Elevator pitch

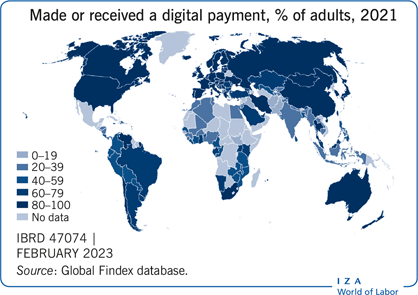

Digital payment systems can conveniently and affordably connect entrepreneurs with banks, employees, suppliers, and new markets for their goods and services. These systems can accelerate business registration and payments for business licenses and permits by reducing travel time and expenses. Digital financial services can also improve access to savings accounts and loans. Electronic wage payments to workers can increase security and reduce the time and cost of paying employees. Yet, there are challenges as many entrepreneurs and employees lack bank accounts, digital devices, and reliable technology infrastructure.

Key findings

Pros

Digital payments can increase an entrepreneur’s profitability by making financial transactions with customers, suppliers, and the government more convenient, safer, and cheaper.

Paying wages digitally benefits employees and is safer and more cost-effective for employers.

Digital payments automatically provide users with a credit history and can thus improve an entrepreneur’s access to credit.

Digital payments give women entrepreneurs greater control over their income, potentially benefiting their entire household, especially children.

Cons

A strong financial infrastructure, including access points such as mobile phones, is needed to support digital payment systems.

Many entrepreneurs and employees lack documents such as government-issued identity cards or birth certificates, which are required to use digital services.

Entrepreneurs and employees often lack financial literacy, making it harder for them to use digital financial products efficiently.