Elevator pitch

Before the great recession of 2008–2009, the “flexicurity” model (with flexibility for firms to adjust their labor force along with income security for workers through the social safety net) attracted attention for its ability to deliver low unemployment. But how did it fare during the recession, especially in Denmark, which has been highlighted as having a well-functioning flexicurity model? Flexible hiring and firing rules are expected to lead to large adjustments in employment in a recession. Did the high rate of job turnover continue or did long-term unemployment rise? And did the social safety net become overburdened?

Key findings

Pros

High rates of flows into and out of jobs enable firms to more readily adjust labor inputs to the business cycle and structural changes.

High job turnover rates make it easy for most unemployed workers to find jobs, implying that most unemployment spells are short.

In the wake of the great recession, there has been no steep increase in long-term unemployment and no signs of increased structural unemployment.

It is fairly easy for youth to enter the labor market, and the youth unemployment rate is relatively low.

Cons

Reconciling unemployment support with job-search incentives is challenging and places a heavy burden on active labor market policies.

The flexicurity model risks encouraging excess turnover of labor.

The system reduces incentives for firm-specific training.

Public finances are sensitive to the employment level, and for the system to function in a crisis, governments must ensure adequate fiscal space.

There is a high risk that low-educated workers will be marginalized in the labor market.

Author's main message

Denmark is often considered as the archetype flexicurity model, and is therefore an interesting test case for how well the model has coped with the great recession. Gross job flows in Denmark remain high, most unemployment spells are short, and there are no strong signs of an increase in long-term unemployment. These outcomes are remarkable since the boom-bust pattern in Denmark before and after the crisis implied a large drop in GDP and thus in labor demand. Yet there are no indications that the prolonged aggregate demand shock has increased structural unemployment. What seems to account for the success of the model are Denmark’s active labor market policies and having the fiscal space to accommodate the crisis.

Motivation

The great recession of 2008–2009 severely affected labor markets in most OECD countries. The crisis has been more prolonged than expected, which is a problem in itself, but which also amplifies the risk of an increase in structural unemployment.

In earlier deep crises in Europe, the increases in unemployment that accompanied the decline in GDP turned out to be long-lasting, and the recovery in employment was slow, with correspondingly high social and economic costs. A natural question is whether the great recession, the worst in recent decades, will lead to lasting labor market problems.

Before the recession, the European Commission and others extolled the so-called flexicurity model for its ability to balance employers’ concerns for flexibility with employees’ interest in income security [1]. It was an open question whether this model could endure a deep downturn. Lax firing rules made it likely that employment would fall steeply. And although the social safety net cushions the unemployed, a prolonged decline in employment would put the financial viability of the model at risk by reducing tax revenues and increasing social expenditures.

Now, some years into the crisis, a pattern is emerging that makes it possible to consider how the flexicurity model is coping with the crisis. Since the Danish labor market has been highlighted as a well-functioning flexicurity model, it is particularly interesting to assess how it has coped with the crisis.

Discussion of pros and cons

The implications of the great recession for labor market performance

As a result of the great recession, no less than 13 OECD countries, including Denmark, experienced a drop in real GDP of 5% or more between 2008 and 2009. The crisis led to a severe decline in aggregate demand, and as a consequence employment fell and unemployment soared.

Although the impact originated on the demand side, the employment response also depends on supply factors and labor market institutions. The key issue is the labor market’s adjustment capability, in particular whether a crisis translates into lasting structural problems that make it difficult to bring employment back to its pre-crisis level.

An increase in unemployment may in itself be a cause of structural problems. Long-term unemployment tends to depreciate human and social capital, broadly defined. As a consequence, it may become more and more difficult to re-gain employment the longer the unemployment spell lasts (called negative duration dependence). Long-term unemployment thus has dire social and economic consequences at the individual level and is a source of increasing structural unemployment at the economy-wide level.

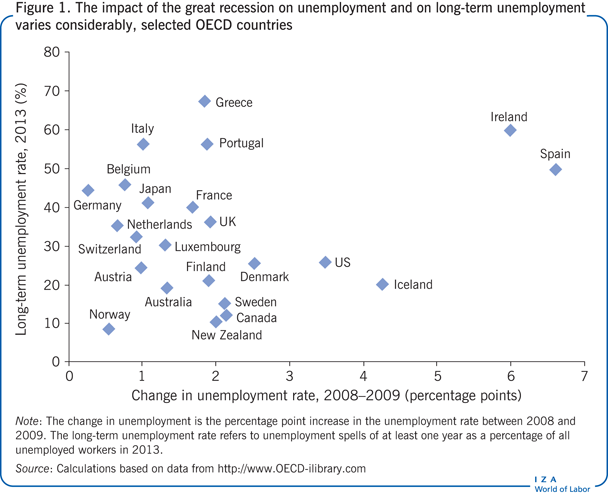

To assess the labor market consequences of the crisis, two broad measures are of interest. How hard was the labor market hit, and are there signs of structural problems building up? The change in the unemployment rate between 2008 and 2009 can be taken as a measure of the labor market impact of the crisis, while the share of long-term unemployment in total unemployment in 2013 gives an indication of structural problems. These two measures are plotted in Figure 1 for OECD countries. The first observation to be made is the substantial differences across countries, pinpointing that there is more than one story on the labor market effects of the great recession.

When unemployment is rising significantly, the duration of unemployment, and thus long-term unemployment, is expected to increase. More severely affected countries would therefore be expected to suffer more from long-term unemployment, as exemplified by Ireland and Spain in Figure 1. However, countries’ experiences are more nuanced. Consider the group of countries that includes Canada, Iceland, New Zealand, the US, Denmark, Finland, and Sweden. They were all reasonably hard hit by the crisis, but long-term unemployment is not high in comparative perspective. While the first four countries are known to have rather liberal labor markets, it is interesting that three Nordic countries are in the same cluster. As these countries have more extensive welfare arrangements, it may be expected a priori that they would be more vulnerable to a deep crisis and have less adjustment flexibility due to the generosity of the social safety net. Evidence does not support this conjecture, however. Why not?

Flexicurity and Denmark’s experience after the great recession

Before the great recession, Denmark was often singled out for having a well-functioning flexicurity system, primarily because of its very low unemployment rate [2]. It is therefore of interest to consider Denmark’s performance during the crisis in some detail.

There is some debate about whether the flexicurity model should be defined in terms of policy and institutional design or performance. Defined in terms of design, the model consists of lax employment protection legislation, generous unemployment insurance, and active labor market policies. Defined in terms of performance, the model has a high rate of turnover in the labor market, allowing firms to adjust their workforce swiftly and workers to find new jobs easily, along with decent income support for jobless workers [3], [4].

What does the actual post-recession performance show? Denmark took a beating during the great recession, severely testing the flexicurity model. Unemployment rose 2.5 percentage points between 2008 and 2009 and 4 percentage points between 2008 and 2010, almost double the average increase for OECD countries, although the unemployment rate remained below the OECD average.

Denmark’s post-recession performance can be seen as the bust phase of a boom−bust cycle. In the years preceding the crisis, the economy was overheating due to soaring domestic demand. Unemployment was below the structural level, high wage increases undermined wage competitiveness, and house prices were accelerating. On the eve of the recession, there were signs that the boom was ending. Then, with the great recession, aggregate demand plunged. Since the recession, demand has remained subdued, reflecting weakness in domestic private consumption and investment, although net exports have been growing. The protracted reduction in private domestic demand may be related to debt consolidation, precautionary savings, and pessimistic expectations driven by the boom−bust pattern. Fluctuations in aggregate demand have had important implications for labor demand which was overshooting before the crisis and undershooting after the crisis. This pattern is reflected in both unemployment rates and wages. Wage increases accelerated in the boom years, contributing to a worsening of wage competitiveness, but the recession has slowed wage growth below that of competitors.

How resilient is the flexicurity model to a large contraction in employment?

How should labor markets be assessed and compared? Changes in unemployment rates are not necessarily an appropriate yardstick since they depend on changes in aggregate demand and thus on factors outside the labor market. With a sharp contraction in economic activity driven by a drop in aggregate demand, an increase in unemployment is inevitable. The interesting question concerns the precise mechanism of adjustment, in particular whether the large drop in employment is leading to structural changes and thus to persistent unemployment.

As aggregate demand declines, so does the demand for labor. The adjustment process includes two important dimensions. First, labor input can be adjusted by reducing either the number of working hours or the number of employees. In the short term, if employment protection legislation is strict, adjustment is expected to occur through reductions in working hours rather than in the number of employees. Empirical evidence [5] and recent experience support this. During 2008–2013, declines in the number of employees as a share of total adjustment in labor input reached 84–85% in the US and Denmark, compared with 53% in France and 58% in Italy. Second, the number of employees can be reduced by firing workers (higher exit rates from employment to unemployment) or by hiring fewer new workers (lower exit rates from unemployment to employment).

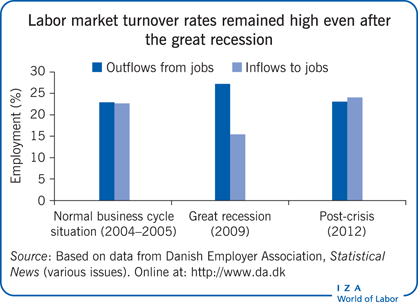

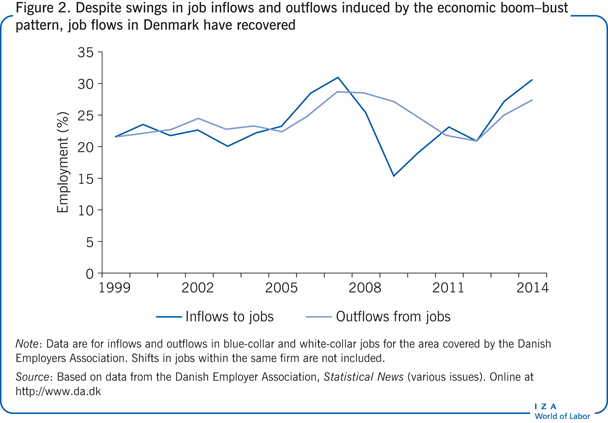

In Denmark, adjustments took place through reductions in both the number of hours worked and in the number of employees. Job exit rates increased, and job entry rates declined. In Figure 2, the swings in the inflow and outflow rates induced by the boom−bust pattern for economic activity are clear. Equally striking, however, is that by 2013 job inflow rates had recovered to the levels seen before the boom.

While the increase in unemployment was unavoidable given the sharp drop in aggregate demand, the distribution across the workforce was not. Whether the increase in unemployment would translate into an increase in long-term unemployment rather than a larger number of short-term unemployment spells was also not obvious. Gross and net job flows can differ considerably. If both gross and net flows are small, the burden of unemployment tends to be carried by a specific group of workers who lose their jobs and who have dim possibilities of finding a new one. Even if net flows are small (no change in aggregate employment), gross flows can be high, implying flows into and out of jobs. In that case, the possibility that unemployed workers will find a job is higher, unemployment spells are shorter, and the burden of unemployment falls on a larger number of workers.

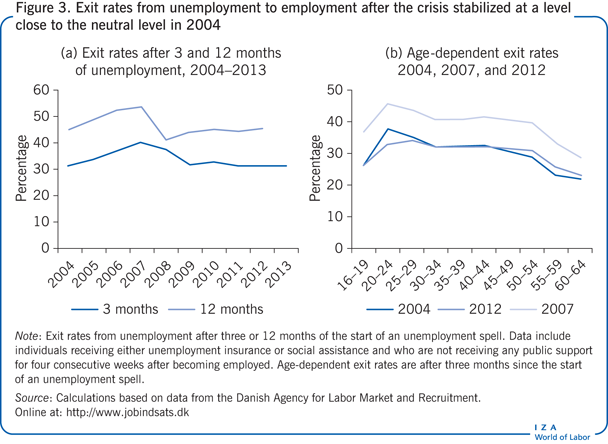

It is striking that gross job flows remained large in the Danish labor market despite the large macroeconomic effects of the crisis. Figure 3 shows the transition rate from unemployment into employment within the first three months of unemployment and after 12 months of unemployment. The exit rate from unemployment was much higher during the boom years of 2006–2007, as expected. However, exit rates after the crisis stabilized at a level close to that in 2004, a year that business cycle forecasters consider to be close to neutral, in the sense that the unemployment rate was at the structural level. Inflow rates into unemployment show a similar pattern, with a peak after the onset of the great recession. High transition rates and short unemployment spells also imply that individuals may experience recurrent unemployment spells within the quarter or year. There was no systematic change in recurrent unemployment spells following the great recession.

Figure 3 shows similar age-dependent exit rates from unemployment to employment for the years 2004 (neutral), 2007 (boom year), and 2012 (well into the great recession). All three curves have the well-known bell shape, reflecting lower exit rates from unemployment for young and elderly workers than for prime-age workers. The business cycle shifts the level of the curve but not its shape. Also, across age groups, exit rates have returned to their levels in 2004. As shown previously in Figure 1, long-term unemployment is relatively low; likewise, youth unemployment is relatively low. High gross flows in the labor market make labor market entry easier.

This evidence on flows into and out of unemployment shows that although unemployment has increased, most unemployment spells are short (in 2013, spells of shorter than three months accounted for close to 40% of total unemployment). This effectively serves as an implicit work-sharing mechanism. Equal burden-sharing is important from a distributional perspective, but high turnover rates also reduce the negative structural implications of high unemployment.

Two remarks are in order. First, as in most OECD countries, employment rates in Denmark for those aged 60–64 have risen in recent years despite the dim business situation. This pattern reflects, among other things, a higher education level among the elderly population (which is usually associated with higher employment rates) and reforms of the early retirement system that have prompted later retirement. These rising employment rates during a period of economic crisis refute pessimistic outlooks on labor market prospects for this age group.

Second, an ongoing trend of declining employment rates for low-educated workers underlies the general labor market situation. This trend was temporarily halted during the upswing that preceded the great recession, but it has started up again. Despite high public spending on education, about one in five members of a cohort do not obtain an education that is relevant to labor market needs. This points to a severe structural problem and to a group of workers that will be increasingly marginalized.

The role of active labor market policies

Active labor market policies are an integral part of the Danish labor market model [2]. An increase in unemployment thus puts such policies under pressure. It is sometimes argued that active labor market policies do not make sense when there is no net job creation in an economy. But this static view overlooks important dynamics in the labor market and the importance of avoiding long unemployment spells that can lead to the depreciation of human capital.

The design of labor policies in Denmark (see Labor market reforms in Denmark during the economic crisis) has changed to reflect the changing labor market and new evidence on effectiveness [6], [7]. Evidence points to the importance of early intervention, with a focus on job search. To reduce locking-in effects and program costs, policies have shifted from expensive programs like classroom training to less expensive programs like on-the-job training. When interventions come late, they have small, if any, effects, especially for groups that have been marginalized in the labor market. This underscores the importance of early intervention to prevent passive unemployment spells from becoming too long.

High gross job flows in the labor market also ease the reallocation of labor, an outcome that may strengthen productivity growth. Both cross-country studies and individual country case studies find empirical evidence that strict employment protection legislation is associated with lower job flows [5]. Evidence for Denmark shows that the reallocation of labor across firms and sectors is associated with productivity gains [8].

Can job flows be excessively high? Lax firing rules have potential drawbacks. They may blunt the incentives for job-specific training for both employers and employees since the investment loses some of its value when a worker changes jobs. Excessive temporary layoffs may also be a consequence of incentives for employers who receive an indirect subsidy in cases of temporary layoffs since variations in the need for labor can be partly absorbed through unemployment insurance. Employers contribute to unemployment insurance financing by covering the first three days of an unemployment spell (for a worker who has been with the company for at least three months), and these payments may fall short of the social costs of layoffs [9].

Adapting labor market models to country conditions

Policy discussions are often directed toward identifying the best labor market model. But while reforms are undeniably needed in many countries, no single best model applies to all of them. Various institutional arrangements have pros and cons, which may be a source of comparative advantage. Countries with flexible employment protection legislation and generous unemployment insurance, for example, may have a comparative advantage in industries with substantial short-term variation in demand and thus in the need for labor. A cross-country study finds empirical support for the claim that countries with more flexible labor markets have a higher degree of specialization in sectors that are more frequently exposed to sector-specific shocks [10]. Denmark’s industry structure, which is dominated by small and medium-size firms, may be very important in this context.

Another important point is the need for adequate fiscal buffers for the flexicurity model to work in a deep recession. A decline in employment causes expenditures on income support and active labor market policies to rise and tax revenue to decline, which worsens public finances. Among OECD countries, Denmark has the public budget that is most sensitive to economic conditions. For the flexicurity model to operate in a recession, the budget at the outset of an economic downturn must be in a position to absorb the impacts of cyclical changes. For the model to work well in bad times, prudence is required in good times. Public finance policies in Denmark have satisfied this condition.

Limitations and gaps

Aggregate demand remains low in Denmark, and the importance of structural barriers will not have its real test until demand picks up. Will employment increase, or has structural unemployment increased? Developments so far strongly suggest that structural changes have not been extensive. But experience and more studies are needed to confirm this.

There also remains a great need for more research on the importance of policies and institutional design, their complementarity, and implications for labor market performance under various economic circumstances.

Summary and policy advice

High gross job flows in the labor market are important for avoiding an increase in structural unemployment. The flexicurity model has accomplished this while also offering relatively generous income support for the unemployed. Despite a severe recession in Denmark—among the deepest in OECD countries—the Danish labor market has coped reasonably well. Gross job flows remain high, and therefore long-term and youth unemployment have remained fairly low.

An important ingredient of the flexicurity model is an emphasis on active labor market policies that keep unemployed workers looking for jobs and that keep their skills relevant. Having enough fiscal space to accommodate large budget changes in a downturn is also critical to success.

The flexicurity model is not static, and labor market policies must be continuously adjusted in light of experience, research, and current conditions. One of the main challenges in the Danish case is to narrow the educational divide. The share of low-educated workers is high, and they risk being marginalized in the labor market.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts. He also thanks Michael Svarer. Previous work of the author contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [2], [6]. The author acknowledges financial support from the Danish Council for Independent Research (Social Sciences) under the Danish Ministry of Science, Technology and Innovation.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Torben M. Andersen