Elevator pitch

Employee ownership has attracted growing attention for its potential to improve economic outcomes for companies, workers, and the economy in general, and help reduce inequality. Over 100 studies across many countries indicate that employee ownership is generally linked to better productivity, pay, job stability, and firm survival—though the effects are dispersed and causation is difficult to firmly establish. Free-riding often appears to be overcome by worker co-monitoring and reciprocity. Financial risk is an important concern but is generally minimized by higher pay and job stability among employee owners.

Key findings

Pros

Employee ownership is linked to better company performance on average.

Employee ownership companies have more stability, higher survival rates, and fewer layoffs in recessions, potentially leading to lower unemployment in the overall economy.

Employer stock tends to come on top of, rather than substitute for, regular employee compensation, and thereby adds to pay and wealth in general.

The broader sharing of economic rewards may help reduce economic inequality.

Cons

Employee ownership is subject to the free-rider problem, since the rewards from individual effort are shared with other workers and the direct incentive to work hard may be weak, which can lead more able workers to leave.

The effectiveness of employee ownership may depend on a complicated combination of supportive policies, such as employee involvement, job security, and training.

Workers can be exposed to excessive financial risk, especially when employee ownership is a large share of a worker’s wealth, and when it substitutes for other pay and benefits.

Author's main message

It has been argued that workers need to have greater ownership stakes in the technologies that increasingly substitute for their labor. But how does employee ownership affect economic performance? Despite skepticism by some academics and policymakers, employee ownership can overcome free-rider problems by raising work standards, and reduce financial risks by raising pay and job stability. In the overall economy, employee ownership has potential both to decrease inequality and to improve macroeconomic stability by reducing layoffs and unemployment when recessions occur. These broader benefits can justify supportive public policies for employee ownership.

Motivation

Why is employee ownership important? There are four main sources of interest in this issue:

First, employee ownership can enhance company performance, as it creates a closer tie between employee performance and rewards. Employees are effectively “working for themselves,” and by sharing the overall economic “pie” more widely, the incentives of workers and owners can become aligned so that productivity-reducing conflict is minimized and productivity-enhancing cooperation and innovation encouraged. This is particularly so when employee ownership is combined with employee participation in decision-making and other high-performance work practices.

Second, employee ownership may enhance firm survival and employment stability, and thereby increase workers’ job security, through greater flexibility or through the creation of a workplace ownership culture where stability promotes skill investment and higher productivity. When this is the case, it can help decrease unemployment and increase macroeconomic stability in the overall economy, creating positive “externalities” (benefits enjoyed by third parties as a result) that can justify supportive public policy [1].

Third, employee ownership has the potential to increase worker pay and wealth, and help alleviate inequality by distributing wealth and capital income more broadly across the economic spectrum.

Finally, employee ownership can give workers a greater role in corporate governance through legal rights and workplace policies that increase access to information and participation in decision-making [2]. This can improve quality of work life due to workers having greater control and more aligned incentives that may help to create a more harmonious workplace, with less labor−management conflict. When employee ownership involves greater employee participation in workplace decisions, this may also help to strengthen democracy by increasing civic skills and interest in participating in politics.

Due to these sources of interest, many countries have public policies promoting employee ownership. The EU highlighted policy developments on employee ownership and profit sharing in five reports from 1991 to 2016 [2], and the US has a long history of supporting employee ownership [3]. If employee ownership enhances productivity there should be good private incentives for firms to adopt it, although public policy may be justified to spread information on performance-enhancing practices.

If employee ownership leads to fewer layoffs and greater company survival, there is a stronger case for supportive public policy, since the economic and social costs of layoffs and firm failures are borne by workers, families, communities, and the larger economy and society. In economic terms, the layoffs and firm failures create negative externalities (costs suffered by third parties as a result) that can justify the use of supportive public policies. Such policy may also be built on the idea of increasing broad-based prosperity that can reduce inequality and strengthen democracy.

Discussion of pros and cons

How prevalent is employee ownership?

The extent of employee ownership within a firm can vary by the proportion of the company owned by employees, the percentage of employees who are owners, and the distribution of shares among employee owners. Common types of employee ownership include: (i) worker cooperatives, where all or nearly all workers share in ownership and typically make decisions based on one-person/one-vote rather than number of shares owned; (ii) US Employee Stock Ownership Plans (ESOPs), where employees have accounts in a collective pension trust, and the trust may borrow money to finance stock purchases (paid back by the company) so employees do not have to put up their own money; (iii) employer stock in other retirement plans, where companies may match pre-tax employee contributions with company stock or workers buy the stock themselves; (iv) employee stock purchase plans, which allow employees to buy company stock at a discount; and (v) stock held after the exercise of granted stock options.

The variety in the types and extent of employee ownership makes it difficult to obtain consistent estimates across countries. In the US about 20% of private sector employees report owning company stock, while about 32% of British employees had some form of employee ownership scheme in 2004 [4]. The percentage of companies offering employee share ownership was 5.2% in the 2013 European Company Survey and 12.4% among medium and large companies in the 2015 Cranet survey, while the percentage of employees covered appears lower at 3.3% in the 2010 European Working Conditions Survey [2], [5]. Employee ownership in Europe is more common in firms that are large, have human resource management systems intended to foster employee commitment, and are in countries with more developed capital markets [5]. There has also been considerable experience and study of employee ownership in Russia, China, Japan, Eastern Europe, and Latin America.

Mirroring race and gender gaps in the US pay distribution, Blacks, Hispanic/Latinos, and women are less likely than White non-Hispanic men to own any employer stock, and their stock value is lower if they do own it. Since broad-based employee ownership plans like the US ESOP automatically cover all workers, they have been promoted as a potential means to help reduce race and gender wealth gaps.

What does the evidence on employee ownership show?

Many types of studies have been conducted on employee ownership. Some compare employee owners to non-owners in the same or different firms, some compare firms with and without employee ownership plans, some compare firms before and after adoption of employee ownership relative to firms that have not adopted employee ownership at all, and others employ laboratory experiments to examine the link between financial participation and performance outcomes. But, overall, what does the evidence show?

Company performance

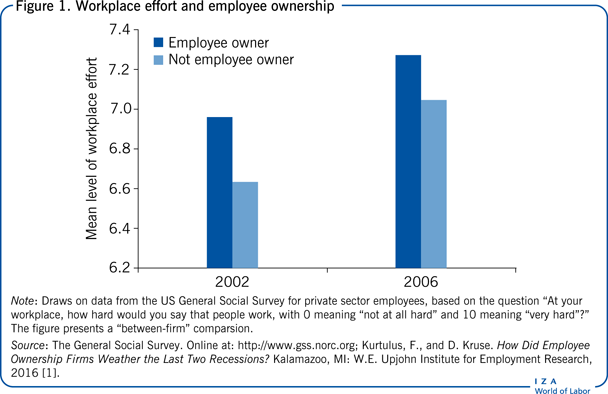

A meta-analysis of existing studies, with 102 samples covering 56,984 firms, finds that employee ownership has a small but significant positive relation, on average, with firm performance [6]. The positive relation exists across firm size, and has increased in studies over time, possibly because firms are learning to implement employee ownership more effectively. This is consistent with other reviews and meta-analyses, including one which finds that two-thirds of 129 studies conclude that employee ownership is positively related to performance or employee attitudes, while only one-tenth find negative relationships (see Figure 1 for one illustration of a positive relationship). As an example, a study sponsored by the UK Treasury analyzes data from confidential tax records on tax-advantaged share schemes at over 16,000 UK firms and finds that broad-based employee ownership is linked to improved firm performance measures, such as value-added and turnover [7]. In addition, a study of French cooperatives finds that employee-owned firms are at least as productive as conventional firms [8].

Of course, correlation does not imply causation. To address causality issues many studies have used pre/post comparisons to adjust for any unknown fixed factors, and have used a variety of statistical corrections to adjust for any unknown factors related to the firm's choice of when to adopt employee ownership. Still, the generally positive relationships remain.

The better performance may result in part from more productive workers being attracted to stock-based compensation, as shown in lab experiments. It also appears, however, that individual performance tends to improve after workers join employee ownership firms, indicated by pre/post studies of workers joining group incentive plans, and laboratory experiments with subjects randomly arranged into groups organized as employee-owned “firms.” These latter results suggest positive effects even among those who do not initially choose to take part in employee ownership.

While a field experiment on profit sharing with random assignment shows favorable effects on performance and turnover, there have not been true field experiments to clearly demonstrate a causal effect of employee ownership. Note that while profit sharing and employee ownership are related, in that both tie worker pay to business outcomes, “profit sharing” simply provides workers a share of profits, while “employee ownership” also provides ownership rights and an addition to employee wealth.

The available evidence therefore goes against the idea that free-riding overwhelms any possible positive effect of employee ownership. Workers themselves report behaviors that counter free-riding: a study of over 40,000 workers finds that those with company stock and other group incentives were more likely to say they would take action if they saw a fellow worker not working well, by talking to the worker, supervisor, or members of the work team [4]. When asked why, many of these workers reported that “poor performance will cost me and other employees in bonus or stock value.” This and other studies also indicate that employee owners generally have lower turnover and absenteeism, more company pride and loyalty, greater willingness to work hard, and more suggestions of how to improve performance.

There is clearly no simple automatic relationship between employee ownership and performance—while the average performance effect of adopting employee ownership is positive, there is dispersion around the average, and some firms adopting employee ownership do not see improvements. Counteracting the free-riding problem appears to depend on workplace norms and policies that encourage cooperation and higher effort. Employee owners are most likely to take action against shirking when they are part of employee involvement teams, have received company training, and have job security, although some research finds that majority employee ownership is positively related to productivity even when there is little or no employee involvement in decision-making.

Broad-based sharing in company rewards may also create dynamics that help deal with diversity, as research finds the use of broad-based stock options creates more favorable effects of racial diversity on employee turnover, commitment, and firm financial performance [9].

Job security, firm survival, and economic stability

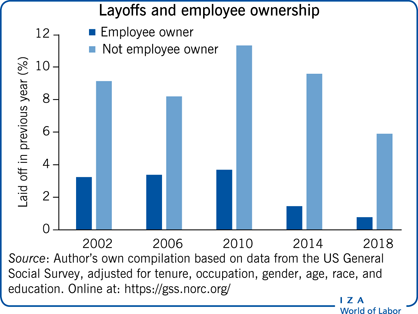

While not as widely studied as company performance, employee owners appear to have greater job security. This is shown by smaller employment cutbacks among employee ownership firms compared to similar firms without employee ownership over the 2001–2002 and 2007–2009 recessions [1], and by lower layoff rates among employee ownership firms during the early stages of the 2020 pandemic recession. In addition, employee owners report greater perceptions of job security and a lower likelihood of having been laid off in the past year (see the Illustration, showing that the reported layoff rate among employee owners is less than half the rate of other employees after controlling for job and demographic factors). Consistent with the idea that employee ownership firms lay off fewer workers in a recession, their relative productivity advantage declines in recessions, which may be due to retaining workers who receive new training or otherwise invest in activities that bolster long-term but not short-term productivity [1].

Employee ownership firms also appear to have higher survival rates [1]. Publicly traded US companies with employee ownership are about 20% more likely than closely matched comparable firms to survive over a 12-year period, and closely held companies with employee ownership plans are only half as likely as comparable firms to go bankrupt or close down over a 12-year period. In addition, studies of worker cooperatives have found high survival rates compared to conventional firms in the UK, France, Uruguay, and other countries.

The reasons for greater stability and survival among employee ownership firms have not been well explored. It is possible that more stable firms are more likely to adopt employee ownership, or that other factors are responsible. If employee ownership is responsible, this may happen through: (i) increased productivity from greater cooperation, information sharing, and commitment; (ii) reduced dysfunctional workplace conflict; (iii) increased employee investments in valuable firm-specific skills; and/or (iv) creation and maintenance of a workplace culture that instills a sense of ownership, with a corresponding commitment to preserve employee jobs whenever possible. A survey during the pandemic recession indicates that employee ownership firms were more likely than other firms to place a high priority on preserving employee jobs for the purposes of preserving employee skills, customer ties, teamwork, and a sense of ownership.

Inequality and broadly-shared prosperity

Employee ownership will not enhance worker incomes or reduce inequality if it substitutes for standard worker pay or benefits. In this case it presents serious issues of financial risk, since workers are likely to have more variable pay and wealth (although financial risk may be reduced by greater job security, as described above). Despite the few cases of wage concessions and the economic logic that employee ownership must substitute for other forms of compensation, almost all studies in this area indicate that employee ownership tends to come on top of market levels of pay.

Most US ESOPs use credit by an employee trust to purchase stock on behalf of the employees as a whole, and the company itself pays back these loans, so employees typically are not directly using their wages to purchase these shares. A comprehensive study of all ESOP adoptions over 1980−2001 finds that employee wages, apart from the ESOP, either increased or remained constant after adoption, so that ESOP contributions came on top of existing pay [10]. Consistent with this, comparisons of matched ESOP and non-ESOP firms find similar levels of pay and other benefits, apart from the ESOP in the two types of firms. Employee owners in general reported higher levels of annual earnings, and were more likely to say they are “paid what they deserve” and that their fringe benefits are good [4]. One study of employee ownership firms finds that an extra dollar of employee ownership value is associated with an extra 94 cents of wealth, and a more fully representative study of US families over the 2004–2016 period also finds that employee ownership appears to generally come on top of other family wealth [4], [11]. The evidence from worker cooperatives is more mixed, with higher wages in Uruguayan cooperatives but lower wages in Italian cooperatives compared to conventional firms.

How can this be? How is it possible in most cases that employee ownership can simply add to, rather than substitute for, other forms of pay or wealth? One interpretation that integrates the accumulated evidence on company performance, worker behavior, and pay is based on ideas of reciprocity and the economic model of “gift exchange,” developed by the Nobel Prize winner George Akerlof. Workers may respond to a “gift” of employee ownership, on top of market compensation, with a reciprocal “gift” of high effort, cooperation, and work standards. The collective incentive nature of employee ownership may make it an especially effective “gift” for creating and reinforcing a sense of common purpose, and encouraging higher commitment and productivity [4].

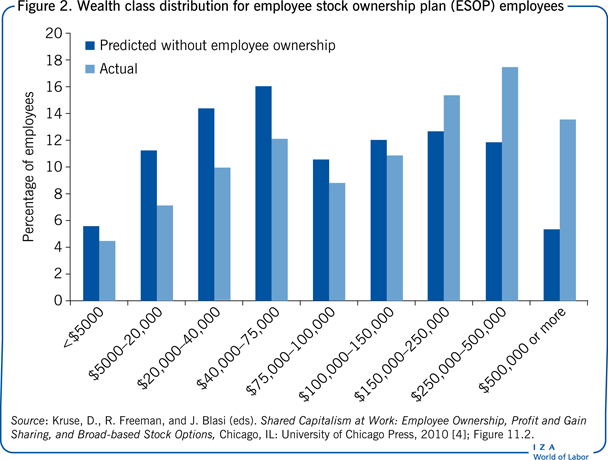

The consistent finding that employee ownership tends to be “gravy” on top of other pay and wealth means that it may be a promising means for increasing worker incomes and wealth in general, which may help to reduce inequality (Figure 2). The limited evidence indicates that pay and wealth appear to be distributed more equally in employee ownership firms than in other firms, although at current levels of employee ownership this has only a minimal effect on overall societal income and wealth distribution. The more equal distribution of pay in cooperatives may lead high-ability workers to find jobs elsewhere, but also encourage productive cooperation among employees, as shown by evidence that productivity in worker cooperatives is generally at least as high as in conventional firms.

Corporate governance, labor–management conflict, and quality of work life

Does employee ownership increase worker roles in corporate governance and create more harmonious workplaces and satisfied workers? Employee ownership is linked to greater corporate transparency when employees have bargaining power, which may account for the lower likelihood of strikes in unionized companies that adopt ESOPs. Employees report a higher likelihood of company-sponsored training and tend to give companies higher ratings on management–employee relations and other aspects of company treatment of employees (e.g. handling of promotions, worker safety, and trustworthiness) when they are employee owners or otherwise participate in shared rewards [4]. Employee owners also tend to report greater participation in workplace decisions, but otherwise little is known about changes in corporate governance under employee ownership, except in the case of cooperatives, where each worker has a vote in strategic decisions and electing management.

If employee ownership does improve quality of work life there should be higher job satisfaction and lower turnover. Employee owners are less likely than other employees to say they will look for a new job, but as with the anti-shirking behavior described above, any favorable effects of employee ownership appear to depend on the presence of other supportive workplace policies (such as employee involvement, training, job security, and low supervision) [4], [12]. The favorable effects of employer stock on voluntary turnover also appear stronger when workers perceive greater management credibility. Without such policies workers with company stock and other group incentives may even have lower satisfaction and higher turnover intention. This may reflect mixed messages to employees when they are given employee ownership without supportive workplace policies: “We want you to be more productive as employee owners, but we’re not going to give you the tools to be more productive, and we’re going to keep a close eye on you.” In such cases, especially if fixed pay and other conditions have worsened, employee ownership may be seen as an attempt to shift financial risk onto workers, rather than to empower them.

The importance of supportive policies in increasing both co-monitoring and satisfaction, and decreasing turnover, indicates that workers do not mind co-monitoring when these policies are present. The generally higher prevalence of participation in decision-making and training among employee owners further suggests that companies recognize the complementarities of these policies with financial participation. Most basically, this points to the importance of providing employee owners with the means to improve performance—through increased skills and opportunities for input—so that they can effectively take action in response to the financial incentives.

What are the “cons” of employee ownership?

The above evidence generally points to a number of “pros” about employee ownership. Three “cons” that are often raised are the free-rider problem, the difficulty in configuring policies for effective performance, and financial risk.

Free-riding is undeniably a potentially important factor in all group incentives. The evidence on the higher average performance of employee-owned firms, and the willingness of employee owners to enforce higher workplace norms and take action against shirking co-workers, indicate that the free-rider problem does not condemn the potential of employee ownership to improve performance. Free-riding may be reduced or overcome by supportive policies to build team spirit, loyalty, and high work standards, although it no doubt occurs in many workplaces that do not have supportive policies and culture.

This raises the second “con” of difficulty in implementing employee ownership for effective performance. There is no simple formula for how supportive policies should be combined with different types and levels of employee ownership. Some research results suggest that simply being an owner can improve performance through employee retention, organizational commitment, and willingness to cooperate with others, while other results imply that the size of the financial stake is more important. Without a simple formula, there is clearly risk in implementing a new policy such as employee ownership—employees may in fact respond badly if supportive policies are not in place as noted above. This risk may be especially salient for risk-averse firms without access to good legal, financial, and workplace policy advisors.

The third “con” of financial risk can be important for some employee owners. Stock values can obviously go up and down, and having a large share of wealth in only one asset—including the stock of an employer—means that an employee may face financial risk by not being appropriately diversified. The financial risk may be increased under employee ownership since if the firm fails, the employee can lose both their job and the company stock value. It is undoubtedly true that some workers are not adequately diversified—for example, each year many people use some or all of their life savings to start their own businesses. Employee owners may likewise have too much of their wealth invested in their companies for sound financial planning. This is exemplified in some failures of employee-ownership companies, which point to the need for policies that mitigate risk and ensure workers are fully aware of potential risks [13]. However, the potential financial risk from employee ownership can be substantially reduced, as evidenced by the following findings: (i) employee ownership generally comes on top of standard pay and benefits, which mitigates any financial risk, since workers are not sacrificing for risky pay—employee ownership can be seen as the “gravy” that supplements their wealth and retirement portfolios. Grants of stock to workers, such as in an ESOP, pose lower financial risk to workers than do worker purchases of stock; (ii) increased job security reduces personal financial risk. The biggest form of financial risk faced by most workers is job loss, as opposed to market fluctuations in the value of their financial assets. If employee ownership does contribute to employment stability and firm survival, as reviewed above, employee owners may face less financial risk than other employees; and (iii) corporate risk-taking appears to be lower when there is widespread stockholding by non-executive employees, potentially reducing company returns but providing more security for risk-averse employees.

Two other noteworthy findings regarding financial risk include an intriguing finding from the study of over 40,000 employees that while risk-averse employees are less likely to be interested in variable pay, two-thirds of the most risk-averse employees reported that they would like at least some ownership, profit sharing, or stock options in their pay package [4]. While risk aversion clearly influences attitudes toward variable pay, these results indicate that even risk-averse employees are interested in employee ownership and other variable pay plans.

Second, recent theory indicates that employee ownership can be part of an efficient diversified portfolio. Harry Markowitz, who won the Nobel Prize in Economics for portfolio theory, explicitly rejects the idea that risk aversion condemns employee ownership. His theory concludes that substantial amounts of a single asset—including stock in your own company—can be part of an efficient portfolio as long as the overall portfolio is properly diversified [4]. Based on standard assumptions about individual preferences, Markowitz concludes that an optimal investment of company stock in a diversified portfolio is 8.66%, while up to 15% would not be imprudent (reflecting the percentage of the individual worker's wealth portfolio, not the percentage of the firm owned by employees) [4]. Representative data from US families show that five-sixths of US families that own employer stock fall below Markowitz's 15% threshold, indicating that excessive risk is likely confined to a minority of employee owners [11]. Markowitz has also stated that the optimal limit of employee-owned shares in a family portfolio includes just shares purchased by employees and not shares received as grants.

Why isn't there more employee ownership?

If the evidence indicates that employee ownership tends to help firms and workers, why isn't there more of it? Are firms and workers simply leaving a “free lunch” on the table? There is insufficient hard evidence on this question. Some points offered by scholars and practitioners are that:

There has in fact been growth in employee ownership and supportive legislation in many countries in the past 50 years, although the growth has not been linear and continuous. As noted above, the positive relation between employee ownership and firm performance found in studies has increased over time, possibly because firms are learning to implement employee ownership more effectively.

Information problems may keep some employers and policymakers from being more aware of the potential benefits of employee ownership, and the conditions needed to realize those benefits. The positive findings from recent meta-analyses on performance and other studies of employment outcomes are not yet widely known.

Probably more importantly, while studies tend to show improved performance on average, there is considerable dispersion around that average, and simply adopting employee ownership is no guarantee of a positive outcome. It is risky to adopt employee ownership without a simple known formula for success, as noted in the second “con” above.

Related to the above point, some scholars and practitioners point to the lack of a supportive infrastructure, including sufficient expertise on the legal, financial, and workplace culture aspects of successfully implementing employee ownership. There is very little business school training on managing employee-owned companies. The Mondragon cooperative system in Spain has a supportive infrastructure that includes a clear legal framework, financial institutions, and university training for managers and workers in how to work in cooperatives. In the US 15 states have centers devoted to supporting employee ownership companies.

Dilution of existing ownership stakes is also a concern in some cases, such as when employees are offered new stock and performance does not substantially improve, or when a company loan is used to finance a partial employee buyout of a retiring owner (although this does not apply to a 100% buyout of a retiring business owner, or to ESOPs buying existing shares in stock market companies).

Financial and credit constraints for workers can limit their ability to finance employee-owned start-up companies, although such constraints are less applicable to conversions where employees do not put up their own pay or collateral, such as when an ESOP trust borrows money and releases ownership to workers as the loan is repaid out of future earnings. Retiring business owners may also be constrained in self-financing loans to employees to buy the firm, and find it more attractive to sell to an outside investor.

Scholars have also pointed to collective choice problems for workers in initiating and establishing an employee ownership conversion, the lack of effective “membership markets” for many cooperatives, and information asymmetries and other market imperfections that can favor investor-owned over labor-managed firms. These problems may be overcome in part by tax incentives and supportive expertise.

More generally, current capital owners benefit from the current wealth distribution and may resist efforts to change it. Existing tax structures and subsidies are built around and reward conventional ownership models, and do not favor employee ownership models that can broaden the opportunity to own wealth.

The relative importance of these (or other) explanations for the lack of more extensive employee ownership has received little direct attention in the prior literature, and represents a fruitful avenue for future research.

Limitations and gaps

Several other topics also warrant further research. While the averaged results across 100 studies indicate that employee ownership is tied to better company performance, more needs to be known about the mechanisms linking employee ownership and performance. The causal effects of employee ownership are hard to isolate, particularly if they work in combination with participation in decision-making, information sharing, and other practices and policies. The pre/post studies, plus the limited evidence from experiments and analyses of employee owners’ workplace behaviors, point to a causal impact, but field experiments with random assignment are lacking, which would more clearly establish causality.

While there have been valuable studies on worker cooperatives, there has been too little research, in general, on corporate governance under employee ownership and its role in firm outcomes, including the issue of managerial compensation. It would be particularly valuable to have further research on employee ownership in closely held companies, where many are majority or 100% employee-owned but data are scarcer.

Causation is an open question in the company stability and survival results, since it may be that more stable companies are more likely to adopt employee ownership. The remarkable finding that employee ownership generally comes on top of standard pay and benefits needs further probing, to determine if and how this supports higher performance, and what happens in cases where employee ownership substitutes for pay.

Finally, the issue of financial risk needs further study, to examine the variability of wealth portfolios that include employee ownership, the overall financial risk for workers when taking job security into account, and the relative risks of employee ownership based on employee concessions or stock purchases, as opposed to stock grants, on top of market wages.

Summary and policy advice

What will happen to economic performance if workers do own more of the “robots” (i.e. new technologies/capital stock) that are taking their jobs? The accumulated evidence on the economic performance of firms that have employee ownership gives no reason to think that performance would be hurt, and in fact suggests that performance may be enhanced. The free-rider and financial risk problems are important, but the evidence indicates that they can be overcome. Not only is employee ownership linked to higher company performance on average, but it may also add to worker pay, employment stability, and company survival. Even if company performance is no better or worse under employee ownership, it may represent an alternative economic model with potential for increasing economic stability and reducing unemployment and inequality in the overall economy.

The evidence that employee ownership can improve company performance might not initially suggest a role for public policy, since the prospect of improved performance may be a sufficient incentive for adoption in companies that are likely to benefit. However, given its low incidence, government can play the role it has often played in promoting performance-enhancing work practices to help overcome information problems or institutional barriers to ensure that the performance benefits are recognized more widely, helping to enhance overall economy-wide outcomes from higher productivity and innovation.

The argument for supportive public policy is strengthened when there are “externalities” involved, effects that extend beyond the firm and its members, as the decision to lay off workers or close a firm can create a number of negative externalities for the overall economy, government, communities, and the families of affected workers.

There are a variety of fiscal and tax incentives related to employee ownership and other forms of financial participation in the EU [2] and the US [3]. Some of the existing and proposed financial incentives for encouraging these plans are:

Direct tax incentives to either the employer or employee, such as the deductibility of contributions to deferred employee ownership plans in the US.

Making retiring owners eligible for exemption from capital gains taxes if they sell the company to an employee ownership plan.

Allowing financial firms to deduct a portion of their interest income from loans made to employee ownership firms.

Making a minimal program of employee ownership a precondition for corporate tax incentives in the tax code.

Requiring or favoring firms with broad-based ownership plans in government procurement.

Tax abatements to firms with broad-based employee ownership in economic development zones or social improvement projects.

Federal guarantees for loans to employee ownership plans when conditions suggest default rates would be low.

Apart from tax and expenditure policies, low-cost policies to spread information, create a supportive infrastructure, or protect workers include:

Establishing high-level national or international commissions or institutions to assess evidence and policies, and draw attention and expertise to employee ownership and related plans, as the EU has done [2].

Establishing an office in the highest levels of national government to support employee ownership and related plans, reviewing public policies and working with the private sector to publicize and encourage best practices.

Providing seed grants to establish employee ownership resource centers throughout a country, modeled on the successful US centers in Ohio and Vermont that assist local businesses with transitions to employee ownership and provide ongoing technical assistance, support, and networking.

Creating an objective scorecard of employee ownership and profit sharing that can be used by workers, investors, and government officials in measuring the spread of these programs in individual firms and throughout the economy.

Amending corporate laws to create legal forms that make it easier for firms to broaden financial participation, such as the “B corporation” (short for “Benefit corporation”) in the US that makes it easier for businesses to take employee, community, and environmental interests into consideration when making decisions.

Limiting employee investments in more risky forms of employee ownership (where workers buy the stock with their wages and savings), and allowing earlier diversification for workers in employee ownership plans, particularly when those plans involve wage and benefit concessions.

Ensuring that companies use best valuation practices so that employee-owned stock is correctly valued in non-publicly-traded companies.

In sum, the accumulated evidence shows that, despite the theoretical free-rider and financial risk objections, employee ownership is generally linked to a number of good outcomes for firms, workers, and potentially society as a whole. These benefits—particularly the greater stability and survival that can help the overall economy by reducing unemployment and resisting recessionary pressures—can justify supportive public policies.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. The author also thanks Joseph Blasi, Marshall Vance, Erik Olsen, Takao Kato, Trevor Young-Hyman, and Lisa Schur for valuable comments. Previous work of the author (together with Joseph Blasi, Richard Freeman, and Fidan Kurtulus) contains a larger number of background references for the material presented here. The summary of evidence and policies draws on Chapters 5 and 6 of a book with Joseph Blasi and Richard Freeman [3] and Chapters 1 and 6 of a book with Fidan Kurtulus [1]. Version 2 of the article updates the “Graphical abstract,” adds a new section answering why more companies do not have employee ownership schemes, and adds new “Key references” [5], [9], [10].

Competing interests

The IZA World of Labor project is committed to the IZA Code of Conduct. The author declares to have observed the principles outlined in the code.

© Douglas Kruse