Elevator pitch

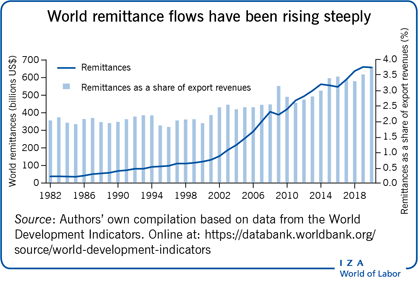

Remittances have risen spectacularly in absolute terms and in relation to traditional sources of foreign exchange, such as export revenues. Remittances can improve the well-being of family members left behind and boost growth rates of receiving economies. They can also create a culture of dependency, lowering labor force participation in recipient nations, promoting conspicuous consumption, and accelerating environmental degradation. A more thorough understanding of their impacts can help formulate policies that enable developing economies to harness the most out of these monetary inflows.

Key findings

Pros

Remittances can increase the well-being of receiving households by smoothing consumption and improving living conditions.

Remittances can facilitate the accumulation of human capital, promoting healthier life styles, access to healthcare, and greater educational attainment.

Remittances can ease the credit constraints of unbanked households in poor rural areas, facilitate asset accumulation and business investments, promote financial literacy, and reduce poverty.

Cons

Remittances can reduce labor supply and create a culture of dependency that inhibits economic growth and raises inequality.

Remittances can increase the consumption of non-tradable goods, raise their prices, appreciate the real exchange rate, and decrease exports, thus damaging the remittance-receiving country’s competitiveness in world markets.

Remittances can have negative impacts on the environment and promote some types of criminal activity.

Author's main message

Remittance flows have the potential to greatly improve the livelihoods of receiving households by smoothing their consumption and enabling investments back home. They can facilitate economic stability, improve creditworthiness, and attract investments to promote economic growth and reduce poverty rates for recipient nations. Data limitations need to be overcome in order to best assess the impacts of remittances and to design policies that facilitate the transmission and productive use of inflows. Policy recommendations range from easing capital controls to reforming immigration policy.

Motivation

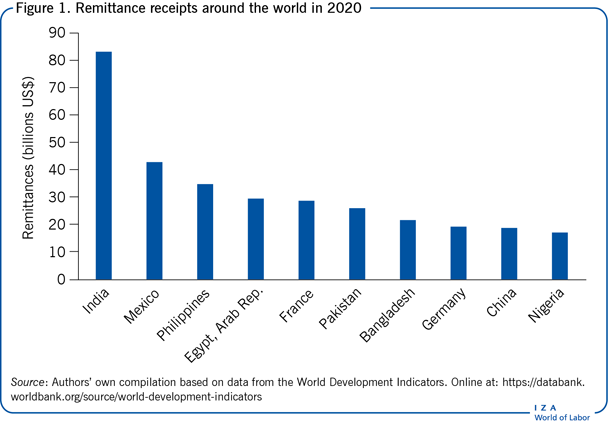

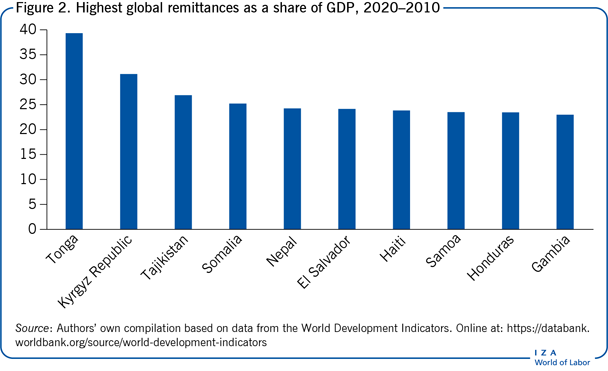

Remittances, the repatriated earnings of emigrant workers, have grown remarkably in recent decades, proving considerably less volatile than other traditional sources of foreign exchange. In 2020, remittances were measured at about US$83 billion and US$43 billion in India and Mexico, respectively (Figure 1). These flows are particularly important for small developing economies (Figure 2), where they amounted to nearly 40% and 24% of Tonga's and El Salvador's 2020 GDP, respectively.

The growth in remittances has fueled debate on their impacts, with some studies pointing to how they promote a culture of dependency, reductions in labor supply, and conspicuous consumption. Others have found that remittances can disadvantage the export sector via the so-called Dutch disease. Yet, many studies have noted that remittances can greatly improve livelihoods back home, promoting education, health, and capital investments. They facilitate consumption smoothing, improve creditworthiness, and widen access to foreign capital.

Discussion of pros and cons

Are remittances good or bad?

Assessing the impact of remittances is difficult. The receipt of remittances is not a random event. Households that receive remittances are likely to exhibit certain characteristics. For instance, they are more likely to have family members abroad and specific needs. As a result, it becomes cumbersome to separate the impact of remittances from that of emigration or other household traits (endogeneity).

Researchers have tried to cope with the challenge in various ways, such as using instrumental variable methods (using variables that do not explain the outcome of interest, but are highly correlated with remittances), exploiting natural experiments, and designing randomized controlled experiments. All these methods have limitations, including identifying valid instruments, financing costly large-scale randomized trials, and extrapolating the findings to other countries and contexts. Because of the distinct methodologies used and the differences in geographic and temporal settings in which the studies take place, conclusions about the pros and cons of remittance flows vary considerably.

What are some of the cons?

Concerns about the economic and social implications of remittance flows can be grouped according to the category of data used in the analysis. Some studies use individual or household level data, while others use country level data.

Micro-level impacts (individual and household)

One of the most widely cited concerns about remittances in studies at the micro level pertains to the potential for these money flows to breed dependency on the receiving side. Remittances may ease budget constraints, raise reservation wages, and through an income effect, reduce the employment likelihood and hours worked by individuals receiving remittances. However, remittances also lower the opportunity cost of leisure of those receiving transfers from abroad and, in turn, may reduce recipients’ labor supply. It is this potential distortion of household labor supply that preoccupies some researchers and policymakers.

In contrast, other studies show that the labor supply impacts of remittances can be complex, varying by gender and type of employment: formal or informal [1]. Specifically, hours of work in marginal types of employment may decrease, whereas hours of work in self-employment might increase. In addition, remittance flows may reduce child labor while increasing the labor supply of older household members [2]. Finally, remittances may also negatively impact the well-being of senders due to the financial burden placed on working emigrants to remit to home [3].

Macro-level impacts (country-level)

At a country level, studies have raised two main concerns. First, they note the potential for moral hazard problems related to potential reductions in the labor stock of the economy, the development of conspicuous consumption patterns, and the inability to develop a culture of saving that enables future investments and growth. Still, while there is evidence of labor supply reductions following the receipt of remittances, evidence of reductions in economic growth are scarcer, and most analyses fail to consider the long-term return on investment in human capital.

A second concern in this literature refers to the effect of remittances on exchange rates through increases in the prices of non-traded goods. Reminiscent of the effects shown for Dutch disease or resource-boom models, some researchers have argued that remittances can increase the consumption and prices of non-traded goods and services, leading to real exchange rate appreciation and sectoral shifts in the economy. The resulting declines in the country's competitiveness in world markets can be particularly troublesome [4]. A related international financial concern is the potential for remittances to promote international indebtedness.

Overall, the tendency for migrants to concentrate geographically in certain regions due to long-standing migrant networks may exacerbate reliance on few remittance corridors and, in turn, increase exposure to foreign exchange shocks when remittance source countries experience an economic crisis.

What are some of the pros?

Micro-level impacts (individual and household)

Some of the advantages of remittance flows that most researchers agree upon at a micro level include increases in individual well-being, human capital accumulation, and infrastructure improvements enabling the accumulation of capital, savings, investments, and financial literacy. These gains emanate from the ability of these money flows to stabilize household income, address income shortfalls, and smooth household consumption.

In addition to addressing daily consumption needs, remittance inflows have also been shown to have positive impacts on children left behind, increasing their formal education, and reducing their hours in the labor market [2]. Overall, meta-regression analyses covering multiple studies and countries are generally supportive of the role of remittances in raising educational expenditures, especially in Latin America. In addition, remittances can increase calorie intake and reduce food insecurity in developing countries.

Importantly, remittances can significantly promote capital investments. By easing credit constraints faced by households lacking access to financial markets, remittances can facilitate asset accumulation and business investments, including in land, tools, and new businesses [5]. In addition to boosting savings, remittances facilitate access to financial institutions, and promote financial literacy. Yet, an important challenge in much of this literature refers to the confounding impacts of human capital acquired during the migration process (new business ideas, production, and sale strategies, for example) and the impact of remittance flows. To further complicate matters, the endogeneity of remittance flows and business investments can be troublesome—for example, if migrants are more likely to send money home when there is a family business in anticipation of future bequests. In that case, it is the business that attracts the remittance flows rather than the remittance flows that make the business possible. Finally, unlike educational investments or consumption, business investments are not a frequent occurrence, thus assessing this impact presents an additional data challenge.

More recently, some authors have also examined the implications of remittance flows on fertility implosions enabling an increase in female labor force participation. Households in the least developed countries who are recipients of remittance have also been shown to increase their political participation due to the stronger ties that develop between senders and recipients, mobilizing the latter to increase their political participation [6].

Macro-level impacts (country-level)

Possibly two positive impacts of remittances at the country level that have been extensively examined include economic stability and creditworthiness.

A key trait of remittance flows is their resilience and countercyclical nature, which help support economic stability. Many studies have shown this to be the case by exploiting natural experiments, such as natural disasters and financial crises, and examining the response of remittance flows to greater economic need at home. They document how remittances increase in response to economic shortfalls and decline otherwise.

In addition, because remittances constitute a large and stable source of foreign exchange, studies have shown they can prevent sudden current account reversals, improve a country's credit rating, and facilitate the inflow of new investments. Recognizing their potential, several countries have developed active emigration policies and started educating potential migrants about the benefits of remitting and investing in the home country to ensure that they do.

Some more contentious impacts of remittances

While there is some consensus on the remittance impacts discussed above, there is much debate on the potential impact of remittances on other outcomes, including economic growth, poverty, or inequality. Some studies have found positive impacts of remittance flows on economic growth and poverty, while others remain skeptical. For example, a widely cited study concludes that remittances slow economic growth [7]. However, the study has been criticized for ignoring the intermediate impact of remittances on labor supply and capital formation. It is possible that slower-growing countries experience more outmigration and receive more remittance inflows. Once again, identifying the direction of causality remains an empirical challenge.

Some studies have also argued that remittance inflows reduce inequality by helping people in rural and poor areas. However, the evidence varies widely by country, along with selection into emigration. Remittances may worsen income inequality if international migration is more prevalent for the elite because the money inflows would be confined to those who are better-off, therefore exacerbating income inequality [8].

There is also debate on how remittances impact the environment. Focusing on Guatemala, some authors document how remittances contribute to a loss of forest cover by inducing remittance-receivers and returning migrants to expand agricultural activities [9]. Despite reducing poverty among lower-income households, remittances may expand the burning of solid fuel. In contrast, remittances may promote the use of cleaner energy sources among higher-income households.

While the state of the literature is emerging, of interest to many are the environmental impacts of remittances on recipient nations. There are numerous avenues by which remittances may impact carbon emissions and result in other environmental consequences. For example, by lifting incomes and elevating households into the middle class, remittances facilitate the purchase of automobiles and the consumption of goods and services that require the use of fossil fuels by those receiving the money flows. In an extensive study of Nepal (one of the top remittance-receiving nations when measured as receipts as a share of GDP), one study finds that rising remittances lowered CO2 emissions [10]. The authors speculate that rising energy shortages, along with widespread and lengthy power outages (and the rising electricity prices), have shifted preferences toward appliances and devices that use cleaner and more energy-efficient technologies—a shift facilitated by remittance inflows. The idea that, at least among the less destitute, remittances promote the use of cleaner energy sources has been reported in other countries as well. Such a finding would be predicted by the environmental Kuznets curve—the notion that rising incomes may lead to more pollution at first; however, at higher incomes, there is a turning point and remittances may result in less environmental degradation. This might explain the distinct conclusions of studies on this topic.

Given the diversity of outcomes with respect to the environmental impact of remittances in country-level studies, it is helpful to consider studies that consider multiple countries at once. One such study collects information from 127 countries over the 1971–2012 period and, using a longitudinal panel methodology, tests for the effects of remittances on greenhouse gas emissions [11]. The author concludes that, in the aggregate, remittances lower greenhouse gas emissions. There could be multiple reasons for this finding given what is known from micro-level studies documenting how remittances change household behavior. For example, it is known that remittances often raise household spending on healthcare and education, detracting from the consumption of goods and services that may be pollution-generating. Social remittances, the idea that individuals touched by migration and monetary remittances may acquire new information and learn new habits from their kin abroad, could also contribute to lower pollution levels.

In addition to their environmental impacts, recent research has examined the impact of remittances on crime, arriving at distinct conclusions. Some studies associate them with increases in white-collar crimes and intimate partner violence, allegedly driven by higher alcohol consumption and reduced employment among men [12]. Others document how, fearing being assaulted, remittance recipients appear to be more supportive of vigilantism and crime-fighting measures.

Some nuances: Level versus volatility and predictability

For the most part, the remittance literature has focused on the impact of remittance flows, paying much less attention to other aspects surrounding the receipt of the money inflows, such as their frequency, volatility, and uncertainty. Yet, the ultimate impacts of remittances depend not only on the amount of money received, but also on their regularity and predictability. Studies focusing on Mexico have found that increases in the volatility of remittance income raise the employment likelihood of men and women in receiving households, as well as the hours worked by employed women [13]. To the extent that men are more likely to be working full-time than women, the latter may be more likely to increase their work hours in response to increased remittance income volatility. In other words, female labor supply may be used as a buffer against increases in the volatility of remittance inflows.

Similarly, the decision to use remittance receipts for consumption or investment might depend in part on the regularity and predictability of remittance flows. Households that receive remittances on a predictable basis might be in a better position to coordinate their day-to-day expenditure and consumption needs with the receipt of remittances. In contrast, households that receive remittances more sporadically are more likely to view the inflows as transitory and, therefore, be less likely to include them in their ordinary consumption planning, saving the inflows instead. Studies for Mexico have found that increased uncertainty in remittance income raises household spending on asset accumulation. Hence, both the level and predictability of remittance inflows should receive full attention in the design of policies seeking to maximize the benefits from remittance inflows into developing economies.

Migration versus remittance effects

The impact of remittance flows is closely intertwined with that of migration. The motive for migrating can affect the propensity to remit and amounts remitted home. A way of distinguishing these impacts is to compare the effect of remittance flows for families with migrant household members with the impact of remittance flows in households with no emigrants but who nonetheless receive transfers from distant family members or friends [14]. When doing so, studies have confirmed the positive impact of remittances on the educational attainment of children and the ability of remittances to level the field by providing better educational opportunities for more disadvantaged children. Nevertheless, concerns about the imperfect portability of human capital from one country to another might persist. Specifically, the emigration of other family or community members might lower the incentives for young children to invest in an education at home if they foresee emigrating in the future.

Furthermore, it remains unclear if remittances compensate for the losses incurred due to the emigration of family members. Some studies conclude they do not, with parental health declines that are only minimally compensated by the remittances received or worse housing quality resulting from lack of upkeep, even if housing investments were stimulated by remittance inflows. Yet, in other cases, reductions in subjective well-being due to family emigration are found to be offset by the receipt of remittances.

Policies affecting remittance flows

A range of policies can encourage remittance sending and allow receiving countries to harness the most from such flows:

(i) Relaxing exchange and capital controls, as well as the operation of domestic banks overseas, to facilitate international transactions by emigrants to their home communities through banks and financial institutions.

(ii) Incentivizing the use of formal transfer systems, which can ensure safe transfers, increase transparency in transmission costs, and enable migrants and their families to build a relationship with formal intermediaries. Developing such relationships is key for financial literacy and for accessing credit for investing and asset accumulation purposes. One example of this type of policy is the Bangladesh Cash Incentive program, which rewards transfers into banks by adding 2.5% of the amount transferred.

(iii) Establishing the necessary institutional arrangements to educate, inform, and orient potential migrants before they emigrate to improve their well-being in the host country and facilitate the flow of remittance funds back home in a safe and productive manner.

(iv) Facilitating diversification in migrants’ destinations to diminish the volatility of remittance inflows.

(v) Reducing remitting costs, so that more of the flows go to the intended recipients. While average costs still vary widely (the costs of sending from Sub-Saharan Africa is double that of sending from South Asia) today's global average of about 6.3% is considerably lower than the 2011 average of 9% according to Remittances Prices Worldwide, the database maintained by the World Bank to track the costs of remitting in the various remittance corridors.

Carefully considering how immigration policy impacts migration and remittance flows. For example, first, immigration policies that facilitate the permanent settlement of migrants could strongly affect remittance flows, though the outcome may be ambiguous. On the one hand, legalizing the status of migrants can facilitate their travel back and forth between the home and host countries, allowing migrants to stay in touch with their families back home and facilitating the flow of remittances. On the other hand, remittance flows could drop if migrants no longer envision their migration as temporary and gradually lose touch with their families back home.

In addition, immigration policies that favor high- versus low-skilled migration can also have important consequences for remittance flows. For instance, it has been found that the sponsoring of family members is less likely to occur among high-income families and, overall, appears to be associated with lower remittance sending.

Finally, stringent immigration enforcement, as has occurred in the US since September 2011, can reduce the number of undocumented immigrants, restrict the cyclicality of migration flows, and limit employment opportunities for undocumented immigrants. In that vein, studies have shown how increased enforcement reduces the share of migrants sending money home [15]. However, legal immigrants tend to increase their money outflows enough to offset any reductions in remittances from undocumented immigrants.

Limitations and gaps

When considering the impact of remittance flows on receiving economies, it is important to keep in mind research limitations that undoubtedly shape study findings. Many studies focus on a specific country or region at a particular point in time. Because of cultural differences and country idiosyncrasies, some of the empirical evidence based on a specific country might not generalize to other economies. In addition, remittance impacts might vary over time within a given country depending, among other things, on its policies and the characteristics of emigrants.

Studies have also applied different methodological approaches in their analyses, contributing to the diversity of findings. Some studies implement randomized trials, some exploit natural experiments, some rely on instrumental variable methods, and others do none of these. Meanwhile, gauging the causal impact of remittances remains a challenge given concerns about the endogeneity of remittances, the difficulty of separating the impacts of migration from those of remittances, and the selection of migrants into emigration and remitting, to mention a few.

Finally, a concern by many revolves around the accuracy of remittance data, with significant gaps in remittance amounts reported by senders and receivers. Some of these discrepancies may be driven by the transfer method used by migrants, as remittances sent through informal channels are less likely to be recorded by the authorities of recipient nations, compromising macroeconomic data on remittance flows.

Summary and policy advice

Remittance flows—exceeding US$600 billion in 2022—are expected to continue to grow along with international migration flows. Because of their size and responsiveness to shocks, remittances have the potential to help developing countries in several ways, from stabilizing their economies and improving creditworthiness to attracting funds for asset accumulation and investments in human capital. The main challenge remains the design of policies that can promote these flows and their productive use while accounting for the idiosyncrasies of each country at a particular point in time.

In addition, while research has expanded the understanding of remittance flows and their impacts, there is more to learn about how the periodicity and predictability of the flows affect their impact. These aspects of remittance flows could prove crucial for the design of policies that can help developing economies attract larger remittance flows and use them productively.

Finally, given the current political environment and escalating anti-immigrant sentiment, strict enforcement of immigration laws, and abusive treatment of immigrants in many remittance-sending countries, more research is needed on how immigration policies in host countries affect the flow of this vital source of foreign exchange for many recipient nations.

Acknowledgments

The authors thank two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Version 2 of the article updates the figures and revises the text and references significantly.

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The authors declare to have observed these principles outlined in the code.

© Catalina Amuedo-Dorantes and Susan Pozo