Elevator pitch

Unemployment insurance schemes face a well-known trade-off between providing income support to those out of work and reducing their incentive to look for work. This trade-off between benefits and incentives is central to the public debate about extending benefit periods during the recent economic crisis. Often overlooked in this debate is that such support can increase the quality of the work found by the unemployed. This quality rise, in terms of both wages and duration, can be achieved by increasing the time and resources available to an individual to obtain a better job.

Key findings

Pros

When receiving unemployment benefits workers can reject poor offers and continue to look for better jobs.

Unemployment benefits slightly increase both the wages received when work is found and the duration of the new job (job stability).

Jobs found earlier in the benefit period are of higher match quality than those found near the end.

Cons

Unemployment benefits create disincentives, in that workers exert less search effort and demand higher wages.

The higher wages that may be gained when benefits are more generous may reduce firms’ profits and hiring, leading to a higher unemployment rate.

More generous benefits increase the length of periods of unemployment.

The benefits of better job matches may not outweigh the cost of longer periods of unemployment.

Author's main message

The existing evidence on the relationship between benefit provision and job match quality is mixed, a number of studies finding positive but in most cases small effects, while others find no effects. Benefits enable recipients to prolong their search for better offers, but the overall benefit to society of better matches may not outweigh the cost of supporting longer periods of unemployment. From a policy perspective, it is important to achieve a smoother transition out of unemployment, striking a better balance between a sufficiently long benefit entitlement period and activation measures that enhance search effort.

Motivation

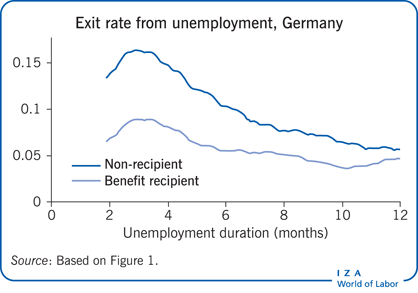

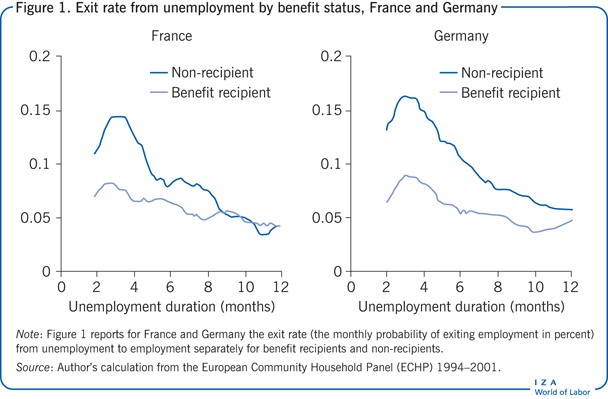

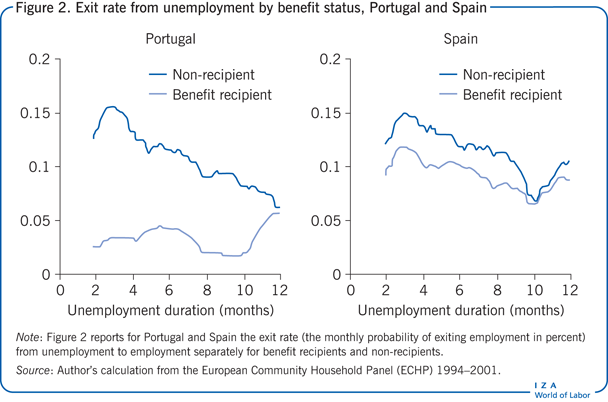

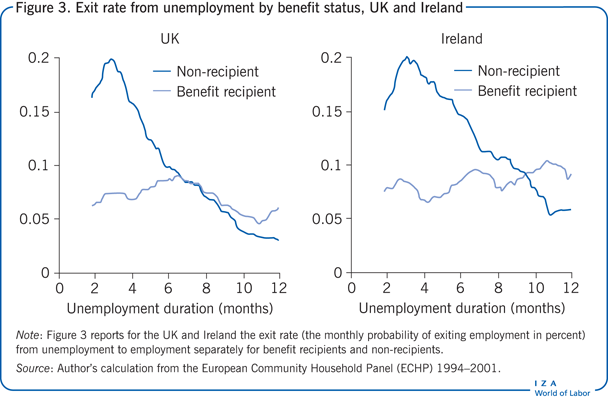

Unemployment insurance (UI) provides the unemployed with benefits while they look for a job. But benefits may induce moral hazard: people may search less intensively, prolonging their time out of work. This trade-off between benefits and incentives is central to the design of UI systems and the debate about extending benefit periods during the recent economic crisis. Figure 1, Figure 2 and Figure 3 show the probability of exiting from unemployment to a new job by the elapsed time in unemployment for a number of selected countries. Jobless people who receive benefits experience a lower probability of finding a job at the beginning of their unemployment spell compared with their counterparts who do not receive benefits. Over time the chances of finding a new job become similar.

The trade-off between moral hazard and insurance has two aspects that are often ignored. The first is that the moral hazard interpretation ignores the possibility that the unemployed may face financial difficulties (lack of liquidity) that force them to find a job immediately. An increase in benefits eases these liquidity constraints, so they can afford to prolong their search for a new job. The second aspect is that, by allowing more time and resources to search, unemployment benefits can lead to better jobs in terms of earnings and stability. This is important: better job-matching can improve labor market performance, increasing productivity and workers’ welfare.

Discussion of pros and cons

Alternative interpretations of the link between benefits and time spent unemployed

The observed pattern of longer unemployment duration when UI is available is typically associated with a moral hazard effect, whereby higher income during unemployment reduces the incentive to search for a new job. The way a UI system addresses this is by specifying a progressive decline in the amount of benefit paid out during unemployment, or by setting a maximum period during which benefits will be received, or both. Designing a benefits system in such a way changes the incentives to search for a job by affecting the utility (in effect, the desirability) of remaining unemployed over time. Specifically, the decline in the amount of benefits paid, or the expiry of benefit entitlement after a set period, induces the unemployed to search more actively for a job by reducing their income.

However, the trade-off between insurance and incentives could change over time, and it is not the only explanation for why those unemployed who receive more generous benefits remain unemployed for longer. An alternative interpretation of the positive correlation between benefit generosity and duration of unemployment is that, in response to higher benefits, the unemployed increase their reservation wage (the minimum wage they require to accept a job). This reduces the probability that they will accept a job offer, leading to longer jobless spells.

Another interpretation of the positive link between benefits and unemployment duration is that unemployed individuals are liquidity-constrained. If their income, and hence consumption, is stable over time through unrestricted access to borrowing, an increase in UI benefits that leads to longer periods of unemployment would operate only through moral hazard. When individuals cannot sustain a stable path of consumption over time because they cannot easily borrow, an increase in UI benefits relaxes those liquidity constraints, allowing the unemployed to search for longer without the pressure to find a new job quickly. The existing—but limited—evidence suggests that a substantial share of the behavioral response to longer benefit periods is attributable to a liquidity effect rather than to moral hazard [1], [2].

Also, the exact mechanisms through which job-finding probabilities change over the duration of unemployment and the different ways individuals react to those mechanisms are important when it comes to designing an optimal benefits policy and understanding the impact of UI. If skills depreciate over time, remaining unemployed for a long period is likely to negatively affect the chance of obtaining a new job. According to this argument, the provision of generous benefits will harm the unemployed individual’s prospects, as well as reduce his or her incentives to search for a job. Conversely, if the number of offers the unemployed receive diminishes over time, or if they face higher uncertainty and higher variance in the offers they receive over time, insuring the unemployed properly will increase the value of their search, which could lead to a better job match.

Positive effects of benefits on quality of job match

By providing the time and resources for a longer search period, benefits may allow the unemployed to be more selective and wait for better job matches that are less likely to dissolve. However, the provision of UI could also encourage workers to search for more productive and better-paid jobs that have a higher risk of being destroyed. This leads to a trade-off between unemployment and match quality, whereby UI increases the number of high-quality jobs in the labor market but at the same time increases unemployment and the average duration of unemployment.

A UI system has two main characteristics: the level of benefits, and the maximum period over which they are paid out. By increasing the value of remaining unemployed and continuing to search, a higher level of benefits has a positive effect on the minimum wage (the reservation wage) that unemployed workers are willing to accept. When the unemployed become more demanding as to the wages they are willing to accept, this translates into their receiving higher wages in their new jobs. On the other hand, when there is a maximum period over which benefits are paid out, the reservation wage declines during that period—especially close to the time when benefits are terminated. This happens because the outside option of remaining unemployed becomes less attractive over time. In turn, this means that the unemployed might accept jobs of lower match quality (less well paid) around the time of benefit termination, which they are more likely to quit in the future in the search for a better job.

It should be noted that wages are not the only measure of job match quality. Job tenure and employment stability are also relevant. In simple terms, employment stability is enhanced by better-paid jobs because the worker is less likely to seek alternative employment in his or her new job. Furthermore, by enabling a longer search period, UI may increase other aspects of job match quality beyond just the wage, leading to higher job tenure.

The job match quality effect of benefits may vary over the business cycle. During recessions, there are more unemployed than jobs available, implying that searching for a new job may lead to congestion, with too many applicants for a single vacancy. Due to low hiring from firms it is more likely for an unemployed person to find a low-quality job, which he or she will quit for a better one once the economy improves. By allowing the unemployed to be more selective, extended benefits during recessions may increase job match quality without substantially increasing the unemployment rate. In a sense, benefit generosity when the labor market is “thin” (fewer vacancies than job-seekers) operates as a mechanism to make the labor market “thicker,” by spreading the search of the unemployed over a longer period of time.

Negative effects of UI

As we have seen, the conventionally accepted negative effect of UI is that it reduces the incentive to look for work. By making the consumption of leisure (being out of work) less costly, benefits reduce the need to exert search effort, leading to longer spells of unemployment. Moreover, because they have a better outside option when they receive more generous benefits, the unemployed can demand and obtain higher wages, which has an effect on firms’ expected profits. When profits are lower, firms reduce their hiring, which eventually leads to an increase in the unemployment rate.

Empirical evidence

The existing evidence on the effect of UI on job match quality is based on two main outcomes of finding work: wages on re-employment, and job/employment stability. Three measures of UI are used: the level of benefits; the maximum duration of benefits; and an indicator of benefit receipt, which compares recipients with non-recipients.

Wages received on re-employment

The empirical investigation of whether benefits affect re-employment wages is motivated by economic theory, which predicts that an increase in the generosity of benefits will increase the minimum wage acceptable to workers and, as a result, the wage they receive in a new job. One of the first studies in the literature investigates the effect of the UI replacement ratio (the ratio of actual weekly benefits to weekly earnings in the previous job) on re-employment wages [3]; the authors use survey data for the period 1966–1971 from the US that compare recipients of benefits with non-recipients. Their findings suggest that, for males aged 45–59, raising the replacement ratio by 10 percentage points increases wages received on re-employment by 7%. For other subsamples (females and young workers) the effect is smaller and statistically insignificant.

Data on US workers who were laid off in the period 1983–1990 also provide evidence on the effect of the UI replacement ratio on re-employment wages. When the analysis is focused on subsamples of UI recipients, the results suggest a small positive effect of benefit levels on wages, but, when benefit recipients are compared with non-recipients, there are non-trivial positive effects. However, the latter findings are of a lower order of magnitude than those found in earlier studies.

Job stability

As mentioned earlier, post-unemployment wages are not the only outcome of interest. If benefits allow workers to search longer before accepting a job, they may be able to obtain jobs that match their requirements better and that last longer, because these jobs are less likely to dissolve and workers are less likely to quit them or return to unemployment.

The first study of the effect of the UI system on job duration [4] uses data from Canada for a sample of young males, aged 18−25, who experienced a layoff in the period 1976–1978. Canada’s UI system, established in 1940, went through changes at the end of the 1970s that introduced reductions in the average duration of benefits without affecting the benefit rate as a percentage of previous earnings. These legislative changes, together with the existing differences in benefit duration at the individual level due to different employment histories, create substantial variation in the maximum period over which a newly out-of-work person can expect to receive benefits at the beginning of a spell of unemployment.

Evidence based on this variation suggests only a weak effect, whereby an increase in the duration of benefits leads to increases in both the time spent unemployed and the duration of jobs that are accepted, with the former effect being larger [5]. Overall, increasing the maximum period of benefits by one week will raise time spent unemployed by 1.0–1.5 days but will raise job duration by 0.5–0.9 of a day only. Although on average the effect on job-matching is weak, there is heterogeneity by the time individuals exit from unemployment. In particular, in the five-week period before benefit termination there is an increase in the rate at which the unemployed find work, but jobs accepted within this five-week period do not last as long. These findings provide some weak support for a positive effect of the duration of unemployment benefits on subsequent job duration.

The UI system in the US also creates differences in the availability of benefits across individuals that arise from the substantial variation in benefit programs between states and over time within states. Using survey data for the period 1979–1998, this variation in the level of benefits received is exploited to examine the effect of benefit generosity on job tenure [6]. The findings suggest that job duration is positively related to the generosity of the benefit scheme. A one standard deviation increase in the level of benefits (about 30%) leads to an increase in median job duration of four weeks.

Substantial differences in the generosity of UI systems are also found in Europe. Countries such as Denmark, Germany, France, and (to some extent) Spain provide more generous benefits—both in levels and duration—than countries such as Greece and Italy. Using survey data from Europe for the period 1994–2001 allows the examination of the effect of being a benefit recipient on unemployment duration and subsequent employment stability [7]. The findings suggest that benefit recipients experience longer unemployment spells than non-recipients, but that the availability of UI has a positive effect on the stability of subsequent employment. The latter effect is more pronounced in countries with more generous systems and for workers who accept a job after being unemployed for at least six months. This suggests that there is some heterogeneity of effects for those who are closer to the end of their benefit period.

In terms of magnitudes, in countries with more generous benefit systems recipients exhibit survival rates (i.e. continuation) in unemployment which are 15 percentage points higher than non-recipients, compared with a 10 percentage point difference in countries with less generous systems. The corresponding difference between the two groups of unemployed in terms of job duration when re-employed is about 17 percentage points and 3–5 percentage points for generous and less generous welfare regimes respectively. The net effect (longer unemployment duration v. longer subsequent employment duration) for the more generous benefit systems is zero after six months in employment but becomes positive after 12 months [7].

Studies exploiting reforms or discontinuities in the UI system

A number of studies have examined the effect of UI on post-unemployment outcomes using a difference-in-differences (DID) approach or a regression discontinuity (RD) design. Studies using the DID approach exploit changes in the rules determining the level or duration of benefits within a specific country; these changes create one group that is affected by the reform and another group that remains unaffected. Comparing the outcomes before and after the reform for the two groups can identify the causal effect of interest. Studies using the RD design exploit certain discontinuities in the rules determining the characteristics of a benefit system. These discontinuities create variation in the amount or duration of benefits received, variation that is often related to the age or previous experience of the unemployed.

Austria

In Austria, there is a discontinuity in the relationship between work experience and duration of benefit entitlement: workers who have been employed for less than 36 months in the past five years receive 20 weeks of benefits, whereas those who have been in work for more than 36 months receive 30 weeks of benefits.

Exploiting this discontinuity allows an examination of the effect of the longer period of benefit entitlement on unemployment duration and job match quality [2], where the latter is measured by two factors: the wage difference between the new and the old job, and the duration of the new job. The analysis compares the unemployed aged 20−50 with previous work experience of just below 36 months with those with just above 36 months—i.e. two groups with a similar work history but different benefit entitlement. The authors used data from the Austrian social security registry for all job separations that resulted in a benefit claim in the period 1981–2001. The findings show that, although those entitled to the longer benefit period remain unemployed for longer, there is no effect on the match quality of the jobs they find in terms of either wages or job duration.

A similar discontinuity in the relationship between age and the duration of benefit entitlement in the Austrian system has been exploited to examine the effect of benefits on post-unemployment outcomes. This discontinuity reflects the fact that job-seekers who become unemployed at 50 years of age or older and satisfy a previous work requirement are eligible for 52 weeks of extended benefit rather than 39 weeks. Furthermore, due to restructuring demands in the state-owned steel sector, a much longer benefit extension (from 39 to 209 weeks) is available to workers aged 50 years or older who have been living in certain regions of Austria for at least six months [8]. As in the other Austrian study [2], the extended benefit periods are not found to have an effect on the wages received on re-employment.

Slovenia

In Slovenia there was a policy change in 1998 that reduced the maximum benefit duration roughly by half for most groups of recipients. Depending on previous work experience, the entitlement period was reduced for some workers from 18 to 9 months, and for others from 12 to 6, from 9 to 6, or from 6 to 3 months. For workers with the least work experience the entitlement period remained unchanged at three months.

This reform is used to analyze the effect of benefit duration cuts on job match quality by comparing the change in outcomes for those affected by the reform with those who experienced no change [9]. The findings suggest that the reductions in benefit duration did not affect the likelihood of a worker taking a temporary rather than a permanent job, had hardly any effect on job separation rates, and did not affect post-unemployment wages.

Germany

In the German UI system, before the Hartz IV labor market reform, there was a discontinuity in the maximum duration of benefits, whereby those entering unemployment before the age of 45 were eligible for 12 months of benefits, while those of age 45 and above were entitled to benefits for up to 18 months. This age discontinuity is used to compare workers who entered unemployment in a very narrow range around the age of 45 in the period 2001−2003 [10]. This allows the identification of the effect of extended benefits on job match quality as measured by employment stability and wages in the new job. The overall effect of the extended benefit duration on employment stability and on wages is found to be positive but small. For example, an additional six months of benefits is associated with 3.7% higher wages for men, but the effect is statistically insignificant.

However, the evidence shows the existence of substantial heterogeneity [10]. Jobs that are accepted close to or after the end of the benefit period are associated with significantly lower stability and lower wages, while those who exit unemployment when they are still insured—and could therefore reject job offers—tend to find jobs that last longer and pay higher wages. In particular, the exit rate from subsequent employment for men who receive extended benefits is about 50% lower, and the received wages are about 15% higher than for those who exit close to benefit expiration. These results are found to be significant for men but not for women. The finding of heterogeneity around the time of benefit termination is in line with the results on job stability for young men found in the study using data from Canada [5].

Limitations and gaps

The evidence for the effect of UI benefits on job match quality is mixed, indicating that, on average, effects are small to non-existent, but that effects can be significant for those who are close to the end of their benefit period. One issue that needs to be emphasized is that, even when there is a positive effect, the overall net effect might still be negative when the longer unemployment durations associated with more generous benefit schemes are taken into account. Also, as most of the existing findings relate to short-term effects, investigating the longer-term effects of benefit entitlement on employment outcomes should be a subject for future research. Another important aspect is to understand how the effect of benefits varies over the business cycle.

Summary and policy advice

Findings on the effects of UI generosity (in terms of benefit duration or benefit level) on the match quality of jobs found after a period of unemployment are mixed. On average, there are either no effects or some positive but small effects on wages received in the new job and on the time the individual remains in that job, or in employment. There is also some heterogeneity, with those who exit close to the end of their benefit entitlement period making less favorable job matches than those who find work earlier. This is because benefit recipients can reject poor offers and continue searching for better ones, while those whose benefits are about to expire may feel compelled to accept worse jobs. From a policy perspective, it is important to achieve a smoother transition out of unemployment to prevent workers from being forced to obtain low-quality jobs close to benefit termination. The way to achieve this policy objective is to find a balance between a sufficiently long benefit entitlement period and activation measures, which are important for reducing the moral hazard effect by enhancing the search effort early in the period of unemployment. Overall, however, the benefit to society of unemployed workers making better job matches may not outweigh the cost of supporting longer periods of unemployment.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Konstantinos Tatsiramos