Elevator pitch

A postsecondary degree is often held up as the one sure path to financial success. But is that true regardless of institutional quality, discipline studied, or individual characteristics? Is a college degree always worth the cost? Students deciding whether to invest in college and what field to study may be making the most important financial decision of their lives. The return to education varies greatly by institutional quality, discipline, and individual characteristics. Estimating the returns for as many options as possible, and making that information as transparent as possible, are paramount in helping prospective students make the best decision.

Key findings

Pros

College is worth the investment for most people, most degrees, and most levels of debt.

Money does not capture the full value of a postsecondary education.

Rising college costs underscore the need for increased transparency in the economic value of a degree to students.

Estimates from the literature can be used to inform policies such as differential tuition and student loans.

Cons

Returns across different fields of study differ substantially.

Evidence is mixed on the differences in returns across institution types.

Students are increasingly pursuing degrees with less public benefit and greater financial benefit due to increased tuition debt.

Estimating the return to education is difficult due to unmeasured ability.

The decision to attend college and what field to study are far from random: smarter people are more likely to attend college and to attend more selective institutions.

Author's main message

Education remains the most certain path to financial stability. However, while this is likely true for most people, the benefits of a four-year degree may not outweigh the costs for everyone, especially in light of high tuition costs and different rates of return for different college degrees. Estimating the returns for as many options as possible and making that information as transparent as possible for prospective students are important for informed decision-making. Understanding how the returns differ is key to efficient pricing of tuition and has implications for relatively new policy instruments, such as government support for differential tuition—charging more for degrees with higher rates of return.

Motivation

It is often assumed that a college degree is a crucial and perhaps even essential component of financial success and independence. As has become even more evident in the aftermath of the global financial crisis of 2008–2009, the dominant motivation for attending college has long been improved financial and job prospects. While scholarship for the sake of bettering oneself is still lauded, the financial rewards of higher education are undeniably the key reason for the recent growth in college enrollment.

Given these motivations and the soaring cost of education in many parts of the world, it is essential that prospective students and policymakers understand the economic return that comes with a college degree and how this return differs across disciplines and types of institutions. There is considerable evidence that all college degrees are not created (financially) equal. For students, this means that decisions made at age 18 can have substantial lifelong consequences. For policymakers tasked with spurring growth in a tough economic climate, understanding which institutions and degrees create value for their students can help inform decisions that will shape the higher education landscape for the next generation.

Discussion of pros and cons

The decision to attend college involves nonrandom selection

Measuring the economic return to a college degree, or more generally, to an additional year of education, is one of the oldest and most often-studied topics in modern microeconomic research. Despite a substantial literature, the problem of nonrandom selection continues to cloud what, on the surface, appears to be a relatively straightforward question.

To understand the problem, first consider that the decisions of whether to attend college, which school to attend, and what field to study are far from randomly made. Smarter people are more likely to attend college, attend more selective institutions, and (to a lesser extent) major in more demanding and financially rewarding fields of study. There are other potential sources of bias discussed in the literature, but ability bias is the most straightforward and thus receives greater attention in this paper.

Examining the reasons why smarter people get more education is not the focus of this paper, but it is important to recognize that the reasons go beyond simply being able to handle the advanced coursework. Furthermore, as with much of the literature described here, this paper deals primarily with average statistics. It is certainly true that there are many brilliant people who did not attend college and a considerable number of college graduates who are not particularly competent, but on average people who choose to attend college tend to be smarter.

The question then becomes: How much of the college premium observable in the population is due to a student going to college and how much to the average college student being smarter than the general population? If the premium were due entirely to intelligence (it is not), meaning that college graduates would be paid equally well whether they attended college or not, then the implications for students’ education decisions would be radically different than if the entire college premium were due to the important skills and connections obtained in college (this is also not the case).

Just as attending college is not a random event, neither is attending a highly selective institution or majoring in a demanding field. Graduates of Harvard or Oxford earn more on average than graduates of a local college, in part because of the talents that got them into a top-tier institution in the first place. These graduates would likely have been financially successful regardless of the school they attended. While the degree of selection into specific disciplines is certainly less than that of selection into college, there are fields of study that, on average, attract smarter students as well. Researchers deal with these problems in a number of different ways, the technical details of which are beyond the scope of this paper.

Additional education has a positive causal effect on future earnings

The Organisation for Economic Co-operation and Development (OECD) produces an annual report, Education at a Glance, that offers a glimpse of the raw differences in earnings between college graduates and people with a standard secondary education across various countries. While the report does not address nonrandom selection into college, the data do provide a useful baseline for policymakers. Across all OECD countries, a postsecondary education is associated with an earnings premium of roughly 64% over a high school (or upper-secondary) education. This premium varies considerably, and somewhat predictably, across countries. For instance, in countries whose upper-secondary education is known to be rigorous, the premium for a postsecondary education is smaller. Conversely, in somewhat less advantaged countries, where access to higher education is limited and influenced to a large degree by family background, the premium is much greater. There are, of course, numerous other factors that influence the relative premia as well. Examples of countries on the low, middle, and high portions of the spectrum are New Zealand (18%), Denmark (28%), Belgium (29%), the UK (57%), the US (77%), Argentina (156%), and Chile (159%).

Qualitatively, a positive causal effect (after accounting for the nonrandom selection described earlier) of additional education on future earnings is a near-unanimous finding in the literature. The magnitude of the effect is less clear, however. Surveys of the literature document wage premia ranging from 5% to 12% a year for studies using US data, with most estimates between 7% and 10% [1]. The difference in estimated returns is due in large part to a sensitivity to the sample analyzed and the method of dealing with nonrandom selection. Extrapolating this out to a four-year college degree, the literature estimates returns in the range of 20–48%. While there is evidence of returns being concentrated around degree or certification milestones (that is, a much greater return associated with going from three years of college to a college degree than going from two years of college to three), this range does a good job of summarizing the literature.

A survey of the returns to education across 15 European countries shows how the education premium varies with demographic characteristics, such as gender and labor force experience [2]. A study presenting evidence on the rate of return to education from an even wider set of countries, and focusing more on the returns in developing countries, finds that returns are much greater for lower income countries [3], similar to the OECD data.

Keep in mind that these reported figures represent average returns. Some people likely gain substantially more as a result of their education, while others gain much less. Some of the reasons for these differences in economic return, such as the type and quality of school attended and field of study, can be fairly easily quantified and are described below. Other factors are more difficult to pin down.

Differences in return across the wage distribution

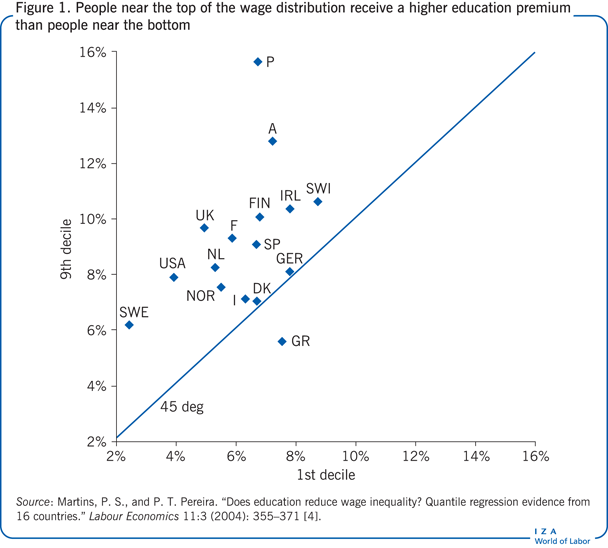

A study of the return to an additional year of education across 16 countries—15 European countries and the US—finds that people at the top of the wage distribution receive a larger education premium than people near the bottom of the distribution [4]. Using an econometric technique known as quantile regression, the study finds this pattern in 15 of the 16 countries examined. Greece is the only exception. This pattern could be indicative of any number of mechanisms, such as a greater return to education for high-ability people or differences in the quality of schools attended by people at the top and bottom of the wage distribution. These results, shown in Figure 1, add a twist to the traditional narrative of education creating a more equal society, suggesting instead that additional education may even increase inequality (although it still makes everyone better off). A data point on the 45-degree line indicates that the returns to education are equal (in percentage terms) for an individual at the ninth decile and one at the first decile of earnings, while data points above the line indicate higher returns for those with higher earnings.

Economic return varies by discipline

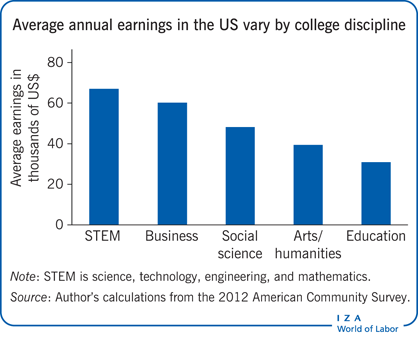

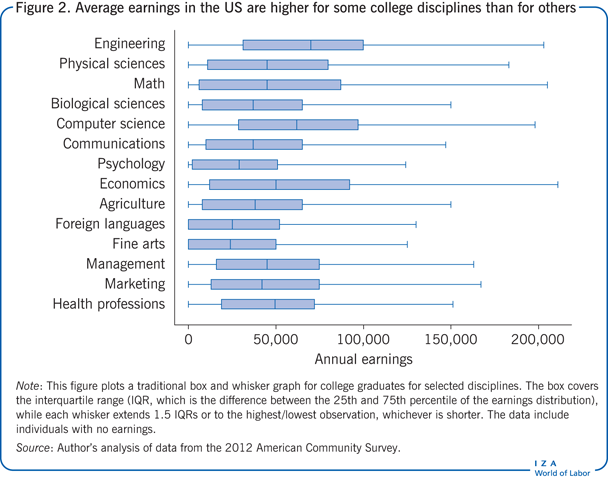

Relative premia can also differ according to a college graduate’s field of study (see [5] for data on raw differences for the UK). The relative rank of earnings by discipline is generally not surprising. The most technical and quantitatively focused disciplines (such as engineering, computer science, economics, and finance) tend to have the largest education premia, while the less quantitative arts and humanities disciplines tend to have much smaller education premia, a difference that appears to be due both to lower wages and a lower probability of being employed. Figure 2 gives a sense of the average earnings for various disciplines and the spread between them for the US.

But while earnings vary, are there actually different premia, in a causal sense, associated with different disciplines? A student’s choice of a major discipline in college is far from random, as it is influenced by factors such as comparative advantage (some students are naturally better writers, others are naturally better at math) and preferences (some students are more concerned with obtaining a high-paying job than others are). Taken in context with research that finds substantial effects of expected earnings on choice of a major discipline [6] and high returns to math ability [7], it is not immediately clear that the earnings differences across disciplines are due to differences in the economic value of the disciplines.

As in the research on returns to a generic college degree, a wide variety of econometric approaches have been used to address nonrandom selection of a major discipline. While the literature in this field is still relatively small, due primarily to limited availability in the past to data sources that contained information on both college major and labor market outcomes, the recent release of rich data on these measures has spurred a great deal of ongoing research in this area.

The consensus is that the economic return varies across disciplines, with the magnitude of the differences likely to be smaller than those that are observed in the raw data (although the relative ranking is roughly the same) [8].

A recent study compares lifetime returns to a college degree in four major disciplines relative to a high school diploma with no college experience: STEM; business; social sciences; and art/humanities [9]. The study looks at men with at least some earnings each year (so it excludes men who were unemployed for an entire calendar year) and finds considerable differences. A STEM degree is estimated to be worth roughly $1.5 million more on average over a lifetime than a high school diploma and slightly more than a business degree. Social science degrees had a premium of roughly $1 million, while the arts/humanities had a premium of about $700,000. There are substantial differences in returns within these broad groupings. For instance, an economics degree is associated with higher earnings than all arts/humanities, social science, and business degrees and most STEM degrees (the exceptions are majors such as computer science and several engineering disciplines), while a biology degree is associated with far lower earnings than most other STEM degrees. These lifetime premia represent the return to each discipline after adjusting for various measures of ability and nonrandom selection.

These premia and selection into both higher education and choice of discipline have changed over time [9]. Premia have risen fastest for social science degrees, growing about 30% between 1965–1974 and 1975–1984 birth cohorts, compared with 21% for STEM degrees, 19% for a business degree, and 15% for arts/humanities degrees. There are also differences in unemployment rates for different degree holders. For instance, in 2012, approximately 71% of STEM graduates were employed full-time for the entire year, while only 54% of arts/humanities graduates were.

Reasons for different returns to different disciplines

What accounts for these differences across disciplines? The most obvious reason (to an economist, at least) is that the labor market values some sets of skills more than others. But while this is certainly part of the story, other, less straightforward factors are at work as well. A recent study finds that people face a penalty for not working in an occupation that matches their college degree [10]. Given that penalty and the differences in unemployment rates for different degree holders, part of the variation in premia may be due to differences in the likelihood of working in the field in which one has a degree (which is distinctly different from a different monetary value being placed on the jobs held by people with different degrees).

A related explanation is a phenomenon known as skill-biased technological change, which relates to how the occupational makeup of economies changes over time as a result of technological advances. Theory predicts that highly routinized jobs will not see the wage and employment growth experienced in other occupations because computers can perform the tasks cheaper and more efficiently. These jobs tend to be disproportionately held by people in the middle and lower socio-economic classes. For people with a college degree, skill-biased technological change argues for a bright outlook for fields that are quantitative (and thus can use new technologies) and heavily focused on critical thinking (and therefore cannot be replaced by new technology). People in these fields are likely to see the best labor market prospects going forward.

The selectivity of the college a student attends may also play into future earnings and labor market success. A more selective college might provide better training, higher quality peers (peer effects have been shown to be an important part of the education process), and access to a better job network. Alternatively, differences in future earnings of students from different schools might be due simply to variation in academic ability. The evidence is considerably more mixed than that of the previously discussed research. For instance, one study finds a 20% wage premium for men who attend the flagship state university rather than less selective state schools [11]. The study compared students who had attended the flagship school with students who were right at the margin of being accepted to the flagship (based on secondary school grades and entrance test scores). By comparing students in a very narrow range of admissions criteria, but who experience very different education outcomes (those just above the cutoff are accepted, while those just under are rejected), the study could effectively control for typically unmeasured ability. Other studies with similarly strong research designs, however, have found considerably smaller returns to college selectivity, some finding no return at all for certain demographic groups.

There is disagreement on differential returns across institutional type (public nonprofit, private nonprofit, and private for-profit colleges). One study examining the returns to selectivity and to public versus private colleges finds a large premium associated with attending an elite private university, a moderate premium for a middle-tier private university, and mixed evidence for public universities [12]. The returns to a for-profit education are part of a recent US political debate over the role of for-profit institutions and how they should be regulated. The evidence on for-profit versus nonprofit education is mixed, with some works finding smaller returns associated with a for-profit education and other research finding no statistical difference. There are very few studies on this topic, however, and more research is needed.

Why it is important to understand the returns to higher education

The evidence overwhelmingly indicates that attending college is, on average, the right financial decision, but what is true of the average is not always true for the individual. There are many people for whom college is not the best option, and pushing these people into four-year degree programs benefits neither them nor society.

The big picture that emerges from the research reviewed here is that the returns to higher education depend on multiple factors. All college degrees are not created equal from the standpoint of the economic return on investment. This finding is important for policymakers, parents, and students to consider when guiding or making education decisions.

Education policy has arguably the greatest potential to shape a country’s future. Higher education, in particular, is often pointed to as the best path to financial success, especially for students from the most disadvantaged backgrounds. Thus, it is crucial that policymakers understand the complexities of labor market returns to higher education.

For prospective college students and their parents, it is also important to have some knowledge of the economic return to different types of education and of the risk associated with different disciplines (the chance, based on luck or other factors, that a college degree will not pay off financially and that not everyone will receive the average premium).

Average college debt after graduation is now roughly $30,000 in the US, and a sizable number of recent graduates carry substantially more debt than that. Combined with the years of forgone earnings during college and the uncertainty of graduating, it is more important than ever for people to understand what the actual monetary return is for the increasingly expensive tuition. Transparency is crucial. Information on the momentous financial decision prospective college students are called on to make must be more readily available.

A final caveat to the research results presented here: the returns to higher education likely go well beyond the easily quantifiable monetary benefits. While surveys indicate that more than 70% of students cite economic considerations as the dominant reason for attending college, there is far more to a job than a paycheck. A college degree can open up careers that are much more desirable along dimensions other than financial ones, creating a level of satisfaction that is difficult or impossible to put into monetary terms. Furthermore, there is evidence that education is positively associated with a multitude of other outcomes such as better health, marital outcomes, and more. Many of these outcomes are good not only for the individual, but for society as well. In this context, the economic return to education discussed here may represent a lower bound of the total returns to education for both individuals and society.

Limitations and gaps

Estimating the standard returns to education (an additional year or a degree) is one of the most common areas of empirical analysis in economics. However, evidence on how the returns to postsecondary education vary with factors such as institutional quality or field of study is concentrated almost exclusively on data for the US and a few European countries. More information is needed on how such factors affect returns in other countries, particularly in developing countries.

Another crucial gap in the literature concerns the economic return to a degree from for-profit and online colleges. Enrollment in these institutions has grown considerably over recent decades, but these institutions have come under political fire lately because of poor labor market outcomes for graduates. One of the big challenges is that the type of student who attends a for-profit or online institution is often very different from the type of student who attends a traditional four-year nonprofit institution. While there have been a few well-done studies on this topic, much remains to be explored.

Summary and policy advice

The evidence laid out here overwhelmingly supports the view that, on average, investing in a college education is a sound financial decision. However, it is also true that the returns can vary substantially across institutional and individual factors, making some degrees a better financial decision than others. While the economic return to education should by no means be the only indicator of a degree’s worth, it is an important one.

Public rhetoric often implies or outright declares that everyone should seek a postsecondary degree. While this is likely true for most people, there is little reason to think that the benefits will outweigh the costs of a four-year degree for everyone, especially in light of high and rising tuition costs and the fact that graduating from college is far from guaranteed. Six-year graduation rates, for example, are roughly 60% at US four-year institutions and 30% at two-year institutions, adding considerably to the cost of a college education for these students. There are some degrees that may not be worth the cost and some people who would do better not to pursue a four-year college education. Estimating the returns for as many options as possible and making that information as transparent as possible for prospective students are the ways to enable people, especially those who are less fortunate, to make the most informed decision.

It is also important to understand that different college degrees are associated with different rates of return. Understanding how the returns to various disciplines differ is key to efficient pricing of tuition and has implications for relatively new policy instruments, such as differential tuition. The rationale behind differential tuition—charging students different tuition rates according to field of study—is simple: if some college degrees have much greater market value than others, an efficient market would charge a higher price to students seeking those higher-return degrees—and the students would be willing to pay the higher tuition because of the prospect of higher returns. Differential tuitions can ease fiscal pressures on colleges without harming students who have chosen careers with a lower financial return.

Information on the varying returns to education can inform a government’s student loan policy in a number of different ways, depending on a government’s goals. There is evidence that rising student loan debt has motivated students to choose disciplines based on financial return rather than on benefits to society as a whole [13]. Governments can use student loan policy, such as interest rates, repayment plans, and debt forgiveness, to incentivize students to pursue disciplines that have a relatively low financial return but a high social return. Alternatively, if the current occupational makeup is not a concern, student loan policies could be set to more accurately reflect the likelihood of default, effectively subsidizing students who pursue disciplines for which the financial returns are high.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [9].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles and that no competing interests exist in relation to this paper.

© Douglas Webber