Elevator pitch

Direct wage comparisons show that public-sector employees earn around 15% more than private-sector employees. But should these differences be interpreted as a “public-sector premium”? Two points need to be considered. First, the public and private sectors differ in the jobs they offer and the type of workers they employ, which explains a large share of the wage gap. Second, public- and private-sector careers also differ in other important dimensions, such as job stability and income progression, which are relevant to individual career choices. So any comparison of the two sectors should take these points into account.

Key findings

Pros

Public- and private-sector careers differ in many dimensions other than wages (e.g. job security, return to experience, etc.)

Differences in wages and other aspects of a career can be aggregated into a lifetime career value.

Wage differences between sectors are largely smoothed out over the life cycle: the average public-private gap in lifetime career values is close to zero in several major European countries.

The public and private sectors employ workers with different observable characteristics, and those differences explain a large share of the private-public wage gap.

Cons

Direct wage comparisons show that public-sector employees earn, on average, around 15% more than private-sector employees.

The vast literature on the public-private wage gap focuses on point-in-time differences in wages.

France and Spain stand out as two countries where low-skilled workers enjoy a sizeable lifetime public-sector premium.

Even after accounting for differences in composition, systematic cross-sector wage differences persist, often in favor of public-sector workers.

Author's main message

Public-sector wages, particularly for low-skilled workers, tend to be slightly higher relative to the private sector. But they are also more stable over time and more tightly linked to experience and education than private-sector wages. Public-sector jobs are also typically more stable. Aggregation of all those differences into the lifetime value of a career in either sector provides a measure of the long-term public-private pay gap. This gap is close to zero in many major European countries; although in France and Spain, low-skilled workers enjoy a sizeable public-sector premium. Policymakers need to consider all aspects of the value of a career when setting the rules governing public-sector compensation.

Motivation

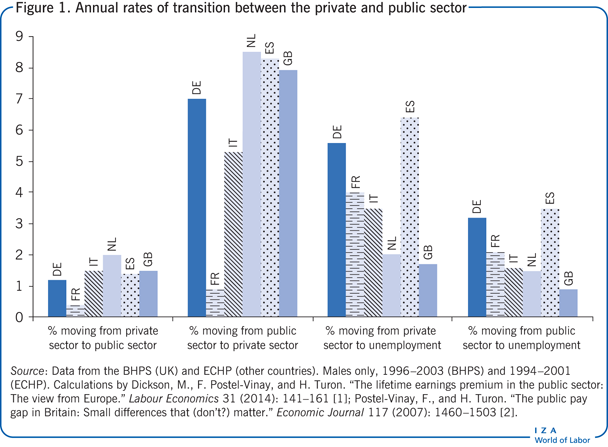

The public sector is a significant stakeholder in the labor market, accounting for about 20% of total employment. Its wage bill makes up about one-fifth of government spending across most European countries. It is also not insulated from the rest of the labor market: upon leaving full-time education, young workers have to choose in which sector to begin their careers. Even among more experienced workers, movements between the public and the private sector, particularly from the former to the latter, are not uncommon (Figure 1). Workers’ decisions of where to seek employment will depend on relative career conditions between the two sectors. As such, private-sector pay, and therefore private-sector hiring, will respond to changes in the perceived “value” of a career in the public sector.

In a context of widespread concern about budget deficits and policies aiming to cut government spending, it is therefore important to assess the differences between public- and private-sector pay and career conditions.

Discussion of pros and cons

What is the effect of making public-sector jobs more attractive?

The public-sector wage bill is paid out of taxpayers’ money, which therefore makes it a politically sensitive issue. The institutional rules and practices that typically apply to public-sector employment (see below) to some extent insulate public-sector jobs from the uncertainties of labor market forces. When combined with generous levels of pay, those rules tend to create a “wedge” between public and private careers. They can also increase inequality, elicit feelings of resentment towards public-sector employees, and cause comparative dissatisfaction with private-sector jobs. None of which is good for social cohesion, the functioning of public services, or the functioning of the productive apparatus in general.

Moreover, as emphasized above, the public and private sectors compete for labor services. Surely though, the unique nature of certain public-sector-specific jobs justifies some differential in pay. But making public-sector careers attractive beyond those “justifiable differences” will force private-sector employers to raise wages, and may also have the effect of inhibiting their ability to hire. Depending on the extent of the similarity of service provision between the public and private sector, this effect can be very substantial: estimates are as high as 1.5 private-sector jobs destroyed for each added public-sector job [3].

Obviously, though, a balance needs to be struck. Were public-sector jobs to become relatively unattractive, recruitment and retention in the public-sector workforce would become difficult. The delivery of high-quality public services requires the employment of a high-quality workforce. Difficulties in hiring and retention will hinder public-sector productivity, with negative knock-on effects on the entire economy.

How, then, do we assess the balance between public- and private-sector career conditions? Point-in-time comparisons of wages paid in both sectors—which have been the focus of voluminous academic and institutional literatures—are useful, but they are only part of the picture. As is documented below, striking differences typically exist between the two sectors in terms of earnings progression, earnings stability, job loss risk, and pension systems. These differences are sometimes enshrined in labor laws, sometimes the de facto outcome of enduring practices. Whatever their origin, they will matter to forward-looking individuals. As such, a summary assessment of the relative attractiveness of public-sector jobs must rely on a criterion that aggregates all these differences into a single measure relevant to individual sector choice [2], [4]. This contribution refers to such a measure as the lifetime value of a career.

What factors determine wage levels?

Differences in wage-setting practices, contract types, career pathways, and entry requirements between the public and private sectors impart different dynamics and affect the public-private gap in both pay and lifetime values.

Wage determination is generally influenced by a combination of economic, political, and institutional factors. However, the degree of unionization, the extent of collective bargaining and the ease of measuring productivity affect pay determination differentially between the public and private sectors. Private-sector wages are typically set through some form of (more or less regulated and centralized) negotiation between employer and worker representatives, with a varying but limited degree of government involvement. By contrast, governments play a much bigger part in public-sector wage setting—which also often involves negotiations [5], [6].

The degree of centralization in public-sector wage setting varies across countries. It is high in France, Germany, and Spain, and lower in the Netherlands and the UK. This partly, but not perfectly, mirrors relative (de)centralization in the private sector. Likewise, the relative weights put on egalitarian principles and political considerations, the government budget constraint, and reference to productivity and macroeconomic conditions differ between countries. Yet it can be said that, in general, the public sector is more directly exposed to political considerations and budgetary imperatives than the private sector. For example, the government may be politically motivated to pay high wages to its lower-skilled employees and be reluctant to pay the high wages found at the top end of the private-sector wage distribution.

Overall, institutional arrangements in most European countries tend to be such that public-sector employees, especially civil servants, face a pay scale that is much more rigid and deterministic (in the sense that seniority and education tend to be rewarded independently of performance) than private-sector workers, and less directly tied to productivity and economic conditions.

Contract types also differ not only between sectors, but also within the public sector, where there is often a marked distinction between civil servants (e.g. the status of Fonctionnaire in France, Beamte in Germany, Funcionario in Spain, etc.), who are often guaranteed lifetime tenure and specific career pathways, and other public-sector employees, who are mostly employed on contracts typically used in the private sector. In some countries (e.g. France and Spain), the public sector makes regular use of fixed-term contracts. The Netherlands is a notable outlier in this general picture: Dutch civil servants do not enjoy the same sort of privilege as compared to the rest of the public sector [7].

Cross-sector differences in contract types and career pathways come with equally important differences in recruitment practices. For the most part, public-sector recruitment into non-civil service roles is similar to private-sector recruitment, in that it is appointment-based rather than career-based, and decentralized to the department or firm level. However, entry into the civil service may follow quite different rules. For example, in France, Italy, and Spain, entry into the civil service is based on open, competitive examinations. These countries recruit individuals explicitly for a life-long career in the civil service. By contrast, there are no entry examinations or central recruitment administration for the civil service in Germany, the Netherlands, or the UK, where recruitment into public-sector jobs is largely devolved to individual departments. Overall, there is something of a pattern across European countries whereby a higher degree of job security and more deterministic careers for civil servants come along with higher barriers to entry into the civil service.

The public-private gap: Point-in-time comparisons

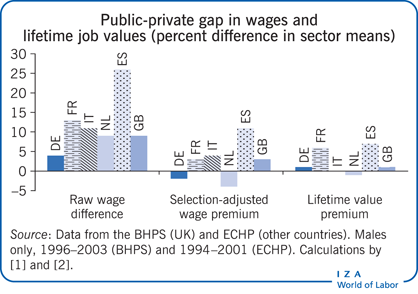

The first cluster of bars in the Illustration show, for a selection of European countries, that average wages are higher in the public sector than in the private sector. Note that “wages” here refers to monthly earnings among men. A number of studies describe public-private differences in men’s usual working times and show that those are generally small, with working hours being slightly longer and part-time work slightly less common in the private sector [1], [2]. The typical wage difference is around 10%, ranging from a relatively modest 4% in Germany to a very significant 26% in Spain. Yet, as argued above, one must look beyond crude comparisons of mean wages in order to understand the true nature of those differences.

The main difficulty one has to contend with when comparing public- and private-sector wages is the non-random selection of workers into either sector. Because the public and private sectors produce different commodities and services using different technologies, an individual ending up working in the private sector—either by choice or necessity—will typically differ from the average public-sector employee along many dimensions that are also relevant to wages (such as education or experience, for example). Indeed, it is widely documented that the public sector tends to attract better educated and more experienced workers [1].

Moreover, one should expect those worker characteristics to be rewarded differently in each sector, again if only owing to differences in technology between the two sectors. The question, then, is whether the earnings gap is due to differences in the composition of each sector in terms of those worker characteristics (in which case there would be no “public-sector premium” as such), or simply to a ceteris paribus more generous pay policy in the public sector, i.e. a pure public-sector wage premium.

To isolate the public-sector wage premium estimates of two different wages for each individual are needed: a public-sector wage and a private-sector wage. Systematic differences between those two wages, regardless of the sector in which individuals are actually employed, can be interpreted as a public-sector wage premium—or penalty, as the case may be. One of these estimated wages—the one from the sector in which the individual is actually employed—is observed in the data. The other is a counter-factual, “potential” wage, the construction of which requires a statistical model. What the statistical model does is to provide estimates of sector-specific “prices” for each worker attribute (education, experience, etc.), which can then be applied to any given bundle of individual attributes to produce sector-specific potential wages for any individual in the data.

The second cluster of bars in the Illustration shows estimates of the economy-wide mean public-sector wage premium based on the methodology just described. Details of the specific statistical model used to produce those numbers can be found in several studies [1], [2]. What is immediately striking in the comparison of these “selection-adjusted” public-sector wage premiums and the wage differentials discussed earlier is that the former are everywhere much smaller than the latter: the selection-adjusted premium is typically less than 5%, sometimes even slightly negative (e.g. in Germany and the Netherlands) or statistically undistinguishable from zero (e.g. in France and the UK). Spain is again the exception, with an estimated average public-sector wage premium of 11%—which is still much less than the 26% earnings difference between sectors.

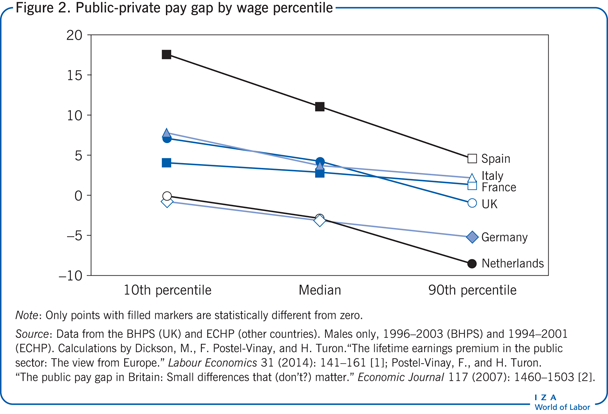

Should one then conclude that public-sector wage premiums are, on the whole, mostly negligible? A closer look at the data suggests a more subtle message. Figure 2 shows estimates of public-sector wage premiums, for the same sample of countries, at three different wage levels. For example, the points aligned on the “median” column of Figure 2 show, for each country, the public-private wage gap for an individual whose (potential) private-sector wage equals the country-specific median private-sector potential wage. Importantly, only values that are represented with filled markers on Figure 2 are statistically different from zero.

The clear message of Figure 2 is that the public-sector wage premium declines, in all countries, as one goes up the wage distribution. While the level of the public premium varies between countries, it is always higher for low-wage than for high-wage individuals. The flipside of this result is that wage distributions are everywhere more compressed, or less unequal, in the public than in the private sector. This, perhaps more than the small average public-sector wage premium, is the main robust finding of the vast literature on the public-private pay gap.

Beyond wage comparisons: The value of a career

As argued above, employment conditions differ between sectors along various dimensions, other than the level of pay, which are all relevant to individual career choices. Among those other dimensions, perhaps the most talked about—if not the most important—is the risk of job loss. The raw annual job loss rates illustrated in Figure 1 suggest that the risk of becoming unemployed is smaller in the public than in the private sector in all countries, often by a wide margin. Differences in wages are affected by the selection issue, and can be adjusted for selection. Doing so reveals that, even though the job loss risk remains generally lower in the public sector, differences between the two sectors are much reduced compared to what the data suggest. One should bear in mind, however, that those results pertain to sector-level average job loss rates, and that there is probably a great deal of difference in job loss risk within sectors, especially so in the public sector. Many countries offer lifetime tenure to certain categories of civil servants, while at the same time making extensive use of fixed-term contracts in the public sector (Spain and France are obvious examples).

The public and private sectors further differ in various aspects of career progression. Experience, for example, is sometimes rewarded differently in the two sectors, although no clear cross-country regularity emerges in this regard. Compared to the private sector, the public sector rewards experience much more in Germany, slightly more in France and the Netherlands, roughly the same in the UK, slightly less in Spain, and much less in Italy. A much more consistent difference between public- and private-sector wage trajectories is in dynamic stability: wages are decidedly more stable from year to year in the public sector. While the specific rules governing career progression may differ between countries, it is generally the case that public-sector careers follow a more “deterministic” pattern.

Compounding all those aspects into a single measure of “the value of a career” is no simple task, and there are many ways one can go about it. In one particular study, the notion of lifetime value that is retained is the sum of future wage flows, discounted to the time of first entry into the labor market (i.e. at zero year of experience). This is the relevant criterion for the career choice of labor market entrants when individuals are either risk-indifferent or perfectly insured against income risks. It is further assumed that all individuals expect to stay active for 40 years, after which they expect to retire and live on for another 20 years, earning a pension income equal to 40% of their last wage. This depiction of retirement packages is obviously very crude, especially since it excludes all differences in retirement plans between sectors or countries. However, specific assumptions about the value of retirement matter little for the following comparisons of lifetime job values, as those are made at the time of labor market entry, when retirement is still 40 years in the future and, as such, very heavily discounted.

Finally, the lifetime job values used in the following comparisons assume that workers never change sectors or experience unemployment. In other words, those literally compare the value of a “job for life” between the two sectors. While this method has the obvious drawback of excluding the effects of any differences in job loss risk between sectors, it singles out differences in earnings levels and earnings mobility as sources of differences in lifetime values. The pros and cons of this approach and the consequences of allowing for mobility between sectors and into unemployment in the construction of lifetime values are discussed at length in one study [2].

For all its shortcomings, this simple approach to calculating lifetime career values yields important insights that usefully complement cross-sectional analyses of wage premiums.

The lifetime earnings premium in the public sector

The last cluster of bars in the Illustration shows economy-wide mean public-sector premiums in lifetime values, constructed as explained in the previous paragraph. Strikingly, those lifetime premiums are virtually nil in all countries except France and Spain, where they remain just above 5%. This finding contrasts quite sharply with the pattern of public-sector wage premiums discussed earlier, and suggests that wage comparisons, however careful, are not sufficient to gauge the relative attractiveness of a career in either sector.

The public-sector wage premium tends to understate the lifetime premium in countries where experience is more generously rewarded in the public sector (Germany, France, and the Netherlands), and vice-versa (Italy and Spain). Overall, cross-sector differences in wage stability and career progression seem to largely compensate instantaneous differences in the level of pay.

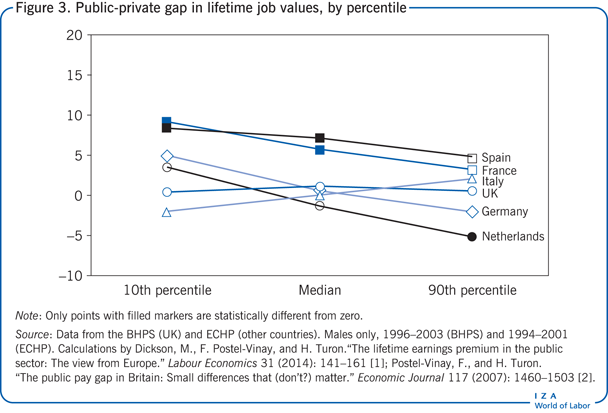

Can we say more by looking at various sub-groups of individuals? Figure 3 repeats for lifetime values the same exercise as Figure 2 reported for wages: it shows estimates of public-sector lifetime premiums at three different percentiles of the distribution of job values.

Comparison of Figure 2 and Figure 3 reveals that, throughout the distribution, and in all countries except France, the public-sector premium in terms of lifetime value is discernibly closer to zero than the corresponding wage premium. It is particularly important to bear in mind when interpreting Figure 3 that the values represented by hollow markers are not statistically different from zero. Barring a negative public-sector premium at the top of the distribution in the Netherlands, significant—and positive—public-sector premiums are only found in the lower halves of the distributions in France and Spain. Those two countries clearly tend to offer particularly attractive public-sector careers to the low and medium skill end of their workforce. Interestingly, France and Spain are two of the countries (together with Italy) that have the highest barriers to entry into public-sector jobs.

Surely, the lack of statistical significance of some of the values reported in Figure 3 is partly attributable to small sample sizes and complexity of the statistical model used to calculate lifetime values, and it should not be taken to imply that the public-private gap in lifetime values is literally zero everywhere except France and Spain. Among the countries studied in this contribution, however, the UK is the one with the largest sample size, which allows for more precise and reliable inference than for other countries. Interestingly, the UK lifetime public premium is consistently (and relatively precisely) estimated close to zero throughout the distribution (Figure 3).

This would suggest that the larger amount of inequality in private- than in public-sector wages, which was discussed in the previous paragraph, is largely transitory. Wages are more volatile in the private sector, causing greater year-on-year mobility across the income distribution. Yet, in the long term, those transitory income shocks appear to “wash out,” so that the degree of long-term inequality, as measured by inequality in lifetime job values, seems very similar between the public and private sectors in the UK. Unfortunately, available estimates of the distributions of lifetime values are overall too imprecise to make reliable statements on this question for other countries.

Limitations and gaps

Any assessment of the public-private pay gap faces the issue of non-random selection of workers into sectors. Some of the worker characteristics that affect both wages and sector choice (such as education or experience) are measured in the data. Others (e.g. motivation for the public service, work ethics, or “ability”) are not. Quantification of the impact on wages of those unobserved characteristics inevitably relies on certain statistical assumptions, the choice of which may affect estimates of the public-sector premium.

Even more debatable assumptions are required for the construction of lifetime job values. The results discussed here are predicated upon such strong assumptions as risk indifference (or perfect insurance), and lack of between-sector mobility. The main consequence of allowing for job mobility is to obtain estimates of the lifetime public premium even closer to zero. The basic reason for this being that job mobility renders the cross-sector boundary permeable, thus making employment in the public and private sectors more “similar” to each other [2].

The consequences of allowing for risk aversion are a much more complex and largely unresolved question. One may speculate that risk-averse individuals will tend to find the smaller degree of income and employment risk in the public sector attractive.

Aside from those methodological issues, the results reported here are further limited by the specific population (men) and time period (the 1990s) covered by the data. Although no existing analysis of the public wage gap focuses on women, we know that women select themselves disproportionately into public-sector jobs, and that the age profiles of public-private wage gaps differ between men and women [8]. Lifetime public-sector premiums are therefore more than likely to differ between genders. It has also been documented that public-sector wage gaps have followed different patterns between countries since the 1990s. They went up in Italy, Spain, and the UK, down in France, and remained the same in Germany and the Netherlands [9], [10]. Caution should therefore be exercised when extrapolating the results presented here.

Summary and policy advice

Most existing analyses of the public-private pay gap focus on point-in-time differences in earnings. However, as the public and private sectors also differ in terms of earnings and job mobility, these factors also need to be taken into account in any assessment of the long-term public pay gap.

Average levels of pay are indeed found to be slightly higher in the public sector in some countries (and slightly lower in a few other countries). Public-sector wages are also consistently more stable over time, as are public-sector jobs. These “dynamic” differences across sectors compound over a lifetime and result in long-term public-private gaps that tell a different story from what can be inferred from spot income gaps.

Aggregating these differences into a measure of the “lifetime value” of employment in either sector shows that the average public-sector premium is close to zero in most countries. However, France and Spain are two important exceptions to this, where medium to low-paid workers enjoy sizeable public-sector premiums.

However, caution must be used when basing policy advice on what is essentially a descriptive analysis as presented in this contribution. Yet, sizeable differences in the values of a career in the public versus the private sector, as are observed in France and Spain, are hard to justify, be it on efficiency or redistribution grounds.

In any event, investigating a potential causal mechanism between institutions and the public-sector lifetime premium seems an important avenue for future research and policy choices. Policymakers need to consider all aspects of the value of a career when setting the rules governing public-sector compensation.

Acknowledgments

The author further thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Much of this article is based on joint work with Matt Dickson and Hélène Turon [1], [2].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Fabien Postel-Vinay