Elevator pitch

Policymakers rely on entrepreneurs to create jobs, provide incomes, innovate, pay taxes to support public revenues, create competition in industries, and much more. Due to its highly heterogeneous nature, the choice of entrepreneurship measures is critically important, impacting the diagnosis, analysis, projection, and understanding of potential and existing policy. Some key aspects to measure include the how (self-employment, new firm formation), why (necessity, opportunity), and what (growth). As such, gaining better insight into the challenges of measuring entrepreneurship is a necessary and productive investment for policymakers.

Key findings

Pros

Various measures can help policymakers capture different dimensions related to entrepreneurship.

More precise measurement options can help target specific types of entrepreneurship or outcomes, such as high growth entrepreneurship.

Comparing multiple measures of entrepreneurship, such as necessity and opportunity entrepreneurship, can be useful.

Different measures, like employment-based or accounting-based measures, can be used to evaluate growth entrepreneurship.

Cons

Measures for new firm formation likely underestimate the entrepreneurial activity in certain places, especially in low-income countries.

There are large gaps in data availability for many countries, especially low-income countries.

Different reporting and accounting standards limit the comparability of firm-level data across countries.

While it is possible to assess entrepreneurs’ intentions, it is harder to measure growth.

A lack of comparable measures hinders research on growth entrepreneurship.

Author's main message

Policymakers can select measures of entrepreneurship that are appropriate to a specific problem or goal; this can improve the contextual relevance of policy design. Several measures, related to different dynamics of entrepreneurship, should be considered. These measures represent how entrepreneurship occurs, why it is undertaken, and what activity or outcome it can yield. Findings based on these measures help identify gains and trade-offs when considering potential policy options, enabling policymakers to design more appropriate policies to target specific entrepreneurship types and outcomes.

Motivation

Entrepreneurship is seen both as a goal on its own and as a tool that can yield employment, income, and innovation gains. Like many other economic trends, the study of entrepreneurship is muddled by challenges related to definition, measurement, data collection, comparability, applicability, and interpretation. Selecting the appropriate measure that matches policymakers’ concerns is critically important to gaining an accurate understanding of relevant issues and for designing appropriate policies. Making use of appropriate measures can save time and money by allowing more precise identification of policy targets and goals, narrowing down the list of potential interventions, and improving the design of suitable measurement and evaluation systems.

Discussion of pros and cons

What do policymakers want and need from entrepreneurship measures?

The heterogeneity of any economic activity has implications for the design, funding, and success of policies. This is also true of entrepreneurship, which can advance a wide range of vital functions, including job creation, income generation, innovation, provision of tax revenue, industry competition, and many more [1]. Policymakers are better equipped to design and evaluate policies when the measurement techniques at their disposal are appropriately matched to context; as such, the identification of effective and precise measures for entrepreneurship is of critical importance.

Determining what policymakers want from entrepreneurship is an important first question that must be answered before one can begin comparing, selecting, interpreting, and inferring from different measures. To this end, it is important to understand that needs vary significantly based on the context and specific challenges faced. It is clear that entrepreneurship as a general concept has been embraced on a global scale, as represented for example in the European Commission’s Entrepreneurship 2020 Plan. Even beyond interest in entrepreneurship overall, policymakers are increasingly interested in specific types or outcomes, e.g. promoting women-owned start-ups or high-growth firms.

When faced with high unemployment, particularly when considering certain segments of the population, such as youth, it may be desirable to focus principally on job creation. In this case, measures that capture aspects of youth entrepreneurship will be most relevant, such as, if they become self-employed due to barriers in the labor market. Measures that evaluate these types of issues are not exclusive to one particular case (such as youth unemployment), but will also be useful in a general sense for those who view job creation as a key goal for economic development. Policymakers with this objective will benefit from knowing how many people become entrepreneurs, as well as how many of those people can grow their businesses and create jobs for others.

Other stakeholders, such as those in tax agencies or international development organizations, may be interested in the tax implications of entrepreneurship. They can gain insight from measures that capture the extent to which it is occurring as a taxable event—i.e. the volume of entrepreneurship that can be taxed. Likewise, increased interest in high-growth entrepreneurship can be served by measures that capture different types of growth, ranging from sales growth, to employment growth, to export growth. These measures can guide those who are specifically interested in capturing the disproportionate economic benefits associated with rapid firm growth [2], [3]. Similarly, for those interested in technological innovation, measures of innovation processes and outcomes may be most relevant, such as how much a firm spends on research and development, or the originality of a patent [4].

Obviously, the range of issues to consider is large. It thus stands to reason that more precise measures of entrepreneurship would allow for the design of more precise policies; therefore, gaining better insight into the many available measurement options is a productive investment for policymakers.

Measuring entrepreneurship

Though many different measures are used in the literature, five measures have been particularly prevalent in the research and represent different dimensions of entrepreneurship. These are: self-employment, new firm formation, early-stage entrepreneurship, necessity entrepreneurship, and opportunity entrepreneurship. Beyond these five, measurement considerations to capture growth entrepreneurship are also highly relevant.

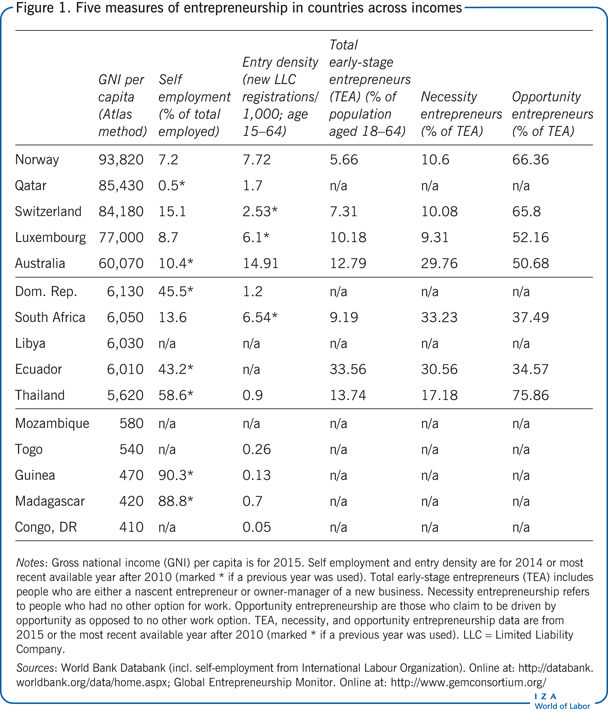

The economic development context in which entrepreneurs operate is important in shaping the type and nature of their activities [1], [5]; it is thus useful to consider this context when comparing measures [6]. In Figure 1, five entrepreneurship measures are listed along with gross national income (GNI) per capita for 15 countries. This list comprises five of the highest income countries, five of the lowest income countries, and five countries in between.

Entrepreneurship type matters: Self-employment and new firm formation

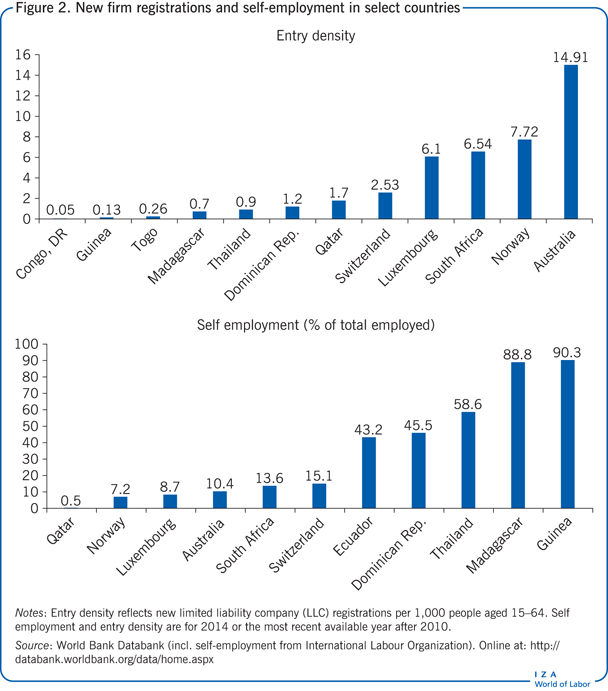

The type of entrepreneurship used by the entrepreneur represents the “how” in this context. In other words, how does it manifest? There are several alternatives, among which self-employment and new firm formation are commonly used [7]. Many empirical studies prior to the mid-2000s used self-employment as the proxy for entrepreneurship. Measuring self-employment is typically done as a proportion of the total employed, consistent with the well-accepted International Labor Organization (ILO) classification of self-employed workers as those working on their own account across four sub-categories (employers, own-account workers, member of producer cooperatives, contributing family workers). Self-employment, as a labor market trend, reflects a different manner of economic participation than entrepreneurship in the form of new business creation.

Data on new business creation, which is often collected by country registrars and other sources, has become increasingly more accessible and provides a count of new business entities. New firm formation—interchangeably also called “new venture creation,” “entry,” and “new business”—is frequently considered an appropriate measure for entrepreneurship [8]. New firm formation represents the creation of a new organizational entity, which is born in order to pursue a market opportunity. While many countries or regions collect data on new firm formation, this was not largely standardized and comparable until the creation of the World Bank Group Entrepreneurship Snapshot (WBGES). The WBGES provides comparable data on new firm formation at the country level. It is noteworthy that due to differences in definitions and legal treatments of different private organizational forms, WBGES provides information on new Limited Liability Company (LLC) registrations only. This enables standardization across countries, but also creates obvious limitations in capturing (and likely underestimates) the full scope of new firm formation in a country [1].

Another measure that can be used to proxy new firm formation is VAT registrations, but it is limited in applicability and not comparable across countries because of data collection and harmonization differences. Novel and relatively recent data from Eurostat’s Urban Audit project also provides information on new business formation at the city and region level. This data set counts new business “births” in a city, and is comparable across European cities, making it one of the few data sets that collects comparable information on new firm formation for subnational analysis. It can be used for comparative analysis because new businesses are standardizable as a proportion of total businesses in the city or region.

Context matters when measuring entrepreneurship

The distinction between different measures of entrepreneurship requires some consideration of the prevailing economic development context [5], [6], [9]. For example, as can be seen in Figure 1, self-employment tends to be higher in poorer countries, where informality dominates labor markets and the organization of production. In such countries, which typically have less-effective monitoring, reporting, and tracking systems, new firm formation may appear low, but likely underestimates the volume of entrepreneurial activity actually taking place [1]. Many new firms could be entering the market, conducting business, even expanding and becoming part of value chains, but are simply not legally registering. Unregistered firms, regardless of how large or successful they might be, would not be included in official “new firm formation” counts.

Economic development contexts can also offer explanations for why the numbers look the way they do. For example, private property is not well-protected and subject to exploitation across all of the poorest countries shown in Figure 1. Such meager protection creates little incentive for an entrepreneur to register a business, because they will have limited to no recourse if exploited, and legally registering a business entity (like an LLC) is costly, risky, and could attract attention. In addition, the regulatory environment in these countries, as in many poor countries, is cumbersome and expensive [10]. However, entrepreneurs must still find a way to support themselves. In fact, entrepreneurs across the developing world face this dilemma, and may choose informal entrepreneurship. This may show in the difference between self-employment and new firm formation, as shown in Figure 2. Rich countries, with effective regulatory systems and strong protection of private property, also tend to have higher rates of new firm formation (entry density) relative to self-employment. Poor countries tend to reflect the opposite; for example, self employment in Madagascar is almost 89%, whereas entry density is less than one new firm per 1,000 people.

“Why” matters: Entrepreneurs’ motivations

An important challenge for policymakers is that there are many possible motivations for entering into entrepreneurship. Self-employment could result from entrepreneurial pull (i.e. to pursue a potentially profitable opportunity) or unemployment push (i.e. due to a lack of other labor market options), and can be either a lucrative opportunity or a “default” (i.e. no other option) activity [11], but it is difficult to distinguish this by simply looking at the volume of self-employment. For example, some self-employed individuals can become employers, thereby creating jobs for others.

Figure 1 demonstrates this challenge by looking at the estimated volume of entrepreneurship, called total early-stage entrepreneurial activity (TEA), as collected by the Global Entrepreneurship Monitor (GEM). These data reflect the percentage of the 18 to 64-year-old population who are either engaged in nascent entrepreneurship or are owner-managers of a new business. Unlike the WBGES and Urban Audit data sets, which are based on official data and count legal new firms, the GEM data set calculates entrepreneurship based on survey responses. In other words, TEA includes individuals who consider themselves as nascent entrepreneurs or owner-managers of a new business, expecting that these individuals share the same definition for their activities. This measure likely overestimates the actual volume of entrepreneurship taking place in a country, but it may provide a picture of real entrepreneurial potential, as it captures people who are already engaging in early phases of the entrepreneurial process. This is especially important given that measuring new firm formation does not accurately do this in poor countries, due to relatively lower levels of registration and higher levels of informality in these countries. As can be seen in Figure 1, TEA tends to be higher among middle-income countries (data are not available for the poorest countries). The advantage of using this type of data, which is comparable and standardized across countries, is that it offers insight on many dimensions of entrepreneurship, including motivation.

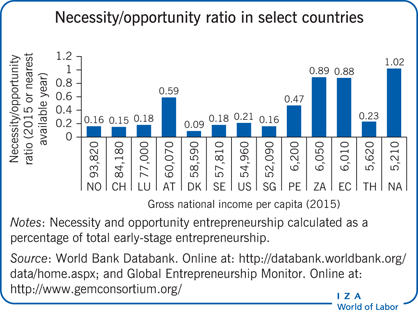

The reason that motivation is important can be seen in the Illustration, which graphically depicts the necessity/opportunity entrepreneurship ratio for several countries. This ratio, calculated using GEM data, reflects the ratio of early-stage entrepreneurs who had no other option for work (“necessity entrepreneurship”) to early-stage entrepreneurs who claim to be driven by opportunity (“opportunity entrepreneurship”). Opportunity entrepreneurs indicate that the main driver for being involved in entrepreneurship is being independent or increasing their income, rather than just maintaining their income. Again, economic development context matters: the overall trend is that rich countries tend to have lower ratios, indicating more opportunity entrepreneurship, whereas poor countries tend to have higher ratios, indicating more necessity entrepreneurship. Policymakers are well served by knowing that these differences exist and, more importantly, by understanding what policies may be able to increase the share of opportunity entrepreneurship.

“What” matters: Growth entrepreneurship

In addition to measures that capture how and why entrepreneurship occurs, determining what is happening in terms of outcome has also become increasingly significant. This is because policymakers may want to target specific types of entrepreneurship that yield particular gains [3]. When it comes to estimating gains such as job creation, knowing the overall volume of new firms and the motivations underlying entrepreneurship are not sufficient, as neither captures the actual outcome of the entrepreneurial activity.

Measuring growth in entrepreneurial firms can be done in several ways, and again, context is very important. One significant challenge is that growth should be measured at the firm level. Employment-based measures, such as changes in the number of paid full-time employees, can be easy to calculate and do not require a high level of technical expertise or manager access within a firm. However, the definition of paid or full-time employees can vary across countries; for example, in a country where subsistence and housing may be informally provided to workers, but not necessarily salaries (i.e. what constitutes paid full-time employment may differ), this measure would not capture growth. In addition, employment-based measures might not be appropriate in some industries. For example, in entrepreneurial firms that automate their production, a decline in employment might be assumed as not reflecting growth, while in fact, the opposite may actually be true.

Another approach to measuring growth entrepreneurship is to use traditional accounting-based measures of performance, such as sales, revenues, or profits. This can be problematic because accounting standards vary across countries and because this approach would leave out a large number of unregistered entrepreneurs. In countries that have significant corruption, entrepreneurs may underreport or not report this information. In richer countries, where regulatory requirements are better enforced, performance-based measures can be more reliable. A particularly interesting subset of entrepreneurial firms include those that may be engaged in exporting, so export growth is another option for measuring growth entrepreneurship.

Limitations and gaps

Policymakers can learn a great deal from data-driven research on entrepreneurship; however, a significant challenge is that coverage, availability, and comparability of data are all limited. The major constraint, not surprisingly, is the difficulty in data collection due to technical requirements, coordination and harmonizing, and cost. Data collection is an expensive endeavor, particularly when undertaken across a large number of independent administrative agencies, for example, company registrars across more than 150 countries. Data collection efforts that aim to compile and integrate existing data face the challenge of unstandardized definitions, which limits comparability [6]. Efforts aimed at creating completely new information using standardized protocols may maximize data comparability, but these are expensive and could end up limiting coverage as not all countries or industries will be able or willing to adopt the new protocols.

Data challenges are especially problematic in low-income countries, which face greater funding and capacity challenges in data collection and reporting. This is evidenced by the prevalence of missing data among the low-income countries in Figure 1. These issues are further exacerbated in conflict countries, where access, security, and funds for data collection are a challenge. These problems disproportionately affect countries that would stand to gain significantly from increased entrepreneurship, particularly those in the Middle East and sub-Saharan Africa.

There is also a disconnect between firm-level and country-level data. Country-level data is helpful to understand the overall trend and to track major changes over time. Firm-level data provide the richness and granularity necessary to identify the drivers, nature, trend, and outcomes of entrepreneurship. This information is useful when targeting specific types of entrepreneurship, such as female or growth entrepreneurship, or for targeting particular outcomes like job creation or export growth. Subnational research on regional economic development and entrepreneurship can also benefit from more firm-level data, which can be compared across regions. For example, regional policymakers need firm-level data to understand which characteristics encourage growth entrepreneurship in cities; regional or country aggregates are useful towards this end.

Summary and policy advice

Scholars and policymakers are well served by moving towards a more nuanced, explicit, and clear picture of the many dimensions of entrepreneurship. Recommended steps include:

Where possible, conduct analyses using several different measures for entrepreneurship. This is especially relevant for comparative empirical studies that assess the determinants of entrepreneurship across regions or countries with wide variance in economic development conditions.

Policymakers should invest in the creation of standardized, comparable data sets at the firm level that are specifically aimed at capturing growth entrepreneurship.

Policymakers can benefit from multilevel research on how different contextual levels can affect entrepreneurship outcomes; in other words, how the country level, region level, and firm level can influence a key policy goal.

Policymakers should invest in understanding why an individual selects self-employment instead of new firm formation, and vice versa. This would improve their understanding of how an individual can be channeled into the form of entrepreneurship most desired by policymakers.

In addition, policymakers should consider pursuing strategies to unlock and improve the gains from entrepreneurial activity in their country. Measurement is also a key consideration here, because effective measurement of policies and pilot programs can increase efficiency and lower costs. Some strategies include:

Lowering the necessity/opportunity entrepreneurship ratio, along with measurement of the determinants of (especially) opportunity entrepreneurship.

Boosting formal registrations of new businesses, along with rigorous measurement of which policies and programs can influence whether an entrepreneur registers a business or operates informally.

Targeted support for growth entrepreneurship, along with measurement of effective policies.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [1], [2], [4], [6].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Sameeksha Desai