Elevator pitch

Entrepreneurs are a rare species. Even in innovation-driven economies, only 1–2% of the work force starts a business in any given year. Yet entrepreneurs, particularly innovative entrepreneurs, are vital to the competitiveness of the economy. The gains of entrepreneurship are only realized, however, if the business environment is receptive to innovation. In addition, policymakers need to prepare for the potential job losses that can occur in the medium term through “creative destruction” as entrepreneurs strive for increased productivity.

Key findings

Pros

Entrepreneurs boost economic growth by introducing innovative technologies, products, and services.

Increased competition from entrepreneurs challenges existing firms to become more competitive.

Entrepreneurs provide new job opportunities in the short and long term.

Entrepreneurial activity raises the productivity of firms and economies.

Entrepreneurs accelerate structural change by replacing established, sclerotic firms.

Cons

Only a few people have the drive to become entrepreneurs.

Entrepreneurs face a substantial risk of failure, and the costs are sometimes borne by taxpayers.

In the medium term, entrepreneurial activities may lead to layoffs if existing firms close.

A high level of self-employment is not necessarily a good indicator of entrepreneurial activity.

Entrepreneurship cannot flourish in an over-regulated economy.

Author's main message

Entrepreneurship is important to economic development. The benefits to society will be greater in economies where entrepreneurs can operate flexibly, develop their ideas, and reap the rewards. Entrepreneurs respond to high regulatory barriers by moving to more innovation-friendly countries or by turning from productive activities to non-wealth-creating activities. To attract productive entrepreneurs, governments need to cut red tape, streamline regulations, and prepare for the negative effects of layoffs in incumbent firms that fail because of the new competition.

Motivation

When an economy is doing well, there is less incentive to encourage new, entrepreneurial firms. When people and firms are making money, why take a risk on something new and untested? Entrepreneurs often challenge incumbent firms, and while this might seem undesirable, unchallenged, established firms tend to become complacent, content to take their profits without investing in research and development to improve their business. These stagnating firms are the first to suffer when imports arrive—withering rapidly, unable to respond to the competition. Thus, challenging incumbents to do better during good economic times is a benefit of entrepreneurship.

Entrepreneurs are equally, if not more, important when the economy is doing badly. When unemployment is high and the economy is contracting or stagnating, dynamic entrepreneurship could help turn the economy around. By developing novel products or increasing competition, new firms can boost demand, which could in turn create new job opportunities and reduce unemployment.

If entrepreneurs are consistently encouraged, in bad economic times as well as good, then all businesses are kept on their toes, motivated to work continuously to improve and adapt (see Different types of entrepreneurs). Entrepreneurs are the fresh blood that keeps economies healthy and flourishing even as some individual firms fail.

Capitalist economies are not alone in encouraging entrepreneurs. Managed economies, such as China’s, are beginning to encourage and facilitate entrepreneurship. They have discovered that entrepreneurial activities, once viewed as a threat to the established system, are crucial for maintaining economic competitiveness and for achieving long-term success.

Discussion of pros and cons

Entrepreneurs introduce innovations and induce economic growth

Entrepreneurs often create new technologies, develop new products or process innovations, and open up new markets [1]. There are many examples of radical innovations introduced by entrepreneurs such as Pierre Omidyar (eBay), Larry Page and Sergey Brin (Google), Larry Ellison (Oracle), Dietmar Hopp and Hasso Plattner (SAP), Bill Gates (Microsoft), Steve Jobs (Apple), and Stelios Haji-Ioannou (easyJet), to name just a few.

Radical innovations often lead to economic growth [2]. Entrepreneurs who bring innovations to the market offer a key value-generating contribution to economic progress. Compared with incumbent firms, new firms invest more in searching for new opportunities. Existing firms might be less likely to innovate because of organizational inertia, which numbs their responsiveness to market changes, or because new goods would compete with their established range of products. Incumbent firms often miss out, sometimes intentionally, on opportunities to adopt new ideas because of the fear of cannibalizing their own markets. For inventors and innovators (who sometimes come from established firms) setting up their own business often appears to be the only way to commercialize their ideas.

Entrepreneurs increase competition

By establishing new businesses, entrepreneurs intensify competition for existing businesses. Consumers benefit from the resulting lower prices and greater product variety. Researchers have developed a measure of market mobility, which identifies the effects of new business formation on existing firms [3]. A change in the ranking of established firms by number of employees indicates a transfer of market share and higher market mobility. This effect is particularly strong when considering entrepreneurial activity five years prior to the start-up, which points to a substantial time lag in the effect of start-ups on market mobility. Furthermore, new business formation has an indirect competition-enhancing effect by pushing established firms to improve their performance.

Entrepreneurs have positive employment effects in the short and long term, and negative effects in the medium term

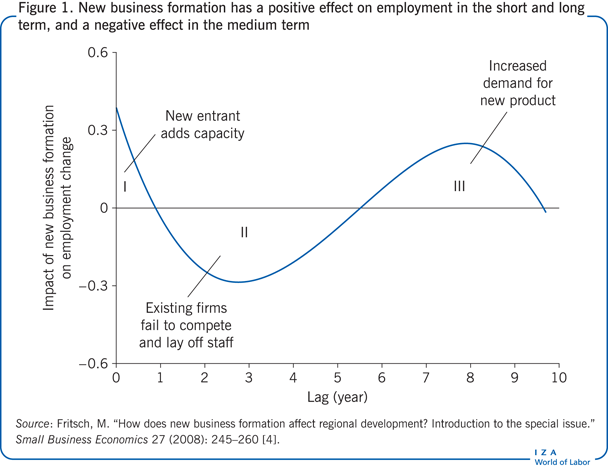

Entrepreneurs stimulate employment growth by generating new jobs when they enter the market. Research has shown (after disentangling all the potential effects) that beyond this immediate effect there is a more complicated, S-shaped effect over time (Figure 1) [4]. There is a direct employment effect from new businesses that arises from the new jobs being created. Following this initial phase, there is usually a stagnation phase or even a downturn as new businesses gain market share from existing firms that are unable to compete and as some new entrants fail. After this interim phase of potential failure and displacement of existing firms, the increased competitiveness of suppliers leads to positive gains in employment once again. About ten years after start-up, the impact of new business formation on employment has finally faded away. This type of wave pattern has been found for the US and for a number of European countries, as well as for a sample of 23 Organisation for Economic Co-operation and Development (OECD) countries [5].

New businesses boost productivity

Competition between new and existing firms ideally leads to survival of the fittest. Even though overall employment may decline, new firms can foster productivity [6]. The productivity-enhancing effect of business formation occurs in the medium term, when the employment effect is dominated by the displacement of existing firms (area II of the “wave” shown in Figure 1). This happens for two reasons. First, new firms increase competition in the market and thus diminish the market power of incumbent firms, forcing them to become more efficient or go out of business. Second, only firms with a competitive advantage or firms that are more efficient than incumbents will enter the market. The subsequent selection process forces less efficient firms (both entrants and incumbents) to drop out of the market.

Entrances, exits, and “turbulence” (the sum of entries and exits of firms in a given year) have been shown to have a positive overall effect on productivity, as measured by various indicators of productivity in several European countries. These effects were found for a sample of 23 OECD countries [6], and in single country studies for Germany, the Netherlands, and Sweden.

In the initial years following entry, the productivity effect can sometimes be negative, probably a result of adjustments to routines and strategies in response to the new entrants. The overall positive relationship is particularly strong for entrepreneurs with high-growth ambitions and a high degree of innovation; the effect on productivity is weaker for entrepreneurs with low-growth ambitions. This pattern indicates that entrepreneurs generally increase the productive use of scarce resources in an economy, with the strongest impact coming from innovative entrepreneurs.

Entrepreneurship encourages structural change

Existing firms often struggle to adjust to new market conditions and permanent changes, getting locked into their old positions. They fail to make the necessary internal adjustments and lack the ability for “creative destruction,” famously described by Schumpeter in 1934 [7]. The entry of new businesses and the exit of worn-out firms can help to free firms from a locked-in position. Moreover, entrepreneurs may create entirely new markets and industries that become the engines of future growth processes.

Only a few people have the drive to become entrepreneurs

Entrepreneurs share certain traits, such as creativity and a high tolerance for the uncertainty that comes with developing new products. Four personality characteristics are particularly important for becoming an entrepreneur: willingness to bear risks, openness to experience, belief in their ability to control their own future (internal locus of control), and extraversion [8]. Entrepreneurs are significantly more likely to have these traits for the following reasons:

The success of each investment, particularly in innovative activities, is unpredictable. Every entrepreneurial decision is risky, and success is never assured. In contrast to ordinary managers, entrepreneurs often put their own funds on the line and risk losing money if the investment fails. They have to be willing to bear risks.

People who are open to experience—who seek new experiences and are eager to explore novel ideas—are creative, innovative, and curious. These attributes are vital for starting a new venture.

Locus of control measures generalized expectations about internal and external control. People with an external locus of control believe that their future is determined randomly or by the external environment, not by their own actions. People with an internal locus of control believe that they shape their future outcomes through their own actions. Entrepreneurs need to have an internal locus of control to propel them.

People who are assertive, ambitious, energetic, and seek leadership roles (in the so-called “Big Five” approach this trait is called extraversion), tend to be sociable as well, enabling them to develop social networks more easily and to forge stronger partnerships with clients and suppliers. All of these traits—being assertive, seeking leadership, and developing networks—are important if an individual aims to become an entrepreneur.

While these personality traits affect a person’s decision to become an entrepreneur, different traits or parameter values of these traits affect the success of entrepreneurship and the decision to abandon or persevere in the new endeavor. Empirical research reveals that the most important personality characteristics influencing entrepreneurial success are lower levels of agreeableness, higher levels of need for achievement, higher levels of (internal) locus of control, and medium levels of risk acceptance:

Agreeableness refers to having a forgiving and trusting nature and being altruistic and flexible. Lower scores on agreeableness might help entrepreneurs survive by enabling them to bargain more for their own interest with their partners.

For entrepreneurs, a need for achievement is expressed in the search for new and better solutions and the ability to deliver these solutions through their own performance.

The same holds for having higher levels of internal locus of control. Believing that one shapes one’s own future through one’s own actions is a very useful trait for entrepreneurial success.

Entrepreneurs with a medium range of risk tolerance have the lowest exit probabilities. The relationship between risk tolerance and the probability of entrepreneurial success is not linear but an inverse U-shape [8]. Too low a risk tolerance leads to low-risk projects with low expected returns, which makes entrepreneurship an unattractive option to dependent employment, and excessive risk tolerance leads to projects that are very high risk with high failure rates.

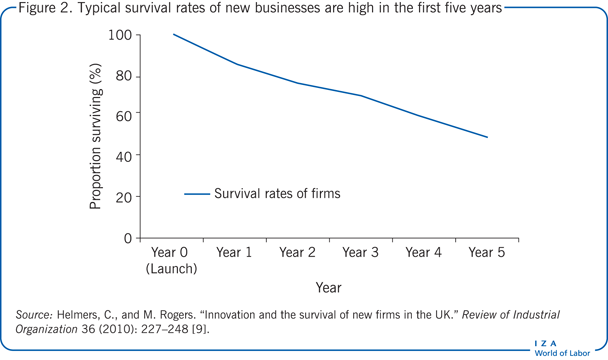

A substantial risk of failure accompanies entrepreneurship

Failure rates are high within the first five years of starting a business, typically around 40–50%, with the highest failure rate in the first year (see Figure 2). Recent studies in Germany and in the UK have shown higher survival rates for new ventures in innovative industries [9].

There are several reasons why new businesses fail and close (see Failure versus closure). Not everyone who tries to start a business has the right character traits to become a successful entrepreneur. Other impediments to success are restricted access to capital, lack of customers, and discouraging regulatory hurdles, including unfriendly entry regulations and difficult and time-consuming requirements for registering property and obtaining or extending licenses or permits.

The level of self-employment is not necessarily an indicator of entrepreneurial activity

Self-employment is not synonymous with entrepreneurship. The level of entrepreneurial activity offers information about the dynamics of an economy, while the level of self-employment is not necessarily correlated with economic development. In fact, most economies with high levels of self-employment are less developed. Less developed economies have fewer large firms (which deliver economies of scale and scope) and a greater number of small firms and self-employed individuals (delivering fewer economies of scale and scope). Thus, a high level of self-employment does not necessarily correspond with a high level of entrepreneurial activity.

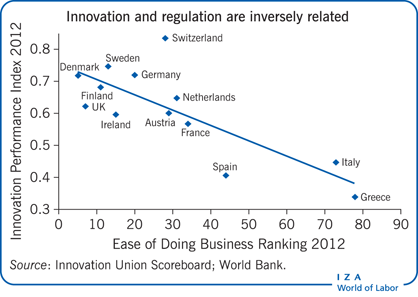

High regulatory burdens and unsecured intellectual property rights are detrimental to innovative entrepreneurship

Regulatory obstacles to setting up a business, such as the need to buy permits or licenses and other entry barriers, may discourage entrepreneurship. Overregulation of commerce prevents entrepreneurship from flourishing because it increases the costs of starting a business and decreases flexibility and the ability to react quickly to opportunities as they arise, thus reducing experimentation. Similarly, frequently changing, complex, unclear, or opaque regulations make it difficult to understand the legal environment for entrepreneurial activity.

Sometimes, overregulation can even make entrepreneurship impossible by restricting or prohibiting entry into certain sectors of the economy through strict control of licenses. Permits and licenses can act as noncompetition agreements. Overregulated markets can turn potentially productive entrepreneurs toward unproductive non-wealth-creating activity. And because there are many potential markets for high-tech innovations all over the world, innovative businesses deterred by overregulation in one market can go elsewhere.

A high level of corruption can be a side effect of overregulation, with direct negative impacts on innovative activities [10]. Success in entrepreneurship and innovation—which are about new products or services—is uncertain. Thus if intellectual property rights are not adequately enforced, this adds to the uncertainty, which can build up to prohibitively high levels that discourage any potential innovators. Corruption may make entrepreneurs unwilling to trust the institutions that are necessary to protect intellectual property rights.

Limitations and gaps

Not enough is known about the differences in innovation between entrepreneurs and large (often multinational) firms. While entrepreneurs are hailed as the source of radical innovations, it may well be that large firms, which can make huge investments in research and development, are the real innovators. Both parties undoubtedly contribute to innovation, but whether they complement each other is still unknown.

Further empirical analysis is also needed of the relationship between entrepreneurial firms and economic growth rates. But while some truly innovative entrepreneurs create fast-growing businesses (so-called “gazelles”) that have an important impact on economic growth, whether replicative entrepreneurs (see Different types of entrepreneurs) have a measurable effect on economic growth seems less likely. Only further study can answer this question.

There is also inadequate understanding of the kind of economic environment that influences innovative entrepreneurs not only to start their businesses, but also to expand them. This is an important issue since the quality of start-ups— their persistence, growth rate, and innovation— influences their effect on the economy.

And we do not know enough about failure rates. About half of all businesses close in their first five years. Yet recent research finds that survival rates could be higher. It is not yet clear whether innovative entrepreneurs survive more often than noninnovative entrepreneurs. Research preceding that reported here found the opposite to be the case. It is also not clear whether the relationship between failure/closure and years of survival is linear. Some empirical analyses find a linear relationship, while others find a higher failure/closure rate in the first year.

Summary and policy advice

Entrepreneurship is considered crucial to a dynamic economy. Entrepreneurs create employment opportunities not only for themselves but for others as well. Entrepreneurial activities may influence a country’s economic performance by bringing new products, methods, and production processes to the market and by boosting productivity and competition more broadly.

Realizing these advantages requires institutions that contribute to an environment that is friendly to entrepreneurs. In particular, it is important to protect intellectual and other property rights, streamline and enforce commercial laws, improve the business climate, reduce regulatory burdens, and create a culture of second chances for entrepreneurs who fail. More specifically, the following policy measures should be considered:

Government policies and legislation on property rights are important in shaping a country’s innovativeness. Protecting material property rights ensures that any wealth creation stays with the entrepreneur, while protecting intellectual property rights fosters entrepreneurship and innovation.

Bureaucratic obstacles constrain innovation-driven activities in many economies. Entrepreneurial opportunities will be greater in deregulated economies with freely operating markets and efficient licensing, because entrepreneurs can operate flexibly and their entrepreneurial activities can respond to changes in the market. It is also important that laws and regulations be enforced fairly and evenly.

Administrative burdens for start-ups need to be low, including the time needed to register a business, the number of bureaucratic steps, and the number of regulations, fees, and reporting requirements. As a benchmark, leading business-friendly countries enable companies to register for business within one day, without the need for regular renewal. This can be achieved by setting up a state-of-the-art online e-administration for all standard businesses.

Conflicting legislation creates uncertainty, and uncertainty discourages business activity. Codification means bringing all amendments to a given law, adopted at different times, into a single legal code. Swift and comprehensive codification of the legislation eliminates contradictions. It should also include reducing and unifying administrative procedures relating to a particular activity.

In many countries, a single failed business effort brands a person for life as a loser. The opposite experience in the US, where entrepreneurs are more readily given a second chance, even following a bankruptcy, makes clear that destigmatizing failure is crucial to the development of a rich entrepreneurial culture. Creating such a culture also reduces the fear of failure, which is still the most important impediment to entrepreneurship.

The negative effects of layoffs in firms that are unable to compete can be eased by improving search options for new jobs and by supporting vocational training for workers who lost their jobs.

Start-up subsidies should be considered to foster entrepreneurial activities. These can reduce the risk of early business failure.

If regulatory burdens are reduced and corruption is eliminated, countries will encourage and retain their own entrepreneurs and even attract innovators from other countries. Thus, policy can influence the volume of entrepreneurial activity most effectively by adjusting the regulatory environment in favor of entrepreneurship.

Acknowledgments

The author thanks an anonymous referee and the IZA World of Labor editors for many helpful suggestions on earlier drafts.

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Alexander Kritikos