-income times. The accounts are also useful for accumulating money to make a large, indivisible purchase such as a piece of farming equipment or a major home appliance, since customer credit for purchases and many investments is severely limited. Additionally, commitment accounts are popular with banks as well as customers, because they stabilize bank portfolios.

The evidence about the impacts of these accounts is positive along two dimensions: the accounts appear to increase savings in the short term, and also generate longer-term benefits. An early study of commitment accounts in the Philippines demonstrated that such accounts could increase savings while the accounts were active and even change savings patterns after they expired. A study in Kenya tested the commitment mechanism without using savings accounts: It showed that advance purchase of fertilizer, which is effectively a commitment to spend money for fertilizer rather than for other purposes, sharply increased investment in this profitable agricultural input [2]. In Malawi, one treatment arm offered farmers ordinary savings accounts while another gave them a choice between an ordinary account and a commitment account [1]. Most farmers who opened commitment accounts chose release dates that corresponded with the upcoming planting season. These farmers appear to have invested more and had larger profits than the farmers who opened ordinary accounts, although the comparison between the account types is inconclusive.

Commitment accounts are not comprehensive savings vehicles and so are best paired with other savings tools. Commitment accounts are useful for people with specific preferences or constraints; they facilitate saving for an indivisible investment or purchase at a specific time of year, or saving to smooth consumption. These accounts are not appropriate for general precautionary savings or for savings for day-to-day use. The channel through which these accounts improve outcomes is still unclear. In Malawi, opening commitment accounts had big effects on farmers, even though farmers ultimately deposited little money into the accounts [1]. That suggests that restricting access to funds may not be the mechanism that affects outcomes.

Since transaction costs and time-inconsistent preferences both reduce the tendency to make deposits, commitment and ordinary savings accounts can be augmented by other design features to increase the amount saved. Direct deposit, which is widely available to salaried workers in developed countries, can reduce these obstacles to saving. Direct deposit played a major role in increasing savings among farmers in Malawi [1]. New studies are investigating whether making savings the default will have sustained welfare effects.

Encouraging saving through labeling and reminders

Other design features can enhance the effect of ordinary savings accounts without restricting access to the funds. Inexpensive features such as labels and reminders that incorporate behavioral factors like time-inconsistent preferences and limited attention can enhance the effect of standard savings products.

Labels, which earmark money for a specific purpose, can reduce the temptation to use the money for other purposes. Savings-group members in Kenya placed a high value on simple piggybanks to set aside money for health care costs, noting that having a separate place to save for health care needs helped them control spending on so-called “temptation” goods like snacks or alcohol [2]. This simple intervention increased spending on preventative health measures by 66–75%. Keeping money in a separate health savings account greatly reduced the risk that a household would be unable to afford medical treatment. Designating the piggybank or the savings account for a specific purpose acted as a “mental accounting” device: people behaved as though the money was non-fungible and were more likely to use it for its designated purpose. This sort of mental accounting may also help explain the success of commitment savings accounts in Malawi by encouraging farmers to think about “fertilizer money” separately from other money and to adjust their savings accordingly [1].

Another strategy for increasing savings is to remind people of their savings goals and progress toward these goals. Researchers worked with banks in Bolivia, the Philippines, and Peru to test whether text-message reminders about savings goals would lead to increased deposits [5]. Some of the reminders mentioned savings goals identified by clients, while others did not. The reminders increased savings by 6% on average. The increase was driven entirely by the messages that mentioned specific savings goals—those messages raised savings by 16%. Text messages also increased savings among account holders in Chile [3]. Messages tripled the number of deposits and the average amount deposited each month. Reminders likely helped savers keep sight of their goals and strengthened their resolve to avoid the immediate gratification of smaller purchases in the short term.

Technological innovations to improve access

Rapid changes in technology present another opportunity to improve the effectiveness of savings products. Serving the poor through brick-and-mortar branches can be expensive for banks, which have to staff and maintain the branches, and for customers, who may have to travel long distances to deposit or withdraw money. Mobile money and other forms of electronic transfer have expanded rapidly, especially in sub-Saharan Africa. One study finds that 16% of adults in the region have used mobile money, although typically to send and receive funds rather than as a savings vehicle [6]. There is well-documented evidence that mobile money reduces the costs of using informal insurance networks to smooth consumption.

Mobile money changes the way customers access money, often in ways that reduce their financial or time costs. Among adults who do not have savings accounts, 20% report that distance to the bank prevents them from opening accounts. The expansion of mobile network coverage and mobile cash agents can sharply reduce this barrier.

Electronic payments can reduce costs of administering aid programs and increase financial inclusion of the poor. Large-scale programs in several South American countries and in South Africa have transitioned to electronic payments, and India is making a similar shift. How such changes affect administrative costs and the savings and welfare of beneficiaries varies with the quality of the local banking infrastructure. A study in Niger of transitioning from cash distribution to mobile money distribution of aid payments found not only that mobile money was more cost-effective but also that it allowed recipients to consume a wider variety of foods and other goods [7]. While this study does not evaluate savings directly, it demonstrates the possibility that simply changing how people access their money can have real welfare consequences.

The most basic form of mobile money allows value to be stored on a mobile phone handset and transferred to another handset using SMS (short message service). While this technology can be used as a savings account, it is costly—transaction fees are higher than typical withdrawal fees, and accounts accrue no interest.

Responding to perceived demand and market opportunity, several mobile providers have introduced products that are designed as savings accounts. One such product, Safaricom’s M-Shwari accounts, operates in partnership with a fully licensed bank in Kenya. Demand for the product is high: More than two million accounts were opened in the first four months after the product was launched, with deposits totaling $47 million [6].

Mobile providers in Mozambique and Rwanda are now offering commitment savings products; evaluations of these products are ongoing. Mobile savings products are new, but the evidence suggests that this technology has the potential to reach many currently unbanked households.

Policies that have not succeeded in increasing savings

Lack of savings response to interest rates

While expanding access to savings by reducing the price of opening an account led to high take-up, moderate utilization, and sizable welfare effects, efforts to encourage savings by increasing interest rates have been far less successful. And while text messages were effective in increasing savings in Chile, increased interest rates were not [3]. In an earlier round of experiments, the Chile study compared low-fee bank accounts paying near-zero real interest with two alternatives: the same basic bank account plus enrollment in a self-help accountability group, and a bank account with the same low fees but a 5% real interest rate. While the self-help led to a tripling of deposits relative to those in the standard bank account group, the higher interest rate had no effect at all.

A study in the Philippines found similar results for interest rates. Accounts with a market rate of 1.5% interest were compared with accounts paying 3% interest, and with accounts paying the higher interest rate only if clients met savings goals they set for themselves. Neither the share of clients opening accounts nor the amount saved increased when the bank offered a higher interest rate [8].

Providing account opening assistance and reducing the up-front costs and fees associated with savings accounts have been very successful strategies for getting people to open accounts and moderately successful in getting people to use the accounts. However, interest rates appear to be less of a draw, at least among predominantly unbanked populations. Why fees and account-opening processes are bigger barriers to savings than low interest rates is unclear, but possibilities are that people are credit-constrained and cannot afford the up-front costs, that they are present-biased and place more weight on up-front costs than on the loss of future interest, or that people distrust banks. Regardless of the mechanism, current evidence supports a focus on lower fees and other obstacles to access rather than higher interest rates.

Limited effect of improving financial literacy

While studies have directly tested the effect of interest rates on savings in developing countries, there is less direct evidence about the effect of financial literacy training. Both financial literacy and savings levels are low in developing countries, but the correlation may be driven simply by low incomes. In the US, evidence on the effectiveness of financial literacy programs is decidedly mixed and focuses on outcomes without direct analogs in developing countries, such as retirement planning, portfolio mix, and propensity to declare bankruptcy. Two randomized controlled trials in Indonesia show very limited evidence of an effect of financial literacy programs on relevant outcomes. The first tests a short, classroom-based program offered to unbanked households in Java by a local non-profit organization. The training had negligible effects overall, although it did increase the probability of opening a bank account among illiterate households [9]. The second study tested a longer, more comprehensive program that used video lessons delivered in five weekly sessions. That study included more nuanced measures of financial literacy, and the training strongly increased financial knowledge, but had no effects on financial behavior [10].

Ongoing work in Ghana and other developing countries is now evaluating the effect of financial literacy training for children and youth, with the idea that children may form good savings habits that serve them well throughout their lives, and may even influence the spending and savings patterns of their parents.

Many studies that test the effect of access to savings accounts also provide some financial literacy training. In the study of farmers in Malawi, for example, members of the control group were not offered any financial products, but they did receive training in budgeting. The treatment groups also received the same training. The study was thus able to estimate the marginal effect of access to financial products beyond the effect of the financial literacy component. Because it is often difficult to offer new financial products to unbanked populations without providing at least some financial information, the possibility cannot be ruled out that financial literacy, while not effective on its own, might enhance the effectiveness of other interventions.

Limitations and gaps

While high-quality, randomized controlled trials provide good guidance about the effects of access to formal bank accounts and the design features that make accounts most effective, more research is necessary to understand the mechanisms through which financial products improve savings and welfare outcomes.

More is known about strategies that are successful in generating take-up of savings accounts than about strategies that increase use of the accounts. More work is needed to understand the conditions and personal characteristics under which access to savings accounts is likely to result in increased amounts saved.

More research is needed to identify the combination of financial products that are most suitable for poor households. The poor have complicated financial needs, including:

smoothing consumption;

accumulating money to purchase assets; and

building savings cushions to meet unexpected expenses.

Many studies do not differentiate among these goals or explicitly evaluate products for their ability to help households meet diverse needs. Moreover, most studies evaluate a single financial product without considering what combination of saving strategies might be appropriate for meeting households’ multiple goals (see Motives for saving).

Finally, few studies address the simultaneous borrowing and saving by poor households or ask whether households would be better off accumulating savings or reducing debt.

Summary and policy advice

Many well-designed randomized controlled trials have evaluated strategies to promote saving in developing countries. The evidence from these studies is largely encouraging: Increased access to low-cost savings accounts leads to higher savings and, even more important, to higher investments and consumption, and better health. Strategies that address behavioral factors related to savings, such as time inconsistency or limited attention, show particular promise. Commitment savings accounts led to long-term behavioral changes in the Philippines and big increases in investments in Malawi. Inexpensive account features or interventions such as labeled accounts and text-message reminders have raised savings in several countries in South America. Mobile banking, which is expanding rapidly across sub-Saharan Africa in particular, has the potential to give millions of people access to formal finance.

Service providers should focus on designing products for the specific needs of the poor. The products should be low cost in order to increase take-up, and, where trade-offs must be made, low fees are more important than high interest rates. It is important to offer a range of products specifically designed to help people save for multiple purposes, including investments, and to cope with emergencies. The poor—like households in developed countries—may benefit from access to multiple products. Low-cost account features and marketing schemes can be efficient ways for banks and customers to increase deposits. While much of the evidence speaks to financial service providers’ design of products, governments and other organizations can facilitate access to accounts by subsidizing fees and offering add-on services like reminders to save.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Jessica Goldberg