Elevator pitch

The Great Recession that began in 2008–2009 dramatically increased youth unemployment. But did it have long-lasting, adverse effects on the careers of youths? Are cohorts that graduate during a recession doomed to fall permanently behind those that graduate at other times? Are the impacts different for low- and high-educated individuals? If recessions impose penalties that persist over time, then more government outlays are justified to stabilize economic activity. Scientific evidence from a variety of countries shows that rigid labor markets can reinforce the persistence of these setbacks, which has important policy implications.

Key findings

Pros

High-educated youth graduating during a recession incur a moderate, but long-lasting loss in earnings.

High-educated youth get locked into lower-quality jobs, especially in rigid labor markets.

Strict employment protection legislation and other rigid worker protections induce more unemployment and reinforce the persistency of losses.

Low employment protection for fixed-term contracts and high employment protection for regular contracts increase the likelihood of unemployment and churning between short-term jobs.

Cons

The earnings of low-educated youth entering the labor market in a recession fall considerably in the short-term, but the penalty dissipates quickly.

High-educated unlucky cohorts can eventually catch up if the labor market is sufficiently flexible.

A high minimum wage shields low-skilled youth against a wage penalty, while other worker protections reduce immediate negative impacts on employment and hours worked.

High-educated youth are less affected in terms of employment and hours worked, irrespective of labor market flexibility.

Author's main message

In flexible labor markets, low-educated entrants are harmed by economic downturns, but the penalties are short-lived. High-educated youth are less adversely affected, but the penalties persist longer. It takes about ten years for young cohorts that enter the labor market during a downturn to catch up to cohorts that did not. In rigid labor markets, however, while low-educated entrants are better shielded in the short term, both low- and high-educated workers never make up their earnings losses. Macroeconomic stabilization policies should be complemented by policies that aim at combining more job flexibility with job security.

Motivation

The Great Recession of 2008–2009 has had a devastating impact on youth employment. In 2009, about 20% of 15 to 24-year-olds in the EU were unemployed—nearly three times the adult unemployment rate. Since the late 1970s, the ratio of youth to adult unemployment rates has never been as high as it was in 2009. Should we be concerned? Some analysts argue that young workers always suffer more from recessions than prime-age workers but that these penalties are only temporary because young workers recover rapidly. Others do not contest these points but claim that the cohorts that bear the burden of the crisis are not the same as the cohorts that benefit from a later economic upturn. Rather, members of the new cohorts that graduate during a period of economic recovery are quickly hired, while the older cohorts that graduated during the downturn experience a permanent set-back in their professional career, resulting in a “lost generation.” Which position is right, and what are the policy implications?

Discussion of pros and cons

Various studies have revealed that labor market conditions at the start of a young person’s career generate different effects depending on the degree of labor market flexibility and the education level of labor market entrants. Labor market rigidity, reflecting strict employment protection laws, powerful trade unions, and generous unemployment insurance, results in greater persistence of the labor market penalties caused by adverse entry conditions. Studies cover labor market conditions that range from the highly flexible North American labor markets to the extremely rigid Japanese ones, with European labor markets occupying positions in-between. The persistence of effects also depends on education level, varying for low- and high-educated workers.

Effects in flexible labor markets

In theory, if the labor market operates like a perfectly competitive spot market and if human capital accumulation is negligible, a recession only temporarily cuts hourly wages and, where labor supply and demand are responsive to change, employment. As soon as labor demand is restored, so are wages and employment. Workers who experienced a set-back are reemployed at similar conditions as they would have been in the absence of the demand shock. Persistence of these effects only occurs if the economic downturn (or upturn) is long-lasting.

Most empirical studies on the long-term effects of recessions on graduates focus on young men because their behavior is more straightforward to analyze than that of women, whose labor market choices may also be influenced by child-bearing decisions and social norms about caring responsibilities.

Large, but short-lived effects for low-educated workers

In North American labor markets (Canada and the US), employment is largely at will (an employee can be dismissed for any reason and without warning), and minimum wages are low. This holds in particular for the market in low-skilled jobs involving simple routine tasks that can be executed without much prior training. Such skills do not erode during periods of inactivity. Thus, low-educated youth entering such a labor market in a downturn are expected to experience only temporary penalties in wages and earnings. However, because they are at the bottom of the qualification ladder, they cannot shield themselves against negative shocks by moving to a lower-skilled job (downgrading). In addition, because they are more financially constrained, low-educated youth are less mobile geographically than higher educated or older workers. This makes the short-term impact of a recession more severe for low- than for high-educated youth.

The findings for the US are largely in line with these theoretical predictions. Adverse conditions at labor market entry for low-educated youth with 12 years of schooling or less have immediate and important negative effects on wages and earnings. These fade after about two years [2], [3]. In the case of a severe recession (defined as a four percentage point rise in the unemployment rate), the year-one average wage falls by 16%, hours worked decline by 28%, and earnings fall by 45%. These effects are largely gone after the first year, however [3]. Similar effects are found for other disadvantaged groups, such as black people and women [4].

Smaller, but more persistent effects for college graduates

College graduates are better prepared than low-educated youth to protect themselves against business cycle shocks. For instance, they can shift to lower-quality jobs rather than become unemployed or can move to a region where the labor market is less negatively affected. The initial penalty of graduating in a downturn is therefore expected to be less important than for less-educated groups. However, theory predicts greater persistence of the adverse effects.

College graduates typically enter high-quality jobs in companies that invest in human resources training and offer long-term incentive contracts. In a recession, these high-quality career jobs are in reduced supply. Thus, college students graduating during a bust phase in the business cycle end up working in lower-quality jobs paying lower wages and offering fewer opportunities for promotion and training than students graduating during a boom phase. When labor demand recovers, these college-educated youths will have forgone valuable human capital accumulation and will have invested instead in task-specific competencies that have little value in higher-quality jobs, putting them behind their luckier cohorts who graduated during a boom [5], [6].

Young workers can respond to this setback by enhancing their investments in human capital and intensifying their search for higher paying jobs. However, this takes time and, therefore, introduces some persistence in the penalty induced by the recession. Moreover, the lag in career progression reinforces this persistence and slows the catch-up process. The inability of wages to adjust to lower demand in a recession, which is implicit in the contracts for high-quality career jobs, along with asymmetric information, shield the internal labor market from external competitive forces. These factors protect the lucky cohorts that graduated during a boom, while making it harder for the unlucky ones to reduce their initial disadvantage. Job tenure and the greater effort needed to search for jobs as people get older may even induce workers to stop searching for better paying jobs [5], [6].

Empirical findings are again largely consistent with the theoretical predictions. Studies for Canada and the US show that graduating from college during a recession imposes a modest but long-lasting penalty on earnings that fades out over about ten years [2], [6], [7]. These earnings losses are due largely to a combination of lower wages and fewer hours of work. The penalty on hours worked, however, generally does not last beyond the first three years after graduation. The employment rate is affected only modestly [5]. These findings imply that high-educated cohorts that graduate during a recession escape unemployment by entering lower-quality (part-time) jobs. The evidence also shows that the penalty differs by field of study, with high-paying majors being less affected by initial conditions than lower-paying ones, although their relative advantage was cut in half during the Great Recession [5]. The early impacts on earnings were much larger during the Great Recession than during previous recessions [7].

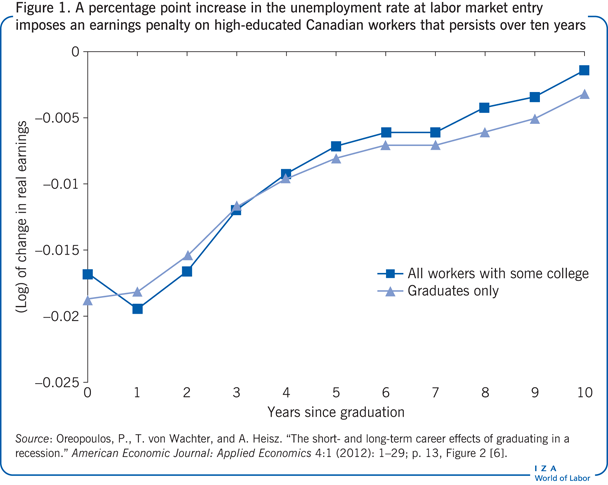

Figure 1 shows the persistence of the effect on earnings of a one percentage point rise in unemployment in Canada for high-educated young job seekers, both college graduates and those with some college education. Since a typical recession in Canada involves a five percentage point rise in the unemployment rate, the initial loss in earnings is about 9%. For both groups of young workers, the loss halves within five years and finally fades to zero or close to zero only after ten years. Over these ten years, cumulative earnings losses are about 5% [6]. Since employment is barely affected, and since the penalty on hours worked lasts, as mentioned, not more than three years after graduation, these earnings losses for high-educated workers must be induced by a drop in the wage rate.

In the US, the effects are very similar for a four percentage point rise in the unemployment rate. The initial loss in earnings is about 10%, compared with 9% in Canada, falling slightly more rapidly to about 4% after three years and then also gradually approaching zero after ten years for college graduates. The effect on employment is slightly greater than in Canada. In the first year after graduation, workers are about five percentage points less likely to work full-time, but this effect does not persist past the first three years after graduation. Wages are about four percentage points lower in the first year after graduation and this penalty persists longer than the penalty on hours worked [7]. These initial effects are about five times smaller than those for low-educated youth, but they persist longer.

The influence of labor market rigidity on the persistence of unemployment

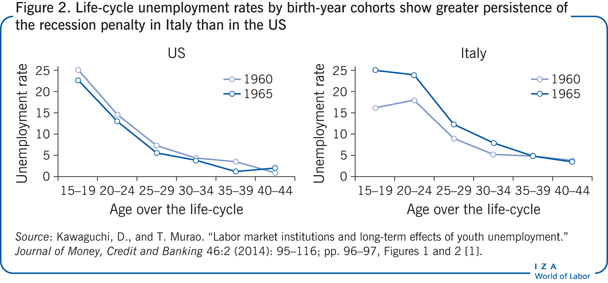

Figure 2 displays life cycle unemployment rates by birth-year cohort in the US and Italy. In the US, the 1960 cohort graduated during more adverse economic times than did the 1965 cohort, so that the unemployment rate was higher for the 1960 cohort than for the 1965 one as they entered the labor market (at ages 15–19 and 20–24). This difference diminished over time, but was still present at ages 25–29. By ages 30–34, the difference had completely disappeared. In Italy, by contrast, the 1960 cohort was less likely to be unemployed than the 1965 cohort at ages 15–19 and 20–24. This disparity remained large at older ages and was completely eliminated only by ages 40–44 [1]. These different evolutions suggest more persistent scarring effects of recessions at labor market entry in Italy than in the US. The different institutional environment in these two countries could explain these different evolutions of the recession penalty. The Italian labor market is much more rigid than the US market. For instance, employment protection legislation is much stricter in Italy than in the US, and union coverage is much higher.

Theory predicts much more persistent labor market effects of a recession in a more regulated labor market, such as in Italy. Employers have more incentives to screen job applicants carefully before hiring, because high firing costs force them into long-term relationships with their employees. For workers, these long-term relationships restrict job mobility after the start of their career. Powerful labor unions may further reduce labor market turnover. They tend to protect employees (“insiders”) at the expense of the unemployed (“outsiders”) and new labor market entrants. Generous unemployment benefits in some countries play a similar role. They decrease the incentive to search for and accept jobs, which, in turn, makes firms more reluctant to post job vacancies since they are less likely to find candidates. Thus, cohorts that enter the labor market during a recession have greater difficulty catching up with the luckier cohorts if the labor market is rigid. They are more likely to get trapped in unemployment or in lower-quality jobs.

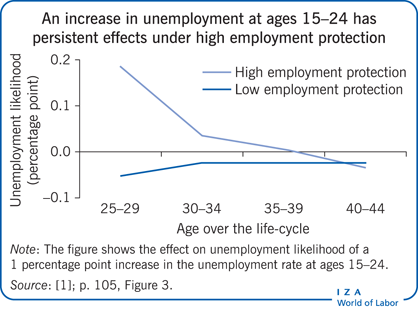

A cross-country study of 20 OECD countries found that in countries with strict employment protection laws or high values on a composite index that includes measures of labor union power and generosity of unemployment benefits, a higher unemployment rate at the start of a professional career increased the likelihood of unemployment later in the career, not fading away until ages 40–44. By contrast, the study found no persistence of unemployment likelihood in countries with low employment protection laws after the years of entry into the labor market (see the Illustration) [1].

Other labor market outcomes and institutions

The cross-country study of 20 OECD countries considered only the effect on unemployment and did not distinguish between youths with different levels of educational attainment. In flexible North American labor markets, there is little evidence of persistence in the effect of early career recessions on the employment rate, irrespective of education level. However, for other labor market outcomes, such as earnings and wages, there is evidence of enduring employment effects, although only for college graduates. Interesting questions therefore arise about whether labor market rigidity also enhances persistence in these other outcomes, whether effects vary by educational attainment, and whether persistence depends on the type of labor market institution. For instance, do high minimum wages protect young workers against wage declines, and, if so, do they persistently reduce employment opportunities? What is the independent impact of more generous unemployment benefit schemes? Evidence on these questions requires comparing the findings of a number of country studies, some of which are of particular interest because of institutional variations within a country.

One study compares the short- and long-term impacts of recessions at labor market entry on various labor market outcomes in Japan and the US, distinguishing between high- and low-educated entrants [2]. In Japan, social norms and resulting case law make dismissal of regular workers for economic reasons almost impossible. In such an environment, employers screen recent graduates thoroughly at labor market entry. High schools are legally obligated to assist firms in this matching of students to jobs [5]. Recent graduates who are not matched at labor market entry, for example because of an economic recession, face tremendous problems in finding a job later on, because labor market entry is essentially limited to the immediate period after graduation. Consequently, in contrast to the US, in Japan strong and persistent (lasting more than 12 years) earnings penalties of recessions at time of labor market entry are found for both low- and high-educated new labor market entrants. For low-educated entrants, these penalties are reflected in significantly lower employment probabilities. High-educated graduates suffer by being employed in lower-paying jobs [2]. When compared to the findings for the flexible North American (the US and Canada) labor markets, these findings suggest that labor market rigidity is particularly harmful for low-educated workers, while also punishing high-educated workers, whose wage gap with other cohorts persists longer than ten years [2], [5].

Evidence from European studies broadly confirms that labor market rigidity makes persistence worse, but the evidence is not as clear-cut as in the comparison between Japan and the US. This may be partly because European labor markets generally occupy a middle position between the more flexible North American labor markets and the very rigid Japanese labor market. Another reason is that most studies consider only a partial set of outcomes or do not distinguish between entrants with different levels of educational attainment. Moreover, some of the European studies had to deal with difficult methodological issues that could bias some of the findings.

Graduating in a recession in a very rigid labor market—The case of Belgium

Belgium is among the most rigid labor markets in the OECD based on the composite index of strict employment protection laws, measures of labor union power, and generosity of unemployment benefits, and measured on the basis of flows in and out of unemployment [1], [5]. Protection varies, however, according to educational attainment. High-educated white-collar workers are strongly protected against dismissal. But, until recently, blue-collar workers have had little employment protection. Blue-collar workers are tied to the firm through a very lenient short-time (reduced time or job sharing) work compensation system: employer contributions are not experience rated, so employers are not penalized for temporarily reducing work hours, while workers may receive a replacement income during unemployment of close to 100%. Thus, there are strong incentives for both parties to preserve the match. Moreover, the hiring of low-educated youth is impeded by (sectoral) minimum wages, which are among the highest among OECD countries. High unemployment benefits of unlimited duration for low-educated workers reduce incentives to find and accept jobs [5].

In this institutional setting, particularly the binding minimum wage, a recession at labor market entry imposes only a negligible penalty on the hourly wage of low-educated workers up to 12 years later. By contrast, the number of hours worked is strongly reduced in the first years after graduation and remains significantly lower than for these entrants during an economic upturn as long as 12 years later. This is consistent with well-established evidence that experiencing unemployment early in a career imposes long-term penalties. Generous unemployment benefits and the lenient short-term compensation scheme reinforce this process and thus the persistence of the penalty. The generosity of unemployment benefits creates strong incentives to remain unemployed. And when labor market conditions improve, the short-term compensation scheme prevents the unemployed from replacing employees whose work time was temporarily reduced during a downturn because those workers remain tied to the firm [5].

A typical recession in Flanders, a region in northern Belgium, increases the unemployment rate by 1.4 percentage points. It was found that a one percentage point increase of the unemployment rate at graduation persistently reduces the working time and earnings of low-educated youth by about 3.2% throughout the first 12 years after graduation, while the hourly wage is hardly affected. Hence, in the case of a typical recession the aforementioned penalty amounts to 4.5% (3.2% multiplied by 1.4) [5]. This contrasts with the outcome in North American labor markets, where the initial penalty is ten times higher but fades away after just a few years.

The persistence mechanism is much different for high-educated youth. As this group has a higher earning capacity, their hourly wage is not protected by the minimum wage floor. Therefore, if labor market entry conditions are bad, these youths have to choose between accepting low-wage jobs or unemployment. Because unemployment benefits are less generous for this group, unemployment is only a temporary option. High-educated youth are therefore bound to accept lower-quality jobs. Catching up with the lucky cohorts that entered the labor market under more favorable conditions is impeded by mechanisms similar to those affecting high-skilled workers in North America. In addition, the very strict employment protection for white-collar workers restricts their labor mobility and thus increases the likelihood that the unlucky cohorts will get stuck in lower-quality jobs [5]. Thus, although a typical recession initially has a similar proportional negative impact on the earnings of high-educated workers in Flanders and North America (a drop of about 8% in the first year after graduation), this penalty is much more persistent in Flanders: while unlucky college graduates in North American labor markets gradually catch up to the lucky ones within ten years, in Flanders the unlucky graduates still earn about 6% less ten years later than the lucky ones [5].

Graduating in a recession in a moderately to highly rigid labor market—The case of four European countries

For countries with moderate to high labor market rigidity, such as Austria, Germany, Norway, and Sweden, there is evidence of more persistence of penalties than in North America [5]. In Austria, a one percentage point increase in the unemployment rate at entry reduces the daily wage by 0.9% and the effect persists for at least 20 years [5]. As is the case for high-educated workers in the US, the effects are smaller for white-collar workers and fade after five to ten years. However, in contrast to the US, and possibly related to labor market rigidity, blue-collar workers suffer more and more persistently from a recession [8]. A German study of low- to medium-skilled workers graduating from the apprenticeship system finds more persistent effects of a recession on employment and wages than for low-educated workers in the US, but less persistent than in Austria and Japan [9]. A negative effect on employment is found during the first five years after graduation, while the wage penalty is important in the first four years after graduation but then fades away after seven years. In the case of both Austria and Germany, the wage penalty may be somewhat underestimated because of methodological issues.

In Norway, a business cycle slump at the time of labor market entry for youths aged 16–19 raises prime-age unemployment rates by as much as 1–2 percentage points [10]. A more recent study reports similar persistent negative effects on employment for college graduates, but finds that earnings are negatively affected only in the first three years after graduation. However, the earnings estimate may be downwardly biased for methodological reasons [11]. In Sweden, white-collar workers entering the labor market during a boom phase are promoted faster than those entering during a slump, resulting in a persistent wage premium for the cohort entering during a boom [12].

Graduating in a recession in a segmented labor market—The case of Spain

Spain’s labor market is segmented between a very flexible segment for workers hired on fixed-term contracts and a very rigid segment for those employed on permanent contracts [13]. Moreover, as in Belgium, entry wages are bargained above the legal minimum wage, providing a wage floor for the low-educated youth. As in Belgium, the penalty for low-skilled workers who enter the labor market during a recession is driven by a lower likelihood of employment rather than by lower wages. However, in contrast to the Belgian case, high-educated workers in Spain do not suffer from large wage penalties. Instead, the penalties take the form of a lower probability of employment and by a higher likelihood of moving from one fixed-term contract to another. In Spain, unlike in Belgium, time limits on the use of temporary contracts are not enforced, so it costs firms little to dismiss workers before the termination of these contracts. Thus, this study finds less persistent effects of recessions in Spain than in Belgium: five years for college graduates and seven years for non-graduates. It is also possible that this study underestimates the wage penalty if people who manage to find a job during a recession are on average more able than those who find a job during a boom.

Limitations and gaps

While the evidence on the short- and long-term impacts of recessions on new labor market entrants in flexible North American labor markets is quite comprehensive, the evidence remains fragmentary for other countries. Most European studies have focused on a partial set of labor market outcomes and have not distinguished between education levels. The gaps in knowledge are partly a result of the methodological problems confronting studies of European labor markets that are less of a problem for researchers of North American labor markets. In European labor markets, the composition of graduating cohorts seems to be much more affected by recessions than in North America because recessions also affect the timing of graduation as well as the fraction of the population that is employed. These compositional effects tend to bias the treatment effects of interest, and getting around these methodological problems can be difficult.

In addition, while most of the available evidence suggests that institutions influence the impact of recessions on labor market entrants and that labor market rigidity reinforces the persistence of penalties, evidence for two countries (France and the UK, not discussed here) conflicts with the second conclusion.

Summary and policy advice

Graduating during a recession has considerable negative impacts on the careers of young labor market entrants, and these impacts differ according to the flexibility of the labor market and the education level of entrants. In flexible labor markets, the short-term impact is particularly severe for low-educated youths, but the penalties are short-lived. College graduates are less penalized initially but the penalties last longer. Nevertheless, after ten years, high-educated workers manage to catch up with the luckier cohorts that graduated during good economic times. In rigid labor markets, entering the labor market during a recession may cause less damage in the short-term but may inflict permanent economic scars.

This evidence reveals that the cost of recessions can be significant and can last well beyond the immediate impact. These negative outcomes justify more investment in macroeconomic stabilization policies that may prevent recessions from occurring or shorten their duration. Policies to protect workers, such as a minimum wage and firing constraints, seem to limit the initial setbacks resulting from graduating during a recession, but they aggravate its persistence. This suggests that policy reforms should aim to combine greater job flexibility measures with job security and social safety net provisions—“flexicurity.” Measures such as the single open-ended contract, in which all workers, including temporary workers, benefit from similar legal protections and in which severance payments increase with seniority, need further scrutiny. Policies should also aim at facilitating the catching-up process for workers who enter the labor market during a recession. Fostering geographic and job mobility would be key measures. Facilitating the job matching process between youths and employers beyond graduation, even after finding the first job, may also matter. In particular, policies should encourage youths and firms to upgrade jobs as soon as labor market conditions improve rather than allowing young workers to remain stuck in lower-quality jobs. A higher minimum wage can protect low-skilled youth against excessive wage cuts, but the tradeoff is likely to be a risk of higher and more persistent unemployment.

Acknowledgments

The author thanks two anonymous referees and the IZA World of Labor editors for many helpful suggestions on earlier drafts. Previous work of the author (together with Corinna Ghirelli) contains a larger number of background references for the material presented here and has been used intensively in all major parts of this article [5].

Competing interests

The IZA World of Labor project is committed to the IZA Guiding Principles of Research Integrity. The author declares to have observed these principles.

© Bart Cockx